In our October 2021 leasing bulletin on rent subsidy programs (which can be found here), we briefly summarized the announcement by the Federal Government (the "Government") of the Tourism and Hospitality Recovery Program ("THRP") and the Hardest-Hit Business Recovery Program ("HHBRP"). Since we published our bulletin, there have been further developments and clarifications on these programs. This bulletin will review the most important recent updates on the rent subsidy components of these programs.

Bill C-2, An Act to provide further support in response to COVID-19 ("Bill C-2") and the Canada Emergency Rent Subsidy ("CERS")

On December 17, 2021, Bill C-2 received Royal Assent, bringing the THRP and the HHBRP into law. It is now clear that these programs represent a continuation of CERS, but with substantial modifications to the parameters that will govern an entity's eligibility to receive rent subsidies under the programs and how the rent subsidies will be calculated. The CERS claim period for which the original CERS program parameters will continue to apply ends on October 23, 2021. The new program parameters implemented by the THRP and the HHBRP will apply for all CERS claim periods starting on or after October 24, 2021.

Clarifications on the THRP and the HHBRP

The only eligible entities that may qualify for the greater subsidy rates under the THRP are those that constitute a "qualifying tourism or hospitality entity" within the meaning of the program and meet both of the following criteria:

- it has a "prior year revenue decline" (more on that

below) greater than or equal to 40%; and

- the total of all of its qualifying revenue for each of the relevant pre-pandemic periods for each of the periods used to assess the prior year revenue decline was earned primarily (being more than 50%) from carrying on one or more of a long list of prescribed activities.

You can find the prescribed list of activities here. The references to "tourism or hospitality entity" belie the somewhat broader scope of businesses that could actually be eligible for the THRP. For example, businesses operating or managing amusement parks, fitness or recreational sports centres (subject to prescribed exceptions), or cinemas could be eligible for the THRP.

A qualifying tourism or hospitality entity would only be entitled to a rent subsidy under the THRP if it evinces a current-month revenue decline that is greater than or equal to 40%.

Lastly, we note that an eligible entity would only apply for rent subsidies at the lower rates offered under the HHBRP if it does not qualify for the THRP and the Local Lockdown Program (discussed below).

Calculating the Prior Year Revenue Decline

The "prior year revenue decline" is determined by calculating the average of all of the eligible entity's revenue reduction percentages for each of the first 13 qualifying periods (March 15, 2020, through March 13, 2021), subject to the following caveats:

- you only include one of the 10th qualifying

period or the 11th qualifying period; and

- you only include periods during which the eligible entity was carrying on its ordinary activities or was prevented from doing so because of a public health restriction (within the meaning of the program).

Local Lockdown Program

Additionally, the Government has introduced a local lockdown program (the "Local Lockdown Program") whereby an eligible entity that does not carry on one of the prescribed activities under the THRP can nonetheless qualify for the same subsidy rates as those offered under the THRP. To qualify for the Local Lockdown Program, the eligible entity must be subject to a "qualifying public health restriction", meaning that: (i) one or more of the qualifying properties of the eligible entity is subject to a public health restriction (within the meaning of the program) for at least seven days in the qualifying period; and (ii) it is reasonable to conclude that at least approximately 25% of the qualifying revenues of the eligible entity for the relevant pre-pandemic periods were derived from the restricted activities. For clarity, this analysis looks at the qualifying revenues for the eligible entity for all of its business locations, not just each individual location. This is different from how an eligible entity determines its eligibility for the traditional Lockdown Support offered under CERS (as continued by the THRP and the HHBRP) when the eligible entity has a location that is subject to a public health restriction, where you only need to look at the qualifying revenues derived from the restricted activities at the individual location.

For clarity, the eligible entity would only be entitled to a rent subsidy under the Local Lockdown Program if it evinces a current-month revenue decline that is greater than or equal to 40%.

Expansion of Local Lockdown Program

Shortly after Bill C-2 was enacted, the Government announced that it intends to introduce modified and more accessible program parameters for the Local Lockdown Program for the CERS claim periods from December 19, 2021, to February 12, 2022.

First, they intend to introduce expanded eligibility criteria whereby an eligible entity would qualify for the Local Lockdown Program if:

- one or more of its locations is subject to a public health

order that has the effect of reducing its capacity at the location

by 50% or more; and

- the activities restricted by the order account for at least 50% of its total qualifying revenues during the relevant pre-pandemic period.

Second, the eligible entity would only need to show a current-month revenue loss of 25% or more (as opposed to the 40% or more required under the THRP and the 50% or more required under the HHBRP). For clarity, it would continue to be the case that the eligible entity would not need to show a prior year revenue decline.

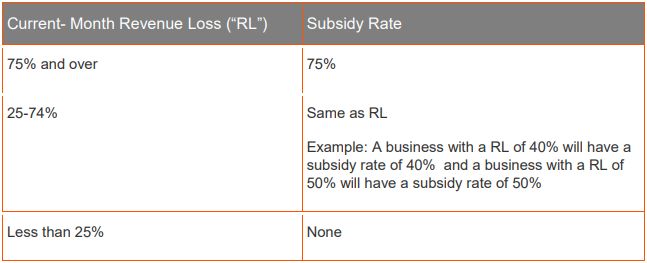

Accordingly, the subsidy rates under the expanded Local Lockdown Program for the prescribed periods would start at 25% for eligible entities showing a 25% current-month revenue decline, increasing thereafter in proportion to current-month revenue loss up to a maximum rate of 75% for those eligible entities evincing a current-month revenue decline of 75% or more. See the table below detailing the proposed rent subsidy structure for the Local Lockdown Program from December 19, 2021, to February 12, 2022.

Continued Lockdown Support

Eligible entities under the THRP, the HHBRP, and the Local Lockdown Program that are subject to a public health restriction (within the meaning of the original CERS program parameters) may claim additional Lockdown Support during the CERS claim periods in which these public health restrictions apply. The program parameters for Lockdown Support remain the same as those initially established under the CERS program. For clarity, in addition to the base rent subsidies offered under the THRP, the HHBRP, and the Local Lockdown Program, eligible entities can receive an additional subsidy equal to up to 25% of qualifying rent expenses incurred at each location affected by a public health restriction.

What's Next?

The expanded Local Lockdown Program is only in place for the two claim periods running from December 19, 2021, to February 12, 2022. For further CERS claim periods, businesses will once again receive rent subsidies to the extent they are eligible under the THRP, the original Local Lockdown Program (as opposed to the expanded version of the program), or the HHBRP, as applicable. It remains to be seen whether the Government will take further steps to expand support in subsequent claim periods if provincial restrictions remain in place.

As we noted in our bulletin on the announcement of the THRP and HHBRP it was unclear if that announcement would impact Ontario's commercial eviction moratorium. In the months since that announcement, no steps have been taken by the Ontario Government to extend the commercial eviction moratorium beyond its set end date of April 22, 2022.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.