- with Senior Company Executives and HR

- with readers working within the Accounting & Consultancy industries

The Corporate Transparency Act (the "CTA") takes effect on January 1, 2024, and imposes federal reporting requirements for certain legal entities, the people who beneficially own or control such entities, and the people who formed such entities. The new law is expected to apply to roughly 32 million entities in the United States that, until now, have not been subject to any governmental reporting requirements. Information is reported to the U.S. Department of the Treasury's Financial Crimes Enforcement Network ("FinCEN"), which will manage the database.

This article highlights key provisions of the CTA and specific requirements that may apply to people with interests in or substantial control over an entity that is formed or registered to do business in the United States.

Who reports?

The reporting requirements apply to Reporting Companies, Beneficial Owners, and Company Applicants.

- Reporting Company:

- Domestic Companies: any corporation, LLC, or other entity created by the filing of a document with the Secretary of State or similar office

- Foreign Companies: any corporation, LLC, or other entity created under the laws of another country that is registered to do business in the United States

| Covered* | Not covered* |

|---|---|

| Corporations | Sole proprietorships |

| LLCs | GPs |

| LPs | Trusts (but may still have to report as beneficial owners) |

| LLPs | Public or large operating companies |

| Business trusts | Tax-exempt entities |

| Pooled investment vehicles | |

| *This list is not exhaustive. The full list of exemptions is in 31 CFR 1010.380(c)(2). | |

- Beneficial Owner: A "Beneficial Owner" is defined as an individual who, directly or indirectly, (a) has substantial control over a Reporting Company, or (b) owns or controls 25% or more of the ownership interests of the Reporting Company. **

| Substantial control | 25% ownership | For trusts, this includes: |

|---|---|---|

| Serving as a senior officer | Total ownership interest in equity, capital, profit, options | Grantor or Settlor with right to revoke trust or withdraw assets |

| Authority to appoint or remove a senior officer or majority of board | Includes direct and indirect interests | Trustee or person holding authority to dispose of trust assets |

| Directing or making substantial decisions over important matters | Includes joint ownership of undivided interest | Beneficiary who is a sole permissible recipient of income and principal |

| Beneficiary who has right to demand distribution or withdraw substantially all assets from trust | ||

| **There are also exclusions to this, such as minor children, non-senior employees, and contingent beneficiaries of a trust, among others. The full list of exclusions is in 31 CFR 1010.380(d)(3). | ||

- Company Applicant: An individual who files the formation or registration documents for a Reporting Company. This includes both the person who actually filed the documents and the person who directed the filing. For example, this can include an employee of a law firm, an assistant, an agent, or a family member filing the document on behalf of someone else.

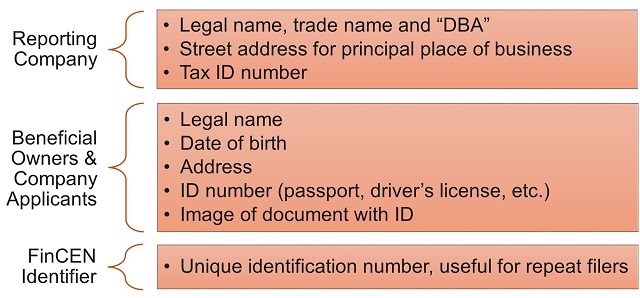

What information gets reported?

The following information must be reported to FinCEN:

When are reports due?

Reporting Companies in existence prior to January 1, 2024, have one year to file the initial report (i.e., by January 1, 2025). Reporting Companies created or registered on or after January 1, 2024, have 30 calendar days to file the initial report. After the initial report is filed, any changes or corrections must be reported within 30 calendar days. Otherwise, there is no other ongoing filing requirement.

| Event | Filing deadline |

|---|---|

| Companies formed before 1/1/2024 | 1/1/2025 |

| Companies formed or registered on or after 1/1/2024 | 30 days of formation or registration |

| Correct an inaccuracy | 30 days |

| Change of ownership | 30 days |

Where to report?

We expect FinCEN to issue a form of the report, which has yet to be released. At the moment, it is also unclear as to how and where reports are to be submitted, and we are awaiting guidance on this point.

What changes should I report?

As noted above, after the initial filing, you are obligated to correct inaccuracies and changes within 30 days. Some of the more common "trigger" events could range from a simple change of address, a change in senior management, or more commonly in the estate planning context, when someone has died and the business interests pass on to new beneficiaries. Note that when a tax-exempt entity loses its tax-exempt status, and therefore becomes a "reporting company," it has 180 days to file a report (instead of the usual 30). FinCEN has indicated that the dissolution or termination of a company does not in itself require an updated filing.

What are penalties for failure to report?

The CTA levies civil penalties of up to $500 per day capped at $10,000. In addition, criminal penalties may be applied in the form of up to a $10,000 fine, imprisonment of up to two years, or both. Whether penalties are imposed will be based upon the facts and circumstances of each case, but FinCEN has said they don't expect that an inadvertent mistake made after diligent efforts would result in a violation.

Who can access CTA information provided to FinCEN?

Given the amount of personal data that is being reported, privacy may be a big concern when filing reports. Any information reported to FinCEN can only be disclosed to a government agency, law enforcement, or financial institutions for compliance with anti-money laundering or other diligence obligations. There aren't any Freedom of Information Act (FOIA) requests available to make the reports available to the public.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.