- within Consumer Protection topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Business & Consumer Services and Transport industries

Michael Bacina, Steven Pettigrove, Jake Huang, Luke Misthos and Kelly Kim of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Banking failure infecting crypto? Circle Stablecoin wobbles on SVB collapse

Circle, the operator of the USDC stablecoin and a peer-to-peer payments company, has faced the impact of Silicon Valley Bank's (SVB) collapse over the weekend. The challenge started when SVB clients rushed to withdraw funds after the bank announced that it had sold around USD$21 billion in assets to strengthen its financial position, suffered a significant loss in doing so and would be seeing to raise capital to cover the shortfall.

With a bank run worsening, the California Department of Financial Protection and Innovation, working with US Federal Government, shut down the bank and appointed the Federal Deposit Insurance Corporation as receiver to protect insured deposits (and subsequently uninsured deposits have been confirmed to be covered).

SVB was a 20 banks in the United States, serving venture capitalists, start-ups and many of the world's fastest growing tech companies. Soon after the collapse, Circle disclosed that approximately USD$3.3 billion of its USD$40 billion USDC reserves were tied up in SVB, and could not be accessed.

This compounds Circle and USDC's exposure to bank fallouts, having recently released an audit outlining $USD8.6 billion of its USDC reserves were held in several financial institutions, including the bankrupted Silvergate and SVB.

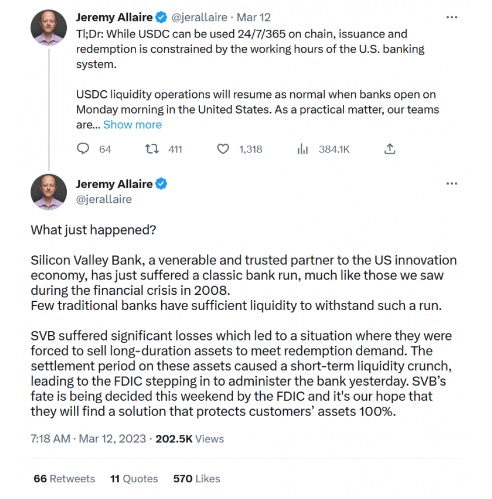

Circle CEO Jeremy Allaire explained the situation via Twitter:

Once the news broke about SBV, Circle's USDC de-pegged on crypto markets and lost over 10% of its value at one point. Other stablecoins including DAI, USDD and FRAX all de-pegged as well as trading grew in intensity. Thankfully, this contagion from the traditional financial system resolved with the bailout announced today, and USDC has nearly recovered it's peg:

It is critical to note that this situation was not due to any cryptoasset related issue, but was a traditional bank run, a failure not seen in the US for many years.

SVB steps back from the valley edge with US Govt bailout

The collapse of Silicon Valley Bank (SVB), the self-proclaimed 'financial partner of the innovation economy' sent nearly half of all venture-backed technology and life-science start-ups in the United States and 2500 venture capital firms into panic on Friday.

SVB's liquidity crisis caused by macroeconomic factors and insufficient risk management led to a bank run on their deposits. SVB's stock plunged throughout Thursday and after crashing by another 69%, SVB was officially shut down by mid Friday.

On 10 March, the Federal Deposit Insurance Corporation (FDIC) announced that it would take over the SVB. The FDIC guarantees return to customers with deposits of up to USD$250,000 and ordinarily customers would receive a "certificate" for the balance of any deposit, with that certificate tradable and otherwise redeemed for the balance (or less than the balance if the bank's assets are not sufficient). In a bold decision designed to stop contagion, the US government announced Sunday night Washington time a decision to guarantee all deposits including those uninsured:

Depositors will have access to all of their money starting Monday, March 13...No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.

The US government announced that the emergency measures will be funded by selling off SVB's assets, differentiating its approach from the congressionally approved bailout of the US financial system authorities during the 2008 financial crisis. The regulators are also closely monitoring other banks that may be facing similar issues.

SVB's collapse marks the largest bank failure since the 2008 financial crisis and one of the biggest in US history. Widespread panic had threatened the banking industry, and concerns of financial contagion spread as investors looked to reduce their risk in smaller banks. Bank runs on smaller banks have already potentially started, with corporate customers making mass withdrawals from regional banks.

Meanwhile, larger banks including JPMorgan, Wells Fargo and Citigroup have remained relatively unaffected. The former chair of the FDIC confirmed:

I don't think that this is an issue for the big banks – that's the good news, they're diversified.

All eyes are on the banks and markets to see if the bold moves by the US Government will stop the contagion. It appears that the financial market contagion which impacted Circle's stablecoin USDC has now ended with the stablecoin returning to its peg.

Attempted Regicide: Class action alleges DraftKings NFTs are securities

DraftKings Inc., a popular online sports betting and gaming company, is facing a class-action lawsuit from non-fungible token (NFT) holders alleging that the company is operating an unregistered securities exchange, the DraftKings' Marketplace, and selling unregistered securities in the form of NFTs.

Filed in the United States District Court for the District of Massachusetts, the lead plaintiff, Justin Dufoe's, complaint alleges violations of federal and state securities laws. Dufoe also alleges that he suffered losses exceeding US$14,000 due to declines in the price of NFTs he purchased.

According to the DraftKings' website, each DraftKings NFT has a unique digital identifier that certifies ownership of a virtual sports card or digital art as an NFT, which cannot be reproduced or deleted.

The complaint alleges that the NFTs in question are securities for the purposes of the Securities Exchange Act of 1934:

Plaintiff and the Class bought DraftKing's NFTs in DraftKing's initial public offerings (called "drops") of the NFTs, with the expectation that the DraftKing's NFT platform would allow them to realize profits on their NFTs.

DraftKings Chief Executive Officer, Chief Financial Officer and President of North American operations are also facing allegations from the class-action concerning their individual involvement in alleged breaches of securities law.

The complaint asserts that the defendants had actual knowledge of the facts indicating that the NFTs they promoted and sold were 'securities' under federal and state securities laws and that they had failed to register the NFTs accordingly.

DraftKings and its executives are facing seven causes of action from the class action including:

- Sale of unregistered securities;

- Control person liability for violations of the Securities Act;

- Operating an unregistered securities exchange;

- Unregistered broker and dealer;

- Control person violations of the Exchange Act;

- Unregistered broker and dealer (State Law); and

- Sale of unregistered securities (State Law).

The DraftKings class action follows hot on the heels of a similar suit relating to Dapper Labs' NBA Top Shot NFT collection and marketplace. In a recent ruling in that case, the US Court allowed similar allegations of breaches of securities laws relating to the issuance of sports related NFTs to proceed to trial. In that ruling, the judge placed some emphasis on the fact the Top Shot NFTs were offered on a private blockchain, called Flow, which meant that holders are allegedly reliant on the continued efforts of Dapper Labs to support the NFT offering. It will be interesting to see whether the judge in this case attributes any weight to the fact that DraftKings' NFTs are minted and trade on Polygon, which is a layer 2 blockchain which runs on Ethereum.

The latest class action against DraftKings is likely to result in increased scrutiny of the securities aspects of NFT offerings in the United States and other jurisdictions.

NAB nabs first Australian cross-border stablecoin settlement

NAB has conducted a pilot transaction on the Ethereum blockchain successfully deploying its AUDN stablecoin for a cross border intra-bank transaction. The transaction, while quite small, was the first of its kind for a major financial institution in Australia.

NAB's stablecoin, the AUDN, is backed one-for-one with Australian dollars and is central to realizing NAB's ambitions in the digital asset ecosystem. The reserves backing the AUDN will be held in audited, segregated accounts at the bank and managed as a liability of the bank.

According to NAB, its stablecoin project is intended to simplify international banking, increasing transparency and lowering costs for customers. NAB plans to enable customers to conduct more efficient settlement in multiple major currencies using stablecoins.

NAB's executive general manager for markets stated:

We believe that elements of the future of finance will be blockchain enabled and we're already witnessing rapid change in the tokenisation market. The stringent governance frameworks we have in place ensures we can support the creation of a safe and reliable digital financial system.

NAB says it will offer the AUDN stablecoin to corporate and institutional clients by the end of 2023:

Later this calendar year, we will be doing real customer trades. We have a couple of clients who want to use this technology.

Meanwhile, the RBA has announced details of its pilot project for a central bank issued digital Australian dollar. One of the pilot projects announced last week will involve using a CBDC for foreign exchange settlement. The race to deploy blockchain technology to allow efficient cross border payment and remittance is heating up.

SBF received USD$2.2 billion from FTX

The FTX bankruptcy trustees have revealed that transfers of around USD$2.2 billion were made to founder, Sam Bankman-Fried (commonly known as SBF) through various entities.

Overall, more than USD$3.2 billion was paid to SBF and other key senior employees, including Caroline Ellison (who already plead guilty to 7 charges). The company announced the payments in a statement and documents filed in the US Chapter 11 bankrupty proceeding.

The next largest beneficiary after SBF was Nishad Singh, former Director of Engineering of FTX, who received around USD$587 million.

The payments were made predominantly via SBF-owned trading firm Alameda Research.

SBF is currently defending 12 charges brought by the US Department of Justice. The US is seeking forfeiture orders against SBF and his related entities in relation to hundreds of millions of dollars' worth of assets, many of which have already been seized by the government. Assets being sought include more than USD$55 million shares in the trading app, Robinhood Markets, currently valued at USD$550 million and over US$150 million in cash held at Silvergate Bank and Farmington State Bank in the name of FTX Digital Markets (FTX DM).

SBF is set to face trial in October and is currently living at his parents' house on a USD $250 million bail. The FTX group is currently subject to US chapter 11 bankruptcy, with FTX Australia and the Bahamian entity, FTX DM, in separate insolvency proceedings.

Fidelity Investments remains faithful in retail crypto trading

Fidelity Investments has quietly launched bitcoin (BTC) and ether (ETH) trading to all existing retail customers via its Fidelity Crypto platform.

The platform was previously available only to institutions and some waitlisted customers, but now individual investors can buy and sell BTC and ETH using custodial and trading services provided by Fidelity Digital Assets.

While a string of bankruptcies and market failures in 2022 among cryptocurrency exchanges and investment schemes illustrated the drawbacks of entrusting digital asset custody to intermediaries, the size and reputation of Fidelity could mitigate concerns around underlying custody risk.

The service will be expanded over the coming year, with plans to allow customers to transfer digital assets to or from their Fidelity accounts by November 2023. As of 17 March 2023, trading is open only to U.S. citizens over the age of 18 who reside in one of the 36 states where Fidelity Digital Assets offers its services.

Following Robinhood and Binance US, Fidelity's trading service will be a commission-free offering, but with a 1% spread added to each transaction that is defined as "the difference between your execution price and the price at which Fidelity Digital Assets fills your order."

At a time of increasing regulatory pressure in the global blockchain ecosystem, the move by Fidelity aims to reinforce the credibility of crypto and provide an additional opportunity for investment participation by retail customers.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]