- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Insurance and Healthcare industries

United States and global M&A rebounded in the first quarter of 2024, powered by the return of mega deals worth US$10 billion or more. According to Bloomberg, global deal values are up about 21 percent year-on-year to more than US$660 billion in the first three months of the year, with the United States leading the charge.

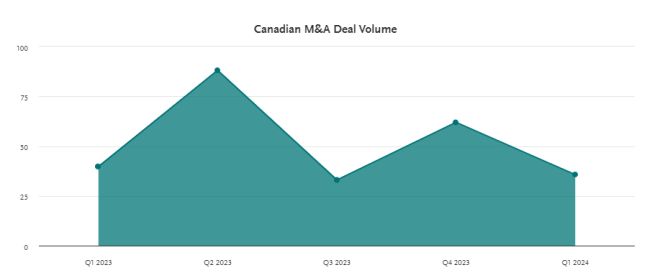

By contrast, in Canada, M&A activity has been lagging so far this year. Deal value declined by US$4 billion in Q1 2024, compared to the same period last year and deal count dropped from 811 to 618. The number of deals in Q1 was up for the second straight quarter, however. The increase in M&A globally and particularly in the U.S. is a welcome development—and a potentially promising sign for the Canadian market.

Deal making trends we are following as we move through 2024 include:

- The appetite for deals, not for debt

- How investor interest in generative AI can translate into more M&A activity

- The growing use of NAV loans, preferred equity and the continued availability of co-investment opportunities in PE

- What's behind longer transaction timelines in M&A deals

- An increased reliance on representation and warranty insurance

Canadian M&A Activity Q1 2024

All numbers are according to Bloomberg data in U.S. dollars (announced, completed or pending deals—excluding those that have been terminated or withdrawn—where a Canadian company is the acquirer, target or seller) as of March 31, 2024.

Canadian M&A deal volume has been up-and-down since the start of 2023. While the overall first quarter of 2024 was down, the $20.26 billion in deals in March was the second highest monthly total since June 2023. January's 216 deals were the most in one month in the past three quarters.

The telecommunications sector led the way by value in Q1 2024 with $10.57 billion on nine deals. Next was oil & gas ($5.25 billion, 14 deals), followed by real estate ($3.22 billion, 7 deals) and biotechnology ($2.53 billion, 7 deals). Mining rounded out the top five by sector with $1.95 billion in value on 153 deals.

Mid-market deal activity softened somewhat to start the year with 43 deals worth $5.18 billion, compared to 58 deals worth $7.69 billion in Q1 2023. So far in 2024, both volume and deal count in the mid-market have been improving month-over-month.

Interest Rates

On April 10, 2024 the Bank of Canada held the key interest rate at 5 percent for the sixth consecutive time. Bank officials believe the conditions for interest rate cuts could materialize this year, but say they need to see a continued decline in core inflation.

The U.S. Federal Reserve held its benchmark interest rate steady at 5.25 percent on March 20, 2024. The Fed announced that it expects to cut interest rates this year but also said it will not be ready until it sees "more good inflation readings."

Appetite For Deals, Not For Debt

Given the current environment, dealmakers have shown a reluctance to use as much debt to finance mid-market acquisitions as they have in the recent past. Potential corporate acquirers have focused on using debt to fortify balance sheet positions, recapitalize, and refinance existing obligations, and private equity firms have turned to direct lenders to provide fresh cash by making preferred equity investments to existing portfolio companies (we take a closer look at preferred equity below).

This is not to say that there is no appetite for transactions that fulfill financial or strategic imperatives, but dealmakers are adjusting to a rate environment that pre-dates the iPhone. In this context, acquirers are exploring a range of financing options beyond traditional debt instruments such as shifting more of the financing burden to sellers (in the form of vendor takeback notes, for example) to offset the need to access acquisition financing. Cash reserves, equity and equity-like instruments, and other creative financing structures are being considered to navigate the challenges posed by higher interest rates, while pursuing accretive transactions. By adopting a prudent and flexible approach to financing, acquirers aim to sustain deal activity and capitalize on growth opportunities in a shifting financial landscape. The recent dip in activity reflects a strategic adjustment period to changing market dynamics.

Continued Interest But Stagnated M&A Activity In Generative AI

Partners from Bennett Jones moderated and spoke during a Canadian Venture Capital Association (CVCA) webinar in February 2024 on investing in generative AI. This included a look at structuring investments and M&A deals. While M&A activity in GenAI remains slow (similar to other industries and sectors), investment in GenAI continues to grow and this is expected to translate into increased dealmaking.

Investors will find it hard to ignore major headlines such as Nvidia's reported blowout Q4 2023 earnings and Saudi Arabia's Public Investment Fund's plans to create a US$40 billion fund to invest in AI, all of which is continuing to generate investor appetite across the AI food chain. This appetite is carrying over from 2023, a year in which AI and machine learning startups attracted 35 percent of all venture funding in the U.S., up from about 22 percent in each of the prior three years, according to PitchBook data.

One potential reason for stagnated M&A activity in the sector is that companies may not be prioritizing an exit yet. As we noted in our prior blog, GenAI has been generating new categories of valuable information, making it crucial for companies to navigate this terrain thoughtfully and compliantly, especially considering the regulatory, legal and social considerations at play. In other words, the market is young and investors may be waiting for these considerations to crystallize further before transacting. From the buyer perspective, high valuations may explain the slower M&A market, as potential suitors wait for peak valuations to cool.

Private Equity

As we begin 2024, institutional investors continue to see the appeal of private equity. Coalition Greenwich's January 2024 report on private markets in North America suggests that institutional investors in both Canada and the U.S. plan to increase their allocations to private assets over the next three years. The survey—which included more than 100 large U.S. and Canadian institutional investors with US$500 million to $50 billion in assets under management—found that 33 percent are targeting increased private equity holdings and over 40 percent are looking to grow their private debt exposure.

The 2024 Alternatives Watch (AW) Research Investor Compendium tracks US$172 billion in capital flowing into alternative investments by more than 70 of the world's largest institutional investors. AW says that each year for the last five years, there have been greater allocations to institutional investment portfolios being carved out for non-traditional and less liquid alternatives. All of this suggests that interest in alternative investments is still running at elevated levels.

So far in 2024, sponsor trends focused on value creation, creative generation of distributions and exit strategies include:

- Growing use of NAV loans. Faced with the need to return cash to investors in a slow environment for exits, NAV loans have been gaining popularity among GPs, allowing them to borrow against the net asset value of the portfolio holdings (as opposed to facilities secured by the uncalled capital commitments of investors). Bloomberg sees a growing trend of insurers lending to PE funds that want to borrow against their investments and about 20 insurers in the U.S. are investing in NAV loans to private funds. Bain & Company notes, however, that LPs are sensitive to tactics like funding distributions with NAV loans that generate cash now but obligations later.

- Use of preferred equity. Sponsors and owners looking for creative alternatives continue to offer partial liquidity deals to investors combined with continued portfolio company growth using preferred share instruments as a financing tool. Preferred equity financing may include both company-level and fund-level funding typically with PIK based dividends and priority in liquidation at the company level. Several preferred equity investments in the US$400 million range were announced in the first quarter of 2024 and Bloomberg says that demand for preferred equity has risen recently, "as more borrowers look to defer cash-paying interest costs and second lien loans go out of vogue."

- Continued availability of good co-investment opportunities. Demand and capacity by investors for co-investment deals continues to be substantive. This, coupled with a restricted fund-raising environment, creates a very active co-investment market. In 2024, sponsors continue to frequently offer their existing or new investors attractive co-investment deals to execute on deals alongside sponsors and provide funding for acquisitions and restructurings either concurrently, or subsequently on a post-closing syndication basis. The co-investment opportunities are mostly investor friendly, ranging from "no-fee/no-carry" deals to transactions with one-time closing fees payable to sponsors and carry interests of up to 20 percent, with a portion of broken deal expenses allocated to co-investors.

Co-investments have become an increasingly popular practice as asset managers expand their LP bases and increase their average deal sizes. Over the past decade, 30 percent of all global PE deals have included co-investors, according to PitchBook data. Infrastructure Investor says LPs are inundated with co-investment opportunities as GPs seek out capital in a tough fundraising environment.

Transaction Timelines

In a post-pandemic world, acquirers, both strategic and financial, have turned their focus to asset quality and accretive acquisitions. In addition to the desire to enhance value and ensure a smooth integration of acquired entities, the shift towards a more detailed assessment process is primarily driven by a desire to mitigate risks as a result of higher borrowing costs. While these practices undoubtedly contribute to more informed decision-making and price discovery, they can also extend the duration of transaction timelines, sometimes significantly. In public-to-private deals, an added layer of complexity to the acquisition process is heightened regulatory reviews and added hurdles to securing shareholder approval.

A recent survey completed by SRS Acquiom of senior executives at investment banks of various sizes headquartered in the U.S. found that almost two-thirds of respondents (64%) report that, compared to their pre-pandemic experience, it takes more time now to complete due diligence in a typical M&A transaction, with over half of those respondents (58%) saying it takes, on average, another one to three months to complete due diligence.

Despite the challenges posed by extended timelines, the added diligence can foster more informed and successful acquisitions, thereby delivering long-term value to stakeholders involved. To adapt to longer timelines, acquirers and sellers are:

- Optimizing the due diligence processes by focusing on the perceived risks and strategic importance of the transaction and prioritizing key areas of concern and leveraging technology, where possible.

- Engaging their advisors earlier in the transaction process to identify any valuation concerns, issues with deal terms, regulatory obstacles or other legal issues that may individually, or collectively, become gating items as the transaction progresses.

- Reevaluating their timeline expectations to consider the current market conditions.

Increased Reliance On R&W Insurance

A trend that we are observing is increased reliance on representation & warranty (R&W) insurance, despite lower deal volume. Off the back of a tremendously busy 2021 and early 2022, R&W insurers increased their capacity and resources, and new entrants entered the market, meaning that competition among insurers is tighter than ever. Throw into the mix a soft M&A market in 2023 for resulting insurance premium reductions and coverage innovations as a key theme of 2024, and ultimately an uptick in usage of the insurance product across all key industry sectors and over smaller deal sizes. Underwriters are also getting more accustomed to coverage of a wider range of jurisdictions, as their experience and relationships with local counsel in those jurisdictions grow.

Generally, a better understanding of R&W insurance and increased buyer sophistication around the product seems to be driving demand. We expect that heading further into 2024, demand for this coverage will remain resilient and an important tool for deal protection across all industry sectors.

Looking Ahead

As we put Q1 in the rearview mirror, our focus shifts to the next 9 to 12 months. So far in 2024, the landscape of Canadian M&A activity has reflected a blend of evaluation and cautious optimism. Despite evidence that the U.S. and global markets have rebounded, the Canadian M&A market remains below pre-pandemic levels, on a quarter-on-quarter basis. Investor certainty typically drives deal activity, and with the Bank of Canada holding the key interest rate steady (while edging closer to getting inflation back to its two per cent target), there continues to be a foundation to support increasing deal activity in the second half of 2024. Market participants will not stop seeking returns and accretive transactions—investors expect returns and growth on the money they have invested—but with careful planning prudent corporates and PE firms can capitalize on pent up demand.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.