With Australians experiencing higher-than-normal electricity prices, the design of the National Electricity Market (NEM) remains under intense scrutiny from consumers, policymakers and regulators. The NEM is a gross pool market, which means it's primarily designed for the centralised dispatch of controllable generators. As the industry grapples with the increased penetration of variable generation and associated changes in system integrity and resilience, the Oxford Institute of Energy Studies has proposed a theory that, in this instance, two energy markets are better than one. This brief will explore that idea further.

Separation of supply

In the NEM, generators are dispatched in real-time based on their bids and regardless of technology type. The NEM, like all efficient markets, seeks to set prices based on underlying costs, allowing generators to realise their long-run marginal costs (LRMC) over time. However, compared to traditional dispatchable generators – such as coal and gas generation – renewable generation has a strikingly different cost profile over time.

Similarly, the role of renewable generation and dispatchable generation in energy supply is very different, with:

- renewable generation providing a bulk generation method that will decarbonise the electricity network while also offering a low cost and a very low short-run marginal cost (SRMC).

- dispatchable generation (for example, gas, battery and hydro storage) providing flexible and stable generation that ensures reliability of supply.

With differences in costs, investment drivers, and the role of each generation source, The Decarbonised Electricity System of the Future: The 'Two Market' Approach (the Oxford report) contends that there may be merit in separating the market for both.

Separation of demand

In addition to differences in supply, consumers' behaviour and preferences are also different. Some consumers may have more flexibility to respond to high price signals and maximise their use of lower-cost renewable power, while others may be willing to pay more to guarantee ongoing supply.

In the NEM, the value of lost load or market price cap (set at $15,000 per megawatt hour) represents electricity's maximum economic value for all consumers. However, the maximum economic value of electricity varies for different consumers, so why should all consumers pay the same price?

Two supply markets

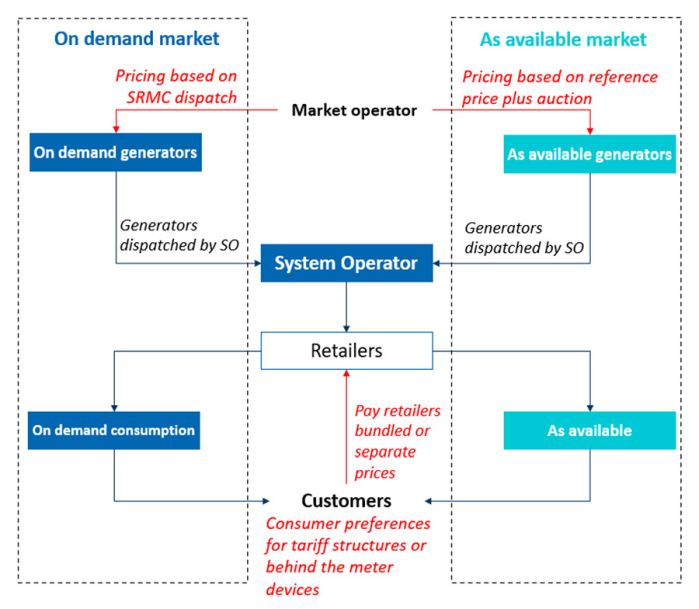

The Oxford report proposes a two-market solution that helps consumers better meet their own preferences, which in turn will create clear and efficient price signals for investment.

An 'as-available' market for variable generation would be cheaper for consumers and priced to represent the LRMC of variable generation.

- Pricing in the as-available market could be set by the market operator using a reference price based on the LRMC of variable generation. In practice, investment cases may require additional support, as generators in the as-available market would no longer receive volatile or higher wholesale prices. This could include, for example, an auction to determine an annual premium for these projects.

- Dispatch would allow as-available generation to preferentially feed into the network (with some allowances for network constraints and minimum operational demand).

An 'on-demand' market for dispatchable generation would act as residual to the as available market. However, the on-demand market could include a combination of generation and battery sources.

- Pricing in the on-demand market would operate as it does in the current wholesale market – that is, using economic bidding for residual demand. A key principle of the two-market approach is that pricing in the on-demand market would not be distorted by lower-priced bidding from as-available generation. As a result, the demand for and the LRMC of dispatchable generation would be revealed over time.

- Dispatch would operate as it does in the current NEM merit order dispatch but only include on-demand generation.

Figure 1: Two-market approach to energy flows

Source: The Oxford Institute for Energy Studies

Two demand markets

The two supply markets would be supported by a retail market (including metering and settlements) that reflects consumer demand across both markets separately.

Retailers would purchase 'hedges' or wholesale supply of as-available and on-demand electricity separately. It would also provide customers with tariffs that separate as-available and on-demand power, allowing them to make an informed choice about their electricity consumption and supply, and investment in their own distributed energy resources.

In practice, does two make perfect?

Although this may sound like it adds further complication to an already complex energy market, the two-market approach could be simpler and more closely aligned with supply.

- Reliability and uninterrupted energy supply becomes a matter for consumers to value themselves – though it would require retail price regulation and established processes for vulnerable customers.

- Demand response becomes a feature of the market rather than a defined product. Demand response in functioning economic markets is simply consumers responding to changes in price.

- Investment signals across both markets represent each market's role in electricity supply and remove price distortions. In addition, it would not require capacity payments for generation in the long term, as consumers are making their own decisions about the reliability of supply.

- Network tariffs could better reflect the role of the network. Networks are built to support peak demand, but network services are often priced based on energy consumption. Separately metering a consumer's on-demand requirement could open a pathway for a more cost-reflective approach to network pricing.

- System security and ancillary services remain a public good. System operator costs and the purchase of system security services would remain centralised and could be passed on to consumers outside of their energy costs.

- Retailers and aggregators will likely optimise supply across both markets, providing more options to consumers.

Over the past 20 years, the NEM has changed from a regulated and public industry to a deregulated privatised market that offers commercial incentives for generation and consumer pricing. The two-market approach may be considered an evolution of this, as it looks to turn the NEM into a fully functioning and efficient market.

Therefore, while traditional thinking has been "why do two things when you can do one?", the current disruption to NEM may be a rare opportunity for a principled, market-based approach to create two good outcomes.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.