- within Criminal Law topic(s)

- within Immigration, Accounting and Audit, Media, Telecoms, IT and Entertainment topic(s)

Malta conducted its National Risk Assessment (NRA) on Money Laundering (ML) and Funding for Terrorism (TF) in 2018, leading to various reviews by international bodies like MONEYVAL, EBA, European Commission, and IMF. The fifth round Mutual Evaluation Report (MER) by MONEYVAL in 2019 identified shortcomings, prompting Malta to focus on enhancing its anti-money laundering and countering terrorism financing (AML/CFT) framework. Initiatives were taken to address recommendations from MONEYVAL and FATF, resulting in Malta achieving technical compliance with FATF standards. However, further improvements were needed in beneficial ownership accuracy and utilisation of financial intelligence. Malta was placed under enhanced monitoring by FATF in June 2021 but made significant progress, leading to its removal from the increased monitoring list within a year. Malta's strategy focused on risk understanding, effective delivery, and sustainability. Thematic risk assessments were conducted, contributing to improved risk understanding and effective AML/CFT measures. The 2023 NRA aims to maintain progress and ensure a dynamic and proactive AML/CFT framework. The process involved extensive policy deliberations, stakeholder dialogue, and commitment from all parties. The NRA aims to enhance Malta's risk-based approach to AML/CFT and ensure long-term effectiveness through regular monitoring and updating.

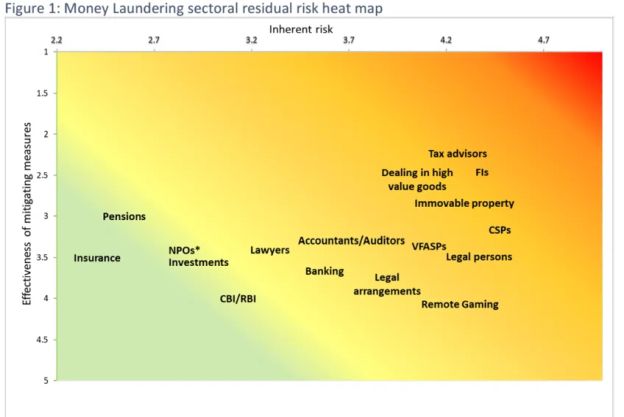

The 2023 NRA represents Malta's latest effort to assess risks related to Money Laundering (ML), Terrorism Financing (TF), as well as Proliferation Financing (PF) and Targeted Financial Sanction (TFS) risks for the first time. The NRA aims to establish a common understanding among competent authorities and the private sector regarding these risks, facilitating the implementation of risk-based mitigation measures. The methodology involves assessing threats and vulnerabilities, considering likelihood, impact, exposure, and existing mitigating measures to determine residual risk. Data from various sources, including EU SNRA, 2019 Mutual Evaluation Report, and discussions with working groups and private sector representatives, inform the analysis. A heat map illustrates ML sectoral residual risks, showing inherent risk versus the effectiveness of mitigating measures.

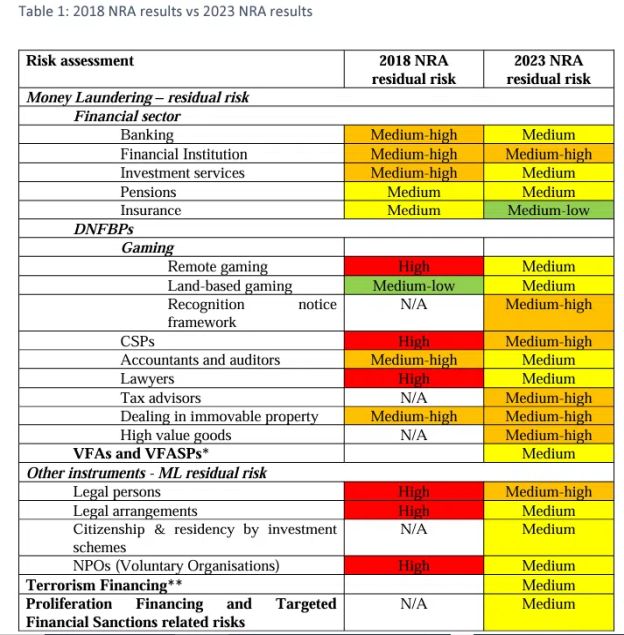

The following table summarises the NRA results for 2018 and 2023. As can be seen, a decline in the residual risk has been identified across most sectors, and this should be attributed mostly to the improvement of mitigating measures applied.

Malta has demonstrated political will and determination to address gaps identified in its AML/CFT framework following the 2019 Mutual Evaluation Report (MER). Significant changes in the legal and regulatory framework have been implemented, alongside enhanced coordination efforts. Data presented in this section includes information on the materiality of various sectors, such as the financial sector, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Financial Asset Service Providers (VFASPs). It also covers factors influencing the effectiveness of AML/CFT measures, such as regulatory maturity, governance improvements, and financial inclusion levels. Since MONEYVAL's onsite visit in 2018, Malta has allocated additional resources to competent and law enforcement authorities, resulting in improved effectiveness in AML/CFT operations. Cooperation, information sharing, and risk-based activities have led to positive outcomes, as reflected in the allocation of resources in financial supervision, DNFBP supervision, FIAU resources, law enforcement, and other entities between 2020 and 2022.

In addition, it is to be noted that the FIAU increased the expenditure on technological equipment from €14,773 in 2017 to €1.8 million in 2020, and €1.6 million in 2022. With regards to the legislative AML/CFT framework, in April 2021, Malta achieved a re-rating by MONEYVAL in the nine recommendations on which it had been originally rated partially compliant in the 2019 Mutual Evaluation Report23. Malta succeeded in achieving a re-rating in the recommendations to compliant or largely compliant.

Malta has undertaken various measures beyond legal and institutional reforms to strengthen anti-corruption structures and enhance capacity building. These measures include bolstering resources for the Police to investigate economic crime, increasing resources for entities like the FIAU, MFSA, and MGA, and separating investigative and prosecutorial roles by transferring prosecution powers to the Office of the Attorney General. This transition, initiated in October 2020, involves prosecuting crimes such as money laundering, economic crimes, terrorism financing, and corruption. Capacity building efforts within the Office of the Attorney General have been undertaken through extensive recruitment processes.

To promote good governance, Malta has enacted substantive laws criminalising corruption, eliminating time limits for prosecuting corruption offenses in certain cases, providing civil remedies for damages resulting from corruption, and implementing procedural tools to encourage witnesses to report and testify on corruption. Measures targeting Politically Exposed Persons (PEPs) and other preventative AML/CFT measures have also been strengthened to preserve and enhance government integrity.

Legal amendments have empowered institutions like the Ombudsman, Auditor General, Commissioner for Standards in Public Life, and Permanent Commission Against Corruption to report corruption findings directly to the Attorney General for prosecution. Decisions by the Attorney General not to prosecute can be judicially reviewed, and Codes of Ethics have been established for employees in the public sector, including public prosecutors. In 2021, contracts for new recruits at the Office of the Attorney General were revised to include a revolving door clause, indicating Malta's commitment to monitoring and further strengthening the rule of law, as recommended by its membership in the Group of States against Corruption (GRECO).

Company service providers (CSPs) play a significant role in Malta, with a majority (91.5%) of legal persons incorporated by CSPs in 2022. However, the CSP sector experienced a decline in population from 2021 to 2022 due to increased regulatory obligations, particularly in prudential and governance requirements, as well as minimum capital requirements.

Amendments to the CSP licensing regime included:

- Bringing lawyers, notaries public, auditors, and accountants within the scope of the CSP Act, subjecting them to market entry requirements and ongoing fitness, propriety, and compliance standards.

- Removing service providers previously exempt under the "de minimis" rule from exemption, making them subject to the CSP Act and market entry requirements.

- Strengthening ongoing requirements for CSPs related to governance, risk management, compliance, and time commitment, addressing sectoral risk assessment outcomes.

Additionally, the amendments introduced categorisation of TCSPs into classes based on business model and service scope to reflect differences in associated risks.

The VFAs landscape in Malta has changed considerably along the years. In assessing the landscape of the VFA service providers it is interesting to note the whole process from 2018 up to 2021, where in November 2018, 180 entities notified interest to the MFSA. By October 2019, there were 89 declarations of cessation of business, and 34 VFASPs submitted a Letter of Intent, 6 (six) of which did not actually materialise into a submitted application. Subsequently, there were 57 warnings issued and entities struck off by the Malta Business Registry. All issues encountered by the supervisory authorities in Malta were proactively shared with other jurisdictions whereby such operators had a footprint. As at end 2022, there were 11 authorised VFASPs in Malta. During 2021, the VFASPs sector attracted six (6) million clients, which are mostly retail, with approximately 56% of such clients being considered as active. Out of these clients, 99.8% are non-resident clients. These licensed VFASPs held €17.9 billion of assets under custody and had a total trading volume of €357 billion. Investment services in 2021 had 55.7% non-resident clients. Money Value Transfer services that had 56.1% of the total value of transactions with foreign countries, while banks had 14.8% of the total value from non-resident clients. These figures, indicate that in terms of clients, apart from the VFASPs, banks and investment services have their number of clients almost divided equally between non-resident and resident clients. With regards to the clients' deposits, the banks' deposits are the majority from the resident clients.

Conclusion

The assessment of the investment services sector in Malta reveals several key findings regarding the risks of money laundering (ML) and terrorism financing (TF). Despite being regulated by the MFSA and overseen by the FIAU for AML/CFT compliance, various sectors still experience significant vulnerabilities and threats.

The assessment highlights risks associated with ML and TF, with evidence suggesting potential exploitation of the sector for laundering proceeds from tax crimes, corruption, fraud, and organised crime. Low reporting of suspicious transactions raises concerns about the effectiveness of transaction monitoring systems and the detection of criminal activity.

Mitigating measures, including competency assessments, due diligence checks, and supervisory activities, have been implemented at the national level. However, enhancements are needed, particularly in customer due diligence controls and reporting of suspicious transactions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.