- within Finance and Banking topic(s)

- with readers working within the Media & Information industries

- within Coronavirus (COVID-19), Accounting and Audit, Litigation and Mediation & Arbitration topic(s)

This article was co-authored by Nick Harrold and Michael Klein from Cayman Finance and was published on Cayman Finance: Cayman Islands funds: At the forefront of Japan's investment evolution | Cayman Finance

Japan's shift from savings to investment is no longer theoretical – it's happening. Institutional, high-net-worth (HNW) and retail capital is moving with purpose toward higher-yielding opportunities, especially in private markets. For global asset managers, the door to Japan is wide open. But only those offering the right products, structures and partnerships will succeed.

After decades of thrift and caution shaped by deflation, Japanese households and institutions are undergoing a historic transformation in financial behaviour. A nation once known for parking its wealth in cash and low-yield deposits is now increasingly turning to equities, investment funds and private markets to generate returns in an inflationary environment.

The New Economic Reality

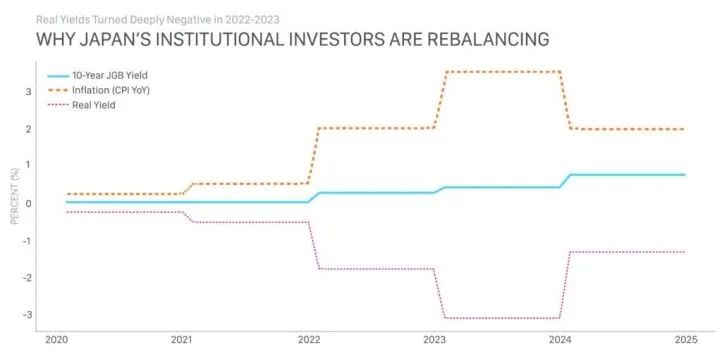

The shift is driven by a new economic reality. As inflation takes hold in Japan after decades of stagnation, the old strategy of leaving cash "under the mattress" is no longer valid and investing becomes imperative. In the past deflationary environment, products and services overall became cheaper. Together with the Bank of Japan's policy of keeping interest rates at, or close to, zero, the economic environment depressed investment returns. Now, with an annual inflation rate of between 3.5% and 4% in 2025, the value of cash is plummeting.

Japanese households have responded by ramping up their exposure to capital markets. Investment in equities and investment trusts has surged reaching an estimated US$2.3 trillion. In 2023 alone, US$108 billion flowed into investment trusts – up 89% from the year before. The trend is also driving investors from Japanese government bonds to private markets.

Nick Harrold says: "Even with the end of Yield Curve Control, the legacy of ultra-low government bond yields lingers. Inflation outpaced returns for much of the last five years, pushing real yields deeply negative."

Yet, over 50% of household assets, around US$7 trillion, remain in cash and deposits, compared with only about 12% in the United States. To encourage greater capital market investments by households, the Japanese government developed the Nippon Individual Savings Account (NISA), a tax-free investment vehicle for retail investors. Since 2022, over 8 million new accounts have been opened and in 2024 purchases tripled to $330 billion. One in four adults over 18 now holds a NISA account.

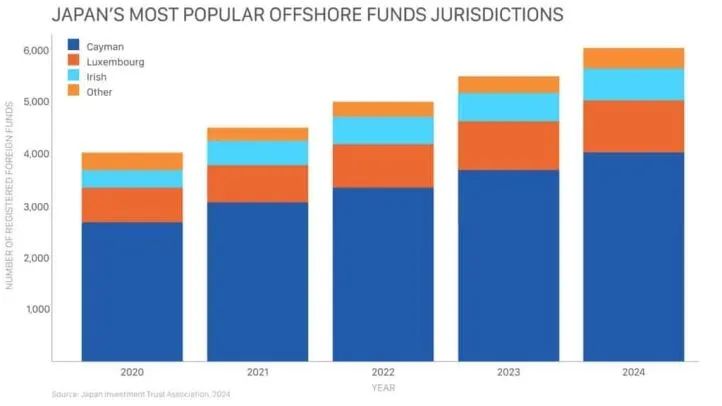

While NISA was designed to boost domestic investment, Japanese investors have been looking outward. Private markets are particularly popular, often necessitating offshore fund structures due to their increased flexibility. Cayman funds remain the preferred vehicle with a close to 70% market share.

US and other overseas equities dominate the portfolios, driven by strong returns and a weak yen, which boosts the value of foreign investments. Last year over 90% was allocated to funds investing in foreign or mixed assets. As foreign institutional interest in Japanese equities is growing, many local retail investors remain committed to global diversification.

"This is still a huge pool of capital waiting to be deployed," Harrold says. "But with inflation back, government initiatives like the expanded NISA programme, and investor education, we're seeing the beginnings of a clear shift."

Investments now constitute the largest portion of household financial asset growth, reaching a level not seen for decades.

Institutional Investors Are Increasingly Allocating to Private Markets and Alternatives

On the institutional side, the pivot is equally pronounced. Japanese life insurers, managing $2.6 trillion, are allocating tens of billions of dollars annually to private markets to match long-term liabilities.

This trend is accelerated by Japan's demographic pressures: With nearly 39% of the population projected to be over 65 by 2050, compared with 31.4% in 2020, generating yield from traditional fixed income alone is no longer viable.

New economic value-based solvency (ESR) regulations regulations have made traditional Japanese government bond-heavy portfolios less attractive, further fuelling this reallocation. Harrold says, the new solvency rules for life insurers, in force since 1 April 2025, require them to hold more capital against such low-yielding assets, especially when they do not match long-term liabilities.

Mega institutions like Japan Post Bank and GPIF, each managing portfolios of around $1.5 trillion, are increasing private market allocations. Japan Post Bank, the world's 13th largest private equity (PE) investor, grew its PE portfolio by 13.4% to $50.12 billion in just nine months to December 2024.

As U.S. President Donald Trump's "reciprocal" tariffs have rattled markets, insurers are also becoming more interested in alternative assets, such as hedge funds and private debt, for their low correlation with traditional assets.

According to Nikkei Asia, all ten major Japanese insurers intend to increase allocations to alternative assets. Dai-ichi Life Insurance plans to keep allocating capital to private equity and real assets such as property and infrastructure. Others, like Nippon Life, plan to increase investment in hedged foreign bonds, expecting that interest rate cuts by the U.S. Federal Reserve and the European Central Bank will reduce currency hedging costs, Nikkei reported.

"Well-structured private market investments/alternatives can deliver stronger long-term returns and greater capital efficiency under the new regime," says Harrold. "This rebalancing is creating significant opportunities for global asset managers who can provide Japanese investors with access to private markets through the right structures."

Global Fund Managers Eye Japan

He says the biggest trend in the Japan market is that Japanese investors from across the spectrum of institutional, high net worth and retail are all wishing to invest into private markets, such as private equity, private credit, infrastructure and real estate.

In response, global asset managers are intensifying their focus on Japan. Leading firms like Blackstone have partnered with local giants Nomura Securities and Daiwa Securities to offer Cayman-based feeder funds into flagship funds across real estate (BREIT), credit (BCRED), private equity (BXPE), and infrastructure (BINFRA). The success of these initiatives is spurring a wave of similar collaborations.

According to Statista Research Department data, assets under management in Japan increased to US$4.2 trillion as at March 2024, a 17% increase over the prior year.

Recent data from Japan's Financial Services Agency also shows that Type II Financial Instruments Business licences were granted last year to StepStone Group LP, Brookfield Japan, Ares Management Asia Japan, and others. These licences enable the distribution of fund interests to Japanese investors, typically via local distributors, and signal a long-term commitment from US managers to the Japan market.

"Over the next 12 to 24 months, we expect a surge in semi-liquid fund offerings aimed at Japanese high-net-worth and retail investors," Harrold says.

The Cayman Unit Trust Remains the Most Popular Investment Vehicle

This represents significant opportunities for Cayman funds due to their flexibility and investor familiarity, he adds.

The Cayman Islands is by far the dominant domicile for Japan's overseas fund investments. The Cayman Islands unit trust has been the preferred investment vehicle for some time for Japanese investors, who are accustomed to similar investment trusts at home.

In addition to its structural similarity, which includes an independent professional trustee overseeing and governing the fund, it can be deployed quickly and, like domestic counterparts, it is treated as tax-exempt, providing certain conditions are met.

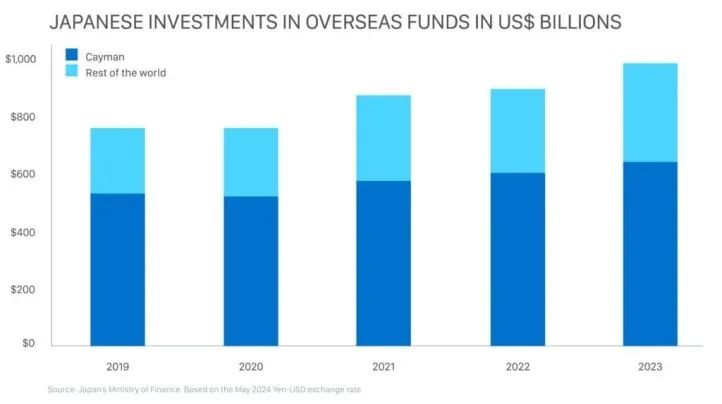

About 65.1% of all overseas fund investments were allocated to Cayman unit trusts in 2023, followed by 16% invested directly in US-based funds and 8.3% invested in Luxembourg unit trusts, according to statistics released by Japan's Ministry of Finance.

Fund investments in absolute terms continued to grow to more than US$645 billion. Overall, about 80% of Japanese investments in Cayman are made in funds, while the remainder is invested in long-dated debt securities.

Japan is undergoing a significant transformation in investment behaviour, driven by inflation, demographic shifts, and proactive government policies. As capital moves from cash into a broader range of assets, private markets are emerging as a key destination for Japanese investors seeking diversification and enhanced returns.

In this context, Cayman Islands funds present the preferred solution for both institutional and individual investors, offering access to global opportunities and robust regulatory standards. As this reallocation of capital gathers pace, Cayman Islands structures are well positioned to support the evolving needs of Japanese investors and the financial service providers who serve them.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.