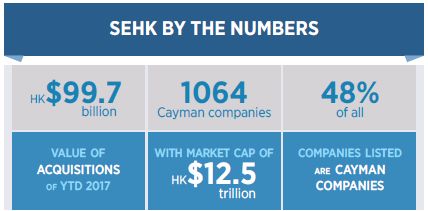

We are pleased to present this Cayman Asia M&A Market Report which recaps merger and acquisition activity involving Cayman public companies listed on the Stock Exchange of Hong Kong ("SEHK") in the second half of 2017.

Conyers currently leads the Asian market in advising on Merger & Acquisition activity. The last half of 2017 saw 85 equity acquisitions among SEHK listed companies, with an aggregate deal value of HK$33.3 billion (US$4.26 billion).

The "going-private" merger of JA Solar Holdings Co., Ltd for an estimated amount of US$362.1 million (approximately HK$2.83 billion) and the HK$3 billion (approximately US$383.7 million) privatisation of Bloomage BioTechnology highlighted a growing trend in privatisations for H2 2017.

Growth in Asian M&A activity remains slow, with both deal volume and value declining. The same is true globally, where strategic M&A transactions have decreased. This is not surprising given geo-political uncertainties. However, consortium bids led by private equity continued to offset the decline, as reported in the final six months of 2017.

This report provides details of transactions and statistical information about the size and growth of the Cayman public companies market in Asia, which we hope will be of interest to our clients and Cayman market followers.

JULY

- Investor Yang Jun completed the acquisition of a 24.13% stake in S. Culture International Holdings Limited (SEHK:1255) for HK$190 million (approximately US$24 million).

- Investor Wang LiangHai completed the acquisition of a 7.61% stake in Millennium Pacific Group Holdings Limited (SEHK:8147) for HK$26.7 million (approximately US$3.4 million).

- Toray Industries, Inc. (TE:3402) completed the acquisition of a 28.03% stake in Pacific Textiles Holdings Limited (SEHK:1382) from Ip Ping Im and Lam Wai Yee for approximately HK$4 billion (approximately US$511 million).

- An individual completed the acquisition of a 2.5% stake in ICO Group Limited (SEHK:1460) from Friends True Limited for an undisclosed sum, thereby reducing Friends True Limited's shareholding from 25.6% (1,025 million shares) to 23.1% (925 million shares).

- Future Empire Limited completed the acquisition of a 5.16% stake in Global Mastermind Holdings Limited (SEHK:8063) for HK$41 million (approximately US$5.2 million).

- Investor Zhu Min completed the acquisition of an additional 7.15% stake in Cybernaut International Holdings Company Limited (SEHK:1020) for HK$120 million (approximately US$15.4 million).

AUGUST

- China Yuen Capital completed the acquisition of a 64.26% stake in Kenford Group Holdings Limited (SEHK:464) from Beaute Inc., Realchamp International Inc, Achieve Best Limited, Lam Wai Ming and Tam Chi Sang for HK$200 million (approximately US$25.5 million).

- Investor Meng Guangyin completed the acquisition of a 70.6% stake in Tic Tac International Holdings Company Limited nka Prosper One International Holdings Company Limited (SEHK:1470) from Lam Man Wah and Chan Ka Yee, Elsa for HK$534.4 million (approximately US$68.3 million).

- Investor Lai Leong completed the sale of a 10.25% stake in Hanbo Enterprises Holdings Limited (SEHK:1367) for HK$116.8 million (approximately US$14.9 million).

- COFCO Corporation, Danone (ENXTPA:BN) and Arla Foods amba completed the acquisition of an additional 0.49% stake in China Modern Dairy Holdings Ltd. (SEHK:1117) from China Mengniu Dairy Company Limited (SEHK:2319) for HK$41.4 million (approximately US$5.3 million).

- An individual completed the acquisition of a 2.5% stake in ICO Group Limited (SEHK:1460) from Friends True Limited for an undisclo(SEd sum, thereby reducing Friends True Limited's shareholding from 23.1% (925 million shares) to 20.6% (825 million shares).

- An unknown buyer completed the acquisition of a 0.007% stake in Future World Financial Holdings Limited (SEHK:572) from Non-Executive Director Hon Hak Ka's spouse for an undisclosed sum.

SEPTEMBER

- China Investment International Limited completed the acquisition of a 28.01% stake in Kenford Group Holdings Limited (SEHK:464) for HK$200 million (approximately US$25.6 million).

- Investor Meng Guangyin completed the acquisition of a 15.62% stake in Tic Tac International Holdings Company Limited nka Prosper One International Holdings Company Limited (SEHK:1470) for HK$120 million (approximately US$15 million).

- An undisclosedd buyer completed the acquisition of a 0.9% stake in Haitian International Holdings Limited (SEHK:1882) from Sky Treasure Capital Limited for HK$1.3 million (approximately US$0.17 million).

- An unknown individual completed the acquisition of a 2.5% stake in ICO Group Limited (SEHK:1460) for an undisclosed sum.

- Forever Star Capital Limited completed the acquisition of an additional 0.74% stake in Huabang Financial Holdings Limited (SEHK:3638) for HK$25.6 million (approximately US$3.3 million).

- Celestial Award Limited completed the acquisition of a 1.31% stake in RM Group Holdings Limited (SEHK:932) from Chan Yan Tak for not more than HK$50 million (approximately US$6.4 million).

- Investor Anthony Wong completed the acquisition of a 44.7% stake in LEAP Holdings Group Limited (SEHK:1499) from Ip Ying Chau and Chan Wing Chung for HK$290.5 million (approximately US$37.2 million).

- An unknown buyer completed the acquisition of a 0.8% stake in SingAsia Holdings Limited (SEHK:8293) from Li Haifeng for an undisclo(SEd sum.

- Zhao Tian Ventures Limited completed the sale of a 1.87% stake in Li Bao Ge Group Limited (SEHK:8102) for HK$72 million (approximately US$9.2 million).

- Ko Chun Hay Kelvin, Executive Director of Super Strong Holdings Limited (SEHK:8262) completed the acquisition of an additional 6.25% stake in Super Strong Holdings Limited (SEHK:8262) from Best Brian Investment Limited for HK$17 million (approximately US$2.2 million).

OCTOBER

- An unknown buyer completed the acquisition of a 60% stake in i-Control Holdings Limited (SEHK:8355) from Newmark Group Limited and others for HK$216 million (approximately US$27.6 million).

- INSPUR Software Group Company Limited acquired a 10.02% stake in Inspur International Limited (SEHK:596) from Dong Hailong and others for HK$220 million (approximately US$28.1 million).

- Forever Star Capital Limited completed the acquisition of an additional 2.96% stake in Huabang Financial Holdings Limited (SEHK:3638) for HK$109 million (approximately US$13.9 million).

- An undisclosed buyer acquired a 1.88% stake in Li Bao Ge Group Limited (SEHK:8102) from Zhao Tian Ventures Limited for HK$72 million (approximately US$9.2 million).

- Investor Ma Chao completed the acquisition of a 31.46% stake in Gold Tat Group International Limited (SEHK:8266) from Fang Gang and Su Peilin for HK$108.6 million (approximately US$14 million).

- Pintec Holdings Limited and Tung Sun Tat, Clement completed the acquisition of a 73% stake in Ever Smart International Holdings Limited (SEHK:8187) from Ho Kin Wai for HK$293 million (approximately US$37.5 million).

- Investor Chiu Ngai Hung completed the acquisition of an additional 23.56% stake in Aurum Pacific (China) Group Limited (SEHK:8148) from Osman Boyraci, Noble Ace Investments Limited and Wong Tai Kuen for HK$35.4 million (approximately US$4.5 million).

NOVEMBER

- YTO Express Group Co., Ltd. (SHSE:600233) completed the acquisition of a 61.87% stake in On Time Logistics Holdings Limited (SEHK:6123) from Lam Chun Chin Spencer for HK$1.04 billion (approximately US$133 million).

- Investor Anthony Wong completed the acquisition of an additional 15.8% stake in LEAP Holdings Group Limited (SEHK:1499) for approximately HK$100 million (approximately US$12.8 million). He now holds a 60.5% stake in LEAP Holdings Group Limited.

- Champsword Limited completed the acquisition of an additional 5.9% stake in Megalogic Technology Holdings Limited (SEHK:8242) for an undisclosed sum.

- Investor Huang Xiaoyun completed the acquisition of an additional 4.06% stake in China Outfitters Holdings Limited (SEHK:1146) from CEC Outfitters Limited for HK$39.2 million (approximately US$5 million).

- An undisclosed buyer completed the acquisition of an equity stake in Li Bao Ge Group Limited (SEHK:8102) from Zhao Tian Ventures Limited for HK$7.16 million (approximately US$0.9 million).

- Champsword Limited completed the acquisition of an additional 3.93% stake in Megalogic Technology Holdings Limited (SEHK:8242) for an undisclosed sum.

- Investor Gao Yunhong completed the acquisition of a 70% stake in FDB Holdings Limited (SEHK:1826) from Masterveyor Holdings Limited for HK$469.15 million (approximately US$60 million).

- Grand Full Development Limited completed the acquisition of Bloomage BioTechnology Corporation Limited (SEHK:963) by way of a scheme of arrangement valued at HK$3 billion (approximately US$384 million).

- Investor Zhang Jinbing completed the acquisition of a 75% stake in Chong Kin Group Holdings Limited (SEHK:1609) from Pioneer Investment Limited for HK$660 million (approximately US$84 million).

- Source Mega Limited and Zhang Chun Hua acquired a 62.55% stake in Prosten Health Holdings Limited (SEHK:8026) from Dynamic Peak Limited, Rainbow Enterprise Holdings Co Limited, Right Advance Management Limited, Will City Limited, China Force Enterprises Inc. and Shen Jing for HK$210 million (approximately US$27 million).

- Investor Ng Kwok Wing Michael completed the acquisition of a 59.47% stake in Celebrate International Holdings Limited (SEHK:8212) from a group of sellers for approximately HK$160 million (approximately US$20.5 million).

- Anthony Wong completed the acquisition of the remaining 55.3% stake in LEAP Holdings Group Limited (SEHK:1499) for approximately HK$360 million (approximately US$46 million).

DECEMBER

- Investor Leung Ngai Man, Chairman and an Executive Director of Sino Prosper State Gold Resources Holdings Limited, completed the acquisition of an additional 0.82% stake in Sino Prosper State Gold Resources Holdings Limited (SEHK:766) for HK$4.6 million (approximately US$0.6 million).

- Tianneng Power International Limited (SEHK:819) acquired 5.12% stake in Chaowei Power Holdings Limited (Tianneng Power International Limited ((SEHK:819) acquired 5.12% stake in Chaowei Power Holdings Limited (SEHK:951) for an undisclosed amount.

- Investor Ma Chao completed the acquisition of the remaining 68.54% stake in Gold Tat Group International Limited (SEHK:8266) from Su Minzhi and other shareholders for approximately HK$240 million (approximately US$31 million).

- Qingda Developments Limited completed the acquisition of a 60.82% stake in Midas International Holdings Limited (SEHK:1172) from Chuang's Consortium International Limited (SEHK:367) for HK$20 million (approximately US$2.6 million).

- Nice Rich Group Limited completed the acquisition of a 41.29% stake in Pegasus Entertainment Holdings Limited (SEHK:1326) from Wong Kit Fong and other shareholders for approximately HK$340 million (approximately US$43.5 million).

- Nice Rich Group Limited completed the acquisition of the remaining 58.71% stake in Pegasus Entertainment Holdings Limited for approximately HK$490 million (approximately US$63 million).

- Investor Chiu Ngai Hung completed the acquisition of the remaining 47.13% stake in Aurum Pacific (China) Group Limited (SEHK:8148) from Osman Boyraci, Lau Yu and other shareholders for HK$70.8 million (approximately US$9.1 million).

- Pintec Holdings Limited completed the acquisition of an additional 25% stake in Ever Smart International Holdings Limited (SEHK:8187) for approximately HK$100 million (approximately US$12.8 million).

- Investor Tang Yau Sing completed the acquisition of a 19.7% stake in Winto Group (Holdings) Limited (SEHK:8238) from Wong Man Hin Charles for HK$85.2 million (US$11 million).

- YTO Express Group Co., Ltd. (SHSE:600233) completed the acquisition of a 28.13% stake in On Time Logistics Holdings Limited (SEHK:6123) for approximately HK$470 million (approximately US$60 million).

TREND WATCH: PRIVATISATIONSConyers advises on the "going-private" merger of JA Solar Holdings Co., Ltd. NOVEMBER 2017 | David Lamb Flora Wong Hanifa Ramjahn Angie Chu Conyers is providing Cayman Islands legal advice in connection with JA Solar Holdings Co., Ltd.'s upcoming going-private merger with JASO Holdings Limited, and subsidiaries JASO Parent Limited and JASO Acquisition Limited for an estimated amount of US$362.1 million (approximately HK$2.83 billion). The merger is anticipated to close in Q1 2018. JA Solar Holdings, one of the world's largest designer and manufacturer of high-performance solar power products, is based in Shanghai. Partner David Lamb, Partner Flora Wong, Counsel Hanifa Ramjahn and Associate Angie Chu of Conyers' Hong Kong office advised on the matter. Bloomage BioTechnology Corporation Limited - HK$3 billion privatisation OCTOBER 2017 | Richard Hall Ben Hobden Conyers provided Cayman law advice to Bloomage BioTechnology Corporation Limited (the "Company") in connection with its HK$3 billion (approximately US$383.7 million) privatisation by Grand Full Development Limited by way of a scheme of arrangement and its subsequent delisting from the Stock Exchange of Hong Kong. Bloomage BioTechnology Corporation Limited develops, manufactures, and (Sells bio-chemical products in China and throughout Asia, the Americas, Europe and internationally. Partner Richard Hall of Conyers' Hong Kong office as well as Partner Ben Hobden of Conyers' Cayman Islands office advised on the matter working alongside Sidley Austin (Hong Kong). |

|

"An anticipated loosening of capital account controls by the PRC regulators in 2018, together with the recent amendments to the US tax code, should result in greater funds being available for cross-border M&A transactions in 2018, with a resulting increase in transaction volumes. On the privatisation side, the increased risk of pricing uncertainty resulting from the use by sophisticated shareholders of the dissent rights under the Cayman merger regime is beginning to result in a move back towards the use of schemes of arrangement for privatisations of Cayman companies from US exchanges, a trend which is likely to continue". — Richard Hall, Partner |

AWARDS AND ACCOLADES

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.