- within Tax topic(s)

- in European Union

- in European Union

- in European Union

- within Privacy, Antitrust/Competition Law and Environment topic(s)

Advocate General (AG) Koopman has advised the Supreme Court to declare the Decree on Tax and Collection Interest (the Decree) non-binding. If followed, the AG's reasoning could lead to a reduction in applicable tax interest rates for periods starting October 2020.

Key insights

- AG advises the Supreme Court to declare the Decree on Tax and Collection Interest legally non-binding

- The AG recommends aligning the rate with statutory interest for non-commercial transactions

- The lower tax interest rate may also be impacted by the Supreme Court's decision

Introduction

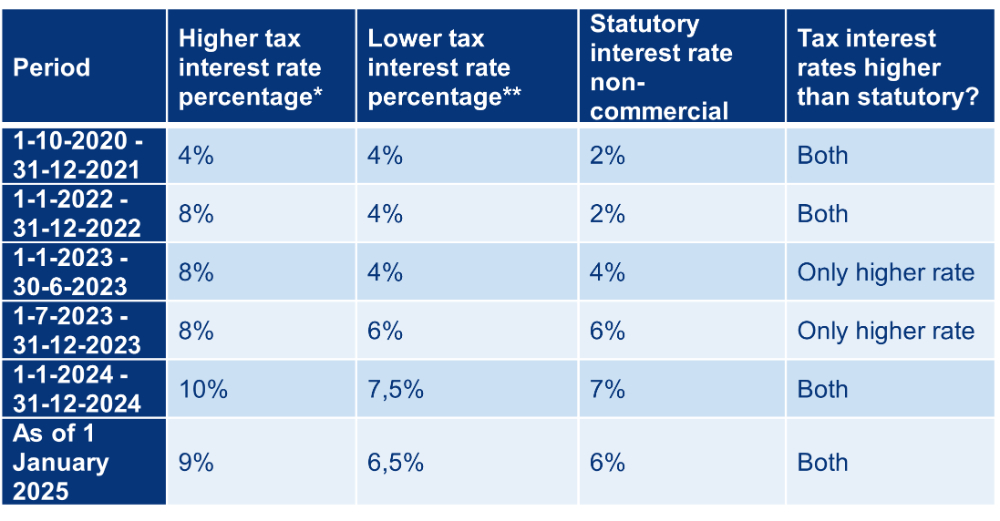

On 26 September 2025, the AG issued an opinion regarding the application of the Dutch tax interest regime. Under this regime, a higher interest rate applies to, inter alia, corporate income tax, while a lower rate applies to other taxes such as personal income tax, dividend withholding tax, wage tax and VAT. An overview of the various rates is included at the end of this post.

A District Court had previously ruled that the higher 8% interest rate applied to corporate income tax for the years 2022 and 2023 was contrary to the principle of proportionality. The State Secretary for Finance lodged an appeal against this judgement with the Supreme Court. The AG advises the Supreme Court to declare the Decree non-binding.

Legal Framework and AG's Analysis

The AG's opinion is structured around three key questions:

- did the legislator remain within the delegated authority;

- was the Decree carefully prepared and sufficiently reasoned;

- does the Decree withstand scrutiny under the principles of proportionality and equality?

A negative answer to any of these questions renders the Decree non-binding in the AG's view.

Parliamentary history shows that tax interest was introduced to compensate the state for financial disadvantage caused by late or incorrect tax returns. The AG argues that the 8% rate significantly exceeds what is necessary for such compensation, and that the legislator therefore exceeded its delegated authority. He also finds the reasoning behind the regulation lacking: taxpayer interests were insufficiently considered, and the distinction between corporate income tax and other taxes is not convincingly justified. Finally, the AG considers the interest rate to result in an arbitrary and disproportionate burden, particularly for taxpayers who are unable to accurately estimate their tax position in time. Based on the above, the AG concludes that all three questions must be answered in the negative.

The AG advises to align the higher tax interest rate applicable to corporate income tax with the statutory interest rate for non-commercial transactions (wettelijke rente voor niet-handelstransacties).

Relevance for practice

If the Supreme Court follows the AG's reasoning, the higher interest rate applicable to corporate income tax may be reduced from October 2020. However, if the Supreme Court were to follow the AG's opinion, this could affect the lower tax interest rate as well, given that the lower rate also exceeds the statutory interest rate for non-commercial transactions in certain periods.

Pending the decision of the Supreme Court, we recommend reviewing tax assessments which include tax interest and assessing whether an objection should be filed by reference to this case.

We will keep you updated on further developments. Should you have queries, please contact your trusted adviser at Loyens & Loeff or one of the advisers mentioned below.

* This includes corporate income tax (vennootschapsbelasting), conditional withholding tax (bronbelasting), minimum tax (minimumbelasting), solidarity contribution (solidariteitsbijdrage) and profit share (winstaandeel).

** This includes other taxes such as personal income tax, dividend withholding tax, wage tax and VAT.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.