Recent economic progress noted across the globe calls for robust planning in relocation, both for business and high-net-worth individuals that wish to set up their business operations in another jurisdiction. The UAE accommodates both as the best alternative in the post-Brexit world, offering long-term and substantial advantages through straight-forward procedures.

In the post-Brexit world, realities hit hard that businesses must find alternatives that are robust, fast and efficient in setting up shop – or a new lifestyle - in a new geography. The noted economic impacts (reduced investment and recession) and manpower issues (migrated workforces and skilled worker shortages) are evident, and despite the recent positive outlook following the vaccination programme in the country, companies and high-net worth individuals are looking for alternatives to set up their business and life.

UK-based businesses face a plethora of current challenges mainly due to the low-demand of the EU market, the strong competition emerging from near-by markets, issues of overt-taxation, such as a high inheritance tax, and the overall Brexit impact which entails operational and logistic obstacles.

Moving a business from the UK to the UAE is a solution for those who value the corporate environment as a set of rules and values enabling their business to thrive beyond the strict business sense. For one, governmental support in the UAE is strong, with a track record of a business-oriented mindset at the official level. The UAE also offers powerful business tools which are tailor-made for British citizens.

The growing demand of the UAE and Middle East market especially for high-tech, luxury goods, renewable energy solutions, smart technologies, pharmaceuticals and IT are among the sectors in which the UK has demonstrated success stories; companies based in the UK and which are active in these industries, will find a familiar environment with an advanced infrastructure ideal for the growth of their multinationals or for the diversification of business. The UAE also provides a familiar territory; the active and strong presence of the UK in the region includes more than 120,000 UK citizens who live, work and have set up business in the country. Moreover, the UK is the largest foreign direct investor in the UAE, with more than 5,000 British companies operating in the UAE. A final consideration is the formidable reputation of UK businesses in the UAE. According to the UK Department for International trade, the UAE is "the UK's largest export market in the Middle East and the 13th biggest globally".

Corporate Migration or Redomiciliation to the UAE

Loggerhead's native experience in the region offers first-hand experience in terms of corporate migration to the UAE. Corporate Migration, the process by which a company shifts its place of incorporation to a new jurisdiction while preserving the same legal identity, enables clients to maintain their brand, history and existing contractual agreements with their own clientele while moving to a more favorable operating environment.

Either due to shifting business needs or a corporate environment that is no longer business-friendly, Corporate Migration is viewed as an increasingly attractive option for restructuring, mainly due to its simplicity and tax incentives. A proper Corporate Structure Review should be able to identify whether Corporate Migration makes sense from a financial and operational point of view

WHAT ARE THE REQUIREMENTS FOR CORPORATE MIGRATION

In general, foreign companies looking to migrate to another jurisdiction must be able to:

- that they are in 'good standing' and prove that they have complied with all relevant statutory and filing requirements in the home jurisdiction

- Prove that they are not under any ongoing investigations, sanctions or disciplinary actions by the home country regulatory authority

- Meet the local substance requirements

- Follow the company name rules and guidelines of the authority in question in relation to company name issues

- Show that the business activity is in line with one of the approved activity types from the authority in question

- Provide all corporate documents notarised and attested by the relevant authority

In recent years, the range of options available for corporate migration in the UAE has grown significantly. Businesses that wish to relocate, can now migrate to the UAE through a Free Zone Company or an Offshore IBC company, through UAE mainland, and most recently, as a Special Purpose Vehicle (SPV).

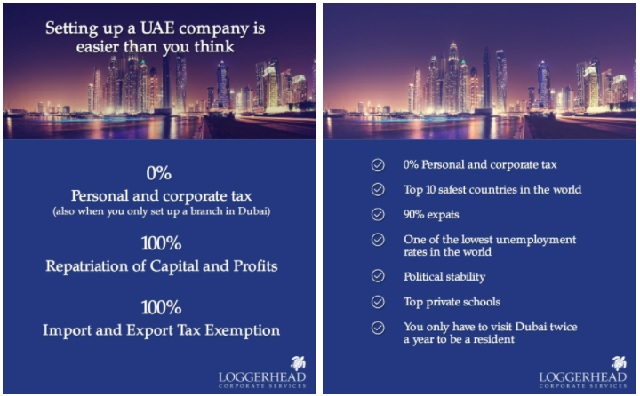

The UAE offers objective benefits for corporate migration, beyond the Brexit consideration too. The country has successfully established itself as one of the premier structuring hubs worldwide, primarily capitalizing on its zero-tax regime, vast range of corporate vehicles, an extensive network of tax treaties with more than 80 countries and the full repatriation of capital and profit. Companies based in the UK and looking to migrate should consider not only the advantages of the process as related to Brexit, but more generally consider the UAE as an attractive destination to do business in spite of it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.