- within Real Estate and Construction topic(s)

- in Australia

- with readers working within the Construction & Engineering industries

- within Real Estate and Construction topic(s)

- in Australia

- with readers working within the Construction & Engineering industries

- within Law Department Performance and Insolvency/Bankruptcy/Re-Structuring topic(s)

Key Takeaways

Mining companies are facing increasing pressure to bring on replacement volumes in the next decade, as ore body depletion accelerates and infrastructure approaches end of life.

This is against the backdrop of worsening construction productivity, increasing regulatory hurdles and development cycles, declining contractor capability, and ineffective commercial models that don't adequately protect owners from cost and schedule overruns.

These factors are seeing owners spend ~60 percent more to generate the same output compared to 25 years ago.

By adopting addressing root-causes with a consistent approach from the very beginning of project scoping, and adopting six key strategies, miners could reduce construction costs by 25-40 percent, dependent on the scope and project context.

Australia's Productivity Imperative

Australia's productivity problem is long-standing and getting worse. In the ten years to 2020, the country experienced its lowest productivity growth in six decades, according to the Productivity Commission's 5-year review.

The construction industry is widely recognised as a major laggard in terms of productivity improvement, with multifactor productivity declining 17.4 percent since 2014, and underperforming select industries by 25 percent since 1990.

Weaker productivity is estimated to have cost the private sector >$500 billion, with mining companies bearing the majority of these costs.

Australia construction sector productivity vs other industries

1. "Selected industries" as dened by ABS, includes agriculture, mining, manufacturing, electricity, wholesale and retail trade, food services, transport and nancial and insurance, arts & recreation

Source: ABS Multifactor Productivity; Productivity Commission; Oxford Economics; A&M analysis

For many, this has meant that the capital required to replace or upgrade aging infrastructure is growing faster than the returns on these investments, intensifying pressure to address rising construction costs.

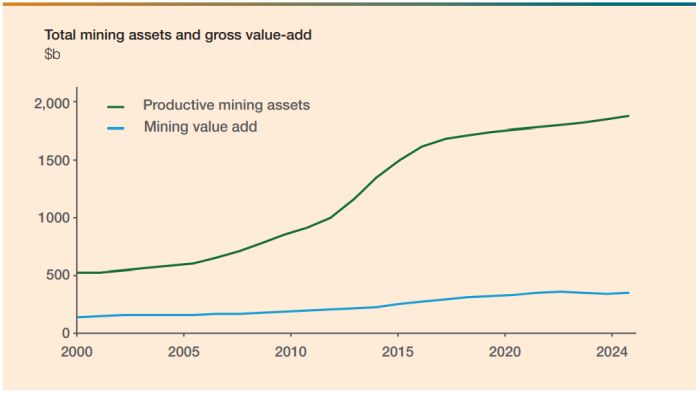

In 2000, mining companies spent ~$3.50 to get $1.00 p.a. in return. Nowadays, the same companies spend ~$5.50 to get the same return (60 percent more upfront capital).

At the same time, production expectations are intensifying, and the demand for reliability is higher than ever. Global inflation, escalating input costs (particularly labour and raw materials), and intensifying competition are collectively putting pressure on margins and highlighting operational inefficiencies

Total Australia mining assets and value-add

On the supply side, consolidation has resulted in a reduced pool of key suppliers, and we are seeing labour shortages across blue and white collar workforces.

Supplier consolidation has been relevant across each of E/PCM, constructor and key supplier markets, where 'tier-1' competitors have reduced from 10-12 in 2013, to 2-4 in 2024 in each case.

Skills and capacity shortages have been exacerbated by post-mining boom exits and retirements, along with post-COVID public sector competing spending and preferences for non-FIFO work.

Responses have fallen short

To confront these challenges, resource companies have implemented various strategies: different delivery models (new and old), commercial arrangements that seek to allocate more risk to the contractor, more stringent contractual terms and strategic procurement levers – the list goes on.

Project-specific execution strategies are frequently being deployed, including low-cost engineering centres, offshore fabrication, pre-assembly and modularisation, along with standardisation of designs.

However, so far these efforts have had limited success in closing the productivity gap.

Project delivery is getting more complex

To complicate matters, project delivery is getting increasingly difficult as mining shifts to areas with lower quality grades, further increasing distances from existing infrastructure, along with preferences for brownfield expansions. Furthermore, the regulatory landscape – including environment, social and heritage approvals – is introducing more uncertainty into the process. This is leading to more complex designs, with longer approvals cycles, putting execution teams under increasing pressure to bring growth and sustaining volumes online faster.

Functional models and teams have expanded to manage such complexities, adding more internal interfaces and complicating delivery for contractors, who are not well placed to deal with these emerging issues.

This in turn is putting pressure on key suppliers to deliver, creating adversarial relationships and risks to contractors achieving their required margins to remain in business. As a result, contractors are increasingly relying on claims to recover their margins — a practice that's fast becoming the norm, often justified by headwinds like poor engineering inputs, site access delays, and scope changes.

All of this ultimately means that commercial models used by mining companies are no longer able to protect owners from cost or schedule overruns. Consequently, cost blow outs in major capital projects will likely continue if resource companies don't pursue other means to combat these headwinds.

Miners are fighting the problem, but still need to do more

With a more complex delivery setting, productivity is declining, and capital costs are trending up.

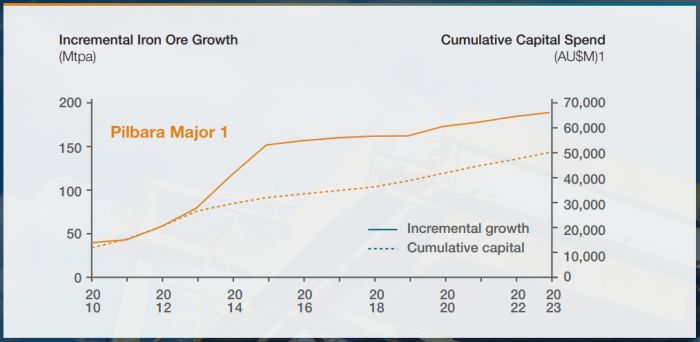

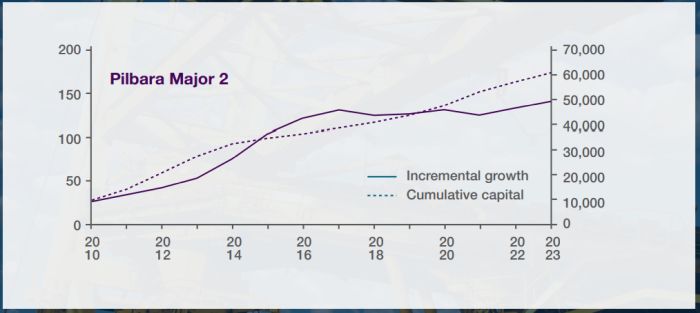

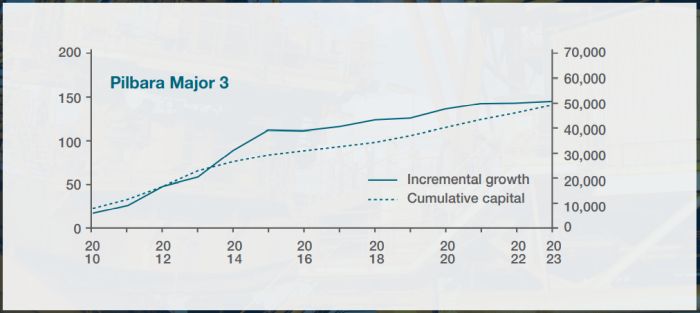

Pilbara majors are now each spending between 35-70 percent ore (in AUD terms) for every tonne of incremental capacity compared to 2015 levels.

Some companies are establishing their own self-performing project delivery functions, to reduce reliance on EPCMs, but this reduces flexibility that is critical for commodity price driven investment cycles and take time to establish.

Others have adopted integrated delivery models to combine delivery capability and reduce number of interfaces but these delivery models rely on trust and collaboration to be successful, which is hard to engineer when the commercial models still have liability/indemnity clauses as fallbacks.

In A&M's view, resource companies need to strike the right balance between outsourcing delivery capability and managing delivery risk, which requires taking an active role in both shaping and influencing the way work is done, particularly when they carry the ultimate cost, schedule and reputational risk.

Capital intensity comparison on incremental growth across Pilbara majors

1. Based on sum of all capital expenditure for Iron Ore segment, divided by total capacity additions since 2008 (based on change in reported YoY volume uplift); Capital and production gures stated as equity share

Source: Company reports; A&M analysis

A multi-pronged approach could see a 25-40 percent reduction in capital cost

With many issues and interdependencies influencing and driving construction performance, there is no silver bullet to solving this problem.

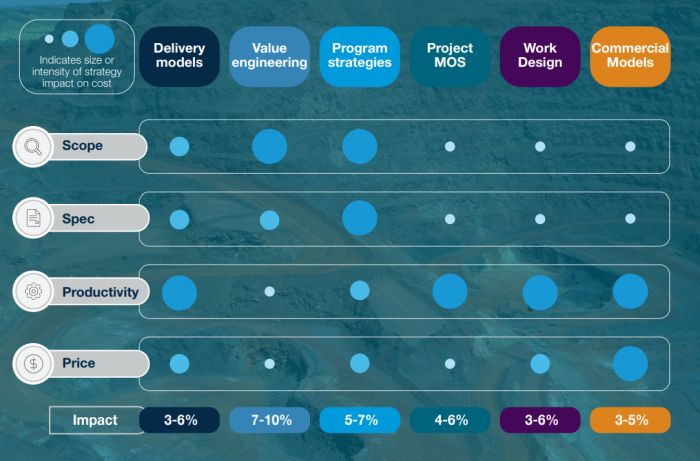

However, with a multi-pronged approach, there are a series of interventions that could feasibly see a 25-40 percent reduction in construction costs by systematically addressing root causes, and resetting the eco-system that is currently broken:

Strategy #1: New Delivery Models

Alternative delivery models that enable owners to have high levels of involvement, remove excessive and duplicate interfaces, and eliminate low/non-value adding work from E/PCMs and contractors.

Strategy #2: Value Engineering

We typically see teams "run through the motions" on options assessments and value improvement practices, only to land on the same suite of options and specifications as the previous project. A new suite of value engineering tools and practices are needed to challenge the status quo, and move away from legacy behaviours.

Strategy #3: Programme Strategies and True Partnerships

Many major mining houses approach their portfolio of projects (growth and sustaining) as a series of one-off contracting exercises. Consolidating demand can provide more leverage in the market, and give delivery partners a more stable demand profile (de-risking cashflow and enabling reduced margin), whilst allowing the partner to develop long-term working norms with the owner.

Strategy #4: Project Management Operating Systems (MOS)

It is common to see construction tooltime of 20-25 percent on WA projects, due to clashing workgroups, missing parts, lack of tools and lack of work methods. Both EPCMs and contractors often adopt a "we'll address it as we go" approach. There's a growing need for a new set of daily and weekly practices to bring the same level of discipline seen in high-performing maintenance teams, where Tooltime typically exceeds 55 percent.

Strategy #5: Work Design (standardised work)

Owner teams, PCMs and construction contractors have an obligation to consider how all the pieces of the puzzle come together, and this is even more important for linear construction and/or repeatable assets.

Often, work methods are borrowed from the previous projects, are too high-level to be translated to the frontline, or don't exist at all. This leads to the workforce to "figure it out" on the job.

A new approach to work design is needed - one that systematically considers how people, parts, equipment and machinery all work together to build assets in a safe, predictable, and low-waste fashion.

Strategy #6: New Commercial Models

There's a growing need for commercial models that better balance risk and reward. Today's approaches often place most of the schedule and cost risk either on the owner's team or on contractors—who, in turn, price in significant margins and contingencies to manage that exposure. This dynamic rarely delivers optimal outcomes. In many cases, claims become a primary means of maintaining profitability, which can strain collaboration and limit opportunities for unlocking genuine value.

New commercial models and approaches are needed to efficiently allocate risk where it is best controlled, whilst appropriately incentivising better performance, giving both parties certainty and shared upside.

Conclusions

These strategies each have varying and overlapping impacts on scope (what is to be delivered), specification (quality of what is delivered), productivity (rate and effort to deliver) and price (price to deliver). If done right, the combination could see a 25-40 percent reduction in construction costs at major mining houses in WA.

The case is clear – doing nothing is not an option.

Originally Published 9 September 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]