- within Media, Telecoms, IT and Entertainment topic(s)

- in United States

- with readers working within the Media & Information industries

- with readers working within the Media & Information industries

New business models are needed to fully realize the promise of mainstream satellite-enabled communications

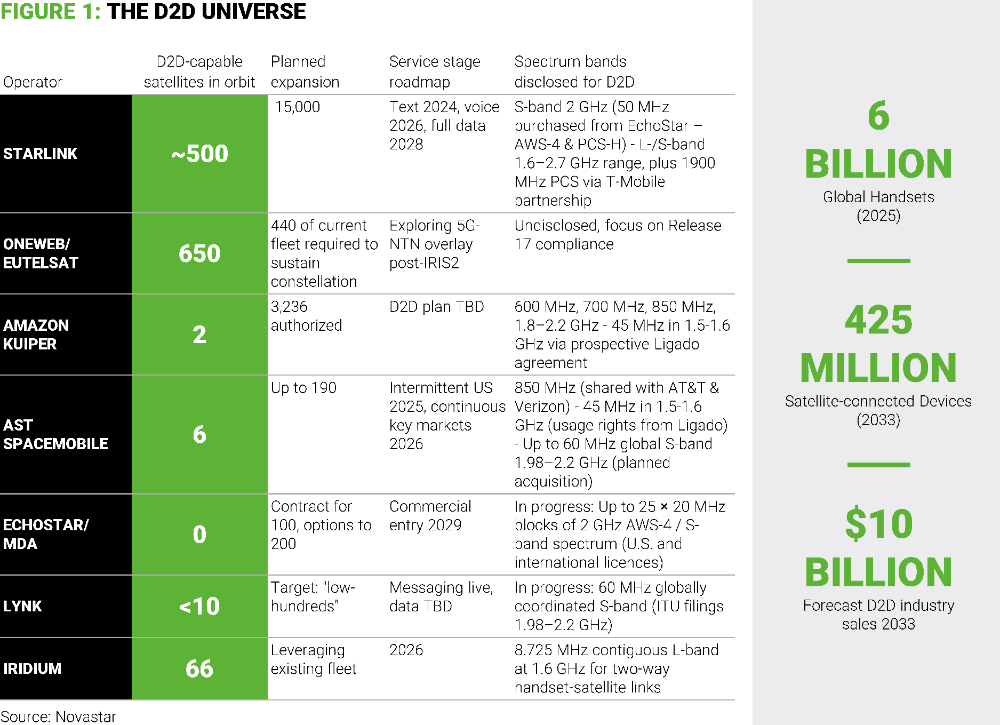

The direct-to-device (D2D) satellite communications sector has reached a pivotal moment as technology collides with the geopolitical realities of expanding from a promising niche into a mass consumer market.

The rapidly growing population of satellites in low-Earth orbit is being expanded with birds dedicated to D2D service as the target market shifts beyond basic messaging and use by first responders into the mass market of mobile devices.

Crucially, many governments now view some form of indigenous satellite connectivity capability as a sovereign priority tied to economic and national security. Such prioritization has triggered a flurry of dealmaking as the satellite industry, telecom operators, and national interests converge.

Suddenly, the moat dug by SpaceX and Starlink in promoting its own D2D infrastructure and network of partnerships looks shallower.

Three technological developments are bringing D2D closer to the mass market:

- Novel satellite designs: These include tennis court-sized arrays able to access weak mobile signals from LEO, or conversely, the proliferation of even smaller form factor satellites with intersatellite link communication capability.

- Falling production costs: Driven by miniaturization and modular design, the smaller form factor can now accommodate more stringent power, communication, and thermal demands to service small ground devices across multiple geographies and orbits at a lower price point.

- Leveraged satellite constellations: Entry barriers have been lowered with new technology that can provide coverage with dozens of satellites rather than thousands. Cheaper satellites necessitate rebasing the calculus of launch costs and significantly altering the capital requirements to scale D2D service.

Spectrum is the glue

Private equity and venture capital have emerged as transformative forces in scaling D2D infrastructure. Now, they are also hungry for spectrum as a Y2K-esque, past-is-prologue asset class.

There is a fundamental shift from seeing space assets as high-risk, long-term investments to quickly scalable industrial platforms with the potential for ongoing revenue.

The space industry is projecting 300 million D2D users worldwide by 2030, based on consensus estimates. This hinges on regulatory harmonization, cross-border coordination, and alignment between satellite and terrestrial service standards. Such alignment is designed to drive the adoption of D2D.

An infusion of venture/private equity capital at this moment could further enable scalable production of configurable satellite buses while supporting aggressive delivery schedules for both commercial and national security applications. Satellite manufacturing startups have secured substantial funding for multi-orbit and reusable bus capabilities, demonstrating diversified investment strategies across the range of satellite service uses.

The broad strategic value of dual-use satellite buses has also attracted more government co-funding and substantial public-private contracts, as government agencies have shown a waning appetite for funding non-recurring engineering and capital expenditure-intensive technology development costs.

As sovereign funding has shifted towards a service model, sovereign concerns have led to more alliances between satellite operators and terrestrial telecom firms that can provide independence from the Starlink nexus. Space infrastructure as a platform is moving a step closer.

This brings us back to spectrum allocation as the core competitive battle in D2D service provision, most evident in the recent transactions involving spectrum held by Echostar. Ownership and leasing will determine not just technical capacity but market access and service quality.

D2D operations rely on Mobile Satellite Service bands and reclaimed terrestrial mobile spectrum. Spectrum remains finite, and competition for prime mid-band assets has intensified dramatically.

The ability to consolidate or control contiguous spectrum blocks grants operators two significant advantages: technical capacity through higher throughput and lower latency, as well as commercial leverage through superior service quality and an expanded geographic reach. Consider it either as an adjustable dial for your dining room lights, or as powerful as an on-off switch.

Spectrum acquisition has simultaneously become a capital markets issue and a regulatory play, where the first-mover advantage in securing spectrum assets can significantly impact global service prospects. Regulatory battles will intensify as legacy terrestrial operators and new satellite entrants contest rules governing spectrum access, interoperability standards, and anti-interference protections.

Right on cue, the next division of global spectrum is slated for Shanghai in October 2027, when China hosts the next World Radiocommunications Conference. This will provide the blueprint for review and potential changes to spectrum use, as well as satellite orbits.

China is making its own push to promote D2D services with the issuance of guidelines and licenses, and could seek to export its own national blueprint for connectivity.

It is no surprise that the D2D convergence carries significant geopolitical implications. Multiple governments view indigenous satellite connectivity capabilities as matters of national sovereignty and national security, seeking alternatives to reliance on foreign-controlled networks. However, this sovereignty is fundamentally reliant on more than just physical ownership; it requires absolute cyber resilience. Governments are demanding systems that guarantee data sovereignty (ensuring national data remains under national legal jurisdiction) and assured mission integrity (protection against jamming, anti-spoofing, and cyber-kinetic attacks aimed at service disruption).

This cyber-driven need for digital trust is the core catalyst for international alliances between satellite operators and mobile operators, as these partnerships must collectively satisfy diverse and often conflicting regulatory frameworks varying significantly by jurisdiction. A lack of verifiable cyber standards is now the primary non-technical risk to securing public-private contracts.

Scenario planning

The D2D sector stands at an inflection point where technology, finance, and spectrum strategy converge to enable genuinely new service models. Success will require not just technical excellence, but also mastery of regulatory environments and strategic spectrum positioning.

For capital investors to succeed, they should not allow investment to be disrupted by regulation – they should create value by making smart plays ahead of time.

For satellite companies to succeed, they should have a solid, focused market strategy and business model that assigns unit economics to partnerships to generate revenue from spectrum allocation.

At AlixPartners, we believe that now is the time for investors and companies to map out the scenarios that can emerge from the upcoming World Radiocommunications Conference in Shanghai. Only then can they chart a winning strategy to stay ahead of the game.

| Scenario | Business Impact |

| Harmonized Spectrum (Optimistic) | Scaled rollout, cross-border service, lowered costs, fierce competition |

| Stricter Interference Protections | Higher compliance costs, slow growth, and incumbent leverage |

| Sovereign-Driven Policy (Fragmented) | Complex negotiations, inconsistent coverage, and market protectionism |

| Expanded MSS & New Use Cases | New segments, bundled offers, and diversified revenue |

| Patchwork or Delayed Policy | Regional deployment, uncertainty, higher R&D and support costs |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.