- with Senior Company Executives and HR

- with readers working within the Advertising & Public Relations industries

Key Takeaways:

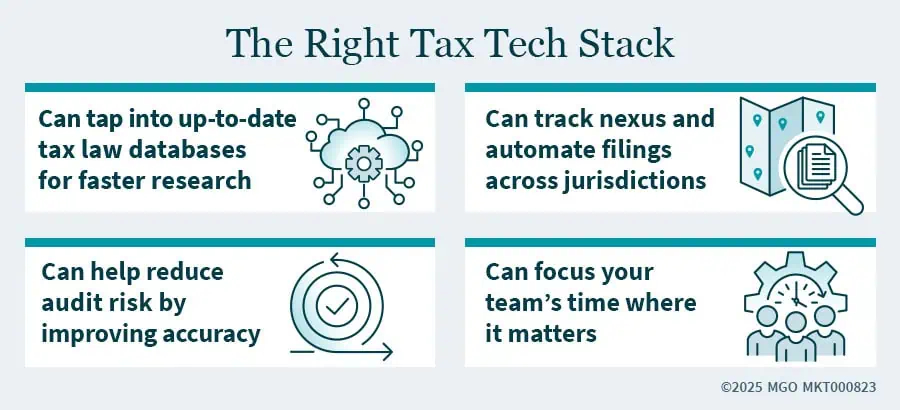

- Technology can streamline tax compliance by improving accuracy in tax filings and offering access to vast tax data libraries.

- Human judgment is still essential for applying complex state and local tax rules to specific facts and circumstances.

- The number of states where you have nexus should guide decisions about investing in tax compliance technology.

In the past few decades, managing multi-state compliance has become increasingly complex for corporate tax departments. Digital transactions and selling across state lines blur the boundaries of state nexus. With state and local tax authorities looking to bolster budget shortfalls by aggressively pursuing income, sales, use, and property tax collections, staying current on state and local tax (SALT) requirements is a critical, resource-intensive task.

Fortunately, technology plays a growing role in helping tax teams streamline compliance, reduce manual workloads, and respond to audit inquiries. Let's explore how you can leverage technology to navigate the complexities of multi-state tax compliance.

Technology Helps, But It Doesn't Replace Judgment

Many states now offer online forms and AI-generated guidance for sales and income tax filings. These resources make initial compliance steps more accessible, as do tax software platforms that automatically pull data from other platforms or business records to generate tax filings faster than ever.

However, these tools only go so far. The rules around nexus, apportionment, and taxability vary widely between jurisdictions, and determining whether a business has a filing obligation often depends on specific facts and circumstances.

These variations make automation most effective when paired with a strategic tax review — either internally or through external advisors.

For example, certain sales tax software might do a good job of staying on top of the applicable sales tax rates in a jurisdiction. But do you really need to file in that jurisdiction? Is the correct state rate being applied? Are there exemptions that allow you to avoid filing in that jurisdiction or at least reduce your tax liability? Technology may suggest a direction, but you should run any plan of action by an experienced and knowledgeable SALT professional who has deep technical knowledge and practical experience in SALT matters.

Automation Reduces Errors and Enhances Audit Readiness

One advantage of automation is its ability to reduce risk. During a state income tax audit, states may flag inconsistencies or question specific adjustments. Software that's programmed to apply state-specific modifications in state income tax — such as differences in depreciation, Section 179 expensing, R&D deductions, or exempt income — can help reduce the chance of errors or missed adjustments.

Some systems can also track reporting across multiple jurisdictions, which helps your tax team identify gaps before a state tax authority does. This reduces the risk of penalties or interest due to missed filings or incorrect returns.

State and local tax compliance audits are increasingly data-driven. Being able to produce clean, well-documented filings and supporting documentation is a major advantage during an audit.

Considerations When Investing in Tax Compliance and Research Software

Comprehensive data libraries and tax engines can be valuable tools for multi-state tax compliance. Platforms like CCH, Bloomberg Tax, and Avalara provide access to legislation, sales tax rate lookup tools, legislative updates, thresholds for economic nexus, checklists for federal and state tax matters, and tools for determining whether a product or service is taxable in a particular state.

However, keep in mind that features and functionality vary across platforms. Those with the most comprehensive features often come with a higher cost of implementation. Others may not have all the bells and whistles you want but can provide the functionality that many small and mid-sized companies struggle to maintain on their own.

The bottom line: These tools may support accurate reporting by making up-to-date content accessible and integrating with your accounting software to automatically flag transactions that trigger nexus or require additional reporting. However, unless you're a large company with a dedicated in-house tax team, we generally don't recommend handling state and local tax compliance in-house if you need to file income taxes and/or sales and use taxes in more than a handful of states. The complexity and administrative burden are just too high for small- to medium-sized businesses, and the work is best left to an outsourced tax team.

The Customization and Context Challenge

Despite advances in automation and artificial intelligence, context remains challenging. Databases and compliance engines provide broad access to rules and regulations but applying that information correctly still depends on the facts.

For example, AI may summarize sales tax thresholds or filing requirements, but determining whether a specific client engagement, product, distribution model, or software license creates nexus takes deeper analysis.

The tools are robust, but they aren't turnkey. You still need to layer the knowledge of your internal tax team or external tax advisors to translate automated outputs into confident decisions.

Building the Right Tech Stack for Your Business

Before investing in new technology, assess:

- How many states your company has nexus in

- The type of taxes you're managing (e.g., income, sales and use, excise, franchise, property, etc.)

- Current pain points in the reporting process

- Available budget for licensing and implementation

- Your potential return on investment

You may not need access to an extensive tax research database or an all-in-one tax engine. Have a candid conversation with your tax department or a qualified SALT advisor to identify gaps and select tools that align with your risk tolerance, complexity, and resource constraints.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.