Malta joined the European Union on 1 May 2004 and adopted the Euro as its national currency in 2008. Malta's political, economic, cultural and historical links to Europe can be traced back for many centuries, due to its geographically strategic location at the cross-roads between East and West.

Malta is a fast developing financial and business centre right at the heart of the Mediterranean, an island which boasts an advanced communications set up and a business environment which gives every incentive to companies operating here, to invest, grow, innovate and compete in the global marketplace. Boasting a highly educated and English speaking workforce, a European time zone, a Mediterranean lifestyle as well as excellent air and sea connections to continental Europe and beyond, Malta is now recognized internationally as a low risk jurisdiction benefitting from economic and political stability which makes the Island a safe and secure place to do business. It also has relatively low labour costs. The legal system is based on a continental Europe civil law system and a UK administrative and fiscal based legislation.

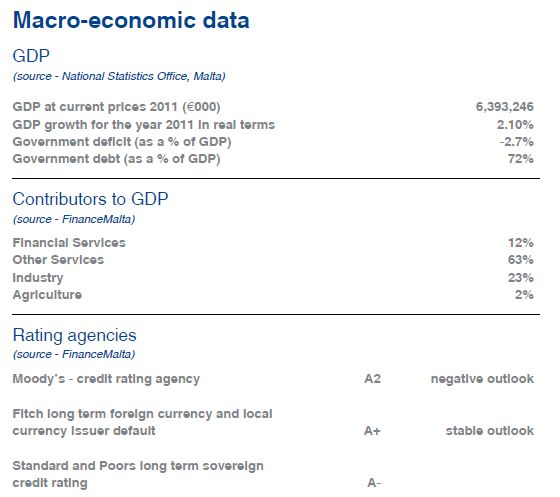

Malta enjoys a balanced and vibrant economy in which manufacturing makes up 17% of GDP and financial services account for 13% of GDP. The financial services sector continues to play an important part in the economic development of the country and indeed, in line with national policy, this sector is well on the way to becoming Malta's third pillar of the economy together with tourism and construction. Malta has a strong yet accessible single regulatory body in the Malta Financial Services Authority which is responsible for all licensed financial services activity on the Island and which has a function based structure in line with EU and global best practice standards. Malta's strong bias towards maintaining a robust regulation and a high level of expertise amongst its pactitioners has resulted in Malta becoming a highly developed financial centre which is expected to grow significantly over the next decade.

Foreword

The Maltese financial services sector has grown very rapidly during the last few years into a world-class reputable financial centre that is contributing very positively to the country's economy, productivity and employment. There have been a number of factors which have helped the Maltese financial services industry achieve such positive results, not least EU Membership, changeover to the single European Currency and a regulatory authority which addresses the need for speed, flexibility and minimal bureaucracy. All this, coupled with a professional, multi-lingual and skilled labour force providing efficient and costeffective services, a competitive tax environment, a world class IT and telecommunications infrastructure and a geographical position right at the centre of the Mediterranean, make Malta an ideal place to do business.

The Exchange has also played its part towards and shared in this success story. The Exchange is today a fully-fledged regulated market which successfully fulfills its role as an effective venue to raise capital as well as providing a well-regulated, transparent secondary market and a broad-based post-trading infrastructure, offering a diverse range of services from registration and custody to cross-border settlement links.

We believe that in an era when economic landscapes and financial markets are changing radically almost overnight, small exchanges such as ours have the opportunity to continue to grow and develop to play an increasingly important role in capital markets and the investment industry.

With this in mind our vision is to consolidate and strengthen our domestic market while at the same time, reaching out beyond our shores by offering well-regulated and costeffective services and products.

We hope that this introduction to the Malta Stock Exchange will be a good source of information which will encourage you to get to know us better.

Welcome to the Malta Stock Exchange!

Mission Statement

To facilitate capital formation in the public and private sector by developing and operating a liquid, efficient and fair securities market for the ultimate benefit of Issuers and investors whilst adding value to its stakeholders.

Milestones

1990 Enactment of Malta Stock Exchange Act establishing the Exchange

1991 First Council appointed

1991 Issue of Bye-laws

1992 Commencement of manual, call-over, once-weekly trading

1994 Interface between clearing and settlement and registration system

1995 Collective Investment Scheme Listing

1996 Electronic Trading – interface with clearing and settlement and registration Systems

1998 Daily trading

2000 Alternative Companies Listing

2001 Issue of Code of Good Corporate Governance

2001 Move to new premises in Valletta

2001 Remote Trading

2002 Enactment of Financial Markets Act

2006 Setting up of MaltaClear, a DVP Clearing and Settlement System

2007 Treasury Bill Market

2008 Euro Changeover

2008 Member of Target-2

2011 Link with Clearstream Banking

2012 Migration to the Xetra Trading Platform

THE MALTA STOCK EXCHANGE

The Malta Stock Exchange became a reality upon the enactment of the Malta Stock Exchange Act in 1990. The main objective was to develop the capital market in Malta by facilitating the mobilization of savings into productive investment through the primary market as well as to facilitate trading of listed securities through the provision of a secondary market.

Trading commenced on 8 January 1992 on a manual, once-weekly basis, initially solely in Government Stocks. From this modest beginning, the Exchange has undergone many positive corporate and operational developments which have enabled it to serve as an effective catalyst to mobilize capital.

In 2002, the Exchange shed its regulatory and Listing Authority roles and in 2007 changed its corporate structure to a group of companies incorporated under the Companies Act. This new structure better reflects the core services and operations provided by the Exchange and moreover provides the best legislative, regulatory and governance platform for the Exchange to continue to expand current operations into new avenues of business.

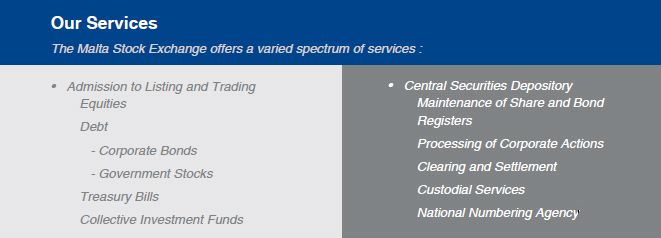

Legislative, regulatory and the many operational developments that have been undertaken throughout the years have ensured that today, the Exchange is an internationally recognized regulated market which successfully fulfills its role as an effective venue to raise capital finance. The Exchange provides a structure for admission of financial instruments to its recognized lists which may subsequently be traded on a fully electronic order book, regulated, transparent and orderly market place through authorized Members. The Exchange also offers a very comprehensive range of back-office services through its posttrading infrastructure, the Central Securities Depository, including clearing and settlement, maintenance of share and bond registers and custody services.

As the Exchange continues to develop in order to continue to achieve sustainable growth, it is committed to widening its horizons to attract more international business. One focus of the Exchange's international strategy has been to achieve connectivity with other markets. In this context, the first interoperable link was set up between Clearstream Banking and the Exchange's own depository which has also led to the launch of the Exchange's custody business. Also, the Exchange has launched a number of major technological upgrades designed to bolster and supports its international strategy, chief among which is the replacement of the current trading system by the XETRA trading platform, supplied by Deutsche Boerse AG, which went live in July 2012.

ADMISSION TO LISTING AND TRADING

The Process

The process to admit financial instruments to any of the recognised lists of the Malta Stock Exchange starts with a prospective Issuer seeking "Admissibility to Listing" from Malta Financial Services Authority (the MFSA) which is the Listing Authority. Granting of "admissibility" means that the Listing Authority has approved the Prospectus for issue and the Issuer may seek admission to any of the Exchange's recognised lists.

It would be opportune to set up a preliminary meeting between the relevant parties and the Exchange before the formal application is made so as to clarify any operational matters and to ensure the smooth running of the whole process in the shortest possible time.

The role of the Sponsor

The first step in order to apply for Admissibility to Listing from the Listing Authority is to appoint a Sponsor who, as a minimum, must be in possession of a Category II licence in terms of the Investment Services Act.

The role of the Sponsor is to guide the prospective Issuer through the whole listing and admission process, to co-ordinate processes of all the advisors as well as to act as liaison with the Listing Authority and the Exchange, to generally advise the prospective Issuer on all relevant matters including those issues related to the secondary market. The Sponsor also assumes responsibility for signing and lodging the application and supporting documents with the Exchange.

Basic Conditions for Admissibility

As may be expected, there are a number of conditions which would need to be met by prospective Issuers of financial instruments as outlined in the Listing Rules issued by the Listing Authority and may be found on the MFSA website – www.mfsa.com.mt. The basic conditions to be fulfilled by an Applicant for admission are:

- Financial instruments for which admission is sought must be freely transferable

- The application must relate to, and apply for, the financial instruments for which admission is being sought

Application for admission must be submitted at the same time as application for admissibility is made to the Listing Authority. The Exchange may require the Applicant to enter into an Admission Agreement.

The current maximum timeframe for approval of a prospectus by the Listing Authority is 20 working days from submission of final documents.

Once the Listing Authority has authorized the financial instruments as admissible to Listing, they would be eligible for admission to one of the recognised lists of the Exchange. The admissibility and admission processes are usually concurrent and do not involve duplication of submissions or vetting of documentation. Requirements for Admission to the Malta Stock Exchange are found in Chapter 6 of the MSE bye-laws – these may be found on the MSE website www.borzamalta.com.mt

Disclosure Requirements

Once a financial instrument is granted admission, the Issuer must ensure compliance with the continuing obligations and disclosure standards as laid down in the Listing Rules and other relevant rules. The Issuer must also appoint a Compliance Officer who shall be responsible to ensure compliance with all relevant rules.

Company Announcements

- May be issued in English in accordance with the Listing Rules and Prevention of Financial Markets Abuse (Disclosure and Notification) Regulations, 2005

- Are disseminated through the Exchange's Dissemination System and may be issued at any time during the Exchange's Business Hours

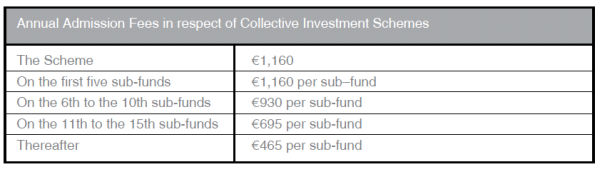

Collective Investment Schemes

The Listing Rules issued by the Listing Authority set out the requirements for the admissibility to primary or secondary listing of Units in both open-ended and close-ended Collective Investment Schemes. These may be incorporated in Malta or outside of Malta. There are also continuing obligations applicable to the different types of Schemes.

Conditions to be fulfilled by open ended schemes seeking authorisation for admissibility to primary listing include:

- Units must be freely transferable

- There must be at least one director and corporate directors are not eligible unless the corporate director is the manager of the scheme

- The Scheme must adopt rules governing dealings by directors

- At the time of the AGM, copies of the Directors' service contracts must be made available for inspection by the public

- Directors and proposed Director and in the case of a Unit Trust, the Directors of the Manager shall be personally responsible for the information contained in the Prospectus In the case of an open-ended scheme seeking a secondary listing in Malta, the Scheme must also have the appropriate licence granted by the MFSA and, in the case of UCITS, must be licensed by a regulatory authority of a Member State or EEA State.

In the case of close-ended schemes seeking authorisation for admissibility to primary listing, conditions include:

- Application must be duly signed by an authorised representative of the Sponsor

- Must be licensed by the MFSA under the Investment Services Act

- The Scheme must comply at all times with MFSA regulations particularly those concerning investment restrictions

- The Prospectus must be drawn up in compliance with the provisions of the Investment Services Act

Detailed Application Procedures for Admissibility by Collective Investment Schemes may be found in Chapter 8 of the Listing Rules as published by the MFSA.

Every Scheme applying for authorisation for admissibility to listing is required to comply with the continuing obligations and disclosure requirements, whether in respect of investors, the Competent Authority or the regulated market on which they are admitted, as set out in the Listing Rules.

Disclosure requirements for all Schemes include information regarding:

- Capital and management including NAVs, any suspension of calculation of NAVs, any change in the status of the Scheme for tax and other purposes

- Rights of holders and rights between holders

- Dividend distributions as applicable

- Financial information

- Information regarding Directors

- Related party transaction

- Any Price Sensitive information

The detail of information required and whether this needs to be made public or not or merely notified to the Competent Authority and/or the Exchange depends on the structure of the Scheme, whether this is a primary or secondary listing and on the nature of the information as outlined in the Listing Rules.

Exchange Requirements

The Bye-laws issued by the Exchange include Admission Requirements and Disclosure Standards which are also applicable to Collective Investment Schemes.

Although admissibility and admission procedures are two distinct processes, these are undertaken concurrently.

When authorising admission, the Exchange does not seek any further information over and above what is required in the admissibility process neither does it, under normal circumstances require additional disclosure.

In the case of close-ended Schemes where the shares in the Scheme may be traded on the Exchange's regulated market, trading, clearing and settlement and registration rules of the Exchange would apply, as outlined in the Bye-laws.

Benefits

Benefits to Issuers:

- The creation of an opportunity for the raising of capital finance in a cost effective and efficient manner that falls outside the more traditional methods of financing one's capital requirements

- Trading on a regulated market that ensures the best-execution transparent pricing based on supply and demand

- The opportunity to broaden the investor base whilst gaining access to a market that has a high level of regulation and transparency

- Market data, such as the price and other announcements are made public and communicated by the Exchange, providing clear and transparent information to potential investors

- Listing on a well-regulated, reputable market within an EU jurisdiction. This increases the prestige of the listed brand, and provides a valuable marketing tool for the promoters of brand by raising the public profile. This is further compounded by the enhanced transparency and governance required of listed companies

- Significant fiscal benefits from trading in listed financial instruments since any capital gains that result from the transfers of these listed instruments are exempt from tax and stamp duty

Benefits of admission to the Malta Stock Exchange's recognized lists :

- Experience - Extensive experience of listing many types of financial instruments such as equities, bonds, money market funds, property funds and venture capital or development funds, and have developed a team of experienced listing personnel specialising in the various sectors.

- EU Membership – Accession to the EU has brought with it adoption of EU legislation including passporting rights for the various financial instruments domiciled and / or listed on the MSE.

- Listing Requirements – Specific Listing Rules which have been continually updated in line with changing industry requirements, following extensive public consultation.

- Flexibility - The experience we have gained during the past years has allowed us to appreciate the commercial reality and rapidly developing nature of the industry. Rules are therefore, constantly being reviewed and amended to facilitate the listing on new products, without compromising on levels of regulation.

- Speed of service – Listing and Admission Rules provide that the two procedures can be undertaken concurrently resulting in a fast end-to-end process.

- Costs – The Initial Listing Fees charged by the Listing Authority and the Annual Listing Fees charged by the Malta Stock Exchange are competitive. Our ability to offer admission and listing operations as well as Central Securities Depository services under one roof makes us a relatively unique and cost effective alternative.

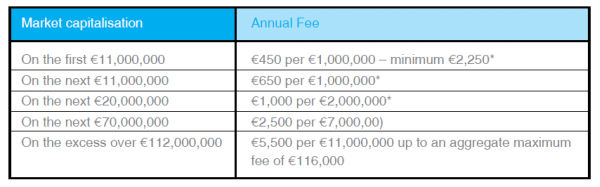

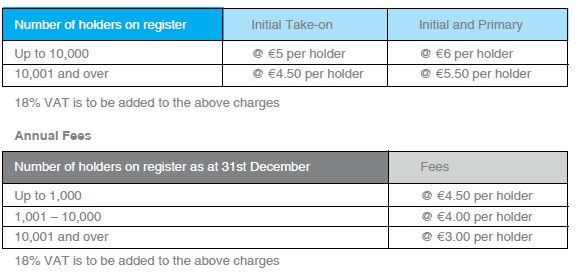

Fees

Equities / Fixed income securities

* Or parts thereof

18% VAT is to be added to the above charges

If any of the above securities already have a primay listing in another recognised jurisdiction, the Annual Fee will be at 50% of the annual rate.

TRADING

Malta Stock Exchange is licensed to operate a regulated market by providing the necessary infrastructure and regulations in respect of secondary market operations.

All listed financial instruments may be traded on the regulated market by authorized Members acting on behalf of, and in accordance with, the instructions of their clients.

The Malta Stock Exchange strives to ensure that the highest standards of market integrity are applied to all the activities conducted on its markets to ensure that the appropriate levels of investor protection are in place, including:

- Clear and transparent rules for the admission of financial instruments to trading on its markets in line with European law

- Pre-and post-trading transparency

- Membership rules which have been approved by the Competent Authority

- Continuous monitoring of trading activity and Members' compliance with trading rules and other applicable regulations

- Regulatory reporting to the Competent Authority

Trading system

The trading system is:

- Order driven

- Electronic order book only

In July 2012, the Exchange migrated to the Xetra trading platform that is supplied, hosted and operated by Deutsche Boerse, AG. Xetra is a common platform used in over 14 partner exchanges with over 250 banks and brokerage firms from 18 countries. Approximately 830,000 different securities are currently traded on this platform. The Xetra trading platform is synonymous with the highest standards in terms of reliability, security, speed and innovation, and is very familiar to many users since it is the mostly widely used trading technology with a truly global reach.

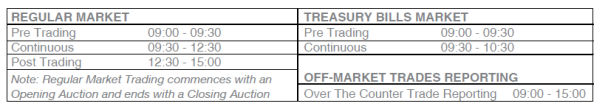

Trading Hours

Trading Calendar

The Trading and Settlement Calendar and the Trading Time-Table are issued annually and are available on the Exchange's website.

OTC Trades

OTC trades must be reported through the Exchange's trading infrastructure for dissemination to the market.

Fees

Transaction charges

e2.50 charge per transaction irrespective of volume that applies to both buyer and seller.

Turnover fees

Members shall pay a fee equivalent to 0.03% of turnover (including VAT). Treasury Bills do not participate in turnover fees.

CENTRAL SECURITIES DEPOSITORY (CSD)

All financial instruments traded at the Malta Stock Exchange are dematerialized, i.e. share and bond registers are held in electronic format and no certificates are issued as confirmation of holdings. All market transactions, off-market transfers and other amendments related to registers of listed companies are reflected in the relevant registers held within the Central Securities Depository.

An investor intending to acquire listed financial instruments traded on, or to otherwise hold securities in the custody of the Exchange, is assigned a unique Malta Stock Exchange Account Number within the Central Securities Depository.

CSD Services

The Central Securities Depository provides a number of specialized securities administration and related corporate services:

- New Issues Registration Services

- Securities Administration

- Clearing and Settlement

- Custody Services

CSD link with Clearstream Banking

The Malta Stock Exchange has set up a link with Clearstream with a view to linking the Maltese market with the international markets. In a nutshell, the link facilitates the participation of MSE customers on the international markets while affording an easy access to international investors to include securities issued in Malta within their portfolios. MSE customers without a Clearstream or other CSD account abroad may still hold internationally issued securities and assets over a secure and efficient link by appointing the MSE as their custodian. This custodial relationship will allow investors to benefit from secure and efficient clearing and settlement processing and a host of other security custody services.

The relationship between MSE and Clearstream allows Maltese financial instruments issued through the CSD to be deposited, cleared and settled in an international environment making these financial instruments much more liquid since they may be actively transferred in a secure manner anywhere in the world through Clearstream's global reach.

The converse of the above also holds and investors wishing to invest in foreign securities and assets may do so by transacting or otherwise acquiring title over such securities and assets through authorised intermediaries or over-the-counter. Instead of maintaining an account directly with a foreign depository, or indirectly through participants in such a depository, to record the holding in these investments, the MSE Central Security Depository will hold these investments in custody on behalf of such investors through its partnership custodial relationship with Clearstream Banking.

National Numbering Agency

As Malta's national numbering agency accredited with the international Association of National Numbering Agencies, the central securities depository issues upon formal request a unique international securities identification number ('ISIN') (and maintains updated details) in respect of securities issues in Malta as part of the preparatory work and other corporate administrative services involved in any type of securities issuance.

Fees

The main fees pertaining to CSD services are:

Initial take-on and primary fees

MEMBERSHIP

Eligibility

Membership of the Exchange is open to applicants who

- Are licensed in terms of the Investment Services Act (Cap 370 of the laws of Malta)

- European Investment Firms

- Are deemed by the Exchange to be fit and proper, to have sufficient level of trading ability and competence, to have sufficient financial resources and, where applicable, adequate organisational arrangements

Candidates wishing to be admitted to membership must submit an application in writing, and authorise at least one trader to carry out trading on the exchange on his/ her behalf. Each Member must appoint a compliance officer to deal with the Member's regulatory issues and its continuing obligations.

The prospective Member must provide the Exchange with confirmation of the pledge of financial assets of a value of at least e23,300 in Maltese Government issued or guaranteed financial instruments, other eligible assets accepted as such by the Eurosystem, or a recognised bank guarantee in favour of the Exchange and acceptable to it.

All prospective traders must undergo the requisite training as prescribed by the Exchange, and must successfully complete any relevant test prior to authorisation being granted. Members must promote high standards of integrity and fair dealing and should act with due skill, care and diligence in providing a service. Members must keep records in sufficient detail to show particulars of its trading activities, and shall retain books of accounts and records for at least 10 years. These shall be available to the Exchange for inspection or audit. Members shall also maintain one or more clients' accounts at one or more licenced banks, into which only such amounts which have been received from, or on behalf of, clients for the settlement of purchases of financial instruments.

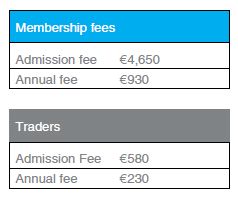

Fees

The fees that pertain to membership with the Exchange are as follows:

The above fees do not include any relevant connectivity charges in respect of the trading system.

The above fees are subject to 18% VAT.

|

Registered Address |

Garrison Chapel |

|

Tel No. |

+356 21 24 40 51 |

|

Fax No. |

+356 25 69 63 16 |

|

Web: |

|

|

E-mail: |

|

|

Incorporation: |

Registered in Malta as a public limited liability company under the Companies Act |

|

Co. Registration No.: |

C42525 |

|

Licences: |

RM / 42525 Licensed by the MFSA as a regulated market in terms of Article 4 of the Financial Markets Act CSD / 425 Licensed by the MFSA to operate a Central Securities Depository in terms of Article 24 of the Financial Markets Act Authorised to operate a Securities Settlement System (MaltaClear) by the Central Bank of Malta in terms of Article 36 of the Central Bank of Malta in terms of Article 36 of the Central Bank of Malta Act. |

|

Competent Authorities: |

Regulated Market/ Malta Financial Services Authority Securities Settlement System – MaltaClear Central Bank of Malta |

|

Primary Legislation: |

Financial Markets Act |

|

Rules: |

Issued in terms of the Financial Markets Act: Financial Market Rules Requirements |

|

Internal Rules: |

Bye-laws Exchange Notice 1 – Fees & Other Charges |

|

International Affiliations: |

Malta Stock Exchange is a Member of: World Federation of Exchanges Federation of European Securities Exchanges European Central Securities Depositories Association International Organisation of Securities Commissions Association of National Numbering Agencies |

|

Language: |

English |

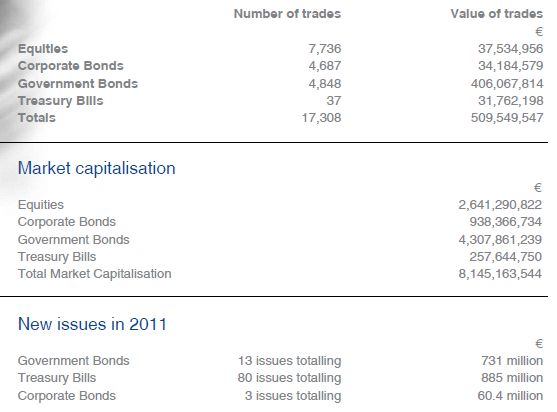

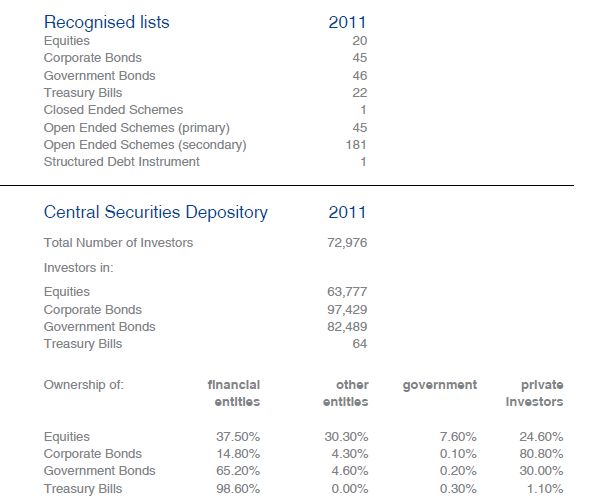

KEY 2011 DATA

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.