- with Finance and Tax Executives

- with readers working within the Accounting & Consultancy industries

Key Takeaways:

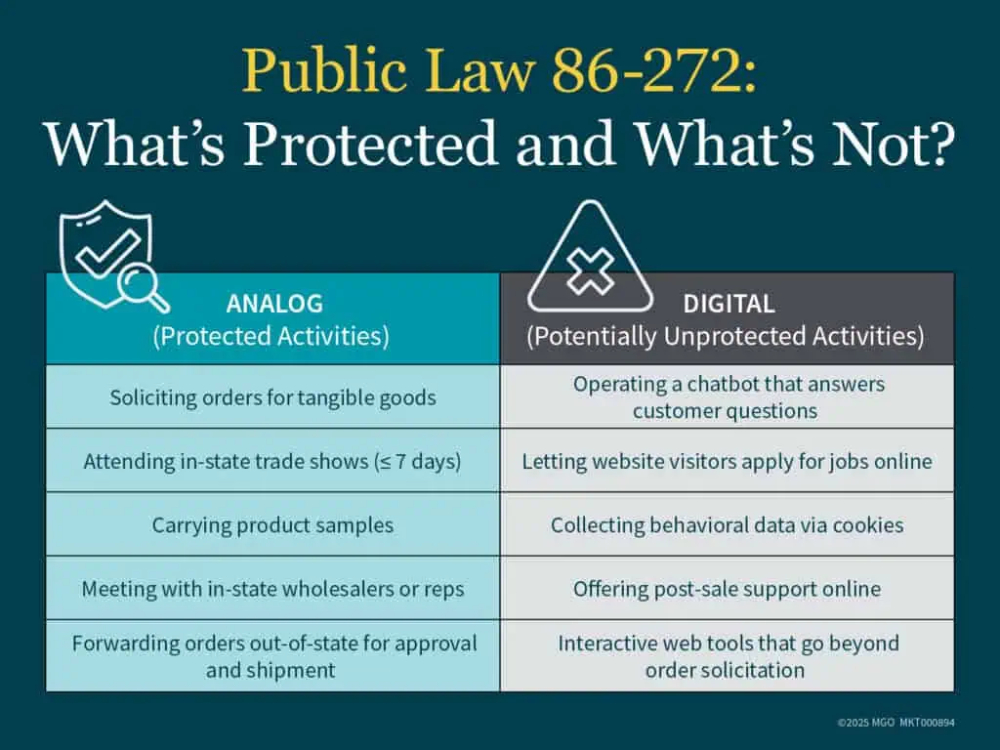

- For decades, P.L. 86-272 protected activities like door-to-door sales and attending trade shows from taxation outside a company's home state.

- With more business conducted online, states want to expand the list of unprotected activities to include offering digital tools like chatbots and online portals.

- Legal challenges are slowing down new regulations, but we expect enforcement efforts to continue to evolve.

Public Law 86-272 (P.L. 86-272) has played a defining role in shaping the boundaries of state income taxation since its passage in 1959. This federal statute prohibits U.S. states from imposing a net income tax on businesses with in-state activities limited strictly to the solicitation of orders for sales of tangible personal property, provided those orders are sent outside the state for approval and fulfillment.

Historically, this law shielded out-of-state sellers with minimal physical presence in other states from income tax obligations. A classic example is a door-to-door salesperson who travels into a state to solicit orders but does not maintain an office, inventory, or engage in other business operations locally.

Over time, the Multistate Tax Commission (MTC) published a widely-referenced list of protected activities — which included limited engagements such as attending trade shows for fewer than seven days or carrying product samples without taking orders on the spot.

However, commerce has evolved since the 1950s. Business models today often blur the lines between physical presence and digital engagement. And in this increasingly digital marketplace, states are re-evaluating what it means to "solicit orders" and what activities should fall outside the protections of P.L. 86-272.

Online Activities and Expanding Interpretations

Modern business interactions rarely resemble the sales strategies in place when P.L. 86-272 was enacted. E-commerce sites allow for real-time order processing, customer service through chatbots, product recommendations powered by algorithms, and interactive tools that go far beyond simple solicitation. Recognizing these changes, tax authorities have begun to update their interpretations of unprotected activities to include many actions a company can perform digitally without a single employee stepping foot in the state.

In 2021, the MTC approved revisions to P.L. 86-272 — including a new section on activities conducted via the internet. This section states:

"As a general rule, when a business interacts with a customer via the business's website or app, the business engages in a business activity within the customer's state."

It also provided eight examples of internet-based activities that, if not de minimis, are unprotected. Some examples include using chatbots to provide post-sale assistance, placing "cookies" on customers' computers, and allowing users to submit credit card applications or job applications through the website.

A few states have indicated they will follow the 2021 statement but have not yet issued updated state regulations. Only a few states have issued formal guidance on unprotected internet activities.

However, these interpretations are controversial. Taxpayers and business advocacy groups argue that states are stretching P.L. 86-272 beyond its original scope. States, on the other hand, maintain that the law must adapt to reflect a marketplace that no longer relies on door-to-door sales or mailed catalogs.

A Patchwork of State Responses

States are moving forward at different paces. Several efforts to formally incorporate expanded definitions of unprotected internet activities into regulation or statute have encountered legal and procedural obstacles.

For example, New York finalized its regulations, which broadly interpreted unprotected digital activities in December 2023. These regulations were quickly challenged in court. Recently, a New York lower court upheld the validity of the regulations while limiting its enforcement to the period following their publication in December 2023.

In California, enforcement of the Franchise Tax Board's revised interpretation of PL 86-272 stalled following a lawsuit challenging the state's guidance on procedural grounds. The state is expected to rework and reintroduce the effort in response.

When New Jersey introduced proposed regulations incorporating parts of the MTC's new guidelines on how PL 86-272 should apply to modern forms of business and customer interactions, opposition quickly followed. The same organization challenging California's efforts issued a public statement objecting to New Jersey's proposal and indicated litigation would follow if the rules were finalized. On June 16, 2025, New Jersey finalized its regulations despite the public comments in opposition.

Clearly, there is tension between evolving interpretations and longstanding statutory protections. The outcome of these legal battles could shape state tax enforcement policies for years to come.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.