- within Real Estate and Construction topic(s)

- in United States

- within Wealth Management topic(s)

Introduced in the 2023-2024 Budget, the new and revamped Capital Investment Entrant Scheme (New CIES) aims at enriching the talent pool and attracting more new capital to Hong Kong. It is one of the eight policy measures under the Policy Statement on Developing Family Office Businesses in Hong Kong issued by the Financial Services and the Treasury Bureau in March 2023.

The New CIES started accepting applications from 1 March 2024. Detailed Rules for the New Capital Investment Entrant Scheme (Rules) were published.

As the first of a series of our write-ups on the New CIES, this Legal Update provides an overview of the eligibility requirements and application procedures laid down by the Rules. It also coverssuch types of investments which would qualify as Permissible Investment Assets under the New CIES, in particular focusing on non-residential real estate. The next write-up will focus on how private fund sponsors can structuretheir private fund products to be eligible as Permissible Investment Assets under the New CIES.

1. Eligibility Requirements

To be eligible to make an application under the New CIES, an applicant must be a natural person who satisfies the following criteria:-

| Age |

| 18 or above. |

| Nationality/Residence |

|

| Net Asset Requirement |

| Absolute beneficial entitlement to net assets with a market value of not less than HK$30 million throughout the two years preceding the date of lodgement of application for net asset assessment (Net Asset Requirement). |

| Investment in Permissible Investment Assets |

|

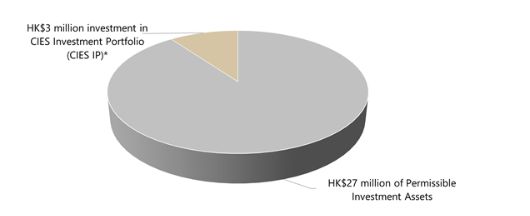

Investment of not less than HK$30 million net in Permissible Investment Assets after 1 March 2024. Types of Permissible Investment Assets The HK$30 million investment must includebothtypes of investment below:-

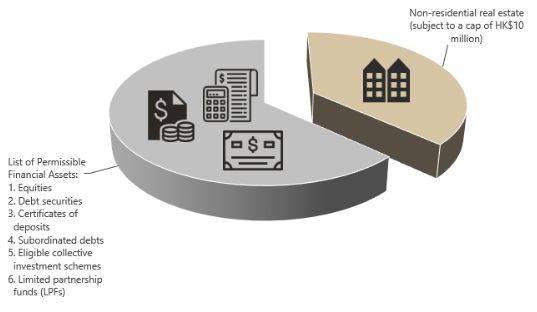

* The CIES IP is an investment portfolio managed by the Hong Kong Investment Corporation Limited. It will primarily invest in companies and projects with a Hong Kong nexus, with a view to supporting the innovation and technology industries and other strategic industries that are beneficial to the long term development of Hong Kong's economy. The HK$27 million of Permissible Investment Assets may include the following financial assets (Permissible Financial Assets) and non-residential real estate:-

|

|

Here are some highlights of investment requirements applicable to specific types of Permissible Financial Assets:-

Portfolio Maintenance Requirements The applicant must comply with the portfolio maintenance requirements set out in the Rules, including:-

|

| No Adverse Record |

| No adverse immigration record and meets normal immigration and security requirements. |

| Financial Support |

| Capable of supporting and accommodating himself and his dependants, if any, on his own without any return on the Permissible Investment Assets, employment, self-employment, business or public assistance in Hong Kong. |

As distinct from other immigration or admission schemes, the New CIES focuses narrowly on capital investments, with minimal additional requirements. In contrast, other immigration channels (such as the Top Talent Pass Scheme) take into account the education background, work experience and annual income of applicants, which will continue to apply as separate schemes in parallel with the New CIES.

2. Investments in Non-Residential Real Estate under the New CIES

We received a number of enquiries on the New CIES relating to non-residential real estate being a Permissible Investment Asset. The following paragraphs elaborate certain key aspects of the Rules regarding non-residential real estate.

2.1. Non-residential Real Estate

Under the Rules, investments in non-residential real estate, subject to a cap of HK$10 million, are qualified as Permissible Investment Assets. In other words, an applicant may acquire non-residential real estate of a higher value, but only HK$10 million will be counted towards Permissible Investment Assets under the New CIES.

Regarding the scope of non-residential real estate, pre-completion non-residential properties and real estate of mixed commercial and industrial uses are eligible. However, it does not include multi-purpose real estate partly for residential use.

2.2. Restriction on Ownership

An applicant must hold the non-residential real estate in one of the following ways:-

- in the applicant's own name;

- through a sole proprietorship under the applicant's name; or

- through a company of which the applicant is the sole shareholder.

To comply with the above requirement, the applicant or the applicant's company must be the sole owner of the non-residential real estate. Jointly-owned real estate will not be counted as Permissible Investment Assets.

2.3. Resale of Property

The applicant may resell the non-residential real estate, but he must reinvest the entire proceeds in new Permissible Investment Assets. If the non-residential real estate is of a value over HK$10 million, the applicant is free to withdraw the surplus equity paid in the non-residential estate upon its resale.

The Rules prescribe time limits for such reinvestments. For example, the time gap between the date of the contract for sale of the non-residential real estate and the date of completion of the purchase of the reinvested non-residential real estate must not exceed three months.

Under the Rules, all material transactions regarding the acquisition, disposal and charging of the non-residential real estate must be proved to the satisfaction of the Director-General of Investment Production of InvestHK (Director-General) by providing the relevant Land Registry records, bank statements or professional valuation report, in order to enable the Director-General to verify whether the applicant has reinvested the requisite minimum level of equity in Permissible Investment Assets. The applicant must notify the Director-General in writing within seven working days after each of the disposal of non-residential real estate and the acquisition of new Permissible Investment Assets.

2.4. Mortgage

The New CIES allows applicants to take out mortgage loans with banks or financial institutions licensed in Hong Kong for financing the acquisition of non-residential real estate. However, the amount of the mortgage debt is excluded and only the amount of equity directly contributed by the applicant is taken into account.

2.5. Real Estate Investment Trusts and Real Estate Funds

Apart from the acquisition of non-residential real estate, given that the eligible collective investment schemes or LPFs are qualified as Permissible Investment Assets under the New CIES, applicants may consider investing in other eligible collective investment schemes or LPFs holding real estate. However, the total investment in private LPFs and open-ended fund companies is also subject to a cap of HK$10 million.

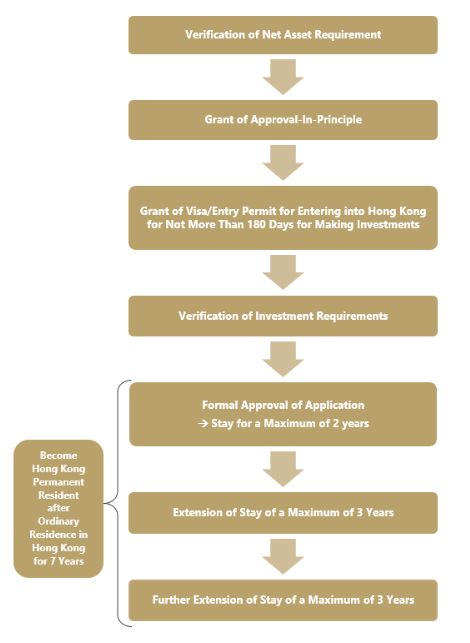

3. Application Procedures

The key stages of the application procedures are summarised below:-

If the applicant has fulfilled the portfolio maintenance requirement for seven consecutive years but failed the seven-year ordinary residency requirement, he may still apply for unconditional stay in Hong Kong.

4. Conclusion

Although the minimum threshold of Permissible Investment Assets has increased from HK$10 million under the former CIES to HK$30 million under the New CIES, the New CIES offers a wider scope of Permissible Investment Assets (e.g. non-residential real estate, retail funds and private funds domiciled in Hong Kong).

It is envisaged that the New CIES would incentivise more high-net-worth individuals to set foot and possibly set up family offices in Hong Kong, consolidating Hong Kong's position as an international asset and wealth management hub.

It has only been less than one month since the launch of the New CIES, but we have already observed heightened interest in the New CIES from an array of financial firms, such as banks, brokers, fund sponsors and real estate clients, who are fielding enquiries from high-net-worth individuals wishing to settle in Hong Kong or set up investment structures to cater for the New CIES.

Visit us at mayerbrown.com

Mayer Brown is a global services provider comprising associated legal practices that are separate entities, including Mayer Brown LLP (Illinois, USA), Mayer Brown International LLP (England & Wales), Mayer Brown (a Hong Kong partnership) and Tauil & Chequer Advogados (a Brazilian law partnership) and non-legal service providers, which provide consultancy services (collectively, the "Mayer Brown Practices"). The Mayer Brown Practices are established in various jurisdictions and may be a legal person or a partnership. PK Wong & Nair LLC ("PKWN") is the constituent Singapore law practice of our licensed joint law venture in Singapore, Mayer Brown PK Wong & Nair Pte. Ltd. Details of the individual Mayer Brown Practices and PKWN can be found in the Legal Notices section of our website. "Mayer Brown" and the Mayer Brown logo are the trademarks of Mayer Brown.

© Copyright 2024. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.

[View Source]