- within Real Estate and Construction topic(s)

Many married couples, especially in community property states (such as Arizona, California, and Texas), will elect to have one joint revocable trust to hold their respective properties rather than two separate revocable trusts.

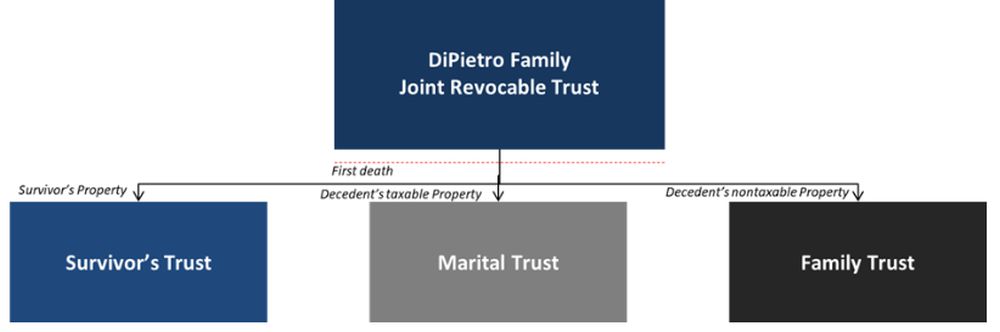

A common format for a joint revocable trust is one that incorporates asset protection, marital protection, and estate tax planning at the first death (with the first spouse being referred to as the "Decedent"). Typically, this type of plan will utilize three distinct trusts upon the death of the Decedent: a Survivor's Trust, a Marital Trust, and a Family Trust. The remainder of this piece will discuss the purposes of each of these trusts and considerations that make them unique when compared to each other. Note that this examines provisions generally found in each of these trusts; given the ability to customize these trusts, the brief explanations do not capture every available option.

Diagram of The Survivor's Trust / Marital Trust / Family Trust Format

Many married couples, especially in community property states (such as Arizona, California, and Texas), will elect to have one joint revocable trust to hold their respective properties rather than two separate revocable trusts.

A common format for a joint revocable trust is one that incorporates asset protection, marital protection, and estate tax planning at the first death (with the first spouse being referred to as the "Decedent"). Typically, this type of plan will utilize three distinct trusts upon the death of the Decedent: a Survivor's Trust, a Marital Trust, and a Family Trust.

The remainder of this piece will discuss the purposes of each of these trusts and considerations that make them unique when compared to each other. Note that this examines provisions generally found in each of these trusts; given the ability to customize these trusts, the brief explanations do not capture every available option.

Survivor's Trust

Upon the death of the first spouse, the Survivor's Trust is created, which consists of the sole and separate property of the surviving spouse along with the surviving spouse's share of any community property. Oftentimes, the Decedent will direct that any remaining tangible personal property (e.g., household appliances, electronics, jewelry, etc.) also be transferred to, and held by, the Survivor's Trust.

The property of the Survivor's Trust is under the control of the Trustee of the Survivor's Trust which is oftentimes the surviving spouse. However, even if the surviving spouse is not the Trustee, the surviving spouse retains complete control over the Survivor's Trust and can amend or revoke it; essentially, the Survivor's Trust is the surviving spouse's revocable trust.

The surviving spouse can receive income and principal from the Survivor's Trust simply by asking the Trustee for it. At the death of the surviving spouse, the surviving spouse has a general testamentary power of appointment over such assets, meaning he or she can appoint those assets to any individual or entity and any assets held by the Survivor's Trust upon the death of the surviving spouse will receive a basis adjustment for federal income tax purposes at the time of the Survivor's death.

Family Trust

The Family Trust will receive a share of the property in an amount generally equal to the Decedent's remaining federal estate and gift tax exemption; for the 2024 tax year this amount is $13.61 million per person, and under current law will be approximately $7 million per person in 2026, minus any prior gifting. The Family Trust is generally designed to provide the surviving spouse with creditor protection and to mitigate estate taxes by capturing the Decedent's unused exemption.

The Family Trust may also lock in the residual beneficiaries after the death of the surviving spouse. For example, the Family Trust allows the surviving spouse to be a beneficiary but ultimately the assets will pass to the Decedent's descendants upon the surviving spouse's death (i.e., the surviving spouse cannot pass the assets of the Family Trust to a new spouse or to the surviving spouse's descendants).

The property in the Family Trust is under the control of the Trustee which may be the surviving spouse or, oftentimes in the case of blended families, a neutral third party such as a trust company. The Family Trust may allow for distributions of income, principal, or both with such distributions often being limited for the health, education, maintenance, and support of the surviving spouse and the Decedent's descendants.

Restrictions can be placed on distributions from the Family Trust to the surviving spouse. For example, the Trustee may be required to consider the resources available to the surviving spouse outside of the Family Trust prior to making a distribution of income or principal to the surviving spouse, or the Trustee may be directed simply to hold and maintain the family home for the surviving spouse's lifetime without making any distributions to the surviving spouse. Furthermore, additional conditions can be added to the Family Trust. One common condition in blended families is that the Family Trust is for the benefit of the surviving spouse while the surviving spouse is unmarried; however, upon the re-marriage of the surviving spouse, the Family Trust terminates with the remainder passing to the descendants of the Decedent.

Upon the death of the surviving spouse, the remaining trust estate of the Family Trust will pass to the beneficiaries named by the Decedent, unless the Decedent grants the surviving spouse the power to change where the trust estate goes (e.g., via a testamentary power of appointment). Generally, the assets of the Family Trust are not included in the surviving spouse's estate; accordingly, the assets do not generally receive a basis adjustment for federal income tax purposes.

Marital Trust

A Marital Trust will generally receive an amount of the Decedent's property that would otherwise be subject to estate taxes at the Decedent's death if left to a non-spouse beneficiary. Essentially, the Marital Trust defers estate taxes until the death of the surviving spouse, provides the surviving spouse with some creditor protection, and locks in the Decedent's beneficiaries upon the death of the surviving spouse.

The property in the Marital Trust is under the control of the Trustee which may be the surviving spouse or, oftentimes in the case of blended families, a neutral third party such as a trust company. All income earned by the Marital Trust is paid over to the surviving spouse every year and the surviving spouse must have the power to direct the Trustee to convert non-income producing property into income producing property. Additionally, unlike the Family Trust, the surviving spouse is the sole beneficiary of the Marital Trust, and no conditions can be placed on the surviving spouse's ability to remain a beneficiary of the Marital Trust (i.e., a Marital Trust cannot provide that the surviving spouse ceases to be a beneficiary upon re-marriage).

Upon the death of the surviving spouse, estate taxes may be owed if the surviving spouse's estate, which includes the trust estate of the Marital Trust, exceeds the surviving spouse's remaining estate tax exemption. After the payment of taxes, the remaining trust estate of the Marital will pass to the beneficiaries named by the Decedent, unless the Decedent grants the surviving spouse the power to change where the trust estate goes (e.g., via a testamentary power of appointment). As the assets of the Marital Trust are included in the surviving spouse's estate, such assets will receive a basis adjustment for federal income tax purposes at the time of the surviving spouse's death.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.