This article is the second part of the discussion in our previous article Queensland infrastructure planning and charging framework review - commentary on DSDIP discussion paper released July 2013 - Part 1.

Identification of trunk and non-trunk infrastructure

Current framework

Local governments and distributor-retailers are empowered to identify development infrastructure as trunk infrastructure in an infrastructure planning instrument. Development infrastructure not identified as trunk infrastructure is non-trunk infrastructure.

Infrastructure planning instruments of local governments have included an infrastructure charging plan, planning scheme policies, adopted infrastructure charges resolution and priority infrastructure plan. Distributor-retailers are empowered to prepare a Netserv plan for trunk water supply and sewerage infrastructure.

The identification of development infrastructure as trunk infrastructure is important in the following respects:

- Infrastructure charges - Prior to the implementation of the maximum adopted charges regime, infrastructure charges were calculated based on an incremental cost methodology for the provision of trunk infrastructure.

- Additional trunk infrastructure costs (impact mitigation levy) - Development approval conditions can require additional trunk infrastructure costs for out of sequence or inconsistent development.

- Trunk infrastructure land and work conditions - In kind contributions for trunk infrastructure are required to be offset against infrastructure charges and to be refunded if the value of the in kind contribution exceeds the infrastructure charge.

- Non-trunk infrastructure land and work conditions - Development approval condition powers for land and work contributions are more limited in the case of non-trunk infrastructure.

Reform option

The Discussion Paper identifies that local governments are not recognising unidentified development infrastructure which is shared with existing or future development as trunk infrastructure with the effect that offsets and refunds are not applicable to shared development infrastructure.

The Discussion Paper proposes the following reform options:

- Standard specifications for trunk infrastructure - A Ministerial guideline for the preparation of an infrastructure plan is to provide minimum standard specifications for the identification of trunk infrastructure in an infrastructure plan.

- Trunk infrastructure definition - Essential infrastructure is to be trunk infrastructure if it satisfies any of the following:

-

- essential infrastructure identified in an infrastructure plan; or

- essential infrastructure which meets the minimum standard specification for trunk infrastructure in the Ministerial guideline; or

- essential infrastructure which provides a trunk function in that it:

-

- facilitates development of other existing serviced premises by enabling increased development or overcoming deficiencies;

- links a group of premises to identified trunk infrastructure; or

- would be identified as trunk infrastructure if the demand and development pattern was known at the date of the infrastructure plan.

Implications of reform option

The reform option materially increases the scope of trunk infrastructure to which offsets and refunds apply by including unplanned essential infrastructure which meets minimum standard specifications or otherwise performs a 'trunk function'.

Whilst the reform option responds to stakeholder issues by providing increased flexibility for developers to have unplanned essential infrastructure recognised as trunk infrastructure, the reform option will have the following implications for local governments and distributor-retailers:

- Planned infrastructure charges misaligned - The identification of deemed trunk infrastructure will result in a misalignment of planned charges in that they are only related to the establishment cost of trunk infrastructure identified in the infrastructure plan. As such planned infrastructure charges will in effect be undercharging for the cost of trunk infrastructure (identified and deemed).

- Offset reduction of infrastructure charges - Infrastructure charges intended to fund the trunk infrastructure identified in the infrastructure plan will be reduced by offsets for deemed trunk infrastructure thereby reducing the infrastructure charges available to fund identified trunk infrastructure.

- Reduced refunds for identified trunk infrastructure from infrastructure charges - The reduction of infrastructure charges from offsets for deemed trunk infrastructure will reduce the infrastructure charges available for refunds for developers which have provided identified trunk infrastructure thereby adversely impacting on the delivery of the identified trunk infrastructure for development consistent with the infrastructure plan.

- Out of sequence and inconsistent development subsidised - The requirement to provide offsets and refunds for unplanned infrastructure to service development which is outside of a priority infrastructure area or is otherwise inconsistent with the planning assumptions of a priority infrastructure plan will undermine strategic land use and infrastructure planning and result in inefficient land use patterns which are being subsidised by local government ratepayers and distributor-retailer customers. Furthermore the current conditioning powers in sections 650-652 of the SPA provide for refunds for additional trunk costs to be conditioned on development which is inconsistent with the planning assumptions in a priority infrastructure plan.

- Increased maintenance and replacement burden - The provision of subsidised out of sequence and inconsistent development will impose additional maintenance and replacement costs on local governments and distributor-retailers for infrastructure that is not required or is provided prematurely.

- Strategic planning and development assessment - The financial implications of approving development requiring the provision of deemed trunk infrastructure which will accrue offsets and potential refunds will introduce significant uncertainty in the development approvals process which will result in local governments adopting a conservative approach in its strategic planning and development assessment which will otherwise limit economic development.

Alternative reform option

The stakeholder issues and implications for local governments and distributor-retailers may be addressed by an alternative reform option in which an item of essential infrastructure is defined as trunk infrastructure if it:

- is identified in an infrastructure plan; or

- meets the minimum standard specifications for trunk infrastructure and satisfies any of the following:

-

- is an alternative to an item of infrastructure in the infrastructure plan or Netserv plan;

- allows for the removal of an item of trunk infrastructure from the infrastructure plan or Netserv plan;

- allows for the delayed provision of an item of trunk infrastructure beyond the planning horizon of the infrastructure plan or Netserv Plan;

- is reasonably likely to have been included in the infrastructure plan had detailed network planning for the planned development been undertaken as part of the preparation of the infrastructure plan or Netserv plan.

The alternative reform option increases the scope of trunk infrastructure for developers whilst providing reasonable certainty to local governments and distributor-retailers in relation to the financial liability of future offsets and refunds.

Infrastructure planning

Current framework

Under the current framework, local governments and distributor-retailers are required to provide detailed long-term plans for the delivery of infrastructure through the introduction of a priority infrastructure plan and Netserv plan, respectively. With the introduction of the maximum infrastructure charges framework in 2011, the detail required in a priority infrastructure plan or Netserv plan was reduced.

Reform option

The Discussion Paper identifies stakeholder issues as relating to the onerous and time consuming amendment process for a priority infrastructure plan and Netserv plan and the limited detail now required in a priority infrastructure plan and Netserv plan resulting in a lack of clarity and consistency in infrastructure conditioning, offsetting, refunding and infrastructure agreement processes.

The Discussion Paper proposes a reform option with the following elements:

- Infrastructure plan - Local governments are required within two years to include in their planning schemes an infrastructure plan which contains a similar level of detail to that required in a priority infrastructure plan prior to the introduction of the maximum adopted charges regime but with the option of either:

-

- including a cost apportionment methodology and applying planned charges; or

- not including a cost apportionment methodology and applying capped charges.

- Netserv plans - A review of the Netserv plan requirements under the South East Queensland Water (Distribution and Retail Restructuring) Act 2009 is to be undertaken by DSDIP in collaboration with the Department of Energy and Water Supply.

- Standardisation - Infrastructure plans are proposed to be standardised in three ways:

-

- Cost apportionment methodology - This proposal involves adopting a standardised methodology for apportioning the cost of trunk infrastructure to future demand which may include one of the following identified methodologies:

-

- average cost methodology - the total existing and future cost of infrastructure is divided by the total existing and future demand for the infrastructure to calculate a cost per demand unit for an area;

- incremental cost methodology - the future cost of infrastructure to service future demand is divided by the future demand.

- Standard schedule of works model - This proposal involves adopting a standard approach and format for the calculation and presentation of data in schedule of works spreadsheets. Draft templates are available for download on the at www.dsdip.qld.gov.au/forms-templates/infrastructure-charges.html.

- Standard demand generation rates - This proposal involves adopting a standardised approach to calculating infrastructure demand to appropriately apportion the cost of infrastructure between developments. The proposed process involves:

- determining the total planned demand in each network service area;

- determining the total infrastructure cost for each area;

- determining the average cost per demand unit by dividing the total cost by the total demand;

- testing the corresponding demand generation table against this information to ensure that demand generation rates are accurate.

- Third party review - Infrastructure plans are proposed to be subject to third party review with the results of the review being further reviewed by the State government.

- Transitional arrangements:

-

- Prior to the adoption of a new infrastructure plan, relevant development approval conditions are to be assessed on a case by case basis to ensure compliance with the new system.

- Local governments will be given a set period (stated to be two years) within which an infrastructure plan or Netserv plan is to be prepared.

- Local governments will be required to attach a compliant infrastructure plan to a planning scheme within a year of the planning scheme's adoption. This recognises the practicality that infrastructure plans (including planned charges) can only be resolved after the land use policy issues in a planning scheme have been finalised.

- A local government or distributor-retailer which has not prepared an infrastructure plan or Netserv plan will be able to condition the provision of essential infrastructure (presumably under the more limited non-trunk infrastructure condition powers) but will be limited to applying capped charges.

Implications of reform option

The reform option addresses the stakeholder issues without having significant implications for local governments and distributor-retailers given that they are provided with the option of implementing a cost apportionment methodology and applying planned charges or not implementing a cost apportionment methodology and applying capped charges.

In relation to the proposed cost apportionment methodology, economic theory tells us that resources will be allocated efficiently when prices are equal to the marginal costs being the costs associated with an increment in supply - the cost of producing one more widget or the cost of providing roads for one additional subdivision or water pipes to one more housing development. A marginal cost methodology therefore reflects true cost pricing as marginal costs will take account of urban form matters such as location, density, local context and type. (See Blais, P, Perverse Cities, 2010, p.163)

However implementing marginal cost pricing can be complex and difficult to estimate and to allocate to users. A practical alternative is an "average incremental cost approach" which combines marginal and average cost pricing and involves allocating each element of cost to a particular incremental decision that results in the provision of a service and then to assign to each additional user the increased cost attributable on average to their usage. (Perverse Cities, p.173)

Alternative reform option

The following alternative reform options are suggested:

- Cost apportionment methodology - The cost apportionment methodology should satisfy the following:

-

- Marginal cost - be based on a marginal cost approach where possible or an average incremental cost approach where marginal cost pricing is not possible.

- Flexibility - be capable of variation between local governments (given their differing development settings) and between trunk infrastructure networks.

- Standard construction indexes and contingencies - The State should also identify standard construction indexes, contingencies and administration costs for use in infrastructure plans and Netserv plans in addition to the proposed standardised land valuation methodology.

- Standard schedule of works - The standardised schedules of works may be too simplistic to reflect more sophisticated and flexible infrastructure charges models and as such, should not be mandated.

- Standard demand generation rates - The mandatory use of standard demand generation rates does not take account of different development settings and as such, should not be mandated.

Capped charges

Current framework

When levying infrastructure charges, local governments are currently limited to levying charges less than or equal to the relevant maximum adopted charge specified in the State Planning Regulatory Provision (Adopted Charges) 2012. This system of capping charges to a clear maximum amount provides a measure of certainty to the infrastructure charges framework.

Reform option

The key issues identified in the Discussion Paper in relation to the current system of capped charges include:

- No link between infrastructure charge and demand - The demand metric (number of bedrooms or GFA) doesn't necessarily reflect the infrastructure demand created by the development and there is little link between the charge and the demand.

- Better alignment of categories with land use - Charge categories need to be better aligned with types of land use to better reflect demand for infrastructure.

- Higher charges on non-residential development - Non-residential development types may currently be too heavily charged on the basis of the attribution of a high degree of traffic generation to these types of development.

The Discussion Paper does not propose any reform options for capped charges as an analysis is to be completed by 31 January 2014. However the Discussion Paper identifies that the analysis is proposed to:

- quantify the impacts of the final reforms on current capped charges and implement appropriate amendments;

- consider differentiating charges on the basis of location and type of development;

- take place concurrently with the implementation phase of other aspects of the reform;

- consider the financial sustainability of local governments and impacts on the feasibility of development;

- involve consultation with local governments and other stakeholders; and

- consider the appropriateness of the current degree of traffic generation attributed to non-residential development.

The Discussion Paper outlines three options for differentiation of capped charges:

- Statewide charges - It is identified that whilst this option is administratively simple, it does not accommodate regional variations in development and infrastructure delivery costs.

- Location based differentiation - It is identified that greenfield development may require more new infrastructure in comparison to infill development although DSDIP analysis indicates that the differences are small.

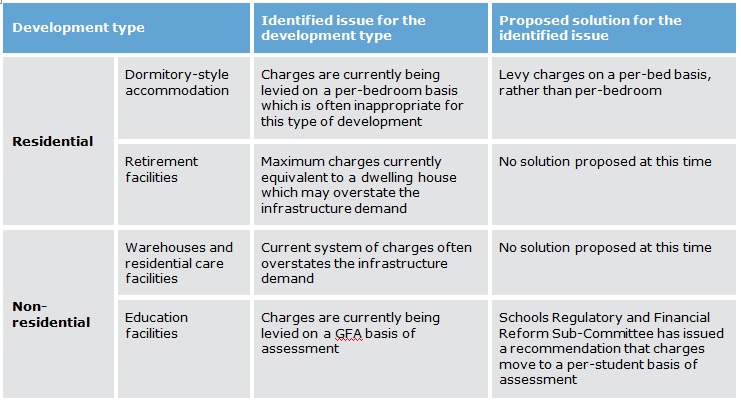

- Development type differentiation - The issues and corresponding possible solutions specified in the below table are to be further considered in relation to the refinement of the capped charges categories:

Table 4: Issues with capped charges

Implications of reform option

The proposed review of capped charges should take account of the Productivity Commission's key findings and recommendations in the Taxation and Financial Policy Impacts on Urban Settlement in respect of the impacts of charging reforms:

- While the incidence of developer charges and other contributions at any particular time will depend on the characteristics of the market, it is most likely in the longer term that they will fall on purchasers of developed land [chapter B5, section 5.1].

- In principle the timing of charges should make little difference to the burden of finance; in practice it may do so because of mechanical lending rules used by banks, the uncertainty created by the potential for public authorities to alter future charges, and government guarantees on the borrowings of public authorities [chapter B5, section 5.1].

- Statistical analysis conducted by the Commission suggests that the consumption of urban land in aggregate is not very responsive to changes in its price (and hence to changes in infrastructure charges). However this does not preclude changes occurring in the pattern of land use within cities, as illustrated by additional modelling undertaken by the Commission. Eventual impacts would depend upon the flexibility of land use restrictions and adjustment costs [chapter B5, section 5.2].

- The mix of people's income levels, household types and ages in the different parts of major cities suggests that the effects of reforms which led to higher charges would not fall disproportionately on any identifiable community group [chapter B5, section 5.3].

- The provision of subsidised urban infrastructure, or concessional charging for it, is not an efficient means of meeting equity objectives. Practical measures to shield deserving categories of people from hardship are better directed to them as people, rather than to the areas where they are thought to live, or to the city-wide networks of urban services they use [chapter B5, section 5.3].

- Charges for existing households should be examined as part of any reform of pricing structures. It would be equitable for established residents to at least face charges that matched the cost of replacing infrastructure required to service them [chapter B5, section 5.3].

Alternative reform option

Whilst planned charges are a better public policy instrument than capped charges for the reasons outlined by the Productivity Commission, if capped charges are to be retained then the following alternative reform options are suggested:

- Location based differentiation - Capped charges which reflect different location settings such as existing urban areas, growth areas (infill and greenfield) and rural and regional areas.

- Development type differentiation - Non-residential development is charged against floor area on the theory that floor area reflects occupancy and that this is what drives capacity-related costs. However floor space reflects occupancy quite poorly given that floor space per employee varies so much between types of non-residential development. It is suggested that types of densities for each type of development be used to construct an estimate of square metres of land area per employee for each category of use. This methodology has the significant advantages of better pricing for marginal costs and of encouraging the densification of development. (Perverse Cities, pp.180-181)

- Proportional amount for distributor-retailers - A methodology needs to be established to calculate the proportionate amount of a capped charge for water supply and sewerage infrastructure networks for distributor-retailers and local government infrastructure networks.

- Distributor-retailer institutional financial arrangements - The reduced revenue from capped charges as a result of the limitation of essential infrastructure, the deeming of unplanned trunk infrastructure and more expensive offset and refund policies, will have significant financial implications on distributor-retailers who are required to provide a return to shareholder local governments and whose utility charges are regulated. In the absence of considered reform, it is inevitable that distributor-retailers will have to reduce their capital and operating budgets to adjust to the reduced revenue environment or increase debt levels or reduce returns to shareholding local governments.

Planned charges

Current framework

The current framework has prohibited local governments from adopting infrastructure charges above the maximum adopted infrastructure charges.

However, some local governments, principally in high growth areas, have requested the ability to adopt infrastructure charges above the capped charges.

Reform option

The Discussion Paper proposes the following reform option:

- Capped charges - These are to be retained as the default option for the levying of infrastructure charges where a local government prepares an infrastructure plan not incorporating a cost apportionment methodology.

- Planned charges - These are to be adopted where a local government prepares an infrastructure plan incorporating a cost apportionment methodology and the resulting planned charges are subject to a third party review assessment process and are approved by the Minister.

The proposed process involves the following four stages:

- Local government assessment - The local government decides whether or not to levy a planned charge.

- Local government financial analysis - This stage involves the following steps:

-

- Step 1 - Network review:

-

- The local government reviews the asset management plan and infrastructure plan to determine the cost profile for delivery of the infrastructure network.

- Step 2(a) - Review infrastructure scope:

-

- The local government estimates the future approach with respect to infrastructure development.

- If this approach would not be financially sustainable, the assessment in step 2(b) is undertaken.

- Step 2(b) - Financing options:

-

- The local government identifies the funding shortage and the possibility of the local government financing the infrastructure itself.

- Step 3 - Impact analysis:

-

- Using the information identified above, an assessment of the impact on local government financial sustainability is undertaken.

- It is proposed that the Queensland Treasury Corporation be authorised to undertake a review of this assessment.

- Development feasibility analysis - This stage involves the following steps:

-

- Step 1 - Feasibility assessment:

-

- The local government identifies areas impacted by the proposed infrastructure charges, assesses the impact within those areas on the goal of development feasibility and prepares a report.

- Step 2 - Third party review:

-

- The local government provides the report prepared in Step 1, in addition to relevant further information, to an independent third party who is to review the information, conduct further research and testing, and issue a binding recommendation.

- Under this proposal there would be no right for an individual developer to appeal a planned charge on the basis that it makes their proposed development unfeasible, as the planned charge is to apply to the whole local government area.

- Step 3 - Ministerial determination:

-

- The Minister receives the outcomes from the impact assessments and decides whether to accept or reject a planned charge.

- Ministerial determination - This stage involves the Minister accepting or rejecting the proposed planned charges. A sunset clause of 3-5 years has also been suggested to encourage continual review of planned charges.

Implications of reform option

The reform option provides for a planned charges assessment process through which a planned charge is assessed in terms of the impact on local government financial sustainability and development feasibility.

In the absence of planned charges, high growth local governments face intense pressure from anti-growth contingencies largely because those groups understand that they are being forced to pay for much of the cost of rapid infrastructure expansion through their property taxes. In practice when local governments find themselves feeling development pressures, the most realistic alternative to user pay levies tend to be growth controls or other exclusionary tools intended to limit growth. (See Burge, GS, The Effects of Development Impact Fees on Local Fiscal Conditions, 2009, p.198.)

The proposed planned charges assessment process has the following implications:

- Reduced planning costs - The alignment of price signals through planned charges with planning objectives will reduce the direct costs of implementing and administering planning through reducing growth controls and other exclusionary controls.(Perverse Cities, p.162.)

- Social and environmental costs and benefits - The assessment process takes no account of the social and environmental costs and benefits of the planned charges; being limited to an analysis of the impact on local government finances and development feasibility.

- Development feasibility - The assessment of the impact of planned charges on potential development categories will:

-

- be complicated and difficult, if not impossible, given that development feasibility is changeable depending on macro scale factors such as market conditions, current land supply cycles, demand cycles and finance policies as well as the financial position and required rates of return of individual developments; and

- impose a significant burden on local governments and distributor-retailers.

- Local government empowerment - The proposed approval of planned charges is at odds with the State government's stated policy of empowering local government. The State government does not purport to approve other local government rates and charges.

- Administrative burden - A significant resource and financial burden will be imposed on local governments and distributor-retailers in relation to administering the assessment process.

- Uncertainty - The requirement for Ministerial approval for planned charges will give rise to uncertainty given local governments' previous experience with long delays in the Ministerial approval of infrastructure charges schedules under priority infrastructure plans under the previous State government.

- Distributor-retailer institutional arrangements - The proposed planned charges assessment process is in addition to the existing institutional arrangements for regulating utility charges for water supply and sewerage. It would be more efficient for the review of planned charges to be carried out within the existing institutional arrangements.

Alternative reform option

The implications of the reform option could be addressed by adopting an alternative reform option which requires a local government and distributor-retailer to prepare a traditional cost-benefit analysis for the planned charges which would ensure that the economic, social and environmental costs and benefits of the planned charges are rigorously considered prior to their adoption.

Conditions

Current framework

Local government may impose development approval conditions for land, work and financial infrastructure contributions as an alternative or supplement to levying infrastructure charges. Currently, shareholding local governments impose conditions on behalf of a distributor-retailer under a delegated assessment model; but under the proposed utility model a distributor-retailer would be empowered to impose development approval conditions.

Reform option

The Discussion Paper envisages that the conditioning of non-trunk and trunk infrastructure would not be changed but that the reform option for deemed trunk infrastructure would address stakeholder issues in respect of the possibility of a local government both levying infrastructure charges for a development and also conditioning the provision of infrastructure which is to be shared with existing and future development for the development.

The reform option for trunk infrastructure and its implications have been considered earlier in respect of the identification of trunk and non-trunk infrastructure.

Alternative reform option

Whilst the Discussion Paper states that the conditioning powers of non-trunk and trunk infrastructure would not be changed, the various reform options raise significant uncertainty in respect of the conditioning of development approvals including the following:

- Non-essential infrastructure - It appears that conditions will not be able to require financial, land and work contributions for non-essential development infrastructure. This raises questions about the legality of conditions relating to non-essential infrastructure such as conditions intended to:

-

- preserve arterial and sub-arterial road corridors;

- preserve amenity standards such as noise and light barriers on roads;

- preserve environmental values such as fauna management crossings.

- Refunds - The following issues are unclear:

-

- Timing for payment of refunds - It is uncertain if refunds are payable at:

-

- the completion of the trunk work or provision of trunk land;

- the completion of a stage of the development; or

- completion of the development.

- Funding source of refunds - It is uncertain whether refunds are to be paid from:

-

- infrastructure charges received from premises serviced by the trunk infrastructure which has been provided (as is currently the case);

- infrastructure charges received for other infrastructure networks (cross crediting of refunding);

- infrastructure charges received from premises not serviced by the trunk infrastructure; or

- other revenue sources.

- Out of sequence or inconsistent development - The following issues are unclear:

-

- Additional trunk infrastructure costs - It is difficult to understand the operation of the conditioning powers under sections 650 to 652 of the SPA for additional trunk infrastructure costs for out of sequence or inconsistent development in the context of the reform option for the identification of deemed trunk infrastructure associated with out of sequence or inconsistent development.

- Refund of additional trunk infrastructure costs - The Discussion Paper does not discuss the operation of the provisions in section 651 of the SPA for the refunding of additional trunk infrastructure costs for inconsistent development in the context of the reform option for offsets and refunds.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.