- in North America

- with readers working within the Banking & Credit industries

- within Law Practice Management topic(s)

It is now confirmed that Australia will have a mandatory and suspensory (competition) pre-merger clearance regime with the passing of legislation late yesterday.

The legislation, titled the Treasury Laws Amendment (Mergers and Acquisitions Reform) Act 2024, will have a widespread and significant impact on the Australian merger landscape.

Under the new regime, mergers (any acquisitions of shares or assets) that meet certain thresholds will be required to be notified to the Australian Competition and Consumer Commission (ACCC) and approved prior to proceeding.

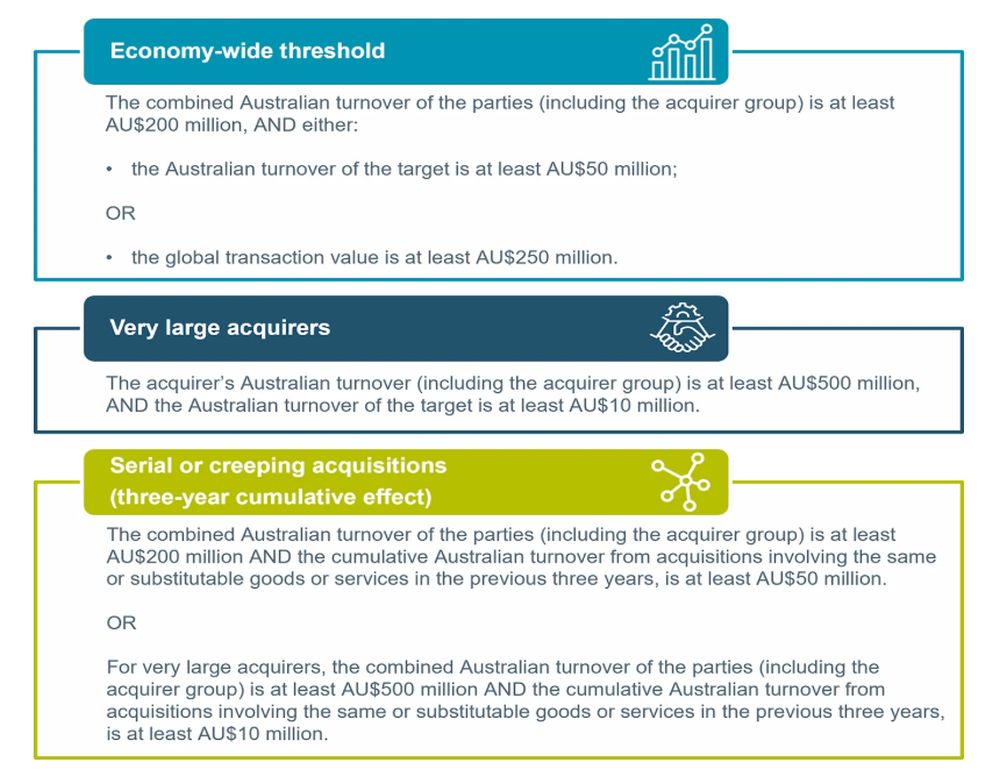

In brief, the thresholds are as follows:

The legislation also provides that the Treasurer will be able to adjust the thresholds to respond to concerns in relation to "high-risk" sectors—for example, the Australian government has indicated that it intends to require notification of all mergers in the supermarket sector.

Prior to these reforms, Australia was one of only three Organisation for Economic Co-operation and Development countries that did not have a mandatory merger clearance regime in place. The Australian government has stated that "the current 'ad hoc' merger process is unfit for a modern economy" and that "these reforms are the largest shakeup of Australia's merger settings in half a century".

While parties can seek voluntarily clearance under the new regime from 1 July 2025, the regime will officially commence on 1 January 2026.

Accordingly, businesses seeking to effect mergers and acquisitions in Australia should begin considering the approach that they wish to take under the legislation, the likely timing of the proposed acquisition and its completion, as well as the effect of acquisitions that have been undertaken in the previous three years.

We set out further detail on the legislation in an earlier Insight, which can be found here.

We will continue to update you on further developments flowing from the passing of the legislation, including the ACCC's upcoming analytical and process processes.

In early 2025, we will be hosting more detailed presentation sessions on the reforms—should you wish to attend, please keep an eye on our future announcements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.