Increased activity levels are bolstering the premium pool

The premium base has increased due to the influx of constructions this year compared to the previous four or five years. This is due to a more stable oil price at US$80-90 levels, compared to the COVID-19 level of US$30-35. During the preceding low oil price environment, many projects were delayed but we have seen project activity restart over the last year, as governments are increasingly focussing on domestic energy security. Countries such as Norway offered meaningful tax incentives to new oil and gas projects, which have encouraged operators to dust off many temporarily shelved projects. The focus on energy security has also resulted in a temporary relaxation of local ESG requirements which had started to impact projects and insurance markets are supporting these placements.

In years to come these projects will likely cause a bump in upstream construction losses at a point in time when future ESG restrictions, both at governmental and insurer level, may result in considerably less incoming construction premium to balance these losses.

In the U.S., onshore we continue to see steady drilling as majors and large independents are sticking to their commitments of operating within cash flow, repurchasing shares and distributing cash back to their investor base. Their growth is steady, generally limited to about 5%, while the smaller public and private companies continue to increase their activity in light of the higher oil pricing. We have seen recent announcements in the U.S. of upstream consolidation and suspect there will be more to come in 2024 as buyers look to replace and supplement their drilling inventory.

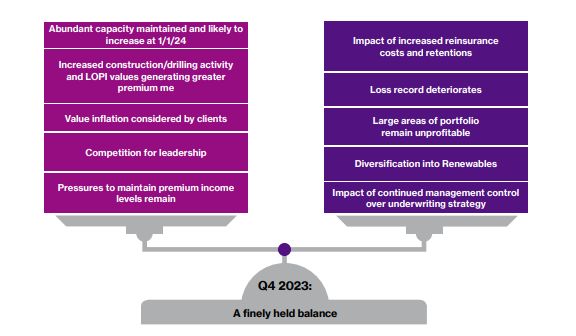

A fine balance — the Upstream underwriting environment, November 2023

A market in a finely balanced equilibrium waiting for what 2024 will hold.

Offshore U.S. activity remains bifurcated, with significant drilling and completion operations in the deepwater Gulf of Mexico and a lesser volume of activity on the Gulf of Mexico shelf. There are generally fewer and smaller construction projects in the U.S. Gulf of Mexico at this time as operators focus on hub and spoke asset strategies by using tie backs to existing facilities as their preferred development concept.

There are other regions such as the UK North Sea, where project and drilling activity has significantly slowed as a result of the government windfall tax. Smaller independent companies are especially seeing their bottom line hit by this and are holding back from drilling wells, uncertain whether they will get a good return on their investment.

Imbalance in underwriting portfolios: A problem for next year

The uptick in construction activity means that most insurers have already made their 2023 budgets, resulting in less management pressure to write business towards the end of the year and likely some reticence by the market to being overly competitive to win business. Some insurers are likely to close their book to further construction business for Q4, having exceeded income targets.

However, the large amount of new construction business could well imbalance portfolios with many markets now writing a book that is more heavily weighted towards construction income than in previous years. This will cause a knock-on problem next year if fewer projects come in as insurers will need to replace this non-recurring income — a difficult position for markets to maintain. Looking back to the last time drilling and construction activity fell away, we saw insurers seeking to increase their lines on operating programmes to make up the shortfall in income, and if history repeats itself, this could result in a significant softening of operating rates as competition for these programmes increases.

Project activity restarted over the last year, as governments are increasingly focusing on domestic energy security and this uptick in construction activity has bolstered the insurance premium pool.

Capacity: Some things don't change

Plenty of capacity continues to be available for most good risks that markets want to write and capacity has in fact gone up slightly during the year. A few insurers have increased their lines, particularly for large North Sea clash assets and we are expecting further increases from existing players at 1st January 2024.

Gulf of Mexico Named Windstorm coverage has seen significant reductions in capacity over the past two years, but similar limits have generally been able to be purchased through increased take up from other incumbent insurers. Going forward we expect Gulf of Mexico Named Windstorm capacity to remain constrained alongside U.S. Business Interruption and/or Loss of Production capacity.

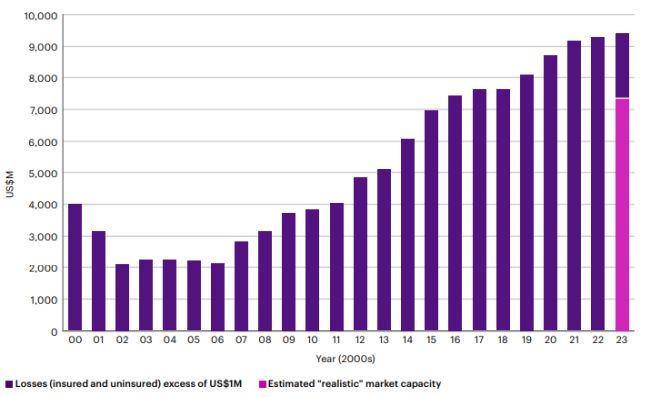

Upstream Operating insurer capacities 2000-2023 (excluding Gulf of Mexico Windstorm)

Both theoretical and realistic capacity levels have increased in recent years — thwarting the efforts of insurers to accelerate the hardening process

Chinese market

Interestingly, we have seen a retrenchment in the Chinese market, which had in the past been a key enabler of competitive pricing for those placements with a Chinese interest. However, over the course of 2023, Chinese insurers have scaled back on the international business they write. This is a result of some significant non-domestic losses now coming through into their book from accounts where they wrote disproportionately large lines. Many Chinese insurers are now taking a stricter view on what qualifies for a "Chinese interest" on international business and are focussing more on technical underwriting to ensure that they are partnering with the right insureds.

For domestic Chinese clients, local markets continue to have meaningful appetite to support with large lines but appetite is more measured on construction where they are a scaling back on line sizes.

To view the full article click here

Originally Published by Energy Market Review

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.