- within Transport topic(s)

The Malta Financial Services Authority has issued a Circular to the Financial Services Industry in relation to the MFSA's Authorisation Process.

Following the Press Release issued on 14 February, announcing a number of organisational changes and senior leadership team appointments, including the overhaul of the Authorisation function, the MFSA is currently in the process of merging sectoral authorisations into their respective supervisory functions. This will ensure consistency in the regulatory approach and a more efficient supervisory process throughout the lifecycle of authorised firms, which fall within the oversight of the MFSA.

To ensure transparency and efficiency, MFSA staff processing applications will be in regular direct contact with applicants (or their advisers, where applicable) regarding the status of their application(s).

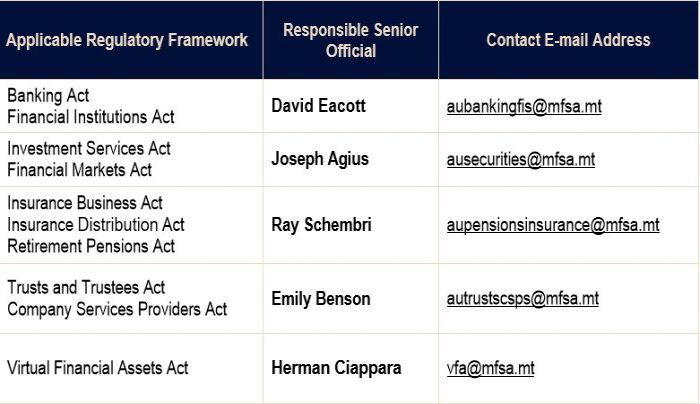

The first point of contact for applications remains, at all times, with the respective MFSA officials processing the application, and applicants needing a follow up on their applications, are required to liaise directly with the relevant MFSA officials. In the interest of transparency, the responsible senior official for applications falling within each of the relevant regulatory frameworks, is identified below:

Furthermore, the Authority has appointed a centralised contact, Anthony Tomaselli Chetcuti - Front-End Relationship Manager, within the Communications function.

Besides MFSA officials within the respective Supervisory functions, Anthony may also be contacted by applicants for updates and/or requests for information regarding any ongoing applications, as follows:

Direct line: 2548 5762 E-mail Address: Anthony.tomasellichetcuti@mfsa.mt.

As communicated in the Press Release of 14 February 2020, the MFSA intends to publish an Authorisation Process - Service Charter. This Charter is aimed to provide high-level guidance on application processing, setting out the Authority's expected regulatory standards and outlining, inter alia, the MFSA's timeframe commitments for the processing of certain types of applications submitted to the Authority.

The industry's attention is drawn to the fact that in view of recent exceptional developments, the MFSA's public commitment of the indicated timeframe for the issue of this document by Q1/2020, had to be revised accordingly and the publication of this document is being postponed to a later date.

In the meantime, as part of the ongoing initiatives to raise service level standards to the industry, the Authority is nonetheless committed to provide a clearer and more efficient authorisation process, whilst ensuring that regulatory standards are always maintained. To this effect, the Authority shall be affecting a number of changes aimed at streamlining the authorisation process of certain applications and separate communications are planned to be issued in this regard, in due course.

The Malta Financial Services Authority has issued a Circular to the Financial Services Industry in relation to the MFSA's Authorisation Process.

[View Source]