1. Overview of the Renewable Energy Sector

1.1 What is the basis of renewable energy policy and regulation in your jurisdiction and is there a statutory definition of 'renewable energy', 'clean energy' or equivalent terminology?

The key renewable energy regulations in Indonesia are:

- Law No. 30 of 2007 regarding Energy ("Energy Law"); and

- Law No. 30 of 2009 regarding Electricity, as amended by Government Regulation in Lieu of Law No. 2 of 2022 regarding Job Creation ("Job Creation GRL") ("Electricity Law").

Other than the above laws, there are also regulations for specific renewable sources, which recognise the utilisation of such resources as electricity. These are:

- Law No. 17 of 2019 regarding Water Resources, as amended by the Job Creation GRL; and

- Law No. 21 of 2014 regarding Geothermal, as amended by the Job Creation GRL.

In addition, the Government of Indonesia has been drafting and discussing the New and Renewable Energy Bill ("NRE Bill") for the last three years. We discuss the latest draft of the NRE Bill in section 9 below.

1.2 Describe the main participants in the renewable energy sector and the roles which they each perform.

- Government Authorities: The development of renewable energy in

Indonesia is overseen by several institutions as follows:

- Ministry of Energy and Mineral Resources ("MEMR"): The MEMR is the main government institution in charge of policy for renewable energy.

- Ministry of Environment and Forestry ("MOEF"): The MOEF is the ministry in charge of the environmental and forestry sectors. In relation to the development of renewable energy, the MOEF is responsible for making policy for and supervising, among other things, forest utilisation area permits and other relevant approvals for development in forest and other protected areas.

- Ministry of Industry ("MOI"): The MOI is the ministry in charge of industrial affairs. This includes making policy for and supervising mandated local content requirements that apply for renewable energy projects.

- Ministry of Public Works and Housing ("MPWH"): In renewable energy projects, the MPWH mainly oversees construction work policy and supervision. In addition, certain renewable energy sources, such as hydropower and floating solar power plants, fall under the authority of the MPWH.

- Ministry of Finance ("MOF"): The MOF has the authority to administer the state budget, including subsidies and other relevant fiscal incentives that apply to renewable energy projects.

- State Utility: In Indonesia, PT Perusahaan Listrik Negara (Persero) ("PLN"), the state-owned electricity company, manages electricity projects. PLN runs the electricity business from power generation and power transmission to the distribution and sale of electricity. The Government usually assigns the development of power projects to PLN, which can develop the projects on its own, assign them to its subsidiaries, or develop the projects in cooperation with Independent Power Producers ("IPPs").

- IPPs and Contractors:

- IPPs: In power projects, private investors and/or sponsors usually establish a project company to develop the projects and sell the power to PLN or other companies (usually industrial estate tenants). IPPs are, for the most part, 100% open for foreign investment. However, for some small-scale renewable power projects, IPPs are required to cooperate with small and medium enterprises.

- Contractors: Since IPPs do not hold the required licences to perform the Engineering, Procurement and Construction ("EPC") or Operation and Maintenance ("O&M") work for power plants, EPC and O&M work is usually given to licensed contractors.

- Financial Institutions: Financing for renewable energy projects in Indonesia is usually provided by, among others, commercial banks, development financing institutions (such as the World Bank, Asian Development Bank, and other green financing institutions), and local infrastructure financing entities (e.g., PT Sarana Multi Infrastruktur and PT Indonesia Infrastructure Finance). Some of these financing institutions have green financing platforms for environmentally friendly projects, including renewable energy projects. According to the Institute for Essential Services Reform's Indonesia Energy Transition Outlook 2022 report ("IETO 2022"), there are now 13 banks that have joined Indonesian sustainable finance initiatives, four of which have disbursed a total of USD200 million in financing for renewable projects.

1.3 Describe the government's role in the ownership and development of renewable energy and any policy commitments towards renewable energy, including applicable renewable energy targets.

The Indonesian Constitution dictates that natural resources, including renewable energy sources such as water and geo-thermal, are controlled by the Government and shall be utilised to optimise the welfare of the people. Under Indonesian Constitutional Court Decision No. 001-021-022/PUU-I/2003 ("CC Decision 001/2003"), which ruled on the constitutionality of the previous Electricity Law, electricity is also recognised as a public utility and thus falls under state control. CC Decision 001/2003 also clarified that state control can be manifested in the following forms: (i) policy making; (ii) administration; (iii) regulatory authority; (iv) management; and (v) supervision. State control over renewable energy can be seen in several related regulations and policies regarding electricity and renewable energy itself, which include certain licensing requirements for the utilisation of renewable sources.

Under Government Regulation No. 79 of 2014 regarding National Energy Policy ("NEP"), the Government aims to have at least 23% of electricity in Indonesia come from renewable energy sources by 2025, with that figure to increase to 31% by 2050. However, there is no implementing policy to achieve these energy mix targets and energy transition, other than the ratification of the Electricity Business Plan ("RUPTL") of PLN by the MEMR. The RUPTL of PLN is ratified annually for a 10-year period and it usually stipulates the number, location and type of power plants that PLN plans to develop. Based on the RUPTL PLN 2021–2030, PLN plans to add 10.6 GW of renewable power plants by 2025.

In addition, the Government enacted Presidential Regulation No. 112 of 2022 regarding the Acceleration of Renewable Energy Development for Electricity Generation ("PR 112/2022"), which also sets out a mandatory phasing out of coal-fired power plants ("CFPPs"). Please refer to section 9 for further discussion of this issue.

2. Renewable Energy Market

2.1 Describe the market for renewable energy in your jurisdiction. What are the main types of renewable energy deployed and what are the trends in terms of technology preference and size of facility?

According to IETO 2022, in 2021, renewable energy installed capacity was at 386 MW: 291 MW of hydropower; 55 MW of geothermal energy; 19 MW of bioenergy; and 21 MW of solar PV.

Indonesia has much greater renewable energy potential to tap, with major renewable energy sources coming from geothermal, solar and hydropower. Globally, Indonesia has the second-largest geothermal potential, with an estimated capacity of 14 TWhe. For hydropower, it has been estimated that Indonesia has up to 241 GW potential. For solar power, the MEMR estimates the potential to be 3551 GWp, according to the 2021 report provided in the Review of Renewable Energy Potentials in Indonesia and Their Contribution to a 100% Renewable Electricity System. By 2030, the installed capacity of solar PV would need to ramp up to 108 GWp, with utility-scale projects accounting for 80% of the installed capacity and the remainder from distributed solar PV, according to IETO 2022. Solar PV technology and business models enable large capture of market players as rooftop technology allows commercial and residential buildings to generate power on their own buildings. This potential is incentivised by MEMR Regulation No. 26 of 2021, dated August 20, 2021, regarding Rooftop Solar PV Connected to the Power Transmission Network of Electricity Supply for Public Interests Business License Holders ("MEMR Reg 26/2021").

2.2 What role does the energy transition have in the level of commitment to, and investment in, renewables? What are the main drivers for change?

To achieve the target set out in the NEP of having renewable energy make up 23% of the total energy mix by 2025, the Government has been working on a number of renewable energy regulations.

Indonesia's House of Representatives is currently deliberating the NRE Bill. The latest draft, from May 2022, mandates the Government to draft an energy transition and NRE development roadmap, with further provisions to be set out in implementing regulations. Recently, the Government enacted PR 112/2022, which also provides more incentives for renewable projects. We discuss this further in section 9 below.

2.3 What role, if any, has civil society played in the promotion of renewable energy?

Civil society in Indonesia has assumed a much larger and more vocal role over the last five years in fostering renewable energy development. As reported by conservation news web portal Mongabay in March 2022, climate activists and students have organised rallies and petitions to push commercial banks to stop financing CFPP projects. Recently, Bank Rakyat Indonesia pledged to limit its credit financing for fossil fuel energy sources such as oil and coal, as reported by Investor.id in June 2022.

There also has been environmental litigation pertaining to the environmental impact of CFPPs. In 2018, the Bandung Administrative Court declared the Environmental Permits of the Indramayu CFPP 2 x 1,000 MW and Cirebon CFPP 1 x 1,000 MW to be null and void. A landmark citizen lawsuit brought by the Clean Air Coalition against the Government in July 2019 was decided in October 2021. The Central Jakarta District Court declared that the Government had failed to take action to maintain healthy air quality.

2.4 What is the legal and regulatory framework for the generation, transmission and distribution of renewable energy?

The main laws and regulations for the generation and transmission of renewable energy are:

- the Electricity Law;

- Government Regulation No. 14 of 2012 regarding Electricity Business Supply, as amended ("GR 14/2012"); and

- MEMR Regulation No. 11 of 2021 regarding the Implementation of Electricity Business ("MEMR Reg 11/2021").

In general, the regulatory framework for the electricity business refers to the above regulations. In addition, project tenders and the purchase of electricity from renewable sources must also refer to MEMR Regulation No. 50 of 2017 regarding Utilization of Renewable Energy Sources for the Production of Electricity, as amended ("MEMR Reg 50/2017").

2.5 What are the main challenges that limit investment in, and development of, renewable energy projects?

The main challenges encountered in the investment and development of renewable energy projects in Indonesia are:

Changes in Regulatory Framework

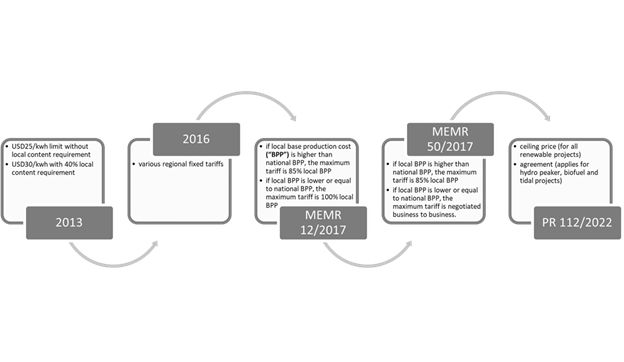

In recent years, the main regulatory framework for renewable energy development has gone through frequent changes, as follows:

As the above regulations include the tariff for selling renewable energy, being one of the primary investment considerations, these frequent changes have hampered the business process as the parties must make frequent adjustments. Under MEMR Reg 50/2017, the benchmarking of renewable energy tariffs against production cost (biaya pokok produksi or "BPP") adds more uncertainty for investors as the BPP is updated annually. Also, in the recently promulgated Presidential Regulation No. 112 of 2022 regarding the Acceleration of Renewable Energy Development for Electricity Generation ("PR 112/2022"), the electricity purchase price for renewable projects is based on either (i) the staging ceiling price, which will be evaluated annually by the MEMR, or (ii) an agreement which is applied to hydro peaker, biofuel, and tidal projects.

Bankability Issues

The main assessment for the bankability of renewable energy projects is the Power Purchase Agreement ("PPA"). In Indonesia, the PPA governs not only the sale and purchase of electricity, but also sets out the terms of the whole project cycle starting from construction, financing, commercial operation and tariff, up to the consequences of termination. The bankability of a PPA depends strongly on the tariff formulated therein, which contemplates the technology, operation, credit and return of project investment. As renewable energy technology is very diverse and relatively new compared to its conventional energy counterparts, some commercial banks need to become more acquainted with renewable energy technology (which is translated into the PPA) in order to determine the bankability of a project.

Competing Incentives

Since the enactment of Presidential Regulation No. 10 of 2021, dated March 2, 2021, regarding Investment Business Fields, as amended ("PR 10/2021"), renewable energy projects are entitled to considerably better incentives. However, the incentives for renewable energy projects still trail the incentives provided for conventional energy projects. Law No. 4 of 2009 regarding Mineral and Coal Mining, as amended by the Job Creation GRL ("Mining Law"), and its derivatives provide incentives in the form of lengthy permit extension and 0% royalty. These competing incentives are critical for the development of renewable energy, in particular with the tariffs for renewable energy still higher than those for CFPPs. It is thus critical that significant incentives be provided to attract more investment in renewable energy.

2.6 How are large utility-scale renewable power projects typically tendered?

Based on Presidential Regulation No. 4 of 2016 regarding the Acceleration of Electricity Infrastructure Development, as amended ("PR 4/2016"), the Government has assigned the development of 35 GW of electricity infrastructure, including renewable projects, to PLN. PR 4/2016 allows PLN to develop these projects on its own or in cooperation with other parties, such as its subsidiaries or private developers.

MEMR Reg 50/2017 sets out that the procurement mechanisms for renewable energy projects are (i) direct selection, and (ii) direct appointment. To join a tender, whether for direct appointment or direct selection, a participant must first be included in PLN's List of Selected Providers (Daftar Penyedia Terpilih or "DPT"). PR 112/2022 exempts (i) multifunctional hydro plants, (ii) geothermal power plants, (iii) expansion projects for geothermal, hydro, solar PV, wind, biomass, and biogas power plants, and (iv) excess power from geothermal, hydro, biomass, and biogas power plants, from the DPT requirement. PLN opens the registration periodically, based on the type of renewable energy technology. After that, PLN will open tenders for each renewable power project. Tender participants are required to comply with the mandatory partnership provisions from PLN, which require that one of PLN's subsidiaries hold 51% of the shares in the project company. Shortlisted tender participants will then be further assessed based on their proposed tariff. Finally, the winning bidder will establish a project company to negotiate the PPA with PLN. PLN may also assign its subsidiaries to conduct the tender with generally the same criteria and procedures.

Previously, project tenders referred to the prevailing RUPTL. Now, under the newly issued PR 112/2022, project tenders are based on quota capacity, which will be determined by the MEMR.

2.7 To what extent is your jurisdiction's energy demand met through domestic renewable power generation?

As of the third quarter of 2021, the share of renewable energy in the energy mix was at 11.2%, short of the 23% target stipulated in the NEP. The largest share came from biofuel at 4.2%, with hydropower and geothermal following at 2.7% and 2.0%, respectively, as reported in IETO 2022.

3. Sale of Renewable Energy and Financial Incentives

3.1 What is the legal and regulatory framework for the sale of utility-scale renewable power?

The regulatory framework for the sale and purchase of renewable energy is MEMR Reg 50/2017 and PR 112/2022.

3.2 Are there financial or regulatory incentives available to promote investment in/sale of utility-scale renewable power?

PR 4/2016 and PR 112/2022 stipulate the incentives available for renewable projects. They set out that renewable projects are entitled to receive incentives in the following forms:

- fiscal incentives;

- licensing and non-licensing facilities; and

- subsidies.

PR 10/2021 stipulates that renewable energy projects are among the priority business lines in terms of receiving corporate income tax reduction facilities. However, in practice, the IETO 2022 states that there are many constraints in the implementation of fiscal incentives that discourage investment.

3.3 What are the main sources of financing for the development of utility-scale renewable power projects?

For government-backed projects, the main source of financing is the state budget. There is also supplementary financial assistance from international development agencies and other sources of PLN financing, such as bank loans and bonds. IPP projects are mainly financed by the sponsors through capital injection and loans from commercial banks or development institutions.

According to IETO 2022, there has also been growth in more innovative financing:

- Green Bonds and Green Sukuk. Since 2018, the Government has offered green bonds and green sukuk to finance or re-finance eligible green projects, including renewable energy. As at 2021, the renewable energy sector has received USD151.5 million of financing.

- Blended Finance. Blended finance is catalysed by instruments such as concessional capital, risk insurance, technical assistance fund, and design stage grants.

- Municipal Bonds. MOF Regulation No. 111 of 2012, as amended, allows local governments to issue municipal bonds to fund public infrastructure. Municipal bonds are an option for local governments to finance renewable energy projects. A Climate Policy Initiative study on renewable energy finance identified the Indonesian capital, Jakarta, and the provinces of West Java, Central Java, East Java, and Bali as leading localities with the greatest potential to generate municipal bonds to finance renewable energy projects.

3.4 What is the legal and regulatory framework applicable to distributed/C&I renewable energy?

Indonesia has no particular legal framework for distributed or C&I renewable projects. The Electricity Law and MEMR Reg 11/2021 enable the integrated business of electricity generation, transmission, distribution and sales. Based on MEMR Reg 11/2021, such business activity requires a Business Area and Integrated Electricity Supply for Public Interests Business License.

3.5 Are there financial or regulatory incentives available to promote investment in distributed/C&I renewable energy facilities?

There are no particular incentives provided for distributed or C&I renewable projects.

3.6 What are the main sources of financing for the development of distributed/C&I renewable energy facilities?

Distributed renewable projects may obtain direct financing from state and local budgets based on the decision of the Minister of Villages, Development of Disadvantaged Regions, and Transmigration Regulation No. 11 of 2019, as amended, regarding Priority of Village Fund Utilization for 2020. This regulation stipulates energy as one of the basic service sectors to receive prioritised village fund allocation.

3.7 What is the legal and regulatory framework applicable to the development of green hydrogen projects?

To date, no green hydrogen regulation has been issued.

3.8 Are there financial or regulatory incentives available to promote investment in green hydrogen projects?

Please see our answer to question 3.7 above.

3.9 What are the main sources of financing for the development of green hydrogen projects in your jurisdiction?

Please see our answer to question 3.7 above.

3.10 What is the legal and regulatory framework that applies for clean energy certificates/environmental attributes from renewable energy projects?

The Government has enacted Presidential Regulation No. 98 of 2021 regarding the Implementation of Carbon Pricing to Achieve the Nationally Determined Contribution Target and Control over Greenhouse Gas ("GHG") Emissions in relation to National Development ("PR 98/2021"). This regulation introduces the GHG Emission Reduction Certificate. Based on PR 98/2021, the MOEF will issue the GHG Emission Reduction Certificate, which can be obtained by registering with the National Registry System on Climate Change Control (and going through the verification process). The GHG Emission Reduction Certificate can further be used for carbon trading, result-based payment, or obtaining green financing.

Also, PLN issues PLN Renewable Energy Certificates ("REC") from three of its renewable power plants with a total capacity of 350 MW and 916,334 RECs quota. These RECs can be purchased only through PLN's website.

3.11 Are there financial or regulatory incentives or mechanisms in place to promote the purchase of renewable energy by the private sector?

There are currently no financial or regulatory incentives in place to foster the purchase of renewable energy by the private sector.

4. Consents and Permits

4.1 What are the primary consents and permits required to construct, commission and operate utility-scale renewable energy facilities?

Based on MEMR Reg 11/2021, business entities supplying electricity (generation, transmission, distribution and/or sale of electricity) are required to obtain an Electricity Supply for Public Interests Business License.

Government Regulation No. 5 of 2021 regarding the Implementation of Risk-Based Business Licensing ("GR 5/2021") requires a contractor that constructs and operates a renewable energy plant to hold an Electricity Support Services Business License, in addition to having the appropriate construction licence. Under MEMR Regulation No. 12 of 2021 regarding the Classification, Qualification, Accreditation and Certification of Electricity Supporting Service Businesses ("MEMR Reg 12/2021"), such contractors are also required to obtain the relevant professional certificates, which include the Certificate of Electricity Support Services Business Entity and Electricity Competency.

Note that upon the completion of the construction of the facilities, the owner of the plant must also obtain an Operation Worthiness Certificate.

4.2 What are the primary consents and permits required to construct, commission and operate distributed/C&I renewable energy facilities?

Please refer to our discussion in question 4.1 above.

4.3 What are the requirements for renewable energy facilities to be connected to and access the transmission network(s)?

Please refer to our discussion in question 4.1 above. In addition, the relevant business actor must also observe the applicable grid code for their location.

4.4 What are the requirements for renewable energy facilities to be connected to and access the distribution network(s)?

Please refer to our discussion in question 4.1 above.

4.5 Are microgrids able to operate? If so, what is the legislative basis and are there any financial or regulatory incentives available to promote investment in microgrids?

Yes, microgrids are regulated under MEMR Regulation No. 38 of 2016 regarding the Acceleration of Electrification in Underdeveloped, Remote, Border Villages and Small Islands through Small-Scale Electricity Business Supply ("MEMR Reg 38/2016"). MEMR Reg 38/2016 encourages the appointed business actor to provide its electricity supply from renewable sources, and they will be entitled to fiscal incentives such as tax holiday and corporate income tax reduction.

4.6 Are there health, safety and environment laws/regulations which should be considered in relation to specific types of renewable energy or which may limit the deployment of specific types of renewable energy?

Yes, the health and safety requirements for renewable energy are regulated under Minister of Manpower ("MOM") Regulation No. 12 of 2015 regarding Electrical Occupational Safety and Health in the Workplace, as amended ("MOM Reg 12/2015"). The health and safety requirements under MOM Reg 12/2015 cover the full range of the electricity business. Environmental requirements are regulated under Law No. 32 of 2009 regarding Environmental Protection and Management, as amended, ("Environmental Law") and Government Regulation No. 22 of 2021 regarding the Administration of Environmental Protection and Management ("GR 22/2021"). Basically, business actors are required to prepare the applicable environmental documents depending on the potential environmental impact of their business activities. The environmental documents required for renewable energy projects differ depending on the technology and the planned capacity of the project, as stipulated under MOEF Regulation No. 4 of 2021.

5. Storage

5.1 What is the legal and regulatory framework which applies to energy storage and specifically the storage of renewable energy?

There is no specific regulatory framework in place for energy storage.

5.2 Are there any financial or regulatory incentives available to promote the storage of renewable energy?

Please refer to our answer to question 5.1 above.

6. Foreign Investment and International Obligations

6.1 Are there any special requirements or limitations on foreign investors investing in renewable energy projects?

Most electricity generation activities in Indonesia are no longer restricted by foreign ownership limitations. However, PR 10/2021 reserves electricity generation projects with a capacity of less than 1 MW for domestic cooperatives and micro, small, and medium enterprises. Under Ministry of Investment Regulation No. 4 of 2021 regarding Procedures and Guidelines for Risk-Based Business Licensing Services and Investment Facilities ("BKPM Reg 4/2021"), the minimum capital requirement for a foreign investment company is IDR10 billion in paid-up capital.

6.2 Are there any currency exchange restrictions or restrictions on the transfer of funds derived from investment in renewable energy projects?

The Foreign Exchange Law mandates that the transfer of foreign exchange from and to Indonesia is subject to reporting obligations to Indonesia's central bank, Bank Indonesia. In addition, Law No. 7 of 2011 on Currency ("Currency Law") provides that payment transactions and settlement obligations that take place in Indonesia must use IDR, with certain exemptions, such as international commercial transactions and international financing transactions. Usually, in power projects, the party will deliver a letter to Bank Indonesia requesting an IDR payment exemption.

6.3 Are there any employment limitations or requirements which may impact on foreign investment in renewable energy projects?

The applicable restrictions and requirements for employment matters are provided under Law No. 13 of 2003 regarding Manpower, as amended ("Manpower Law"). The Manpower Law prohibits expatriate workers from being employed in any position related to human resources. In addition, any expatriate employment must be drawn up under an Expatriate Utilisation Plan, which must be approved by the Ministry of Manpower. Employers must also appoint an Indonesian understudy for every expatriate employed in the interest of skill and technology transfer.

6.4 Are there any limitations or requirements related to equipment and materials which may impact on foreign investment in renewable energy projects?

The local content requirements for the electricity sector are listed in Minister of Industry Regulation No. 54/M-IND/PER/3/2012 regarding Guidelines for Local Content Requirements for the Development of Electricity Infrastructure, as amended.

7. Competition and Antitrust

7.1 Which governmental authority or regulator is responsible for the regulation of competition and antitrust in the renewable energy sector?

The relevant authority overseeing competition and anti-trust, including for the renewable energy sector, is the Indonesian Business Competition Supervisory Commission (Komisi Pengawas Persaingan Usaha or "KPPU").

7.2 What power or authority does the relevant governmental authority or regulator have to prohibit or take action in relation to anti-competitive practices?

Based on Law No. 5 of 1999 regarding the Prohibition of Monopolistic Practices and Unfair Business Competition, as amended by the Job Creation Law ("Competition Law"), the powers of the KPPU include evaluating:

- agreements that may result in monopolistic practices and/or unfair business competition;

- business activities and/or the actions of business actors that may result in monopolistic practices and/or unfair business competition; and

- the existence or non-existence of the misuse of a dominant position that may result in monopolistic practices and/or unfair business competition.

7.3 What are the key criteria applied by the relevant governmental authority or regulator to determine whether a practice is anti-competitive?

Under the Competition Law, the main criteria applied by the KPPU to determine whether a practice is anti-competitive based on the Competition Law are as follows:

- Monopoly: A business actor may be reasonably suspected of monopoly if, among other things, one business actor or a group of business actors control(s) over 50% of a market segment.

- Monopsony: One business actor or a group of business actors control(s) over 50% of the market segment.

- Market Control: One of the criteria of market control is supplying goods or services by selling while making a loss or by setting extremely low prices with the aim of eliminating or ruining the business of competitors in the relevant markets.

- Conspiracy: One of the criteria of conspiracy is conspiring with other parties to hinder the production and/or marketing of the goods and/or services of competitors with the aim of causing such commodity offered or supplied to the relevant market to reduce in quantity, quality or timeliness.

8. Dispute Resolution

8.1 Provide a short summary of the dispute resolution framework (statutory or contractual) that typically applies in the renewable energy sector, including procedures applying in the context of disputes between any applicable government authority/regulator and the private sector.

The typical dispute resolution framework in renewable energy projects involves consultation, negotiation, expert evaluation, arbitration and judicial procedures. The preferred dispute resolution forum depends on the parties involved in the relevant agreements. In practice, PPAs and large-scale EPC contracts for renewable projects refer to the Singapore International Arbitration Centre or the Indonesian National Board of Arbitration (Badan Arbitrase Nasional Indonesia or "BANI") as their dispute resolution forum.

8.2 Are alternative dispute resolution or tiered dispute resolution clauses common in the renewable energy sector?

Yes, alternative dispute resolution or tiered dispute resolution clauses are common in the Indonesian renewable energy sector. MEMR Regulation No. 10 of 2017 regarding Main Provisions of Power Purchase Agreement, as amended ("MEMR Reg 10/2017"), provides that a dispute arising from a PPA is to be settled first by amicable discussion. Should amicable discussion fail to produce a settlement, the parties may refer the dispute for expert evaluation. If expert evaluation fails to settle the dispute, the parties may refer their dispute to BANI, the United Nations Commission on International Trade Law, or any other appointed arbitration body. Based on MEMR Reg 10/2017, the settlement reached through the arbitration body shall be final and binding.

8.3 What interim or emergency relief can the courts grant?

In judicial procedures, a party may ask the court to grant provisional measures to maintain the status quo. Such emergency relief is granted to protect a claimant's interests. In some cases, the court may also grant provisional measures, such as the intervention of a third party or seizure of assets.

8.4 Is your jurisdiction a party to and has it ratified the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards and/or the Convention on the Settlement of Investment Disputes between States and Nationals of Other States and/or any significant regional treaty for the recognition and enforcement of judgments and/or arbitral awards?

Indonesia is a party to:

- the New York Convention on the Recognition and Enforcement of Foreign Arbitral Awards, as ratified by Presidential Decree No. 34 of 1981 regarding the Ratification of the Convention on the Recognition and Enforcement of Foreign Arbitral Awards; and

- the Convention on the Settlement of Investment Disputes between States and Nationals of Other States, as ratified by Law No. 5 of 1968 regarding Dispute Settlement between States and Foreign Individuals regarding Investment.

8.5 Are there any specific difficulties (whether as a matter of law or practice) in litigating, or seeking to enforce judgments or awards, against government authorities or the state?

The major challenges in any dispute settlement process against government authorities or the state are as follows:

- Judicial Procedures: Typical judicial proceedings in Indonesia can last for two to three years. Parties may also encounter challenges in enforcing court decisions against government authorities or the state, as they will usually challenge the decision through the appeal and cassation process.

- Arbitration: Currently, there are two BANIs in Indonesia. Therefore, parties must be clear in their agreements which BANI they are referring to for their preferred dispute resolution forum. Parties may also encounter challenges in the enforcement of arbitration awards, as Law No. 30 of 1999 regarding Arbitration and Alternative Dispute Resolution ("Law 30/1999") dictates that arbitration awards are subject to enforcement order by the relevant district court.

8.6 Are there examples where foreign investors in the renewable energy sector have successfully obtained domestic judgments or arbitral awards seated in your jurisdiction against government authorities or the state?

There have been examples of foreign investors in Indonesia's renewable energy sector successfully obtaining domestic judgments against government authorities or the state. For example, South Jakarta District Court Decision No. 267/Pdt/P/2008/PN.Jkt.Sel, which was affirmed by Supreme Court Decision No. 45 PK/Pdt.Sus-Arbt/2015, in the case PT Geo Dipa Energi v. PT Bumigas Energi and BANI regarding the tendering process and shareholder approval for the development of the Dieng-Patuha Geothermal Power Plant.

9. Updates and Recent Developments

9.1 Please provide a summary of any recent cases, new legislation and regulations, policy announcements, trends and developments in renewables in your jurisdiction.

- PR 112/2022: On September 13, 2022, the Government enacted PR

112/2022, which aims to address several concerns and accelerate

renewable energy development in Indonesia. Key provisions of PR

112/2022 include:

- Phasing Out CFPPs: PR 112/2022 mandates the MEMR to develop a roadmap for the phasing-out of CFPPs. This roadmap shall comprise (i) the reduction of emissions from CFPP projects, (ii) early retirement strategies for CFPPs, and (iii) harmonisation with other relevant policies. Generally, PR 112/2022 prohibits the new development of any CFPPs except for those (i) included in the current RUPTL and CFPPs, which are integrated with certain industries or listed as National Strategic Projects, (ii) committed to reduce emissions by 35% within a 10-year period using the average CFPP emissions baseline in 2021, and (iii) that will operate at the latest until 2050.

- Electricity Pricing: PR 112/2022 introduces two schemes for pricing electricity from renewable projects. First, as a general rule for all renewable projects, the pricing mechanism is staging the ceiling price. Under the ceiling price mechanism, the MEMR has the authority to determine the ceiling price and annually evaluate the pricing based on the average purchase price of PLN's PPAs. The ceiling price is determined based on the type of project and location. The second pricing mechanism is agreed price, which is based on negotiations and requires MEMR approval. This mechanism only applies to hydro power, biofuel, and tidal projects.

- Renewable Projects Tendering: Generally, the project tendering mechanisms under PR 112/2022 are in line with those under other prevailing regulations, which are direct selection and direct appointment. As a measure to accelerate the development of renewable energy projects, PR 112/2022 exempts (i) multifunctional hydro plants, (ii) geothermal power plants, (iii) expansion projects for geothermal, hydro, solar PV, wind, biomass and biogas power plants, and (iv) excess power from geothermal, hydro, biomass and biogas power plants, from the requirement to be listed in PLN's DPT. Previously, project tenders referred to the prevailing RUPTL as its baseline. Now, the baseline shall refer to quota capacity as set by the MEMR.

- Carbon Pricing: In October 2021, the Government enacted PR

98/2021 concerning carbon pricing as part of its effort to achieve

its Nationally Determined Contribution

("NDC") under the Paris Agreement. In

addition to PR 98/2021, the Government in 2022 promulgated two

implementing regulations on carbon pricing, namely: (i) MOEF

Regulation No. 21 of 2022 regarding Procedures for Carbon Pricing

Implementation ("MOEF Reg 21/2022"); and

(ii) MEMR Regulation No. 16 of 2022 regarding Procedures for Carbon

Pricing Implementation for the Power Plant Sub-sector

("MEMR Reg 16/2022"). These regulations

provide four mechanisms for carbon pricing, as follows:

- Carbon Trading: This market-based mechanism aims to reduce GHG emissions through the sale and purchase of carbon units in both the domestic and international markets. PR 98/2021 divides carbon trading into two schemes, which are emission trading and GHG emission offset. MEMR Reg 16/2022 mandates that all CFPPs and other fossil fuel power plants must, among other requirements, obtain GHG emission cap approval and conduct carbon trading. Meanwhile, renewable power plants are required only to conduct GHG emission offsetting.

- Result-based Payment: This mechanism is an incentive or payment from a verified and/or certified GHG emission reduction as well as other benefits outside carbon. Note that based on PR 98/2021, the result-based payment does not cause the transfer of carbon ownership and its result will be counted as part of the NDC target achievement.

- Carbon Levy: The levies introduced under PR 98/2021 are tax, customs and excise, and other state levies on the grounds of carbon content and/or emission potential, as well as climate change mitigation performance. According to Law No. 7 of 2021 regarding Harmonization of Tax Regulations, a carbon tax roadmap will be prepared. The carbon tax for CFPPs is targeted to be introduced starting this year.

- Other mechanisms pursuant to the development of science and technology.

- NRE Bill: Since 2018, the Government has been drafting and

deliberating the NRE Bill as the regulatory framework for renewable

energy projects and green energy transition. The most recently

circulated draft of the NRE Bill, dated May 30, 2022, included the

following provisions:

- Energy transition roadmap.

- New and renewable energy sources.

- Licensing.

- Health, safety and environmental requirements for NRE.

- NRE price.

- Incentives.

- Funding.

There has been much public discussion of Article 9 of the NRE Bill, which includes liquefied coal and gasified coal as "new energy sources". Consequently, the NRE Bill treats "new energy sources" as equals to renewable energy sources. This provision has caused an outcry from civil society seeking the removal of new energy sources from the Bill or the suspension of all discussions of the Bill, as new energy sources that are clearly carbon intensive receive the same priority and incentives as renewable energy, being the actual green energy. The Government aims to wrap up and issue the finalised NRE Bill by the end of 2022.

Originally published by International Comparative Legal Guide - Renewable Energy 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.