- within Real Estate and Construction topic(s)

- with Inhouse Counsel

- in United States

- with readers working within the Banking & Credit, Property and Retail & Leisure industries

Investment Climate

Fast 5: What we're seeing in the industry

Capital moves & power plays: APAC's investment pulse

Tell me more: Australia is leading the charge in Asia Pacific's evolving M&A landscape, with Q2 2025 marking its strongest quarter since 2021. While global uncertainty has prompted a more cautious tone, dealmakers are still getting deals done – especially in the living sector, where the $3.85 billion Aveo acquisition set a new benchmark. Fundraising has slowed overall, but private equity and infrastructure remain bright spots, and foreign capital continues to flow, drawn by Australia's stable currency and safe-haven status. Meanwhile, boardroom dynamics are shifting, super funds are challenging fund managers, legal disputes are surfacing, and capital is being reallocated to more agile players. The message? The market is moving, but the rules of engagement are changing

Australian hotel market dubbed a 'safe haven' for investors

Tell me more: The tourism and hospitality sector in Australia has become an increasingly attractive focus for investors, supported by a sustained recovery in tourism levels, robust hotel trading performance, and global market volatility that enhances Australia's reputation as a 'safe haven' for investment. Australia is currently the second most popular investment destination in the APAC region, behind only Japan. The sector's strength is reflected in the H1 2025 transaction volumes which rose 56% compared to H1 2024, with foreign investors comprising 45% of total activity.

The office sector recovery continues

Tell me more: The office market is continuing to recover. Rents recorded positive growth in Q2 and in H1 2025, all four of the major CBDs recorded positive net absorption. National average national CBD capital values experiencing three consecutive quarters of positive growth, notably achieving the first y-o-y increase since December 2022, registering at 1.4%. While global uncertainty may pose a challenge, the office sector is well positioned to continue its recovery

Total returns for healthcare assets are on an upward trajectory

Tell me more: Although there have been relatively few major transactions in Q2, investor demand in the healthcare sector remains strong, with a shifting focus toward day hospitals, specialist clinics, and life sciences hubs. Despite recent pressures from operating costs, market conditions are expected to improve over the next several years, supported by a moderation in inflation, increased investment in workforce training and enhanced funding through the Medicare and Private Health Insurance schemes.

Supply constraints continue across multiple sectors

Tell me more: The commercial office market's limited new supply is driving medium-term rent growth as tenants increasingly prefer premium-grade spaces. Likewise, in the retail sector, steady demand coupled with scarce new supply has reduced vacancy rates to 11.1%, the lowest since CBRE began tracking in 2021. In the living sector, innovative construction methods, including prefabricated homes, are gaining momentum as solutions to the national housing shortage, alongside sustained investment in the BTR sector. Overall, constrained supply across commercial, retail, and residential sectors is shaping market dynamics, driving growth and innovation to meet evolving demand.

Australia's investment trends

- "Inflation continues to ease. Inflation has fallen substantially since the peak in 2022, with trimmed mean inflation at 2.7% in the June quarter, and headline inflation at 2.1%, which has partly been affected by temporary cost of living relief measures.

- Cash rate cuts continued in Q2. The RBA cut the cash rate from 4.10% to 3.85% in June and again in August to 3.6%, which is expected to further ease cost of living pressures, particularly for households with mortgages. Market economists are predicting additional cuts this year.

- Business confidence saw an overall uptick during Q2. While business confidence weakened following tariff announcements, a positive shift has occurred due to recent interest rate reductions, the deferral of US tariff implementations, and a rebound in global equity markets. In July, business confidence increased by 2 points, reaching +7 on the index, surpassing the long-term average of +5. Should this trend persist, a corresponding increase in leasing activity across various real estate sectors is anticipated in H2.

- Transaction activity remains robust. Despite persistent geopolitical challenges, Australia's commercial real estate investment sector is demonstrating continued signs of revitalised strength. Q2 2025 saw transactions reach ~$16.6 billion, marking the highest quarterly volume since the final quarter of 2021. This performance highlights heightened investor confidence and continued market momentum.

- Spotlight on AREITs annual report trends: Several prominent listed real estate companies, including Mirvac, Charter Hall, Lendlease, Stockland, Dexus and Goodman Group, released their annual reports, with GPT reporting its interim (1H25) results. A clear theme has been a return to profitability for Dexus, Mirvac and Lendlease, which all rebounded from losses in the prior year. Capital inflows and funds under management grew strongly, particularly at Charter Hall and Goodman, reflecting continued investor demand. Several groups, notably Stockland and Goodman, are expanding into digital infrastructure, with data centres becoming a major component of development pipelines. Occupancy levels remain high across portfolios, logistics continues to underpin earnings, and land lease communities feature in growth strategies. Portfolio optimisation is also evident, with groups such as Dexus and Lendlease recycling capital through disposals of non-core assets to sharpen focus on growth sectors.

- The retail sector continued to grow. In Q2 retail transaction volumes reached ~$2.346 billion, representing a 39.4% increase compared to Q2 2024. Q2 investment activity rose by 51% relative to Q1. This positive trajectory is expected to continue, particularly as retail spending will likely see an increase as a result of the RBA's recent cash rate cut to 3.6% and easing inflation. "Investment in PBSA is expected to increase. The Albanese government's announcement to increase international student intake by 250,000, reaching a total of 295,000 in the coming year, has sparked excitement in the sector. Investor activity is already present with major players such as Scape as a result of the policy announcement.

- Unlisted real estate investment performance has shown marked improvement. Following a period of subdued results, all segments within the unlisted real estate market experienced significant gains in the twelve months ending June 2025. Retail and industrial property funds delivered robust annual returns of 7.6% and 6.2% respectively. Meanwhile, office property funds demonstrated a notable recovery, posting a less negative return of -0.6% over the same period.

- "Retail funds have demonstrated exceptional performance. Within the MSCI Australian Wholesale Index, retail unlisted wholesale funds emerged as the top-performing sector, delivering a strong total return of 7.6% for the year ending June 2025. This notably surpassed the broader market's annual return of 2.4%.

- Australia's data centre boom is continuing. More than $26 billion in investment is forecasted and a projected doubling of national capacity by 2030. In Q2, data centre transactions exceeded $2.4 billion, driven primarily by the Future Fund's $1.9 billion co-investment alongside New Zealand's Infratil in CDC.

- "Investor interest in alternative assets is continuing. In particular, Australia's cold storage sector is expected to increase in the coming years, driven by rising demand, increased online food consumption, and population growth. Other alternatives such as self-storage facilities, childcare centres, yacht marinas, and PBSA are also expected to grow.

- Uncertainty remains for M&A transactions. Market volatility has been intensified by escalating global tariffs imposed by the Trump administration, coupled with stringent messaging from newly empowered competition regulators. Together, these factors have introduced considerable uncertainty and instability, weighing on deal activity throughout the region. In the Australian market, Q2 2025 experienced a reduction in both transaction count and average deal size, with 252 deals completed compared to 281 in the same period last year

Sub-sector snapshots

Office

Fundamentals within the office sector have shown ongoing improvement during Q2 2025, supporting a sustained recovery nationally

Consecutive yield growth recorded

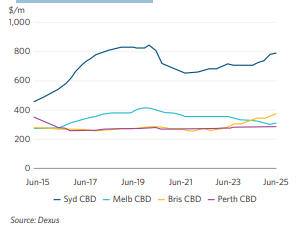

National average yields remained relatively stable at 6.87% for prime-grade assets and 7.96% for secondary assets. Continued stabilisation of yields coupled with growth in face rents has resulted in average national CBD capital values experiencing three consecutive quarters of positive growth, notably achieving the first y-o-y increase since December 2022, registering at 1.4%.

Although office investment activity remains below initial expectations, with sales totalling $136.5 million in Q2, forecasts indicate a resurgence in the second half of 2025, driven by heightened investor interest aligned with strengthening market fundamentals.

Prime effective rents have experienced notable growth, with Brisbane leading at a 13.1% increase over the past year, followed by Sydney at 11.1% and Perth at 1.8%..

Prime net effective rent growth.

Vacancy rates are on the rise

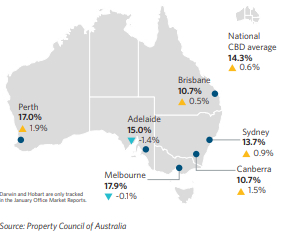

Australia's office market vacancy rate has increased to 15.2% nationwide, marking its highest level in approximately thirty years. The Property Council of Australia attributes this rise to a market shift towards premium-quality office space, alongside the introduction of new supply aimed at meeting tenants' demand for higher quality spaces.

Australian CBD office vacancy rates

In Q2 2025, gross leasing volumes remained steady at approximately 80,000 sqm, comparable to Q1, with Melbourne and Sydney CBD accounting for 35% and 27% respectively. During this period, 65% of leased space consisted of Premium or A-grade assets, demonstrating tenants' sustained preference for high-quality premises in prime locations. However, this represents a decline from the 75-80% range recorded over the previous year, reflecting a reduction in available Premium-grade options in preferred areas and limited new supply

Annual gross additions by year-end are expected to be 25% below 2024 levels and 35% beneath the decade-average. Nevertheless, the commitment rate upon project completion increased from 54% in Q1 to 70% in Q2.

To view the full article clickhere

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.