- within Finance and Banking topic(s)

- with readers working within the Securities & Investment industries

The Securities and Exchange Commission (the SEC) has proposed rules requiring climate-related disclosure in the registration statements and periodic reports of public companies that would, if enacted in their current form, create significant new disclosure requirements for all public companies. The Enhancement and Standardization of Climate-Related Disclosures for Investors (the Proposed Rule),1 released last week, provides an update to the SEC's most recent climate guidance, issued in 2010, proposes amendments to Regulations S-K and S-X and makes related revisions to Forms 10-K and 10-Q, Forms 20-F and 6-K and to registration statements filed under the Securities Act of 1933. The Proposed Rule, according to SEC Chair Gary Gensler, is "driven by the needs of investors and issuers" seeking information about climate risks in order to make informed investment decisions.2 Although many public companies already disclose some climate information, the form and content of that disclosure varies widely by company and by industry. Additionally, key parameters used to analyze climate risk, such as methodologies, data sources, and assumptions, frequently are not disclosed, making it impractical if not impossible to compare one company's disclosure to another. Further, climate information is often disclosed separately from a company's financial disclosures included in its periodic SEC filings. Such climate information is found instead in Corporate Social Responsibility or ESG Reports or on company websites. The Proposed Rule is intended to enhance and standardize climate disclosure and offer "consistency, comparability, and reliability" needed to guide investment decisions. The SEC explained that the proposed disclosure requirements focus on risks and metrics that can have an impact on public companies' financial performance or position, and as such may be material to investors in making investment or voting decisions.

I. Proposed Rule

The Proposed Rule would require registrants to include specific, climate-related disclosure in their annual reports, registration statements, and financial statements. As drafted, this disclosure would include climate-related risks, actual or likely material impacts, and the management of such risks, as well as greenhouse gas (GHG) emissions data. The framework is largely based on the Task Force on Climate-Related Financial Disclosures (TCFD) and the Greenhouse Gas Protocol, both of which are widely endorsed and adopted by companies and governments around the world.

A proposed new Subpart 1500 of Regulation S-K3 will require narrative climate disclosures in a separate section of the annual report or registration statement, captioned "Climate-Related Disclosure," which may include relevant cross-references to other sections of the report containing such disclosure. Registrants will need to include this disclosure in addition to other climate-related disclosure, such as risk factors. New Article 14 of Regulation S-X4 would direct registrants to present quantitative climate disclosure, including financial statement metrics, in a note to the consolidated financial statements. As with any information included in the financial statements, climate information would also be subject to accounting principles and the registrant's annual audit.

The Proposed Rule would require the disclosure to include discussion of the following topics:

- Oversight and governance of climate-related risks by the registrant's board and management, including, a description of relevant committees and expertise, information about how climate risk is incorporated into strategy and operations, and goal-setting and measurement. The SEC did not add any additional requirements related to the connection between climate risk and compensation as it believes existing rules already require that disclosure.

- The registrant's process for identifying, assessing, and managing climate-related risks, and whether any such processes are integrated into the overall risk management system. Registrants would need to discuss these processes for both physical risks (i.e., having a direct impact on physical assets) and transition risks (i.e., having indirect impact as a result of the changes in the company and outside the company as it transitions to a low carbon footprint). If a registrant uses insurance or other financial products to manage its exposure to climate related risks, it may need to describe its use of these products if loss of coverage or an increase in premiums would be material.

- Any climate-related risks that have had or are reasonably likely to have a material impact on the company's business, including on its consolidated financial statements, products, suppliers, and research and development expenditures, over the short-, medium-, or long-term, and any impact these risks have on strategy, business model, and outlook. Registrants with exposure to flood and water stress must disclose the percentage of assets located in the relevant regions.

- Any actual impact of physical climate-related events, such as severe weather or natural events, and transition activities on the line items of the registrant's consolidated financial statements, as well as the related estimates and assumptions used in the financial statements.

- If the registrant has adopted a transition plan to manage climate-related risk, a description of the plan, including metrics and targets used. If the registrant uses scenario analysis or other tools to assess its resilience to climate-related risks, a description of the scenarios, parameters, and assumptions used and any projected financial impacts.

- If the registrant uses an internal carbon price, information about how the price is set.

- The registrant's GHG emissions, as discussed in more detail below.

- If the registrant has publicly set climate-related targets or

goals, information about the scope of the goals, including the

target, timeline for meeting the target, underlying activities and

emissions included in the target, and how the registrant intends to

meet the target.

- The registrant should include annual updates on progress made toward the target, including how progress was achieved and whether the registrant is on track to meet the intended target.

- If achievement of the target or goal involves the use of carbon offsets or renewable energy certificates (RECs), information about the offsets or RECs, including the amount of carbon reduction represented by the offsets or the amount of renewable energy generated.

Registrants also may choose to include information about climate-related opportunities when discussing the above topics. The Proposed Rule includes relevant detailed definitions, for example for "climate-related risks" and "GHG emissions," that are intended to be helpful in clarifying what is required and standardizing the approach to disclosure by public companies.

II. GHG Emissions Data

The Proposed Rule would require all registrants to disclose certain information about their GHG emissions, including from Scope 1, direct emissions from company-controlled operations, and Scope 2, indirect emissions from the purchase of energy used in operations. Registrants would need to identify their methodology for setting the organizational boundaries to categorize the GHG emissions. Scope 1 and Scope 2 emissions must be disclosed separately, with a breakdown of six specific constituent GHGs as well as total emissions, excluding any carbon offsets. Registrants would also be required to disclose GHG emissions intensity, or the emissions per unit of economic value or production. Registrants may use reasonable estimates and must disclose any gaps in the data used. Disclosure of Scope 1 and Scope 2 emissions would be subject to a phase-in period in fiscal years 2023 through 2025, depending on the type of filer. Accelerated and large accelerated filers would also be required to obtain an attestation report from an independent service provider covering at least Scopes 1 and 2 emissions disclosure and certifying the company's GHG emissions analysis. The level of assurance required in the attestation report is to be phased in-it may be limited (i.e., equivalent of an auditors review of quarterly financials or so called negative assurance) for the first two years after the first year the attestation report is required, with reasonable assurance (i.e., the level of assurance that auditors provide over the annual financials) required thereafter. The attestation report may be obtained from an independent auditing firm or any other independent expert in the field that meets certain specified requirements. The attestation must contain specified information about the certifier. Smaller reporting companies and non-accelerated filers are exempt from the attestation requirements.

A registrant also would be required to disclose Scope 3 emissions, which are all other indirect emissions upstream and downstream of its operations,5 if the emissions are material6 or if the registrant has set a GHG emissions reduction target that includes Scope 3 emissions. Scope 3 emissions should be disclosed in total emissions, excluding any offsets, and including emissions intensity.

The SEC recognized that calculation of Scope 3 emissions is more difficult than Scopes 1 and 2 because the operations and activities in question are outside of the control of the company. For example, the calculation may require utilizing various estimates or assumptions about the end use of the company's products, or obtaining emissions data from the company's suppliers which may not be possible to verify. Due to these challenges, the Proposed Rule includes a safe harbor from liability for Scope 3 emissions disclosure "unless it is shown to be made without a reasonable basis or was disclosed other than in good faith." The requirements would have a phase-in period of fiscal years 2024-2025, which is one year after disclosure would be required for Scopes 1 and 2. Additionally, smaller reporting companies would be exempt from reporting Scope 3 emissions.

III. Financial Statement Disclosures

The proposed amendments to Regulation S-X would require a new note to a company's financial statements disclosing any climate-related financial impacts, expenditures expensed or capitalized costs that, in the aggregate, result in impacts of 1% or more on any line item of a company's financial statements. Both physical and transition impacts, such as changes to revenues or costs, carrying amounts of assets, loss contingencies or reserves, cash flows, interest expense, and impairment charges, would need to be included for the most recently completed year and for any historical years that would otherwise be included in the company's consolidated financial statements. Physical impacts can include damages from severe weather events or other natural conditions, as well as expenditures to mitigate these risks, such as costs to increase the resilience of assets or operations, to relocate, retire or shorten the useful life of impacted assets or operations. Expenditures and costs for transition activities may include those "related to research and development of new technologies, purchase of assets, infrastructure, or products that are intended to reduce GHG emissions, increase energy efficiency, offset emissions (purchase of energy credits), or improve other resource efficiency." Companies would also be required to include a qualitative description of how financial estimates and assumptions were impacted by physical risks or transition activities, and they may choose to include impacts of any climate-related opportunities.

IV. Compliance Timeline

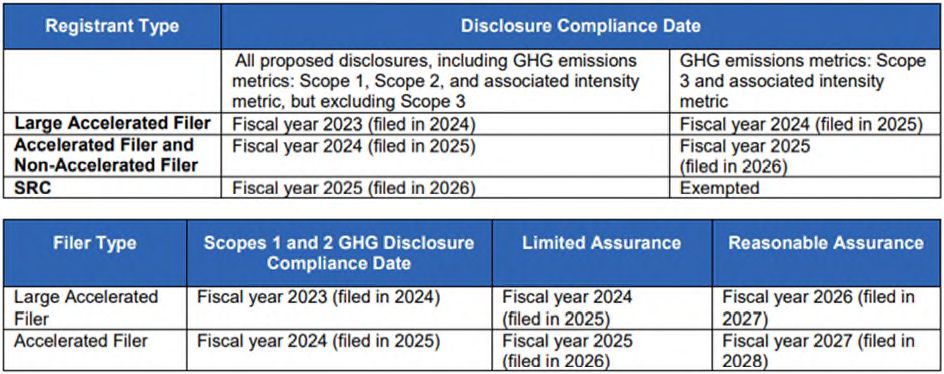

The SEC is currently soliciting comments from the public on over 200 specific requests included in the Proposed Rule. The public comment period will end May 20, 2022. If the Proposed Rule takes effect by the end of 2022, disclosure requirements would be phased in starting in fiscal year 2023 for the largest companies, per the following charts provided by the SEC in the proposing release:

7

7

V. Conclusion

The Proposed Rule aims to standardize the disclosure of climate-related information and to enhance the quality of disclosure by including information about the registrant's processes, assumptions and plans relating to climate risk, how the company intends to achieve those plans, and what progress the company has made toward that process. The SEC voted 3-to-1 to approve the Proposed Rule, with Commissioner Hester Peirce dissenting.9 Her dissent echoed many of the comments received by the SEC in opposition to the Proposed Rule, including that the current disclosure rules are adequate as they already require registrants to disclose climate information that is material, that the SEC is overstepping its authority by requiring registrants to take actions that are not directly related to financial matters, and that the new rules may be in violation of the First Amendment rights of registrants in that it requires them to make statements about matters not related to their financial position.

The Proposed Rule may change before being finalized, but standardized climate-related disclosure has strong support among stakeholders and across many sectors, and companies should be preparing to disclose more detailed climate-related information.

Footnotes

1. See Securities and Exchange Commission Release Nos. 33-11042; 34-94478 "The Enhancement and Standardization of Climate Related Disclosures for Investors" (https://www.sec.gov/rules/proposed/2022/33-11042.pdf). Unless otherwise specified, quoted statements in this memorandum are taken from this release.

2. https://www.sec.gov/news/press-release/2022-46

3. To be located at 17 CFR 17 CFR 229.1500 through 1506.

4. To be located at 17 CFR 210.14-01 and 14-02.

5. Scope 3 emissions include any GHG emissions indirectly caused by the operations or activities of the company other than purchased energy. This could include emissions from the manufacture of purchased goods or raw materials, contract manufacturing, the shipment of goods purchased or sold, or the usage of the company's products by its customers. For many companies, Scope 3 emissions represent a majority of the company's total emissions.

6. "A registrant would be required to disclose its Scope 3 emissions if there is a substantial likelihood that a reasonable investor would consider them important when making an investment or voting decision."

7. https://www.sec.gov/files/33-11042-fact-sheet.pdf

9. https://www.sec.gov/news/statement/peirce-climate-disclosure-20220321

To subscribe to Cahill Publications Click Here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.