- in United States

- within Real Estate and Construction topic(s)

If there was one sector that truly dominated the headlines globally throughout the course of 2014, it was the Information Technology (IT) sector where a flurry of IPOs and eye-watering valuations for dotcom businesses spurred talk of a bubble. The offshore world took its fair share of the action, witnessing 269 IT deals worth a cumulative value of almost USD60bn. The most notable was Alibaba Group, the Chinese internet firm incorporated in Cayman, which listed on the New York Stock Exchange to raise an eye-watering USD21.8bn in September. That far exceeded the USD16bn raised by Facebook in 2012.

In all, the offshore jurisdictions witnessed eight technology deals each worth over one billion dollars in 2014. Four deals, including the Alibaba IPO, were worth in excess of USD3bn, amongst them the USD4.9bn acquisition of Oldford Group, an Isle of Man based computer games firm, by Amaya Gaming Group of Canada.

Another computer gaming firm, Giant Interactive Group of Cayman, sold to a Chinese investment consortium for USD3bn, and the other bumper deal saw JD.com, a data processing business, list on the Nasdaq in May in a deal valued at USD3.1bn.

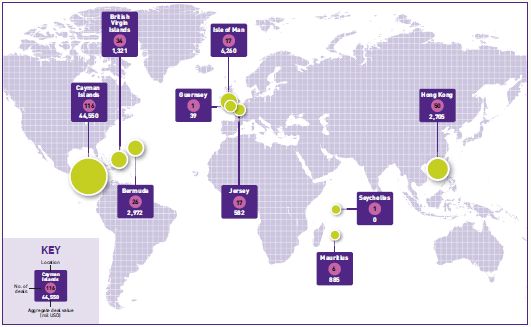

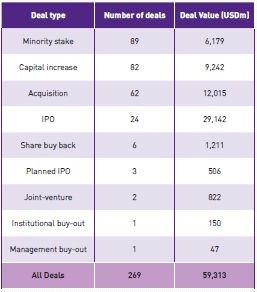

Of the top 10 offshore IT deals seen in 2014, four were acquisitions, three were IPOs, and three were capital increases initiated by the business to bring in more money from shareholders. Overall, minority stake deals comprised 89 of the 269 technology deals done, followed by 82 capital increases, 62 acquisitions and 27 IPOs or planned IPOs. The Cayman Islands was the favoured target of buyers of technology businesses, as home to 116, or 43%, of the 269 deals done, and that jurisdiction also unsurprisingly dominated by deal value thanks to Alibaba. The Cayman Islands saw an aggregate technology deal value in 2014 of USD44.6bn, which calculates as 75% of all technology dollars spent offshore. Hong Kong performed well in deal numbers, while Isle of Man stood out for deal value, driven by the Oldford Group deal.

"The Cayman Islands saw an aggregate technology deal value in 2014 of USD44.6bn."

TOP TEN OFFSHORE IT DEALS 2014

IT SECTOR DEALS BY VOLUME & VALUE 2014

IT SECTOR DEALS BY TYPE 2014

And so are we on the brink of a dotcom crash that will echo the global collapse in valuations seen at the end of 2000? Opinion is, obviously, divided. While it is now common for companies with little or no revenue to be valued at billions of dollars – think Snapchat, WhatsApp, Instagram and Pinterest – comparisons with the year 2000 show that the quality, strength and track records of the majority of technology companies coming to market now are significantly more robust than they were 15 years ago. The ability of the sector to cause a global contagion now that any slump would be largely confined to private markets and a few large firms with strong balance sheets, is questionable and any predictions of impending bubbles bursting as they did in 2000, are probably overstated. We certainly see continued offshore activity in this space for 2015.

"The ability of the sector to cause global contagion is questionable."

LOOKING FOR OFFSHORE TRANSACTIONS ADVICE?

The Corporate group at Appleby is among the largest and most widely recognised in the offshore world. Our multi-disciplinary teams advise a large number of FTSE 100 and Fortune 500 companies on all aspects of corporate and commercial law, focusing on mergers and acquisitions, corporate restructurings, joint ventures, capital markets and investment funds. Our lawyers are part of a truly international practice operating from our offices in Bermuda, the British Virgin Islands, the Cayman Islands, Guernsey, Hong Kong, Isle of Man, Jersey, London, Mauritius, the Seychelles, Shanghai and Zurich. Our network enables us to service our clients all over the world, including the key developing regions and, in particular, the BRIC economies. Appleby's cross-border Corporate team works closely with our global Fiduciary & Administration group, which provides offshore company incorporation, management and administration services to our domestic and international clients in all locations.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.