- within Real Estate and Construction topic(s)

- within Real Estate and Construction, Wealth Management and Law Practice Management topic(s)

- in European Union

Summary

- RESILIENT DOMESTIC ECONOMY FORECAST TO GROW AT 3% IN 2025 WILL SUPPORT CONSTRUCTION RECOVERY.

- NEW COALITION GOVERNMENT EXPECTED TO CONTINUE INVESTMENT PROGRAMMES FOCUSED ON HOUSING CRISIS AND INFRASTRUCTURE SHORTFALL.

- EARLY TAX AND TRADE POLICY PURSUED BY THE US UNDER PRESIDENT TRUMP HIGHLIGHTS GROWING DOWNSIDE RISKS FOR GROWTH AND INVESTMENT.

- NATIONAL DEVELOPMENT PROGRAMME ACCELERATING IN 2025 WITH HOSPITAL AND HOUSING PROGRAMMES IN PROCUREMENT.

- URGENT ACTION ON HOUSING NEEDED TO DRIVE DEMAND AFTER A WEAK 2024.

- DOMESTIC INFLATION REMAINS UNDER CONTROL, BUT CONSTRUCTION IS EXPOSED TO RESOURCE SCARCITY RISK.

- BOOMING EUROPEAN DATA CENTRE MARKET AN ATTRACTIVE OPPORTUNITY FOR THE BRIGHTEST AND BEST OF IRISH CONSTRUCTION.

Introduction and market summary

2025 looks set to be a positive year for the Irish construction sector, with a strong domestic economy laying the foundations for an improved outlook. A potential 2-3% growth in domestic demand and fixed capital formation in 2025 is set to be much stronger than EU peers, providing the platform for construction activity to recover after a disappointing 2024.

However, forecasts have a higher than usual downside risk component related to trade, tariffs and competitive taxation regimes. The Irish economy is also exposed to an over-heating risk due to low levels of unemployment and a powerful fiscal stimulus. Construction's bright outlook might not be quite as sustainable as current forecasts suggest.

The construction economy has endured two disappointing years, with output in real-terms only returning to late 2022 levels in the fourth quarter of last year. Ireland's non-residential sector has seen greatest growth, whereas the country's fragmented housebuilding industry has struggled to respond to continuing high levels of demand. Completions of apartments fell by 15% last year.

By comparison with the wider eurozone, Ireland should benefit from a wide range of positive investment growth drivers in 2025. With the domestic economy in surplus, and a 1.8% population growth boosted by inward migration and a growing workforce, prospects are positive. In addition to wider market forces, the government is planning on expanding public spending by 6.9% in 2025 with the investment component increasingly focused on the housing crisis.

With inflation increasing in many markets, price movements in Ireland could trigger some policy challenges in 2025. The Consumer Prices Index (CPI) is forecast to remain within the European Central Bank's (ECB) 2% target, but unlike most of the eurozone, Ireland is exposed to significant resource constraints around workforce, housing and energy. With the ECB cutting rates sharply, Ireland's economy could accelerate unsustainably this year. The new government may need to act to keep the economy in balance. This might require some adjustment to the timing of capital investment programmes, directly affecting construction businesses.

Encouragingly, the election appears to have delivered an effective coalition, with the Regional Independent Group (RIG) joining Fianna Fail and Fine Gael in a tripartite government in late January 2025. The prospective parties share a commitment to generous social spending and action on housing, although RIG members are retaining the right to speak in opposition and are likely to focus on the local application of regional policies.

One factor that cannot be ignored is the inauguration of President Trump on 20th January 2025. The success of Ireland's economic model owes so much to its competitive position with the United States and Europe with respect to the business environment, trade and taxation. Ireland runs a very large surplus with the United States based on trading by US companies. Some of the measures proposed by President Trump associated with tariffs and corporation tax could have a very negative effect on this trading model.

As a minimum, uncertainty is likely to weigh down on Foreign Direct Investment flows in the immediate future. Windfall tax receipts associated for instance with historic tax liabilities could cushion the blow in the medium term. The early learnings of the second Trump administration is that policy announcements are made with no warning and little background information – countries across the world, including Ireland, are going to have to get used to reacting quickly to a fast-moving policy landscape.

Construction market overview

Whilst the outlook for the construction sector is improving after an uncertain 12 months, the recovery has been slower than anticipated, finally seeing growth in Q3 2024 after markets had remained flat for 18 months, according to Central Statistics Office (CSO) GDP data. A weak residential sector has clearly held back the pace of recovery although output indices highlight expansion in the non-residential and civil engineering sectors from the first quarter onwards. With residential expected to do better in 2025 on the back of lower borrowing rates and real wage growth, the stage is set for a construction recovery.

Output in 2024 in current prices is likely to reach €13bn for the first time but in real terms activity levels remain 2.5% below pre-pandemic levels. There is no sign so far of a data centre or housing development goldrush.

Industry sentiment is mixed. The most recent Construction Industry Federation (CIF) survey points to growing confidence with respect to growth in workload and employment. However, the latest AIB Ireland Purchasing Managers' Index (PMI) for January 2025 scored 48.2, a return to contraction after a brief rebound at the end of 2024. These data points suggest that it is too early to confirm that a recovery is fully established.

As highlighted in the introduction, the non-residential building sector did well in 2024, supported largely by publicly-funded schemes. The national development programme is expected to accelerate in 2025, with major new investments in housing and hospitals and infrastructure totalling €2-3bn proceeding to site in 2025.

On top of the public sector boost, the residential sector is likely to be the big swing factor for construction activity – absorbing critical manpower – particularly in Dublin and surrounding counties. With house price inflation running at 10% pa, and a fall in completions in 2024, 2025 should be a better year. There are plenty of new homes in the pipeline due to the effect of commencement incentives, leading some forecasts to predict a 14% increase in completions in 2025 to 32,500.

A current 20,000 shortfall in completions points to a clear need for housing, although the next development cycle is likely to be very unpredictable. Even though increased demand should be stoked by government funding, chronic delays in planning and the house building sector's capacity constraint mean that production might not respond as quickly as hoped. Clearly there is a lot riding on the success of the 2024 Planning and Development Act, but bedding in a well-resourced, plan-led and fit for purpose planning system will take time.

Interestingly, growing developer interest in Build to Rent (BtR) could provide both welcome workload to the main contractor supply chain and also take some pressure off Ireland's SME-dominated house building sector.

By comparison with the residential sector, commercial development – with the exception of data centres – is exposed to short-term oversupply and weak levels of take-up. Logistics saw the lowest take up in a decade in 2024, but an increasingly tight market for Grade A distribution space points to a brighter construction market in 2025.

The challenge for office development is more acute given the availability of four year's supply of high-quality second-hand 'grey space' with ESG credentials. Currently, there are no developments in key city markets scheduled to be delivered after 2026 and it is likely to take 1-2 years for new schemes to come forward.

Data centres (DCs) could also be an additive demand driver in 2025, albeit that the Irish construction industry does most of its data centre work in mainland Europe. Like many mature locations, Ireland has huge DC development potential which is constrained by power grid and generating capacity. DC related energy consumption was forecast to reach over 20% of the total supply in 2024, which has resulted in an embargo on connections for Large Energy Users (LEUs) in locations with constrained supply capacity.

In a pragmatic move, The Commission for Regulation of Utilities (CRU) has developed new connection criteria which include the provision of on-site dispatchable power and/ or storage or alternatively, the ability of a DC to reduce consumption on request. These criteria will contribute to releasing some grid capacity, but this also means that DC development in Ireland will likely remain constrained at an annual €1-2 bn rolling investment, including equipment.

Despite this move, there remains a risk that AI could be directed to EU markets with a more resilient energy supply. Should this occur, Irish contractors are likely to be well-placed to secure a share of this work as a result of their strategic development of relationships and skills.

Construction forecast

Workload

We anticipate a 5% increase in new build output in 2025. This will be driven by demand for housing, including a 10% increase in house completions in 2025 and a significant increase in government investment. There is potential for further growth as the national development public programme picks up

Workforce

The construction workforce has been stable, as workload in Ireland stalled during 2023 and 2024. Employment recovered to 160,000 in early 2021 and has fluctuated in a +/- 3% range since. The latest data points to a further uptick in the labour force in the third quarter 2024

Contractor availability

Contractor availability is currently good, with clients in Ireland being able to secure a reasonable level of interest in projects. Market conditions are presently competitive, delivering projects that are aligned to estimates. Pricing levels are not so competitive as to enable clients to address viability challenges simply through bidding activity.

Construction earnings

Despite the appearance of a slow market in 2024, earnings have seen positive growth, underlying our view that labour costs are currently the most inflationary element to the forecast. Although worked hours saw little growth during 2024, weekly earnings grew by up to 14% year on year. Building work including house-building saw the highest rate of growth in the year with the Civils sector lagging. Given our expectation that workload growth will accelerate in 2025, it is foreseeable that earnings growth will feed into higher levels of inflation in 2025

Materials

In common with other European markets, in the aggregate, prices for materials have been stable over the past 12 months. Annual cost inflation of 5-6% affecting the cost of aggregates, cement, brick and block has been cancelled out by price cuts in bitumen, steel and steel reinforcement of between 5-8%. Many products have seen little price movement at all, including timber and insulation.

Increasing energy costs related to a tighter gas market in Europe could potentially have an inflationary effect during 2025. Wholesale gas prices measured by the Dutch TTF benchmark are up by 35% in the past six months but have recently been falling as high prices attracted more supply.

Retaliatory tariffs on imports from the US could have a limited impact on some material categories but are unlikely to significantly affect overall project costs due to a low level of import penetration.

Forecast

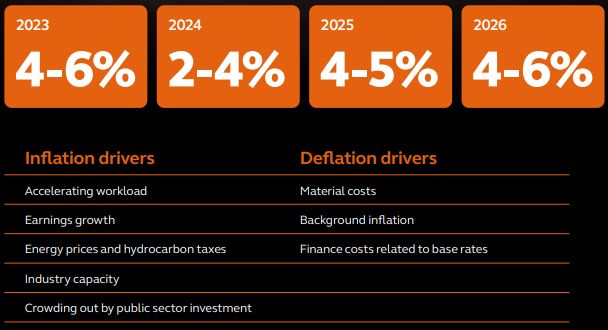

Annual building construction price inflation. % change pa.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.