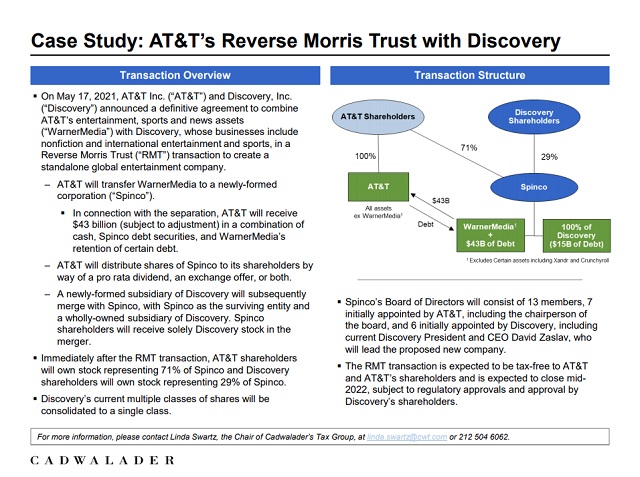

Earlier this week, AT&T and Discovery announced the proposed $43 billion merger of WarnerMedia with Discovery through a Reverse Morris Trust transaction, in what is the largest deal of 2021 thus far. Read the Cadwalader Tax Team's case study here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.