- in European Union

On 14 May 2024, the European Securities and Markets Authority (ESMA) published the final version of its new Guidelines on funds' names using ESG or sustainability-related terms (the Guidelines).

The purpose of the Guidelines is to specify the circumstances under which the funds' names using ESG or sustainability-related terms are unfair, unclear or misleading. Funds' names can have a significant impact on the investors' expectations and decisions. Unfair, unclear or misleading sustainability terms could expose them to greenwashing risks.

Furthermore, the Guidelines apply in relation to the obligation of the entities in scope to act honestly and fairly in conducting their business as well as the obligation that all the information included in marketing communications is fair, clear and not misleading.

Application dates

Further to the publication by ESMA of the translations of the Guidelines on 21 August 2024, their application will start on 21 November 2024 for new funds and on 21 May 2025 for funds existing before such date, in application of the relevant transitional provisions which, for these funds, foresee an extension of the application date of six months.

All in scope entities, which include UCITS management companies and AIFMs, will have to comply with the Guidelines within the above-mentioned dates.

Key points of the Guidelines

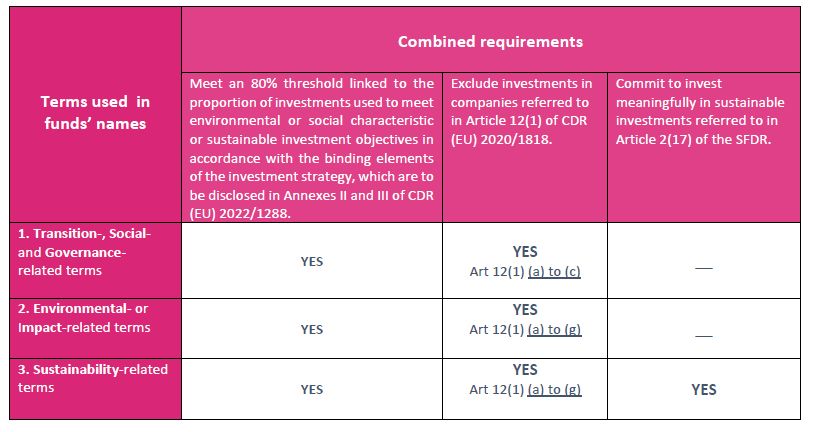

In case of a combination of terms, use of transition, sustainability- and impact-related terms, and for funds designating an index as a reference benchmark, further criteria are specified in the Guidelines.

A temporary deviation from the threshold and the exclusions should be treated as a passive breach and corrected in the best interest of the investors.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.