- within Government and Public Sector topic(s)

- with Finance and Tax Executives and Inhouse Counsel

- with readers working within the Healthcare and Retail & Leisure industries

AUSTRAC has recently taken enforcement action against several remittance and digital currency exchange (DCE) providers for failures to comply with reporting obligations within the timeframes required under legislation. These providers were issued infringement notices ranging from $75,120 to $187,800.

Obligation to submit reports on time

AUSTRAC Ongoing Reporting Obligations

Apart from the annual compliance report, there are three (3) types of reports that AUSTRAC receives from reporting entities:

- Suspicious matter reports (SMRs) - All reporting entities are required to submit a SMR within three (3) business days of forming a suspicion in relation to suspected money laundering activity, and within 24 hours in relation to suspected terrorism financing activity.

- Threshold transaction reports (TTRs) - Remittance providers are required to submit a TTR within ten (10) business days of receiving from or paying to someone, cash of at least AUD 10,000 (or foreign currency equivalent).

- International funds transfer instruction (IFTI) reports - Remittance providers are required to submit an IFTI report within ten (10) business days, each time they send an IFTI out of Australia, or receive an IFTI into Australia.

It is essential that regulated entities adhere to these timeframes to allow AUSTRAC to detect and respond to criminal conduct in a timely manner. Delayed or non-reporting of suspicious matters, threshold transactions and IFTIs are faults that can be exploited by criminals that engage in money laundering and/or terrorism financing activities.

Reports must be accurate and of quality

Apart from timely reporting, it is also important to provide accurate and quality information within reports to increase their usefulness to AUSTRAC.

AUSTRAC has published several resources that provide guidance on how to improve the quality of reporting, including this page and e-learning modules. In summary, reporting entities should provide clear, correct and relevant information in relation to the specific fields found in the relevant reporting forms.

What can reporting entities do?

How to comply with reporting obligations

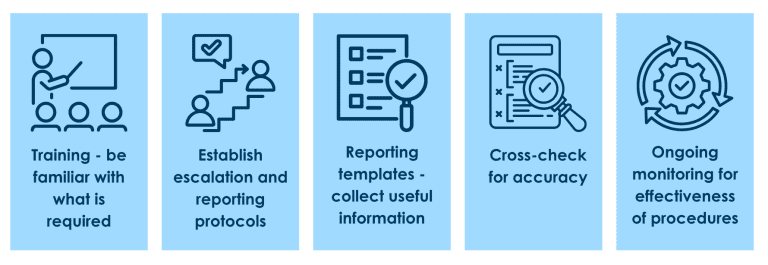

Here are some steps reporting entities can take to ensure that they are complying with their reporting obligations:

- Training - Staff should be provided regular training to familiarise themselves with what type of information is expected to be included in the reports, and how to identify such information when interacting with customers or using internal systems/software. Reporting entities should appoint someone with expertise on AUSTRAC reporting requirements to oversee the reporting function in their business.

- Escalation protocols - Reporting entities should develop appropriate internal escalation and reporting protocols, to enable information to reach the relevant person within the business who is responsible for submitting the reports to AUSTRAC. Please note, escalation protocols and reporting procedures must not contravene the tipping off prohibition.

- Reporting templates - Reporting entities can implement internal reporting templates that assist relevant staff to collect all the information required for reporting purposes. The templates should contain helpful guiding questions that assist the relevant staff member to provide useful information.

- Cross-checking - Reporting entities should ensure that information submitted to AUSTRAC is accurate and complete. Where possible, prior to submitting a report to AUSTRAC, information contained in the draft report should be cross-checked against internal system data, client files, transaction records and any other information available to the reporting entity. Any inaccuracies must be rectified as soon as possible.

- Ongoing review of procedures - Reporting entities must recognise that AML/CTF compliance is an ongoing effort that requires regular monitoring on effectiveness and changes to ensure that procedures are fit for purpose and appropriate to the size, complexity and risks of the business.

If you require assistance understanding your reporting obligations, please contact us.

Further Reading

- What are the reporting obligations for remittance dealers and DCEs?

- Crypto exchange $75k out of pocket for missing reporting deadlines

- AUSTRAC issues $187,800 infringement notice for late reporting

- AUSTRAC orders external audit of Western Union Financial Services

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.