- within Intellectual Property topic(s)

- with readers working within the Business & Consumer Services, Media & Information and Retail & Leisure industries

- within Coronavirus (COVID-19), Government, Public Sector and Strategy topic(s)

Quantum technology is rapidly evolving from a primarily academic discipline into a competitive commercial sector, driven by accelerating innovation and the pursuit of market‑ready applications. Patent data from the MIT Quantum Index Report 2025 confirms a sharp increase in quantum-related activity, with filing rates growing and intellectual property (IP) rights concentrating among a relatively small group of global leaders. This surge reflects not only scientific maturity but also expanded access to capital, as venture funding for quantum companies reached an all‑time high last year. with quantum computing firms alone securing US$1.6 billion in publicly announced investments and quantum software companies raising an additional US$621 million.

This influx of capital is also fueling a more crowded competitive landscape, as both established technology giants and well‑funded start‑ups race to secure technological advantages. Between 2012 and 2024, the United States and United Kingdom together attracted over 60% of disclosed global quantum investment, but other nations such as Canada, the Netherlands, and Australia are making bold, well‑capitalized moves into the space. As funding accelerates globally, the stakes for securing freedom to operate through early and strategic patent filings are rising just as quickly. The window to claim foundational IP across hardware, algorithms, and systems is narrowing, and those who move now will be best positioned to both defend their innovations and shape how the quantum industry and market evolve in the decades ahead.

The Shifting Quantum Patent Landscape

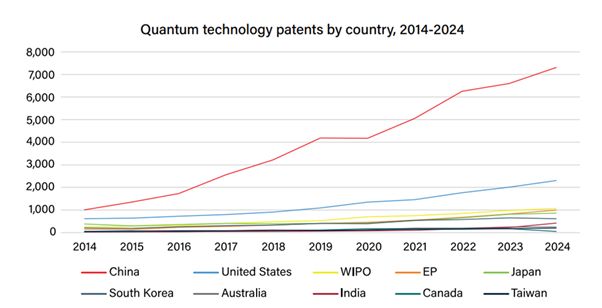

Quantum technology patent filing increased five‑fold between 2014 and 2024. In quantum computing alone, patent family filings rose by more than 300% between 2016 and 2021. China has established clear leadership with 60% of all quantum technology patents as of 2024. The United States remains the second‑largest filing venue with roughly 19%, followed by Japan. The locations where quantum inventions are being patented are an indicator of investment, focus, and activity for quantum research and suggest where quantum technologies will most likely be commercialized.

Figure 1 – Global Quantum Technology Patent Filings,

2014–2024

(Source: MIT Quantum Index Report 2025,

https://www.yumpu.com/en/document/read/70553845/2025-mit-quantum-index-report)

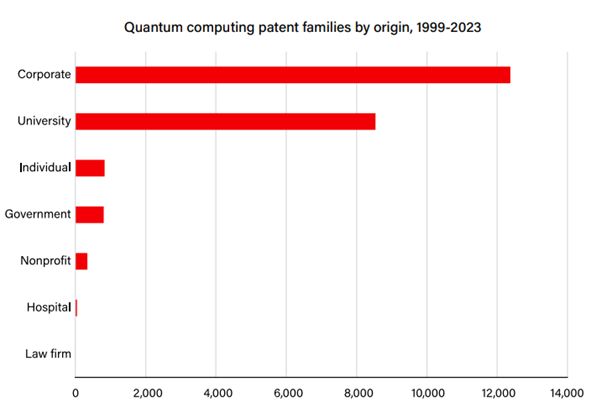

Patent ownership in the quantum technology sector is heavily concentrated between corporations and universities, which together account for the overwhelming majority of filings. Corporations hold 54% of all quantum computing patent families, reflecting the aggressive IP strategies of leading industry players, while universities account for 37%, underscoring the continued impact of academic research in driving foundational innovation. The remaining 9% of patents are split among governments, nonprofits, and individual inventors, indicating that while there is some diversity in ownership, the core of quantum IP is dominated by these two primary groups.

Among corporate assignees, major technology companies such as IBM, Google, Microsoft, Intel, and Baidu top the list, demonstrating their commitment to securing proprietary positions in critical quantum domains. On the academic side, 2023 marked a record‑breaking year, with universities filing 1,668 patent families, their highest output to date — outpacing an already strong 2022. Corporations followed with 837 patent family filings in the same year, reinforcing that both industry and academia are accelerating their IP activity in parallel. Together, these trends highlight a tightening race for control over key aspects of quantum technology, with the most prolific filers shaping the boundaries of future innovation and commercialization.

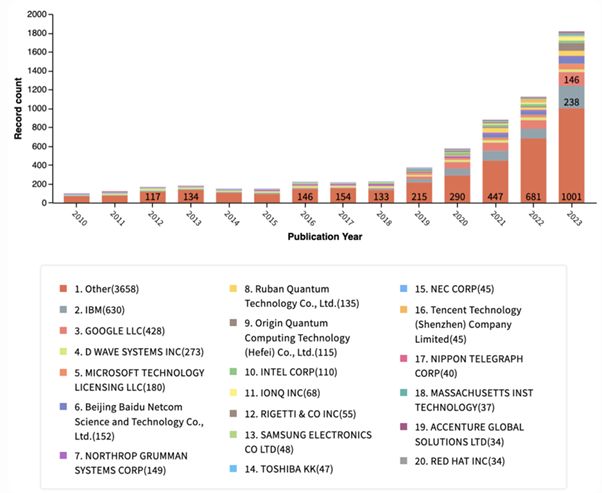

The Quantum Economic Development Consortium(QED‑C) is a global coalition of professionals, businesses, and institutions collaborating to grow the quantum economy. The QED-C State of Quantum Industry 2024 study (QED‑C 2024) notes an average annual growth rate of 49% in quantum computing patents from 2019 to 2023, and 33% in quantum communications patents for the same period. This acceleration reflects both increased public and private research and development spending and a widening diversity of players.

While the top 19 assignees account for a significant share of patents, more than half of all patents are owned by other entities — highlighting that opportunities remain for newcomers.

Figure 3 – Annual Growth in Quantum Computing Patents

— Filings 2010–2023

(Source: QED‑C

2024https://quantumconsortium.org/publication/state-of-quantum-industry-innovation-what-patents-tell-us/)

Venture Fueling

Venture investment in quantum technologies has accelerated over the past decade, consistently raising new benchmarks despite volatility in broader markets. According to the MIT Quantum Index Report 2025, total funding for the sector reached a new all‑time high in 2024, even though quantum still represents less than 1% of total global venture capital. Quantum computing firms captured the largest share, securing US$1.6 billion in publicly announced investments in 2024 alone, followed by quantum software companies with US$621 million. This rising capital flow reflects growing confidence in the sector's technical progress and commercial potential, particularly as hardware performance improves and nearer‑term applications emerge. Venture capital investment may also be spurring the increased corporate and government spending on research and development.

Probing for a Quantum Cache: Pre‑Mainstream Adoption

According to the MIT Quantum Index Report 2025, more than 40 commercially available quantum processing units (QPUs) are now offered by at least two dozen manufacturers. However, none yet meet the performance needs for large‑scale applications such as full‑scale cryptanalysis or complex chemical simulations.

At this stage of quantum technology development, innovators have a rare opportunity to secure patents on foundational aspects of the field before the landscape becomes saturated. Claimable subject matter spans a wide range, including core hardware architectures across different quantum modalities, novel error correction and control mechanisms essential for stable operation, and methods for optimizing the performance of quantum–classical hybrid systems. There is also substantial room to protect domain‑specific quantum algorithms tailored to industries such as pharmaceuticals, logistics, finance, and materials science. Patents in these areas not only safeguard technical breakthroughs but also position their holders to influence future standards, create licensing opportunities, and establish long‑term competitive advantage as the technology matures toward full commercial deployment.

Patent activity in quantum technologies is expanding rapidly and case history from comparable fields like AI shows that early filers often become the gatekeepers for subsequent waves of innovation. The strategic window for foundational quantum patents is open but narrowing. Innovators who act now can secure not only freedom to operate but also the ability to shape the market's technological and commercial evolution.

Learning from History

In fast‑moving technology sectors like quantum computing, the timing of patent filings can be as critical as the innovation itself. Filing early offers several key advantages: it secures freedom to operate before established players dominate the claim space, creates leverage in licensing negotiations with larger entities, and positions companies for cross‑licensing opportunities or strategic acquisitions. Early patents also allow innovators to lock in broad claim coverage, protecting core concepts before a growing body of prior art limits what can be protected. For emerging technologies that are still defining their technical and commercial boundaries, early action can shape a company's competitive position for years to come.

The evolution of AI offers a valuable analogy. In 2014, AI was a promising research frontier but had not yet achieved the broad commercial traction evident today. Early filers in AI secured patents on foundational training techniques, architectures, and application methods that later became core to entire industries.

By the time AI entered mass adoption after 2018, the core technological claims in many areas were already locked up by early patent filers. New entrants found themselves navigating around an increasingly dense thicket of prior art, with many forced into licensing arrangements or entirely excluded from critical market segments. The companies and institutions that had secured broad, early AI patents often monetized those rights directly, either through licensing deals that generated substantial revenue or by leveraging their portfolios in strategic partnerships and cross‑licensing negotiations. This early IP positioning allowed them not only to protect their innovations but also to shape the pace and direction of industry adoption on their own terms.

Today, quantum technology stands at a comparable inflection point. The underlying science is being proven, commercial readiness is on a fast‑approaching horizon, and, critically, foundational claim space in both hardware and software remains open for the taking. Innovators who secure patents now can capture broad rights before the patent landscape becomes crowded, creating competitive leverage for the inevitable adoption wave. Waiting risks entering the market only to find that desired claims are already captured or otherwise covered, leaving fewer strategic options other than paying for access or re‑engineering around entrenched rights. In this window, timely patent filings are not simply protective measures — they are strategic assets that can determine long‑term market participation and profitability.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.