April 2016

On April 19, 2016, Prince Edward Island Finance Minister Allen Roach tabled the province's 2016-17 budget. The budget forecasts a deficit of $27.7 million for the 2015-2016 fiscal year, and projects a deficit of $9.6 million for the 2016-17 fiscal year. Surpluses of $9.2 million and $24.5 million are projected for 2017-18 and 2018-19 respectively.

Net debt to GDP ratio peaked at 37% in 2012-13. A return to fiscal balance coupled with economic growth is expected to reduce the ratio to 31.8% in 2018-19. Although the budget includes no personal or corporate income tax increases or decreases, the budget proposes to increase the Harmonized Sales Tax (HST) to 15% (from 14%), effective October 1, 2016.

Following is a summary of the tax measures in the budget.

Business tax measures

Corporate tax rates

No changes are proposed to the $500,000 small business limit or the small business and general tax rates.

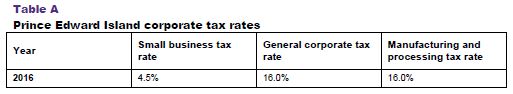

Prince Edward Island's corporate tax rates for 2016 are summarized in Table A below:

Personal tax measures

Personal income tax rates

No changes are proposed to personal income tax rates.

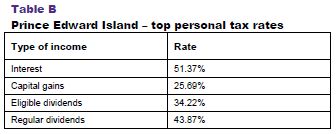

Table B illustrates the combined 2016 federal-provincial top marginal rate of tax on various types of income:

Basic personal amount

The basic personal amount will be increased to $8,000 for the 2016 and subsequent taxation years. This is an increase from the current level of $7,708. The spousal and eligible dependant amounts will also be increased to $6,795 each (from $6,546 and $6,294, respectively).

Low income tax reduction program

The low income tax reduction program provides targeted personal income tax relief to low and modest income families and individuals. The basic, spousal, equivalent to spouse, and child amounts will all be increased by $50 effective for the 2016 and subsequent years.

Real property transfer tax

The 1% real property transfer tax will be eliminated for all first-time home buyers, effective October 1, 2016.

Sales tax measures

Harmonized sales tax (HST)

Effective October 1, 2016, the HST rate will increase from 14% to 15%.

Prince Edward Island sales tax credit

Effective July 2016, the refundable Prince Edward Island sales tax credit for eligible recipients will increase by 10%. The basic credit amount will increase to $110 (from $100) and the spouse, equivalent to spouse, and supplement amounts will increase to $55 (from $50). The maximum amount under the enhanced credit will be $220.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.