- in United States

- within Criminal Law, Law Practice Management, Litigation and Mediation & Arbitration topic(s)

This edition of the Automotive Industry Spotlight will focus on how market forces will change the automotive aftermarket for original equipment manufacturers (OEMs), suppliers and retail service providers.

In industry news, Ford cancels three-row electric SUVs and delays next-generation electric pickups in a $1.9 billion strategy shift as the automaker reduces spending on full battery-powered products. Volvo Trucks picks Monterrey for its $700 million Mexico assembly plant, which will supply the group's Volvo Trucks and Mack Trucks businesses in the U.S. and Canada. General Motors (GM) announces a cut of 1,000 software jobs, including 600 at the Michigan Tech Center, citing the shift of resources to the highest-priority work.

In regulatory news, the National Highway Traffic Safety Administration (NHTSA) investigates false activations of automatic braking systems (AEB) amidst criticism by automakers and industry groups of its strict AEB requirement. NHTSA closes the Tesla investigation related to front suspension failures that potentially affect 75,000 Tesla vehicles. Automakers and suppliers want less drastic swings in electric vehicle (EV) policy after the 2024 presidential election, citing concerns of continued significant and frequent policy changes.

Industry Focus: The Automotive Aftermarket

The automotive aftermarket, encompassing secondary sales of replacement vehicles parts — such as tires, batteries and brake pads — grew to approximately $391 billion in 2023 amidst rapidly changing industry dynamics [1]. The industry, dominated by OEMs and major Tier 1 suppliers, faces significant disruption as automakers pivot strategies around EVs and component sourcing, forcing retailers and consumers alike to re-think their approaches to aftermarket parts and services.

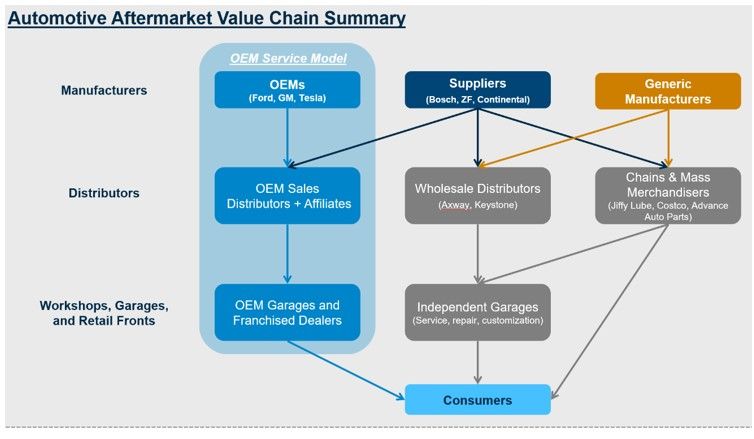

The aftermarket value chain remains a relatively crowded space with a variety of stakeholders serving end consumers:

At a global level, Tier 1 suppliers like Bosch, ZF and Continental are as relevant to aftermarket sales as they are to the manufacturing process for OEMs. Manufacturers of purely aftermarket parts are more limited, typically to parts that are not reliant on typical wear and tear maintenance or crashes such as electronics and performance body parts.

Essential to aftermarket part manufacturers are the 'delivery' systems that deliver parts or perform services for consumers. These take the shape of franchised dealership service centers, independent garages, automotive retail chains and even big box retailers. Major automotive-focused retailers like AutoZone and Advance Auto Parts are market leaders in comprehensive aftermarket services, where certain category segments, like tires, are dominated by specialty shops like Discount Tire and big box retailers like Walmart and Costco.

With significant changes to every corner of the automotive aftermarket, the industry faces a critical stage of disruption in the next several years. Key driving factors include the long-term fallout of the COVID-19 pandemic and its impact on consumer behaviors, the push for further insourcing of components by OEMs and the broader industry transition to EVs and autonomous vehicles.

The COVID-19 Pandemic

While the pandemic itself had a relatively limited impact on aftermarket sales, its effect on consumer behavior will last. Customer driving habits have largely rebounded from the low-mileage and lower-collision period influenced by COVID-driven lockdowns, but the way customers make aftermarket purchases has shifted significantly.

The dramatic rise of digitally-oriented retailers and service delivery can be traced primarily to the pandemic. A market study done by Hedges & Company and the Auto Care Association showed that in 2020 aftermarket eCommerce revenue grew more than 30 percent, to just over $30 billion, compared to the prior year. The same study projected aftermarket eCommerce market to grow to more than $65 billion by 2030, including sales across third parties and direct to consumer sales [2].

The effect of the shift toward digital sales goes beyond the method of sale. With greater visibility into the variety of channels through which parts can be purchased and services can be performed, consumers are experiencing improved price transparency. As a result, prices on services and parts have generally come down as providers compete for market share with depressing margins.

OEM Production: For both front-end manufacturing and aftermarket sales, automakers are actively looking to produce more of the vehicle in-house; currently 60 to 70 percent of the components and parts of cars made in North America are produced by third-party suppliers [3]. Suppliers expect that number to shrink in the near future, potentially hurting suppliers at both the front end of production and aftermarket sales.

The growing EV market and labor are key drivers for OEMs looking to increase the percentage of parts manufactured in house. According to Ford CEO Jim Farley, EVs require 40 percent fewer parts than their internal combustion engine (ICE) counterparts and, as a result, 40 percent less labor [4]. Insourcing parts would result in job protection for OEMs, a particularly crucial point for automakers with union labor. Batteries, motors, power electronics and software are all key areas as OEMs are focusing on moving production in house. Long-lead-time production items, such as batteries designed to power EVs, have been very public investments for OEMs with the intent of simplifying supply chains and lowering costs, but the insourcing of a higher percentage of 'minor' components could lead to a competitive edge and increased margins for OEMs as well.

Tesla demonstrated this well. A study by engineering solutions company Caresoft Global found that Tesla's front fascia for its Model Y was dramatically simpler than the comparable part built for a legacy automaker: the Tesla fascia included seven parts, 32 fasteners and one wire connection compared to the legacy automaker's 28 parts, 61 fasteners and two wire connections [5].

The same story is occurring with Chinese OEMs to an even more dramatic degree. Low-cost EV manufacturer BYD has indicated it will work toward trying to produce as many of the components in its vehicles in house as is possible, only buying rubber and glass components [3].

The effect of insourcing by OEMs on suppliers as it pertains to the aftermarket is less clear. Suppliers will likely halt production on parts that don't achieve scalable volumes for front-end manufacturing, meaning their availability in the aftermarket could be limited if OEMs don't take on production of parts. This market shift would ultimately be to the detriment of independent garages and wholesale distributors, who would lose access to a major supply stream, but would in turn benefit the dealership's aftermarket value chain.

Not all suppliers would be affected equally by an OEM shift toward insourcing. Suppliers whose parts are usually specific to front-end manufacturing with limited aftermarket sales will retain a competitive advantage in front-end manufacturing via a continuation of their existing production scale.

EVs and the Shift to Autonomous Driving

While EVs will have significant impact on OEM insourcing and the number of parts required to manufacture vehicles, certain automotive aftermarket categories and vehicle channels are certainly more vulnerable to negative change over time. Traditional batteries and exhaust systems in particular stand to be hurt by a shift toward EVs. While the aftermarket for these component part types will likely continue for the foreseeable future, the overall volume will shrink as the percentage of new vehicles represented by EVs continues to grow. EVs themselves also provide a unique challenge for independent garages and workshops. Historically strong with technicians well-versed in internal combustion engine systems, these shops will need to expand capabilities to include technicians skilled in EVs or risk losing access to a growing segment of business.

A farther-reaching and less obvious effect on the automotive aftermarket comes with a broader transition to autonomous driving through EV development. While the transition toward autonomous driving has been in effect for years via technology developments already in place with ICE vehicles — such as through lane assistance, adaptive cruise control and collision-detection braking — software like Tesla's autopilot is rapidly accelerating the pace of development toward fully autonomous driving. As a result of this technology maturing, industry experts expect that autonomous vehicles will lead fewer accidents, more mobility fleets like Waymo — Alphabet's self-driving taxi service that is currently testing in Los Angeles, San Francisco and Phoenix — and potentially even to decreased private vehicle ownership. While autonomous vehicles are also designed to drive in an 'optimal' fashion, they should in theory also require less wear-and-tear maintenance. These factors would contribute to a significant decline in ongoing vehicle maintenance, hurting direct aftermarket players like parts retailers and independent garages.

Experts also anticipate that a shift toward autonomous driving would change regulatory requirements around part sourcing and insurance liability. This would likely mean an even greater shift toward the OEM service model where parts are consistent throughout the value chain and service delivery is 'certified' by OEM technicians.

Autonomous vehicles will also provide significant data-driven opportunities for the aftermarket. With increased data coming from vehicles themselves because of autonomous systems, predictive maintenance will become an increasingly important competitive pillar for aftermarket service providers. This will likely primarily benefit the OEM service model.

Sources

[1]. MEMA Automotive Aftermarket Annual Results (https://www.mema.org/news/us-automotive-aftermarket-industry-beats-expectations-growing-86-2023)

[2]. Hedges & Company Aftermarket eCommerce Growth Study (https://hedgescompany.com/blog/2021/11/auto-parts-ecommerce-38-billion-in-2022/#:~:text=Some%20of%201P%20sales%20come,parts%20industry%20growth:%203P%20revenue)

[3]. Automotive News: Automakers Insourcing Crucial EV Parts, Leaving Suppliers with Fewer Potential Customers (https://www.autonews.com/automakers-suppliers/suppliers-grapple-automakers-making-their-own-ev-parts)

[4]. Automotive News: Ford CEO: Insourcing is Key to Protecting Jobs in EV Transition (https://www.autonews.com/executives/ford-ceo-jim-farley-insourcing-key-protecting-jobs)

[5]. Automotive News: Massive Parts Reduction is Key to Tesla's Manufacturing Efficiency (https://www.autonews.com/manufacturing/tesla-manufacturing-system-cuts-parts-complexity-cost-weight)

Additional August insights are included below.

Industry Update

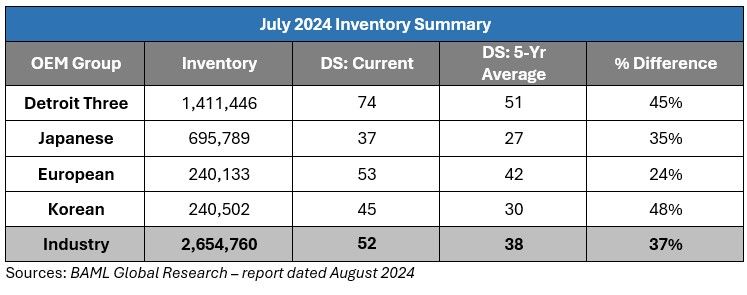

July inventory levels ended at 2.65 million units, a 148,000-unit decrease from June. Days' supply closed at 52, approximately 37 percent above the five-year average. Inventory across the Detroit Big Three original equipment manufacturers (OEMs) had the largest decrease, with a 115,000-unit decrease in inventory that was partially offset by a 5,000-unit increase across the Korean OEMs.

Regulatory Landscape

NHTSA investigates false activations of automatic braking systems: Automakers and industry groups say NHTSA is too strict in its rulemaking, which mandates AEB systems be included in all new vehicles by September 2029. The groups expressed concerns that the AEB systems will cause more incidents of false positives. However, advocacy groups and a government watchdog have criticized the NHTSA for failing to keep up with technology [1].

NHTSA closes Tesla investigation: NHTSA said it closed the preliminary evaluation of front suspension failures in Tesla vehicles. The safety agency said the investigation into approximately 75,000 Tesla vehicles showed no instance that a failure of the part prevented the ability to control the vehicle in testing [2].

Automakers and suppliers want less drastic swings in EV policy after 2024 presidential election: Executives offered competing visions of what federal EV policy should look like but agreed that frequent, significant changes in policy don't help the industry. Industry executives and lobbyists called for more certainty and less drastic shifts in EV policies and regulations between administrations ahead of the 2024 presidential election [3].

Regulatory News source

[1]. Automotive News: https://www.autonews.com/regulation-safety/new-aeb-rule-will-cause-more-phantom-braking-automakers-say

[2]. Automotive News: https://www.autonews.com/regulation-safety/us-probe-tesla-front-suspensions-closed

[3]. Automotive News: https://www.autonews.com/regulation-safety/auto-industry-wants-ev-policy-certainty-ahead-2024-election

Originally published 30 August 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.