- in United States

- with readers working within the Accounting & Consultancy and Construction & Engineering industries

- within Criminal Law, Technology and Family and Matrimonial topic(s)

Key Takeaways:

- Beginning in 2025, domestic R&D expenses under Section 174 will once again be immediately deductible, offering potential cash flow benefits.

- Companies that previously amortized R&D costs may be able to file Form 3115 and adjust past filings to recapture deductions.

- With IRS scrutiny rising and state tax rules varying, proactive planning and clear documentation are critical to maximizing benefits and minimizing risk.

The return of immediate research and development (R&D) expenses under Section 174 is one of the most consequential shifts in the 2025 tax landscape — yet many mid-market companies have not updated their plans to reflect the change. From documentation of risk to transition-year amendments, these are the most common questions we're hearing from finance and tax leaders:

What exactly is changing with Section 174 in 2025?

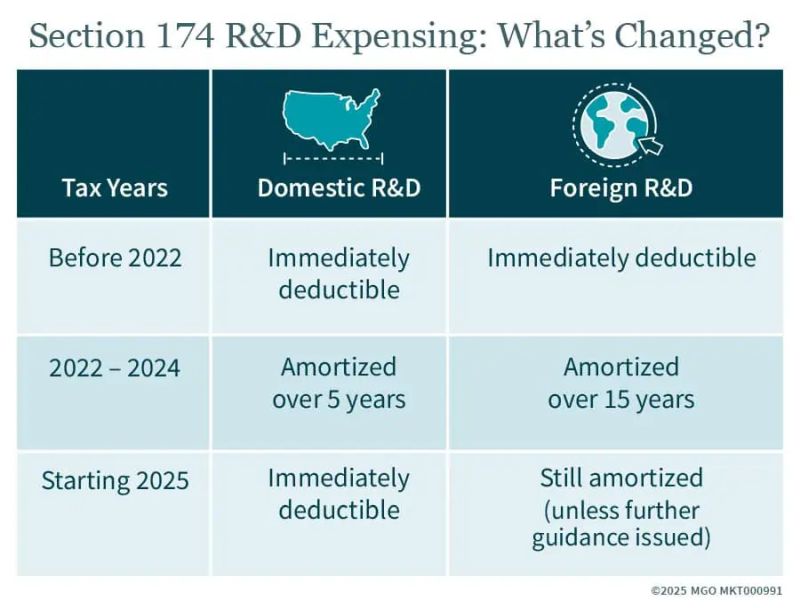

Beginning in tax year 2025, domestic R&D expenditures will once again be immediately deductible in the year incurred. This change reverses the five-year amortization requirement introduced under the Tax Cuts and Jobs Act (TCJA). However, current IRS guidance shows that amortization will still apply to certain foreign R&D expenses unless more legislative or regulatory relief is provided. Businesses should evaluate both domestic and international R&D classifications in preparation for the shift.

Will this improve our 2025 cash flow position?

It may — provided the new expensing rules are properly integrated into your financial and tax forecasting. Immediate expensing of domestic R&D reduces taxable income in the same year the costs are incurred, lowering overall tax liability. Companies that have not yet adjusted their estimated tax payments or quarterly modeling may be overstating liabilities and missing near-term cash flow efficiencies.

Can we amend our 2022–2024 returns based on this update?

In some cases, yes. Companies that previously amortized Section 174 expenses may be eligible to file Form 3115 to change their accounting method and apply a Section 481(a) adjustment. This could allow for partial or full deduction of deferred R&D costs in 2025. However, the benefits and eligibility vary depending on your current method, the types of R&D involved (domestic versus foreign), and whether returns were previously extended, filed, or audited. A review of your filing history and applicable IRS guidance is necessary before proceeding.

Currently, there is uncertainty as to whether Form 3115 will be required to change the method from capitalization to expensing of these costs. The IRS needs to provide guidance in this area and whether or not small businesses that have average annual gross receipts of under $31 million that have not filed their 2024 tax return yet will need to capitalize their R&D costs on the 2024 tax return and then file an amended return to expense these costs.

Should we still separate costs that qualify for the R&D tax credit?

Yes — and this distinction is critical. While Section 174 requires capitalization (or expensing, beginning in 2025) of all R&D costs, the R&D tax credit under Section 41 applies to a narrower subset of those costs. Documentation should clearly delineate which expenditures qualify for credit versus which are deducted under Section 174. Maintaining separate records supports credit claims and mitigates examination risk.

Will this affect our state tax filings?

It may. Some states conform to federal Section 174 treatment automatically, while others decouple and apply their own rules. This can create differences in how R&D is deducted at the state level. For companies working in multiple states, it's important to review each jurisdiction's treatment of R&D expenses and track how decoupling may affect apportionment, deductions, and compliance requirements.

What are CFOs and tax leads overlooking most frequently?

In our recent tax reform webinar polling, we asked CFOs and tax leaders how Section 174 has impacted their company's R&D and tax planning. Their responses:

- 17% said Section 174 changes had a significant impact

- 24% said they made some adjustments

- Over 50% indicated the impact was minimal or unclear

This suggests a gap between policy changes and planning execution. Many companies have not yet updated forecasts or examined whether transition-year filings could improve cash position. As a result, opportunities to unlock deductions or perfect quarterly payments may be unrealized.

What actions should we be taking now?

Section 174 expensing should be addressed proactively during 2024 planning and Q3-Q4 reviews. Start by reviewing how R&D is treated in your current financial models and incorporate the updated expense rules into your 2025–2026 forecasts. If you amortized expenses in prior years, evaluate whether filing a method change (Form 3115) could allow you to recapture deductions, depending on what guidance is issued by the IRS from a procedural standpoint.

It's also essential to keep clear and contemporaneous documentation — especially if you're claiming R&D credit or have international R&D exposure. The IRS has increased scrutiny around improper claims and substantiation. Additionally, continue checking IRS guidance related to foreign R&D and coordinate any tax position changes with your broader strategy and compliance obligations.

Strategic Considerations

Section 174 expensing brings welcome relief for businesses investing in innovation, but it also introduces complexity — especially for companies with multi-year R&D planning or global footprints. By updating forecasts, assessing historical filings, and aligning documentation now, CFOs and tax leaders can better prepare for the 2025 transition and minimize risk. Early action supports stronger compliance, cash management, and credit positioning in an evolving regulatory environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.