According to CB Insights' latest State of Venture Report, global startup financing in Q2'21 reached $156.2 billion, a 157% year-over-year increase and a record quarter high. U.S. startup funding accounted for the largest portion of the global quarter total, raising $70.4 billion, followed by Asia raising $42.2 billion. Meanwhile, funding to China-based companies continued to decline with an 18% drop from its peak in Q4'20.

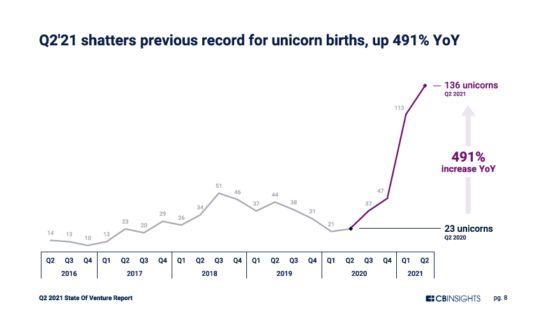

As a result of increased funding, global unicorn births saw a record quarter high with 136 new unicorns, an increase of 491% year-over-year. In the first half of 2021, the average unicorn valuation rose to $1.6 billion, up from the 2016 average of $1.2 billion. Mega-round deals (capital raises over $100 million) almost tripled compared to Q2'20, totaling 390 deals. Global M&A exits rebounded from pandemic lows to reach new records with 2,613 M&A exits and 280 IPOs.

Source: CB Insights State of Venture Report Global: Q2 2021

Venture-backed fintech funding also reached a new high; it represented $33.7 billion or 22% of the global venture financing total. Other sectors that saw growth include e-commerce–funding was up 23% quarter-over-quarter, raising $16 billion. Following three quarters of funding growth, digital health saw another quarterly increase, raising $14 billion and AI funding reached a new half year record, raising more than $30 billion.

In line with global increases, to date, U.S. venture funding is close to 2020's yearly total despite a dip in number of deals. Paralleling the global quarter record, the U.S. also reached a record quarter high of 76 unicorn births. Notable U.S. unicorns include Stripe valued at $95 billion, SpaceX valued at $74 billion, and Instacart valued at $39 billion. The U.S. also saw increases in valuations across all financing rounds. Especially noteworthy was the increase in series A valuations, rising to $42 million. In addition, U.S. exits are close to 2020's full year level and IPOs reached a quarter high of 88.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe - Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.