- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Healthcare and Law Firm industries

INTRODUCTION: GENERATIONAL CHANGE IN CANADIAN COMPETITION AND FOREIGN INVESTMENT LAW

2024 was a watershed year for Canadian competition and foreign investment law reform. After incremental legislative and regulatory changes to the Competition Act and Investment Canada Act in 2022 and 2023, 2024 delivered passage of the most significant amendments to both statutes in more than a decade. Now, in 2025, the rubber is ready to hit the road. As we turn the page from legislative reform to law enforcement, time will tell whether we are entering a new epoch of emboldened enforcement or whether the amendments will reveal themselves to be a Potemkin village. The year ahead will serve as an important marker as the practical implications of the new legislative environment begin to crystallize.

Matthew Boswell, the Commissioner of Competition ("Commissioner"), has advocated passionately for competition law reform and can claim a number of significant victories. The Competition Act has been amended to provide powerful new enforcement tools (many on the specific recommendation of the Commissioner), including, to name just a few, the adoption of a per se wage-fixing cartel offence, a structural presumption for mergers, a less demanding test for abuse of dominance and substantial penalties for civil anti-competitive agreements. In order to put these tools to use, the Competition Bureau ("Bureau") has been handed a larger budget and the gate has been opened wide for private actions. In the wake of these changes, the Commissioner has heralded a new era of competition law enforcement. He has promised more enforcement, quicker action and stronger remedies.

New competition laws do not, however, necessarily translate into more robust enforcement. When the Competition Act was last meaningfully amended in 2009, following earlier Bureau recommendations, new civil competitor collaboration provisions were added to serve as a flexible complement to the criminal cartel offence; in the roughly 15 years since the adoption of those provisions, they have gone largely unutilized. So far, at least, history has repeated itself. The first year of criminalized wage-fixing and no-poach agreements has passed without a case being brought, and the repeal of the merger efficiencies defence (perhaps the Bureau's most hard-fought legislative change) has not precipitated an increase in merger remedies. However, the Bureau has flexed its new power to compel information through market studies and has announced investigations that are poised to leverage recent changes to the Competition Act's abuse of dominance and civil anti-competitive agreement provisions. These steps set the stage for more vigorous enforcement in the year ahead.

On the foreign investment side, the Canadian government's national security enforcement posture has stiffened markedly in recent years. In the first 10 years after the Investment Canada Act's national security review regime was introduced in 2009, the provisions were invoked only 28 times; over the last five years, the national security review process has been initiated 115 times (26 of which were in the last year alone). 2025 is set to see expanded compliance obligations for foreign investors as new mandatory filing regimes, including for minority investments, come into force. The Canadian government has already demonstrated its willingness and ability to intervene in minority investments it considers injurious to Canada's national security. It is to be seen whether the new filing obligations fuel an even more robust enforcement posture.

Our 2025 Outlook seeks to tackle the uncertainty of Canada's new competition and foreign investment law enforcement landscapes. As the dust settles after years of frenzied legislative action, we set our sights on whether the objectives of the push for reform are likely to be achieved, and the risks and opportunities these new enforcement paradigms create.

Investment Canada Act: How Will the Government Use Its New Powers?

NEW MINISTERIAL POWERS ARE NOW IN-FORCE

This last year has seen considerable changes to the Canadian foreign investment law landscape; most notably the passage of Bill C-34, An Act to Amend the Investment Canada Act ("Bill C-34"), which represents the most significant update to the Investment Canada Act ("ICA") since 2009.

Certain of the amendments introduced through Bill C-34 came into force on September 3, 2024. They contain a host of new Ministerial powers including, in the context of national security reviews, authority for the Minister of Innovation, Science and Industry ("Minister") to impose interim conditions, extend national security reviews of investments without an order of Cabinet, accept undertakings to mitigate national security risk and disclose privileged case-specific information to allies. The in-force amendments also include changes to the closed material proceeding rules used in judicial reviews, clarification surrounding the consideration of intellectual property rights as a factor in "net benefit" reviews (a separate ICA regime to the national security review process), and a requirement for the Minister to report accepted national security undertakings and Cabinet orders to other Canadian agencies.

These changes were accompanied by two administrative notes providing insight regarding the Minister's new powers to impose interim conditions and to accept undertakings, including detailed procedures for the use of these new Ministerial powers as well as a non-exhaustive list of the types of interim conditions that may be imposed and the categories of undertakings that may be accepted.

The remaining amendments set out in Bill C-34 are expected to come into force in 2025, the most notable being the new mandatory pre-closing filing requirement for acquisitions of control and minority investments in sensitive sectors. Taken together, the currently in-force and pending amendments to the ICA are likely to significantly impact both procedural norms and substantive strategies followed by foreign investors potentially subject to the ICA's national security regime in the coming year. Investors and their counsel will need to take note of both potential new requirements to file pre-closing, as well as the Minister's new power to extract concessions from investors to achieve clearance and interfere with post-closing integration, when developing their strategy.

Taken together, the currently in-force and pending amendments to the ICA are likely to significantly impact both procedural norms and substantive strategies followed by foreign investors potentially subject to the ICA's national security regime in the coming year

AN INCREASINGLY POLITICAL STATUTE

The ICA is a creature of politics, as the last year has made even clearer. In 2024, we saw particular industries come to the political forefront, with the ICA positioned as a critical government tool to address growing concerns. This was particularly apparent in government consultations on electric vehicles, economic security and unfair Chinese trade practices commenced in 2024, each of which sought input on the use of foreign investment regulation to address these issues. Nonetheless, these consultations have also provided increased transparency by highlighting key areas of concern for the Federal Government, including electric vehicles, batteries, battery parts, semiconductors, solar products, critical minerals and interactive digital media. This level of transparency is expected to continue into 2025 as the Federal Government works – in part through public consultation – to identify critical sectors that will be subject to its new mandatory, pre-closing filing regime.

The ICA is a creature of politics, as the last year has made even clearer

The impact of a Federal election, which must occur by no later than October 2025, further underscores the political nature of the ICA. Foreign investment reviews are likely to be extended where they raise politically sensitive issues, and approvals are likely to be "on hold" between the date the election writ is dropped and the date the new Cabinet is formed, pursuant to the traditional "caretaker" convention. Moreover, a change in the Federal Government would likely have a significant impact on ICA enforcement priorities, specifically in the national security context, although sensitivity to Chinese investment and investment in key resource sectors such as critical minerals is likely to continue.

In recent years, the enforcement of the ICA has been heavily influenced by political priorities in the United States, with close cooperation observed by security agencies on either side of the border. The election of President Donald Trump and associated shifts in the U.S. national security and foreign investment landscape are also likely to directly impact the types of transactions that will be reviewed under the national security provisions in Canada.

CONTINUED EMPHASIS ON NATIONAL SECURITY ENFORCEMENT

The Foreign Investment Review and Economic Security (FIRES) Branch's significant national security enforcement activity maintained its course in 2024, a trend we expect to continue into 2025. For the fiscal year ended March 31, 2024, 26 investments were subject to national security review, approximately on a par with the record 32 in 2022– 2023. Of those 26 reviews, 15 received an order for full review, which was seven fewer than the year prior. Of those 15 full reviews, six investors withdrew their application and terminated their investments, two were ordered to divest their investments entirely (i.e., a divestiture or prohibition order), and seven reviews were cleared by the government (officially, unconditionally). It is likely that at least some of the reviews reported as unconditional clearance were subject to informal mitigation. We expect that the number of reviews cleared (officially) unconditionally will decrease in 2025 as the Minister exercises his new power to statutorily accept undertakings, leading to more conditionally cleared investments. Moreover, three of the 11 reviews that concluded without requiring a full review involved investors terminating their transactions, suggesting that the government had identified national security concerns in those cases as well.

The Foreign Investment Review and Economic Security Branch's significant national security enforcement activity maintained its course in 2024, a trend we expect to continue into 2025

Despite the continued emphasis on national security reviews, only 26 of the 1,201 investments (about 2%) for which notifications and applications were made were subject to a national security review. In this respect, investors can take some comfort from the fact that very few foreign investments into Canada are subject to, let alone blocked by, national security reviews. However, with the likely implementation of the new mandatory filing regime for certain investments in 2025, this number is expected to increase (potentially to a large degree).

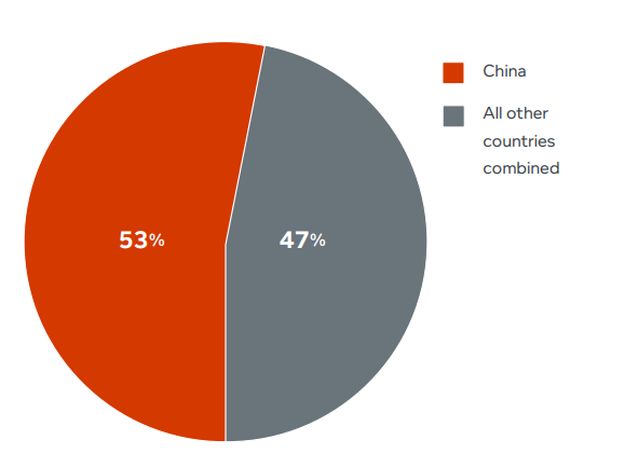

Extended National Security Reviews by Investor Origin

This chart compares the number of orders for a full national security review by investor country of origin.

The origin of the investor continues to be a critical national security consideration. As in prior years, investments by Chinese investors made up a disproportionate number of investigations. Of the 15 full reviews ordered, 8 related to investments by Chinese-controlled purchasers, of which all but one were either withdrawn and terminated or subject to a prohibition. Nevertheless, the majority of investments from China (over 79% in 2023–2024) received no national security intervention. Accordingly, while Chinese investors continue to be more likely to attract scrutiny than investors from other jurisdictions, Canada is still open to Chinese investment, and a case-specific national security risk assessment is imperative in the deal planning stage. Interventions relating to investments from a range of other countries – including the U.S., UK and Germany, shows that national security concerns can arise even where an investor is ultimately controlled in an allied country. Notably, however, six of these seven non-Chinese investments were officially cleared on an unconditional basis.

STRONGER NATIONAL SECURITY RISK ALLOCATION IN TRANSACTION AGREEMENTS

Our annual review of the 30 largest negotiated deals involving Canadian publicly listed entities between January and December 1, 2024 ("Canadian M&A Deal Study") indicates that the manner in which the ICA is incorporated in transaction agreements is subtly changing. Whereas there was a decrease in the number of 2024 transactions featuring a representation on the purchaser's status as a World Trade Organization or trade agreement investor (designations which dictate the applicable ICA review threshold), there was a further increase in the number of agreements containing a representation that the purchaser was not a state-owned enterprise for ICA purposes, reaching 35% in 2024 compared to 27% and 23% in 2023 and 2022, respectively. This is a clear market-driven response to the additional enforcement risk associated with state-owned enterprise purchasers under the ICA.

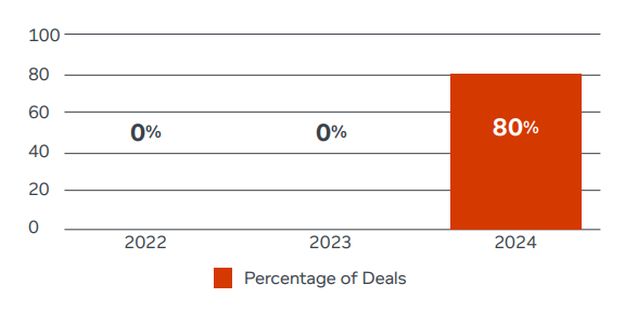

Percentage of deals including a covenant regarding filing timelines for net benefit review applications which also require purchaser to file net benefit undertakings.

However, the ICA is not only impacting representations and warranties in transaction agreements – it remains pertinent to deal timing. Of the six deals in 2024 that included a covenant regarding filing timelines for net benefit review applications, five required that the foreign purchaser file undertakings. This further underlines that merging parties are being much more prescriptive in how they covenant regarding the anticipated review process under the ICA. Additionally, of the 26 deals with a foreign-controlled buyer, 19% included national security clearance under Part IV.1 of the ICA as a closing condition (which typically includes either the expiry of the time period after filing a notice in which a national security review can be initiated by the Minister, or clearance if a review is commenced), compared to 27% and 5% in the previous two years, respectively. More prescriptive conditions regarding filing timelines and remedies and break fees with respect to national security remain relatively unusual, but are likely to become more commonplace as the national security landscape continues to shift. More specifically, as the mandatory filing regime enters into force in 2025, it is likely that those deals falling under the to-be-determined definition of "prescribed businesses" may consider stronger conditions relating to foreign investment approval, including lengthier outside dates for any high-profile or politically sensitive transactions to ensure sufficient risk allocation between the parties as a result of the new pre-closing filing requirements.

As the mandatory filing regime enters into force in 2025, it is likely that those deals falling under the to-be-determined definition of "prescribed businesses" may consider stronger conditions relating to foreign investment approval

Merger Review: A Change in the Toolkit and a Change in Emphasis?

Following a series of piecemeal changes over the past 15 years, comprehensive amendments to the merger control regime of the Competition Act came into effect in 2024 with the passage of Bill C-59. These amendments have facilitated a shift in the Bureau's enforcement approach, foreshadowing a few key trends for Canadian merger review in 2025 and beyond.

TRANSACTIONS INVOLVING A TARGET WITH SIGNIFICANT IMPORT SALES ARE NOW MORE LIKELY TO BE NOTIFIABLE

For the first time since 2019, more than 50% of the transactions considered as part of our Canadian M&A Deal Study have included a Competition Act closing condition.1 While the Canadian M&A Deal Study focuses on transactions involving publicly listed Canadian entities, we expect to see an increase in the number of transactions involving non-Canadian entities that will require Competition Act approval as a result of a key change to the merger notification thresholds under the Competition Act.

Transactions involving the acquisition of an operating business2 in Canada are subject to a mandatory pre-merger filing where two monetary thresholds are exceeded (additional criteria and exemptions may also apply). The Size of Parties threshold, which requires parties to a transaction (together with their affiliates) to have a combined aggregate book value of assets in Canada, or combined annual gross revenues from sales in, from and into Canada, exceeding C$400 million, remains unchanged.

However, the Size of Transaction threshold, which previously only considered the target's assets in Canada and the revenues they generate (i.e., sales in and from Canada), now requires that the target's assets in Canada or its revenues generated from sales in, from or into Canada from all of the assets being acquired exceed C$93 million (the monetary value of this threshold can be adjusted annually based on gross domestic product growth). As such, merger notification analysis now requires consideration of sales from Canadian assets within and outside of Canada as well as sales from non-Canadian assets into Canada.

The inclusion of import sales in the Size of Transaction threshold means that transactions involving a target with cross-border business are more likely to be notifiable to the Bureau. For example, the acquisition of a manufacturer with a distribution centre in Canada (i.e., an operating business) that made significant sales (i.e., >C$93 million) to Canadian customers exclusively and directly from non-Canadian manufacturing facilities was not previously notifiable, as these cross-border sales were not considered under the Size of Transaction threshold. Under the revised threshold, these cross-border sales would be caught as sales "into Canada" and, assuming the Size of Parties threshold is also exceeded, the transaction would be notifiable to the Bureau. Firms contemplating the acquisition of a foreign-domiciled company that doesn't have a material manufacturing or sales presence in Canada will nonetheless now need to consider whether the company's sales "into" Canada require the transaction to be pre-merger notified under the Competition Act.

The inclusion of import sales in the Size of Transaction threshold means that transactions involving a target with cross-border business are more likely to be notifiable to the Bureau

PARTIES TO COMPLEX TRANSACTIONS CAN EXPECT LENGTHIER REVIEWS

Arguably the most significant change to the Competition Act is the introduction of a structural presumption, whereby a transaction that results in, or is likely to result in, market shares in excess of 30% or concentration beyond prescribed thresholds, together in either case with an incremental increase in concentration above a prescribed level, is presumed to be anti-competitive, unless the merging parties can prove otherwise on a balance of probabilities. While the new structural presumption closely mirrors the structural presumption in the U.S. DOJ's 2023 Merger Guidelines, the U.S. guidelines can be revoked or amended at any time and can be applied on a discretionary basis, whereas this new structural presumption is enshrined in law, creating a much more permanent feature with arguably more limited scope for enforcement discretion.

Over the past few years, the Bureau has advocated for a structural presumption, which is expected to be at the centre of its merger enforcement approach going forward

Over the past few years, the Bureau has advocated for a structural presumption, which is expected to be at the centre of its merger enforcement approach going forward. While it is too early to predict whether the structural presumption is likely to result in a material increase in the number of mergers being blocked, it will result in a lengthier and more complex review process for a larger set of transactions, and may well have a chilling effect on transactions that exceed the presumptive thresholds. In particular, parties to a transaction that would result in a market share or concentration in excess of prescribed thresholds in any relevant market are now more likely to receive a Supplementary Information Request (akin to a second request under the Hart-Scott-Rodino process in the U.S.). This will allow the Bureau to obtain the records and data necessary to closely assess any arguments being made by the parties to rebut the structural presumption but will necessarily increase the costs and timelines associated with regulatory clearance.

SUBSTANTIAL REMEDY PACKAGES MAY BE REQUIRED TO CLEAR TRANSACTIONS

The Competition Tribunal ("Tribunal") can now make remedy orders that restore competition to pre-merger levels. This expands the scope of the Tribunal's remedial powers, which were previously limited to orders that restore competition to a point at which it can no longer be said to be substantially less than it was before the merger.

As a result, parties can expect more onerous, and potentially contentious, remedy negotiations with the Bureau. Additional enhancements to the Bureau's toolkit, such as an automatic prohibition on closing of a transaction pending disposition of the Bureau's application for an interim order to enjoin closing, will also incentivize the Bureau to take a more aggressive stance where parties attempt to close over the Bureau's objections.

In line with this regulatory enforcement shift, we expect to see a change in negotiation tactics between merging parties, as purchasers attempt to account for this higher remedial standard when negotiating regulatory efforts covenants in transaction agreements

To view the full article, click here.

Footnotes

1. As described in the previous chapter, the Canadian M&A Deal Study involves an annual review of the 30 largest negotiated deals involving Canadian publicly listed entities between January and December 1, 2024. Of the 30 transaction agreements reviewed, 17 agreements included a Competition Act closing condition.

2. An operating business is defined in the Competition Act as "a business undertaking in Canada to which employees employed in connection with the undertaking ordinarily report for work."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.