- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Law Firm industries

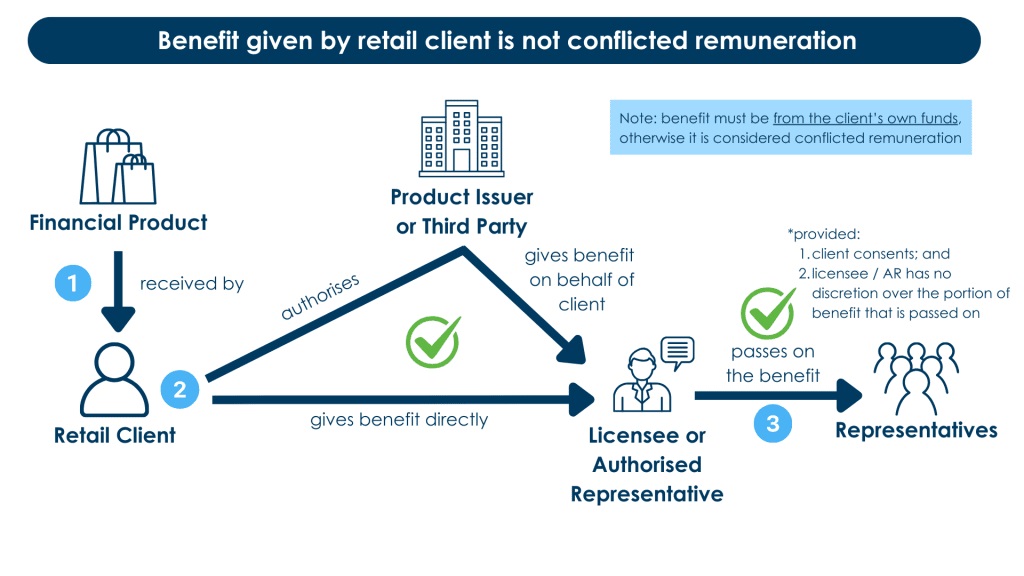

The definition of conflicted remuneration has been amended by clarifying that monetary and non-monetary benefits given by a retail client are not conflicted remuneration and removing some of the previous exceptions to conflicted remuneration. These changes came into effect on 10 July 2024.

Specifically, a benefit given by a retail client to a licensee or its authorised representative is not considered conflicted remuneration if:

- the benefit is given directly by a retail client or a retail client causes or authorises another party (for example, the product issuer) to give the benefit on their behalf;

- the benefit is given by a retail client or on behalf of the client, including from one or more financial products in which the retail client has rights or benefits (for example, a benefit is paid out of a premium paid by a client); and

- the benefit given by a retail client is not provided at the instruction of the product issuer or seller.

Note: The benefit, whether given by the retail client directly or through a third party, must be borne out of the client's own funds.

Further, if a retail client authorises another party to give a benefit to a licensee or its authorised representative:

- the licensee can subsequently pass on the benefit (or a portion of it) to one of its authorised representative or representatives (e.g. employees); or

- the authorised representative can subsequently pass on the benefit (or a portion of it) to another authorised representative or representative of the licensee;

provided the client consents and the licensee or authorised representative that passes on the benefit does not have discretion over the portion of the benefit that is passed on.

Accordingly, conflicted remuneration refers only to benefits given by a product issuer or seller (instead of by a retail client) to a licensee or its authorised representative, that could reasonably be expected to influence the advice provided by the licensee or authorised representative to the retail client.

Note: In light of the amendments applicable to superannuation trustees (discussed here), advice fees paid by a trustee of a regulated superannuation fund to the financial adviser out of the member's superannuation account in accordance with the client's directions are not considered conflicted remuneration.

Background

The Delivering Better Financial Outcomes Act 2024 ("DBFO Act") has amended a number of areas impacting financial services licensees – check out other articles on our website.

If you have any questions about how the changes implemented by the DBFO Act apply to your business, please contact us.

Further Reading

- An overview of the DBFO Package (Tranche 1)

- RG246 – Conflicted and Other Banned Remuneration

- RG175 – AFS Licensing: Financial Product Advisers – Conduct and Disclosure

- Treasury Laws Amendment (Delivering Better Financial Outcomes and Other Measures) Act 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.