- within Accounting and Audit, Cannabis & Hemp and Consumer Protection topic(s)

Below, please find issue 3 of ENS' Kenya in brief, a snapshot of the latest developments in Kenya.

corporate commercial

Welcome to the third issue of ENS' Kenya in brief, focusing on the latest legal and regulatory updates across Kenya's corporate commercial, real estate, and banking and finance industries. Click here to read the second edition.

- Corporate and Commercial

Banking (Penalties) Regulations, 2024

The Central Bank of Kenya has published draft Banking (Penalties) Regulations, 2024 (the “Draft Regulations”) and has invited the public to comment on the Draft Regulations. If passed, the Draft Regulations will revoke the existing Banking (Penalties) Regulations, 1999. The purpose of the Draft Regulations is to promote compliance with and deter a violation of the Act and the Prudential Guidelines by providing a clear framework for assessing a violation and ensuring that an institution or person is penalised for a violation. For more information on this, please read our article here.

Companies (Beneficial Ownership Information) (Amendment) Regulations, 2023

The Attorney General published the Companies (Beneficial Ownership Information) (Amendment) Regulations, 2023 on October 2023. The Regulations provide the instances in which a company can disclose beneficial ownership information, the entities that may seek for beneficial ownership disclosure from the Registrar and the process towards making that request. This is aimed at aligning the disclosure of beneficial ownership information with the Financial Action Task Force (“FATF”) standards and to provide for the protection of personal data in accordance with the Data Protection Act, 2019 (“DPA”). For a more detailed analysis on access to beneficial ownership information in Kenya, please read our article here.

- Immigration and Consular fees

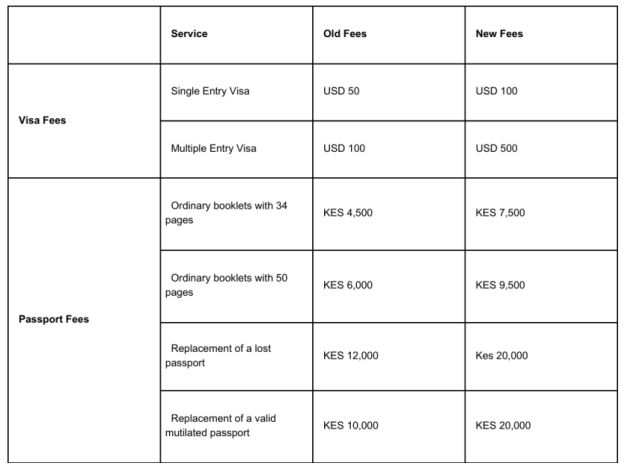

The Cabinet Secretary for Interior and National Administration (the “Cabinet Secretary”) published a Gazette Notice intending to revise fees on its various services to take effect from 2024. Notably, the following visa and passport fees have been revised among others.

For more information on this, please see the Gazette Notice here.

Further, starting January 2024, Kenya became a visa-free country, replacing traditional visas with an Electronic Travel Authorization (“ETA”). The Cabinet Secretary published the Kenya Citizenship and Immigration (Amendment) Regulations, 2023 on January 2024 outlining the ETA requirements, including pre-screening and submission of Advance Passenger Information (“API”) as well as Passenger Name Record (“PNR”) by travellers.

- Competition

There have been a series of developments across various industries in 2023 for competition in Kenya. For a summary of the key developments in competition law in Kenya over the last year, please read our article here.

- Tax

Affordable Housing Bill, 2023

The Parliament passed the Affordable Housing Bill, 2023 (the “Affordable Housing Bill”) and it has been assented to law on 19 March 2024. This development comes after the High Court declared the housing levy unconstitutional. The Bill therefore will extend the housing levy to a broader segment of the population, beyond just salaried employees. It aims to bring into taxable bracket, any gross income received or accrued that is not a salary, targeting farmers and small and medium enterprises.

Draft Medium Term Revenue Strategy (MTRS)

The government has released the draft MTRS which will run between July 2024 and June 2027. The strategy provides tax policy and administration reforms to be implemented between 2024 - 2027, focusing on income tax, Value Added Tax (“VAT”), customs and excise duty. The MTRS further provides for the integration of the tax administration system with systems of third-party data producers; reform and modernisation of the tax systems; improvement of compliance; efficiency in management of tax refunds; improving taxpayer audit as well and strengthening the Kenya Revenue Authority (“KRA”).

Low Interest Benefit

The Kenya Revenue Authority (“KRA”) has announced the implementation of tax rate adjustment on loans provided to Kenyan employees at their workplaces, impacting taxpayers with regard to a low interest benefit for purposes of section 5(2A) of the Income Tax Act at a prescribed rate of 14% applicable until June 2024.

- Land

Proposed Land Transaction Fee Revisions

The Government of Kenya has increased the fees payable for various land transactions by amending the existing statutory instruments that govern fees payable for various categories of services offered under the Ministry of Lands. The fee adjustments are contained in various gazetted Legal Notices enacted pursuant to the Statutory Instruments Act, No. 23 of 2013.

- Health

The Social Health Insurance Act, 2023 (“SHIA”) came into force on 22 November 2023. The SHIA replaces, the National Health Insurance Fund (“NHIF”). Three funds are established under the SHIA namely: the Emergency Chronic and Critical Illness Fund; the Primary Healthcare Fund; and the Social Health Insurance Fund (“SHIF”). Every Kenyan household, as well as the National and County Governments, will be required to contribute to the SHIF. As for the other two funds, they will be funded through appropriations from the National Assembly. The government has, in addition, developed two (2) sets of draft regulations to the SHIA namely:

1. The Social Health Insurance (General) Regulations, 2023 which provide a framework for the implementation of the three funds; and

2. The Social Health Insurance (Dispute Resolution Tribunal) Regulations, 2023 which set out the procedure to facilitate determination of complaints, disputes and appeals arising out of decisions made under the SHIA.

The High Court however issued conservatory orders on 27 November 2023, to stop the implementation and enforcement of the Act due to lack of proper public participation. The Cabinet Secretary for Health approached the Court of Appeal to seek a stay of implementation of the orders. The Court of Appeal in its ruling on 19 January 2024 lifted the orders, suspending the implementation and enforcement of the Act, with the exception of three sections where the parties were requested to file their written submissions. Following this, the Registrar will then allocate a hearing date before 31 March 2024. Further, the Chief Justice has appointed a three-judge bench to hear and determine the case. ENS | Kenya continues to monitor this and will provide an update once the judgment is delivered by the High Court. It is also important to note that the above mentioned regulations are yet to be gazetted. Further, the Cabinet Secretary for Health has indicated that the SHIF contributions will start in July.

- Anti Money Laundering and Combating of Terrorism Financing Laws (Amendment) Act, 2023

The Anti Money Laundering and Combating of Terrorism Financing Laws (Amendment) Act, 2023 (the “Amendment Act”) has made amendments to the Proceeds of Crime and Anti-Money Laundering Act (“POCAMLA”). The Law Society of Kenya (“LSK”) has been included as a self-regulatory body to ensure compliance with anti-money laundering and combating the financing of terrorism with regard to lawyers. Further, the LSK and the Financial Reporting Centre will establish appropriate mechanisms to cooperate for exchange of information relating to the reporting and supervision of suspicious transactions.

The Amendment Act also introduces section 243A to the Companies Act, 2015 which requires a private company or company limited by guarantee that does not have either a Kenya-qualified company secretary or a resident director to appoint a contact person. For a more detailed analysis on a contact person, please read our article here.

The protection of your personal information is important to us

ENSafrica takes your privacy and the protection of your personal information very seriously and is committed to doing the right thing as underpinned by our privacy policy and values.

It is our understanding that you are receiving this communication because you are an esteemed client of our firm or have historically elected to opt-in to receive communications from us. If you no longer wish to receive communications from us, please click here to unsubscribe so we can ensure your details are removed from all our communication lists. Should you change your mind, you can subscribe to specific areas of interest using the following link http://www.ensafrica.com/contact-us.

We appreciate your ongoing support and interest.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]