This quarterly update discusses developments related to the accounting for income taxes. It includes:

- Federal and provincial/territorial bills tabled or received royal assent in 2012; or tabled before 2012, but did not receive royal assent before 2012

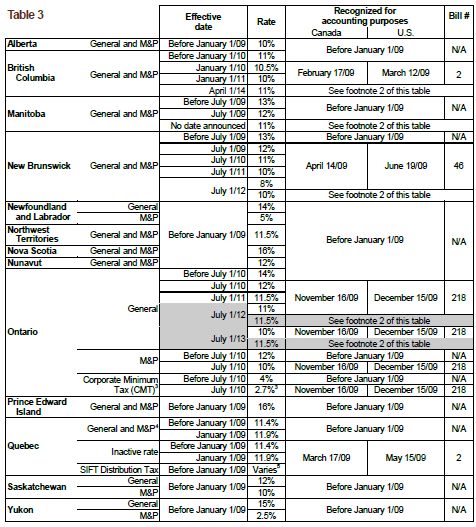

- Corporate income tax rates1 accounting status (January 1, 2009, to June 30, 2012)

- Background determining the accounting status of income tax changes (see the Appendix on page 5)

There were no key legislative developments from April 1 to June 30, 2012, that affect income taxes.

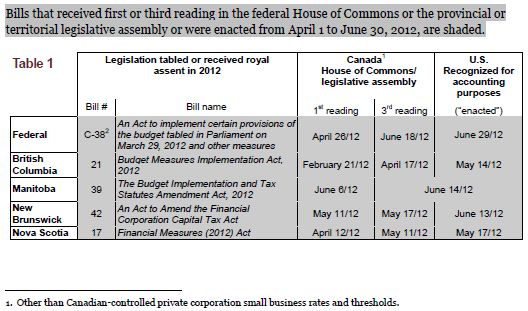

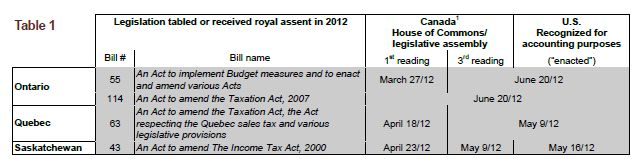

Federal and provincial/territorial bills

The following tables list key bills that include income tax rate changes, other income tax changes (e.g., for research and development) or capital tax changes, and that were:

- tabled or received royal assent during 2012 (Table 1); or

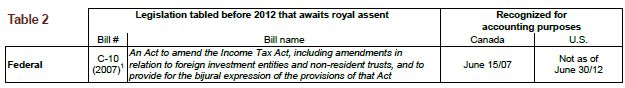

- tabled before 2012, but did not receive royal assent before 2012 (Table 2)

1. See "IFRS" in the Appendix for information on when IFRS applies and the entities that are subject to IFRS.

2. Bill C-38 (2012 federal budget bill) does not include the federal government's March 29, 2012 budget measures that:

- revise the scientific research and experimental development (SR&ED) investment tax credit and expenditure rules;

- confirm the tax treatment on secondary transfer pricing adjustments with foreign affiliates;

- strengthen the thin capitalization rules;

- introduce rules to curtail a variety of transactions, referred to as foreign affiliate dumping transactions; and

- ensure that partnerships cannot be used to circumvent the intended application of sections 88 and 100 of the Income Tax Act.

1. Bill C-10 (2007) died on the parliamentary order paper on September 7, 2008, when the October 14, 2008 federal election was called.

On July 16, 2010, the Department of Finance released revised income tax technical proposals, which reintroduce amendments included in Bill C-10 (2007) and are largely identical to those in Bill C-10 (2007). However, amendments included in Bill C-10 (2007) but absent from these proposals include those pertaining to:

- non-resident trusts and foreign investment entities; and

- the Canadian Film or Video Production Tax Credit.

Amendments in Bill C-10 (2007) that are reflected in the July 16, 2010 proposals continue to be substantively enacted as of June 15, 2007. The July 16, 2010 proposals are expected to be introduced as a bill in the House of Commons.

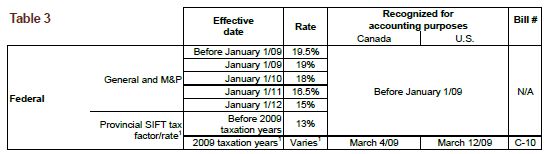

Corporate income tax rates accounting status (January 1,

2009, to June 30, 2012)

The following information excludes Canadian-controlled private corporation small business rates and thresholds. When there is a status change from April 1, 2012, to June 30, 2012, the row is shaded.

1. The effective date for the "provincial Specified Investment Flow-Through (SIFT) tax rate" is 2007 or 2008 taxation years if an election is filed. Except for Quebec, this rate will be:

- based on the general provincial corporate income tax rate for each province in which the SIFT has a permanent establishment; and

- 10% for SIFTs that do not have a permanent establishment in a province.

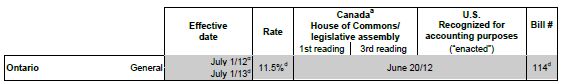

2. The following table shows the status of legislation for corporate income tax rates (excluding Canadian-controlled private corporation small business rates and thresholds) from January 1, 2011, to June 30, 2012, inclusive.

a) See "IFRS" in the Appendix for information on when IFRS applies and entities subject to IFRS.

b) British Columbia's 2012 budget increases the general and M&P income tax rate to 11% on April 1, 2014, but describes the increase as a temporary measure to be triggered only if the province's fiscal situation worsens.

c) New Brunswick's Bill 53 (2011 budget bill) maintains the general and M&P rate at 10% (the rate was to decline to 8% on July 1, 2012).

d) Ontario's Bill 114 (2012 budget bill) freezes the general income tax rate at 11.5% (the rate was to drop to 11% on July 1, 2012, and to 10% on July 1, 2013). See Table 1 on page 2 for the bill name.

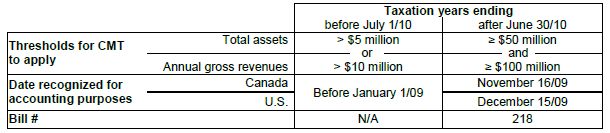

3. For Ontario, the thresholds at which the Corporate Minimum Tax (CMT) applies (on an associated basis) are revised as follows:

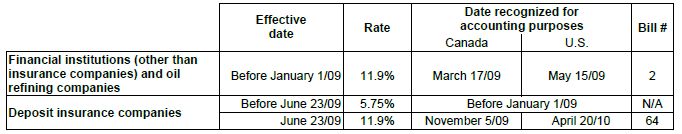

4. For Quebec, exceptions to the general rate follow:

5. Quebec's SIFT Distribution Tax equals the Quebec corporate income tax rate that would apply if the SIFT were a corporation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.