Since the Queensland Government announced that it is targeting 80% renewable energy by 2035, all states in the National Electricity Market (NEM) have made plans to supercharge their energy transition. One of the little-understood consequences of ongoing energy transition is the impact on Frequency Control Ancillary Services (FCAS). These are essential system services procured by the Australian Energy Market Operator (AEMO) to keep system frequency within a target range. This is important to keeping the system stable and preventing collapse.

This brief provides an overview of what FCAS is, the drivers that affect prices, and why it is important to understand these drivers.

So what is FCAS, and why does frequency control matter?

For a power system to operate safely, demand and supply should always be in balance. Frequency control refers to "controlling the speed" of a power system. If there is a sudden increase in demand and no corresponding increase in supply, frequency will deviate, destabilising the power system. In extreme cases, this could lead to a system collapse. To ensure that the system is balanced, AEMO manages the frequency of our electricity system at 50 HZ (cycles per second) with tight tolerance. They do this through the procurement of FCAS. FCAS essentially facilitates the fast injection, or reduction of energy, into the system to bring it back into balance where it deviates from the target range.

There are eight different frequency markets across the NEM.

Two regulation markets – used to correct a minor drop or rise in frequency and typically provided by thermal generators, including:

- Regulation market to raise

- Regulation market to lower

Six contingency markets – used to arrest a major drop or rise in frequency, stabilise, or recover frequency following a major fall or rise in frequency, including:

- 6-second contingency market to raise

- 6-second contingency market to lower

- 60-second contingency market to raise

- 60-second contingency market to lower

- 5-minute contingency market to raise

- 5-minute contingency market to lower

These services are typically provided by fast-responding generators, like batteries.

FCAS is becoming critical to the market as more variability exists within the system. These variabilities can include the following:

- Sudden demand changes due to extreme temperatures

- Sudden rise or drop in renewable generation due to cloud cover

- The unexpected exit of generators like coal generators that typically provide FCAS services

- Increasingly unexpected transmission outages with extreme weather-driven events.

Put simply, there is a lot more volatility within the system that throws off the supply and demand balance, making frequency control more important than ever.

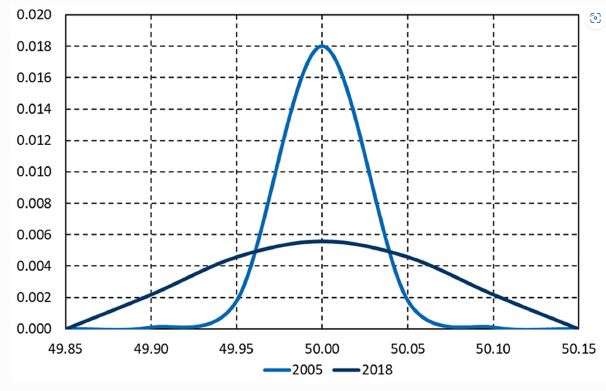

Figure 1 shows the distribution of frequency for NEM for the years 2005 and 2018. Frequency distributions for the NEM are increasingly further away from the 50 Hz mark. The widening range indicates that the control of frequency deteriorated between 2005 and 2018. In 2005, renewable energy penetration was approximately 9%. By 2018, this had doubled to 18% of the total energy generated.

Figure 1: Frequency distribution within the normal frequency operating band in the NEM (2005 Snapshot vs. 2018 Snapshot)

Source: AEMO, Removal of disincentives to the provision of primary frequency response during normal operating conditions — Electricity rule change proposal, 1 July 2019, p.14.

With aggressive renewable energy targets announced across NEM states and a significant pipeline of coal-fired exits expected before 2040, the importance of FCAS will only continue to grow. Recent market observations show that future contingency events for the NEM are likely to be multi-faceted. Whether it be a hydrogen-producing electrolyser creating a sudden spike in demand, or a simple millisecond cloud cover over the largest solar renewable energy facility, additional weighting must be given to other sources of variability in a way that the NEM has not considered before. This can be expected to impact both the demand and prices for these services.

These changing market dynamics have already had significant price impacts. FCAS regulation cost moved from an average of $1.6/MW/Hr between 2003-15 to $26/MW/Hr during 2016-21, and FCAS reserve jumped from $4/MW/Hr to $23/MW/Hr.

What does the future hold for FCAS Pricing?

While increased variable renewable energy generation and accelerated coal closures have increased the demand for FCAS, several factors have impacted FCAS prices.

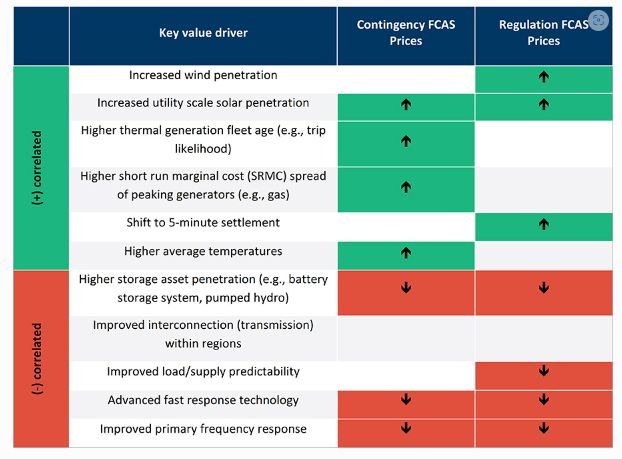

FTI Consulting analysed different drivers of FCAS to determine whether the driver had a positive or negative correlation with FCAS prices. The results of this analysis are presented in Figure 2.

Figure 2: Results of FTI Consulting's analysis on different drivers of FCAS

Source: Battery Operation in the WEM, 20 July 2022, Report for the Economic Regulation Authority

Table 1 shows that drivers resulting in more uncertainty in generation output, like ageing thermal generation fleet or transmission outages, meant higher FCAS prices, particularly with respect to contingency FCAS.

An analysis of 2019-2021 FCAS price data shows that most extreme price occurrences in FCAS contingency markets are due to separation events caused by transmission faults and/or extreme weather events. This happens where one region is isolated from the rest of the market and FCAS must therefore be supplied locally by the isolated region. Due to their location at either end of the network, Queensland and South Australia are most vulnerable to these events.

Additionally, frequency deviation caused by sudden changes in renewable energy output can likely cause wide swings in FCAS prices. For example, when comparing the contingency FCAS markets in South Australia in 2016 with an increased level of renewable energy generation in 2021, it's clear that the frequency of extreme price events is much greater for the raise market.

However, as shown in the table above, drivers that diversify or firm generation output, such as increased storage investment, result in lower FCAS prices. This is provided that these services can be offered at a lower cost per unit from these technologies.

It's not always the large transition investments in storage technologies that can improve the frequency balancing capability of the system. Small changes, like asking every generator to do their fair share of frequency control through the recently mandated primary frequency response control rule, can help stabilise frequency across the NEM (at the expense of curtailing output from generators).

So can we bank on FCAS markets humming away reliably?

Will they provide a bankable revenue stream for new technologies, including energy storage?

Storage is well placed to mitigate the deterioration of system frequency, given its technical properties, and FCAS is an important source of revenue for storage. The FTI Consulting experts' analysis suggests that FCAS revenues in the short term typically make up between 50 – 60% of the value stack for batteries. This makes it critical for business cases for new projects and delivery of return expectations.

However, FCAS prices are difficult to predict given the relationship with (generally unpredicted) volatility in generation output. Investors in storage can undertake historical analysis of FCAS prices, but this information can't be used to bank a project. Whilst many advisors predict that FCAS will fall to low levels as more storage enters the market, it is difficult to foresee how this can eventuate in practice if:

- Storage investors require FCAS revenue for their return expectations

- Investment in variable renewable energy generation continues

- Coal generation retires in line with expectations (announced retirements) in the medium term.

While new storage projects will bring increased supply to FCAS markets, potentially driving lower prices, we can expect similar levels of contingency events in the future and new spot markets for storage (Fast Frequency Response, Primary Frequency Response, Inertia and Operational Reserve). These spot markets will likely be implemented in the future to meet the dual objective of promoting investment in storage while meeting system security requirements in a future NEM with high levels of renewable energy generation.

Storage will have a huge role to play in the market to support the achievement of government renewable energy targets. For this investment to occur, storage dependency on existing or likely new forms of FCAS revenues must be understood and planned for. This is from the perspective of accessing finance, but also for the projects to remain solvent. Some state governments have effectively addressed this through specific arrangements to support new storage investment – like the New South Wales Long-term Energy Service Agreements (LTESA) for generation and long-duration storage and the Victorian energy storage targets.

While these are important initiatives to support investment in storage, scepticism should be applied to any FCAS forecast that predicts low prices in the next 15 years.

How we can help you

Our clients get access to a range of scenarios for revenue stacking with FTI Consulting's proprietary models:

- NEM-Lab - an in-house electricity market model that provides insights into different market futures

- B-Rom or Battery Revenue Optimisation – helping you understand the value and risks of achieving an optimal revenue stack for different types of batteries

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.