- within Corporate/Commercial Law topic(s)

- in United States

- within Corporate/Commercial Law, Technology and Real Estate and Construction topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Retail & Leisure and Law Firm industries

Pre-bid stakes not only provide the bidder with a seat at the target's table for engagement purposes, it can act as a significant deterrent to rival bidders.

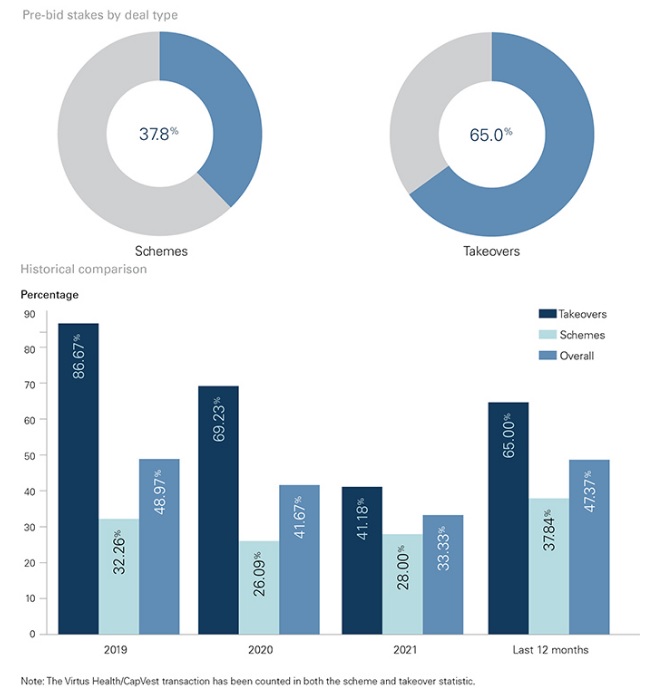

Our M&A 2023 Outlook found pre-bid stakes were much more prevalent this year – with pre-bids used on 47% of all deals, which is a 14% jump from the previous survey period.

This reflects both improved market conditions, with lower relative equity markets and more stable economic conditions, and a growing recognition of their strategic importance for deals. It also reflected an increase in opportunistic bids from existing shareholders. Bidders had some form of pre-bid stake on almost 50% of deals, taking the forms of direct stakes, call options, pre-existing stakes and voting agreements.

Source: M&A 2023 Outlook

Pre-bid stakes have historically been the domain of strategic bidders who are prepared to invest cash upfront to take direct stakes in target companies. These typically took the form of an acquisition of a direct legal interest, potentially accompanied by a physically settled equity derivative for a portion of the stake (to address any FIRB or other regulatory approvals required before the legal interest could be acquired).

Increasingly, however, private equity bidders and institutional investors are also willing to take stakes with a view to maximising their prospects of success in a bid. Notable examples include BGH Capital, which took a direct 19.9% stake in Virtus Health, and Blackstone, which took a direct 10% stake in Crown. In addition to BGH Capital's stake, it followed up its pre-bid stake by launching a takeover and acquiring additional shares on market to take its position above 20%. This decision was critical in overcoming CapVest's agreed deal after a prolonged period of competing offers back and forth.

However, pre-bid stakes can take other less direct forms which can serve as useful deterrents to rival bidders. One such example this year was TA Associate's exclusivity and standstill arrangements with Viburnum Funds (Viburnum) in relation to its stake in Infomedia. The arrangements precluded Viburnum from negotiating with competing bidders or supporting a competing proposal.

If a bidder can tie itself up with a major shareholder (in recent years super funds have proven a willing partner for many sponsors), this can be a cost-effective way of taking an interest in the company without an initial outlay of capital. It is not as watertight as a direct stake however, and most institutional investors find it difficult to actively vote against a competing proposal, which means that excluding these stakes from the vote can be less effective than originally perceived.

Despite the Viburnum tie-up, Infomedia still managed to solicit interest from two other potential bidders, although no transaction ultimately eventuated with any bidder. As we have seen in previous years, financial investors (when pushed) will almost always need to sell eventually and accept or vote in favour of the best deal on the table.

This is where strategic bidders tend to have an advantage, with Woolworths, Qantas, Wesfarmers, 360 Capital and Cooke Inc. using physical stakes or negotiated call options to overcome or discourage competing bids, given their ability to commit to not support other proposals.

Wesfarmers exercised its right to acquire 19.9% of API under a call option in response to a competing proposal from Sigma and publicly committed to vote against the Sigma proposal and a subsequent Woolworths proposal. Both Sigma and Woolworths walked away from indicative proposals at higher prices than that at which Wesfarmers ultimately proceeded.

Another recent development in pre-bid stakes is the collar/forward derivative, which was employed in the Grok/AGL and Gold Road/De Grey Mining stake builds. Corrs acted on the Gold Road stake build, which was structured to allow the bidder to build a stake quickly in circumstances where there was insufficient liquidity in the stock for an equity swap. This structure requires the bank writing the swap to build the stake incrementally, based on the number of shares it can acquire in the market to hedge the swap.

The collar/forward structures rely on liquidity in the stock lending market to build the stake, which allows for a larger initial stake build at the outset than might otherwise be available. Gold Road employed this structure in its stake build for De Grey Mining even though it is an Australian entity and did not require FIRB approval to acquire the stake. The structure was used simply because of the liquidity constraints in the stock.

This article first appeared in Corrs' M&A 2023 Outlook. Find the full report here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Lawyers Weekly

Law firm of the year

2021 |

Employer of Choice for Gender Equality

(WGEA) |