- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Banking & Credit, Basic Industries and Property industries

AUSTRAC launched investigations aimed at identifying and removing non-compliant providers, as well as enhancing the reporting of suspicious matters and transactions by remittance dealers and digital currency exchanges (DCEs). After a year-long investigation during 2024, AUSTRAC took action against 13 remittance dealers and DCEs, with over 50 more still under scrutiny.

According to AUSTRAC records, there are over 400 DCEs and over 5,000 remittance dealers across Australia. Since January 2024, AUSTRAC has issued 106 reminders to these entities, to help them ensure reporting obligations are met.

Action to take

Remittance dealers and DCEs should ensure they have:

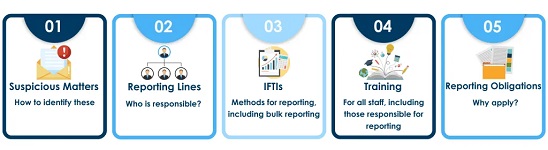

- Adopted procedures to determine what is suspicious and how these matters are identified and reported;

- Clear reporting lines in relation to suspicious matters;

- Reviewed reporting obligations and communicated the obligations to all employees;

- Conducted training for employees in relation to reporting obligations, particularly in relation to SMRs and the new tipping off offence;

- Routine procedures for reporting IFTIs. For remittance dealers that conduct a large number of transactions, this may include daily bulk reporting.

Background

Remittance dealers and DCEs play a vital role in detecting and disrupting criminal abuse of Australia's financial system. AUSTRAC continues to be concerned about money laundering risks in the DCE sector and will address these issues through the Crypto Taskforce established in 2024, and its broader regulatory activities.

Further Reading

AUSTRAC campaign targets remitters and digital currency exchanges

Remittance Sector Register and remittance registration actions

Digital currency exchange provider registration actions

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.