- in United States

Most real estate investors have at least a passing familiarity with the concept of a "tax sale" or the acquisition of tax delinquent property subsequent to foreclosure. Although there are several ways to acquire tax delinquent properties, this primer relates to purchasing properties subject to non-judicial foreclosure.

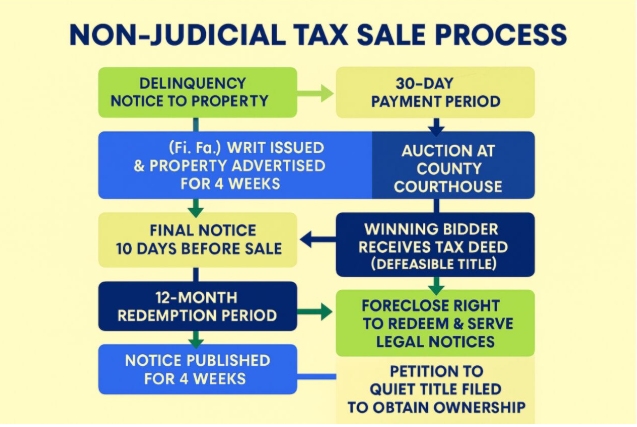

The process begins with a tax-delinquent property owner receiving notice of delinquency from the tax commissioner. The owner of the delinquent property then has 30 days from that notice in which to pay the taxes that are owed. If they fail to do so, the tax commissioner may issue a "writ of fieri facias", which is Latin for "cause it to be done", and is commonly referred to a "f i. fa", or "tax execution". The issuance and recording of this writ allows the levying officer ,or ex-officio Sherriff, to seize and auction the tax delinquent property at a tax sale. The property is then advertised in the legal organ of the county in which the land is located for four (4) consecutive weeks. (O.C.G.A. §§ 9-13-140 through 142). Then, 10 days prior to the tax sale, the owners of the property are required to be served with notice pursuant to O.C.G.A. § 48-4-1 informing them of the impending tax sale.

Tax sales are typically held at the county courthouse on the first Tuesday of the month between 10 a.m. and 4 p.m., if the county has sufficient inventory. However this varies by circumstance and location, your local tax commissioner or county website will have more information on the timing and location.

The initial bid at a tax sale is set at the amount of taxes due, plus penalties, interests, and costs. In the event there are no bids on the property it may be auctioned off again on the same day at the tax commissioner's discretion pursuant to O.C.G.A. § 48-4-1(3). Payment for the property may be made in cash, certified check, or money order, but must always be tendered in full. Failure to pay the full amount of the winning bid or to comply with the terms of the sale in any way will result in the purchaser becoming liable for the full amount of the purchase money. Then, the levying officer shall have the option to either proceed against the purchaser for the full amount of the purchase money or may elect to resell the property and proceed against the purchaser for any deficiency in the sale price under O.C.G.A. § 9-13-170.

However, even if the purchaser pays the full amount and complies with the terms of the sale, they are only in possession of a "defeasible title" at this stage and only hold a "tax deed". To acquire "fee simple" title and complete ownership of the property, the purchaser must "foreclose the right to redeem" or "bar redemption" of the tax delinquent property owner. The tax sale purchaser may not collect rent, improve, or otherwise exercise dominion over the property until this process is completed.

Under O.C.G.A. § 48-4-42, a party with an interest in the property sold at the tax sale (typically the person who failed to pay their property taxes) may exercise their right to redeem their interest within a year (12 months) of the tax sale by paying the full amount tendered at the sale, plus any taxes paid on the property by the purchaser after the sale, any special assessments on the property, a premium of 20% of the amount for the first year or fraction of a year which has elapsed between the date of the sale and the date on which the redemption payment is made and 10% for each year or fraction of a year thereafter. If the interested party tenders these proceeds to the tax sale purchaser, the tax sale purchaser must re-convey their interest in the property to the redeeming party via quitclaim deed.

In order to effectively bar the right of redemption or foreclose the right to redeem of the interest holder, the tax sale purchaser must comply with a detailed set of notice provisions under O.C.G.A. § 48-4-45 and 46. Beginning 12 months after the tax sale, the tax sale purchaser may retain the sheriff of the county in which the land is located to serve the notice prescribed in O.C.G.A. § 48-4-46 on the interested parties. These notices must be served by the sheriff within 15 days of their delivery to him and must be served 45 days before the right to redeem expires. Further, the notice regarding the foreclosure of the right to redeem must be published in the legal organ of the county in which the land is located for four (4) consecutive weeks. Therefore, the entire process to bring a tax sale property to this stage takes a full calendar year and two months. Tax deeds may also be "ripened by prescription" under O.C.G.A. § 48-4-48. This process is lengthy (7 years), is disfavored and therefore not discussed at length here.

However, even this is not the final step to obtaining fee simple ownership of the tax sale parcel. In order to obtain full title to the property the tax sale purchaser must file a petition to quiet title to land under O.C.G.A. § 23-3-60. Essentially, the tax sale purchaser makes a request to the court to take jurisdiction of the matter, appoint a "special master", and ultimately issue a decree establishing the purchaser's title to the land. This step of the process will likely require the retention of an attorney specializing in this area of law.

In closing, the world of tax sales is best described by the axiom, "buyer beware" and involves the conveyance of defeasible property interests, as well as compliance with a litany of esoteric statutes. Please contact Drew, Eckl, & Farnham, LLP or your local real estate attorney for any of your tax sale questions or needs.

For a step by step video on how the non-judicial tax sales work for real estate investors you can watch our video on YouTube.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]