Executive Summary

Despite adding personnel and making a concerted effort to speed up the advance pricing agreement process, the Advance Pricing and Mutual Agreement Program (APMA) faces challenges with the mounting demand. Our International Tax Group breaks down the hurdles for APMA and identifies important trends companies negotiating APAs should keep in mind.

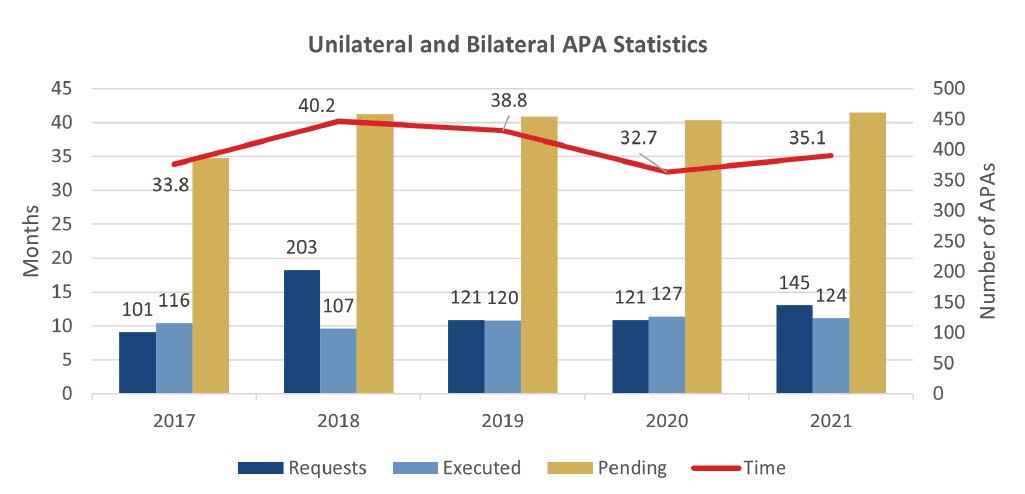

- APMA staff increased 21% last year, but median completion time for an APA increased to 35 months (up from 33 months in 2020)

- APMA would need more than three years to work through its existing inventory of bilateral APAs at its current processing rate

- The mountain of work keeps growing: more APA applications, but fewer APAs executed

issued its Announcement and Report Concerning Advance Pricing Agreements (APA Report), which presents the key results of the IRS's Advance Pricing and Mutual Agreement Program (APMA). The APA Report provides general information about the operation of the program, including staffing, and statistical information about the numbers of APA applications received and resolved during the year, including countries involved, demographics of companies involved, industries covered, and transfer pricing methods (TPMs) employed.

Much of the data in the APA Report represents a snapshot in time, and similar to prior years, the APA Report does not provide data for categories involving fewer than three APAs. Despite these caveats, we can identify important trends based on such data and our experience advising companies pursuing and executing APAs. First, in another challenging and unusual year, APMA performed moderately well compared with prior years. Positively, APMA staffing increased approximately 21% from 2020. However, it appears that the APMA workload continues to grow at a pace that may be outstripping resources and APMA's ability to resolve APAs, as shown by the delta between APA applications filed and APAs executed and by the elevated number of pending APAs.

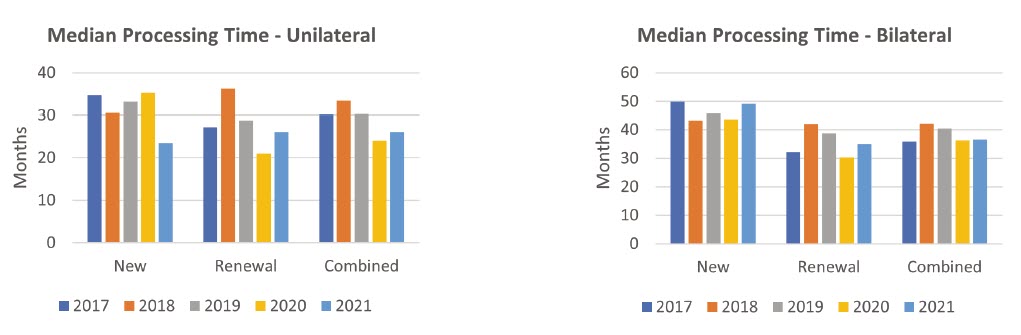

Second, the overall time to obtain an APA remained lengthy in 2021 despite the increased staffing, with the median time to complete unilateral and bilateral APAs up slightly at approximately 35 months in 2021 compared with approximately 33 months in 2020. However, the median time remains historically lower than the median of approximately 40 months in 2018 and 39 months in 2019. A continued favorable trajectory should help APMA to work through the backlog of pending APAs and reduce processing times.

Third, as companies navigate negotiating APAs with terms covering years impacted by COVID-19, supply chain issues, sanctions, and other unexpected events, our experience continues to indicate that companies with robust proposed TPMs that effectively address arm's-length returns for nonroutine intangibles and COVID-19 should see their APAs progress more efficiently than APAs with proposed TPMs that arguably require significant modifications. Although not discussed in the APA Report, APMA has indicated that addressing the impact of COVID-19 and supply chain issues on an APA requires careful analysis of each company's situation and that there is not a one-size-fits-all approach. APMA has indicated that taxpayers will have to do more than cite general economic trends to justify results that deviate from the terms of the relevant APAs. In public comments, former APMA director John Hughes stated that APMA and its foreign counterparts have generally succeeded in finding mutually agreeable solutions to COVID-related issues that have arisen in APAs when the circumstances of a particular taxpayer warrant relief.

APMA Operations and Staffing

Demand for APAs continued to grow in 2021, and APMA's headcount did as well. APMA's staffing resources increased more than 21% in 2021. The total number of APMA employees increased from 97 professionals at the end of 2020 to 117 professionals at the end of 2021. At the end of 2021, APMA had 80 team leaders (increased from 64 at the end of 2020), 25 economists (increased from 21 at the end of 2010), 9 managers (unchanged from 2020), and 3 assistant directors (unchanged from 2020). Each assistant director oversees three managers who lead teams composed of both team leaders and economists.

Rev. Proc. 2015-41 continues to serve as the main source of IRS guidance on the APA process. APMA is currently considering guidance updating Rev. Proc. 2015-41, and this is one of the items on the 2021-2022 Priority Guidance Plan. On November 10, 2021, the IRS requested comments on Rev. Proc. 2015-41, which were due on January 10, 2022. The IRS specifically requested comments relating to: (1) whether the collection of information is necessary for the proper performance of the functions of the IRS; (2) the accuracy of the IRS's estimate of the burden of the collection of information; (3) ways to enhance the quality, utility, and clarity of the information to be collected; (4) ways to minimize the burden of the collection of information on taxpayers, including through the use of automated collection techniques or other forms of information technology; and (5) estimates of capital or startup costs and costs of operation, maintenance, and purchase of services to provide information.

APA Demand and Output

Increased processing time and pending APAs

Despite the increase in APMA staffing, the median time required to complete an APA increased to approximately 35 months in 2021 (up from approximately 33 months in 2020). This increase was largely driven by the approximately five-month increase in median processing times for renewal unilateral and bilateral APAs. It is disappointing to note that, after three years of progress in reducing processing times for renewal bilateral APAs from approximately 42 months to 30 months, renewal bilateral APAs executed in 2021 required 35 months, a 17% increase. Of course, because the data reflects a snapshot in time of cases resolved during 2021, the increase may be due to the resolution of older cases, and 2022 may show improvement. Nevertheless, combined with the increased pending bilateral APA inventory, APMA has challenges to address.

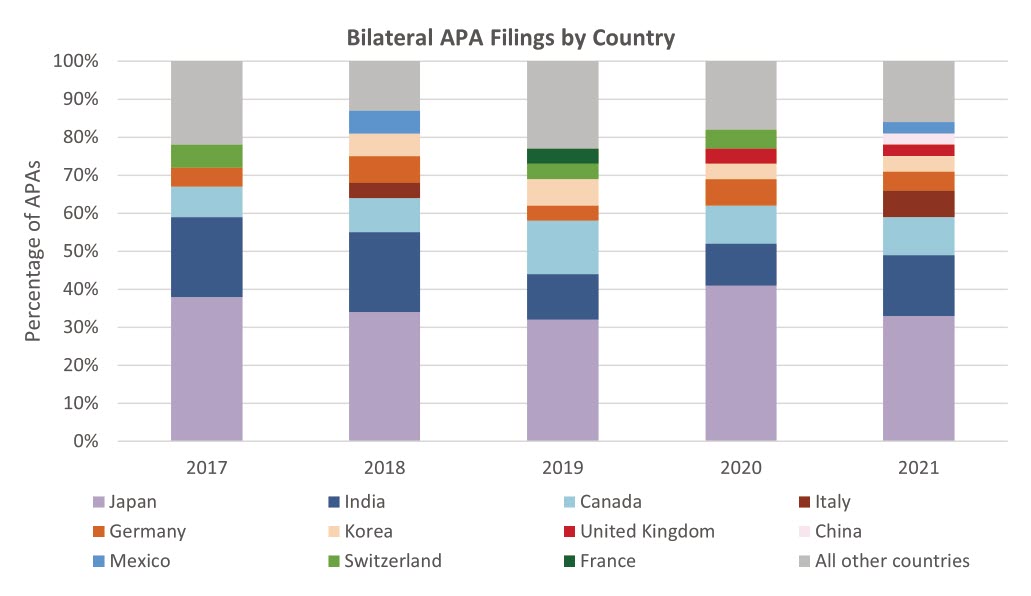

The number of pending APAs also increased from 2020 to 2021. At the end of 2021, 461 APA requests were pending (39 unilateral, 395 bilateral, and 27 multilateral), up from 448 at the end of 2020 (43 unilateral, 348 bilateral, and 21 multilateral). As in past years, the number of pending bilateral APAs continues to trend upward to historic highs – APMA would need more than three years to work through its existing inventory at its current processing rate. Pending multilateral APAs also increased by more than 28% from 2020. An open question is whether investments in APMA's resources will alleviate obstacles in processing bilateral APAs and working down its pending bilateral APA inventory. Japan (25%), India (22%), and Canada (11%) constituted the majority of the pending bilateral APAs, consistent with past years. On a positive note, APMA has successfully decreased its inventory of pending unilateral APAs to its lowest number in the program's recent history.

Increased number of new applications

In 2021, 145 APA applications were filed, an increase of 20% from 2020. This was the highest number of APA applications filed since at least 2010 in any year in which impending filing fee increases did not influence demand (impending fee increases influenced filings in 2010, 2015, and 2018). Natural demand for APAs continues to grow.

The country-by-country breakdown of bilateral filings remained fairly consistent, with the exception of a marked increase in the number of applications involving Italy. In line with previous years, the number of bilateral filings involving Japan, India, and Canada represented 59% of all bilateral filings in 2021. Bilateral filings involving Italy represented 7% of all bilateral filings in 2021, while Italy was not specifically represented in the country-by-country breakdown in 2019 or 2020.

Decreased number of APAs executed

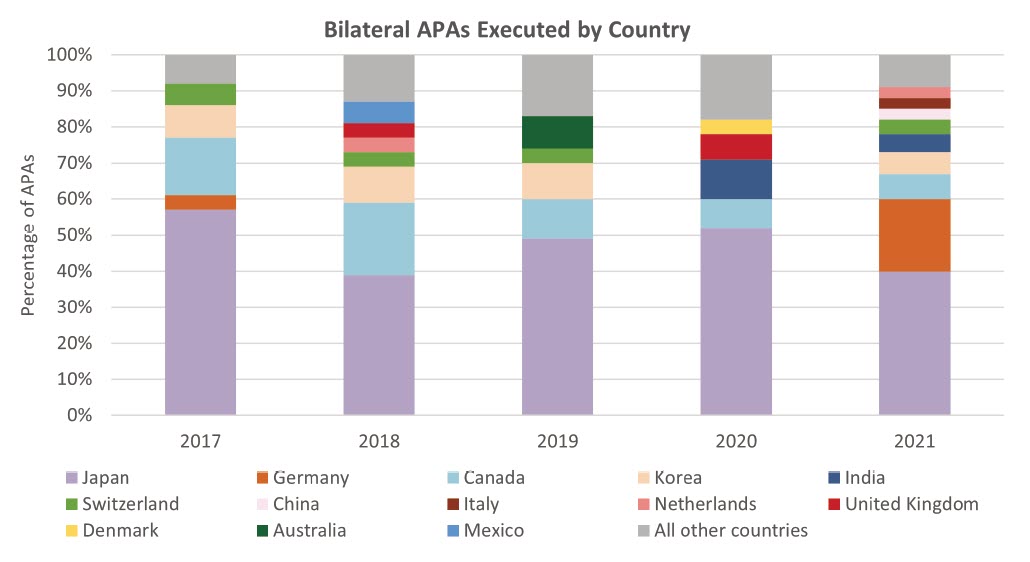

The IRS executed fewer APAs in 2021 than in 2020 (124 compared with 127). The percentage of executed APAs that were renewals increased slightly (63% in 2021 and 59% in 2020). There was also a slight decrease in the percentage of executed APAs that were bilateral (79% in 2021 and 83% in 2020).

As in past years, the APA Report indicates that U.S.-Japan bilateral APAs continued to constitute the largest percentage of overall APAs that the program processed (40%), followed by Germany (20%), Canada (7%), Korea (6%), India (5%), Switzerland (4%), China (3%), Italy (3%), and the Netherlands (3%). The large number of bilateral APAs executed involving Japan can be attributed to the long history of the APA programs in the United States and Japan. The number of bilateral APAs executed involving India fell dramatically from 2020, when bilateral U.S.-India APAs represented 11% of the bilateral APAs executed. This appears to be due, in part, to the complicated relationship and disagreements between the competent authorities of the U.S. and India. Notably, the number of executed bilateral APAs involving Germany increased significantly in 2021 to approximately 20 – the number of bilateral APAs executed between the U.S. and Germany had not been material enough to be shown in the APA Reports since 2017.

In terms of geographic diversity, APMA's execution of a reportable number of APAs with a larger number of tax authorities from other countries signals that APMA appears to be developing more substantial and regular APA discussions and negotiations with a broader range of countries, which should be a positive development for the overall APA process and companies desiring to resolve transfer pricing issues through APAs.

Withdrawn APA requests

The number of APA applications withdrawn in 2021 decreased from seven in 2020 to six in 2021. For the tenth consecutive year, no APAs were revoked or canceled in 2021.

U.S. vs. non-U.S. parent companies

Similar to past years, the majority of APAs involved non-U.S. parent companies: 61% of the executed APAs for 2021 were for non-U.S. parent companies and their U.S. subsidiaries, while 25% involved U.S. parent companies and their non-U.S. subsidiaries and 14% involved sister companies. The ongoing appeal of the APMA program to non-U.S. parent companies, particularly Japanese parent companies, could be due to, among other things, the IRS's continued focus on transfer pricing involving non-U.S. parent companies, non-U.S. parent companies' desire for transfer pricing certainty, or an increase in audit activity in other countries for which resolution through a bilateral APA with the United States may be preferred.

Industries represented

Most of the APAs executed in 2021 involved the wholesale/retail trade (38%) and manufacturing (37%) industries. The other industries specifically identified in the APA Report were services (17%), management (8%), and finance, insurance, and real estate (4%). Within the wholesale/trade industry, a majority of the APAs executed involved merchant wholesalers of durable goods (62%); merchant wholesalers of nondurable goods (19%) and motor vehicles and parts dealers (8%) were also represented. Within the manufacturing industry, the largest proportion of APAs executed involved transportation equipment (37%); chemical (22%), computer and electronic products (11%), and machinery (6%) were also represented. To some extent, the year-over-year industry breakdown is random, providing a snapshot of a particular 12-month period, and many factors can impact the resolution timing for specific cases.

TPMs applied

For 2021, the comparable profits method/transactional net margin method (CPM/TNMM) continued to be the most commonly applied TPM for tangible and intangible property transactions (applied to 85% of such transactions). Of the profit level indicators (PLI) used when the CPM/TNMM is employed, the operating margin (defined as operating profit divided by net sales) was applied 65% of the time. Similar to past years, the CPM/TNMM was applied in 90% of the APAs with intercompany service transactions, and the most commonly selected PLI with the CPM/TNMM was the operating margin, used 56% of the time. Based on our experience, increased focus by APMA and other tax authorities on nonroutine intangibles, including marketing intangibles, may lead to a shift in the types of TPMs going forward.

APA terms

Rev. Proc. 2015-41 instructs taxpayers to request a term of at least five prospective years, and taxpayers may also request that the APA be "rolled back" to cover one or more earlier taxable years. APA term lengths, including rollback years, averaged six years in 2021, unchanged from 2020. The largest number of APAs were executed with five-year terms (59%), and 91% had terms of five or more years. In 2021, the longest APA term was 15 years (only one APA had a 15-year term), compared with 14 years in 2020. A substantial number of the APAs with terms of greater than five years were submitted as a request for a five-year term, and the additional years were agreed to between the taxpayer and the IRS (or between the IRS and the foreign government, upon the taxpayer's request, in the case of a bilateral APA) to ensure a reasonable amount of prospectivity in the APA term. Interestingly, of the APAs executed in 2021, 22% included rollback years, compared with only 11% of the APAs executed in 2020. Companies with APA terms spanning years before and after the effective date of the Tax Cuts and Jobs Act of 2017 should take into account any implications from APMA's announcement, "Implementation of Competent Authority Resolutions," which addresses "telescoping" and other related topics.

FX adjustments

APMA does not have a set policy for adjustments to company financials to account for currency fluctuations. As in past years, the APA Report notes that "[i]n appropriate cases, APAs may provide specific approaches for dealing with risks, including currency risk, such as adjustment mechanisms and/or critical assumptions." Over the years of the APA program, FX-adjustment mechanisms have been proposed by companies and by governments, and when the fluctuations are extreme, or when a currency has weakened significantly, this can be taken into account when shaping a bilateral APA.

Observations and Conclusions

While APMA staffing levels increased again in 2021, taxpayer demand for APAs is outpacing APMA's ability to work through the historic inventory of pending APAs. APMA has its work cut out for it given the sheer number of new APA applications and pending APAs, challenges related to addressing issues such as COVID-19 and supply chain implications for transfer pricing, tax law changes, and the need to navigate relationships with treaty partners. Additionally, looming on the horizon are potential complications relating to BEPS Pillars One and Two. On top of these challenges, the leadership transition with the departure of John Hughes will likely divert resources from APMA's normal workload.

Despite these numerous challenges, APMA continues to work to reach resolution on APAs. While the process for entering into an APA with APMA is by no means quick and easy, company demand for APAs continues to be strong given the many benefits that an APA offers. Based upon our experience advising companies on APAs since the beginning of the IRS's APA program, the critical role that APAs play in achieving principled, effective, and efficient tax administration concerning transfer pricing issues warrants additional investments by the IRS.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.