- in United States

- within Strategy topic(s)

- with readers working within the Banking & Credit and Pharmaceuticals & BioTech industries

Delivery terms aren't just legal fine print—they are strategic terms that can drastically shift the costs and obligations between the parties to a contract, especially when tariffs are involved. This installment of MVA's Supply Chain Brief Series explores the nuances between shipping terms, highlighting why choosing the right term is essential for understanding tariff responsibility, minimizing risk, and maximizing clarity in both domestic and international trade.

Two primary frameworks govern shipping terms: the Uniform Commercial Code (UCC) and the Incoterms® Rules (we call these Incoterms for the sake of brevity). While both aim to clarify the logistics of shipment/delivery and the risks on the contracting parties, they differ in scope, consistency, and legal interpretation.

UCC vs. Incoterms

The UCC is a standardized set of model laws, adopted by each state in some form1, governing commercial transactions, including the sale of goods. The UCC includes shipping terms defining when risk of loss transfers from seller to buyer and the parties' respective expenses for transportation, insurance and tariffs. However, UCC shipping terms are codified into state law and subject to state caselaw interpretation, and as a result, the division of responsibility associated with a UCC shipping term can be interpreted inconsistently across jurisdictions.

By contrast, Incoterms are standardized, globally recognized rules, published by the International Chamber of Commerce. Like the UCC, Incoterms also define risk transfer and who pays for transportation, insurance, and tariffs. One of the primary benefits of Incoterms, as compared to the UCC, is the certainty and predictability that comes from incorporating an Incoterm. Incoterms leave little room for ambiguity, as indicated by a lack of caselaw interpretation of Incoterms—they are rarely disputed because of their clear meaning. On balance, these unambiguous Incoterms are better suited for both international and domestic trade than the UCC.

For example, Free on Board (FOB) is the most commonly used shipping term in contracts for the sale of goods. Many buyers and sellers, even sophisticated ones, often utilize FOB without much consideration, yet don't truly understand its implications. If FOB is used plainly2, it falls under the UCC and as a result is subject to state law interpretation, which introduces uncertainty for buyers and sellers contracting in multiple states. Despite its pervasive use, buyers and sellers often do not understand the uncertainty adopted by incorporating FOB under the UCC.

Delivery Point

Point of delivery or "named place" is another important layer in choosing the correct shipping term. Unless contracted otherwise, the delivery point is where risk of loss and cost shift from seller to buyer. Delivery points are either "Origin", which may refer to the seller's premises or the port of shipment, or "Destination", which may refer to the buyer's premises or port of destination, depending on the term. In practice, parties should specify the actual geographic location rather than using Origin or Destination to prevent any ambiguity.

Most delivery terms are Origin or Destination by nature, however, some depend on whether they are used as a UCC delivery term or an Incoterm. Looking again at FOB, as an Incoterm, it is clearly Origin-based, with the delivery point being the port of shipment, and risk of loss passes once the goods are loaded on board the vessel. However, under the UCC, FOB can be either Origin or Destination. If Origin, the risk of loss passes when the goods are handed to the carrier, with the buyer arranging and paying for freight. If Destination, risk of loss passes when the goods arrive at the buyer's location, and the seller arranges for and pays for freight.

As an example of a disambiguation, Ex Works or EXW, which is only an Incoterm (with the UCC equivalent being FOB Origin), is often considered the most seller-friendly delivery term. The seller has no obligation to transport the goods – the buyer is responsible for arranging for all transportation and paying for all freight, plus coordinating all export and import procedures, including paying tariffs – and the buyer takes risk of loss at the seller's location. The seller's delivery obligations are generally fulfilled when they make the goods available at their premises (or another named place, for instance, a warehouse). Confusion results when the parties adopt an EXW (Incoterms 2020) but name the place as buyer's facility – going against EXW's nature.

On the opposite end of the spectrum is Delivered Duty Paid or DDP, which is also only an Incoterm (with the UCC equivalent being FOB Destination), and is generally the most buyer-friendly delivery term. Under DDP, the seller has all transportation obligations – the seller arranges and pays for all freight and delivers the goods to the buyer ready to be unloaded, bearing all export and import expenses, including tariffs. Therefore, the point of delivery is most appropriate at the final destination, typically the buyer's facility. A delivery point at the seller's facility would be counter to DDP's nature.

Common Incoterms and What They Mean

- EXW (Ex Works): The delivery point is seller's premises and risk of loss transfers to the buyer when the goods are made available for pickup. The buyer handles and pays for all transport costs, insurance, and export and import formalities, including duties and tariffs. This is most favorable to sellers but can also be appropriate for buyers that have strong logistics and customs capabilities and prefer to handle those areas themselves.

- FCA (Free Carrier): The delivery point is a named place, typically the seller's premises or terminal, and risk transfers to the buyer when the carrier picks up the goods. The seller is responsible for export clearance and delivery to the carrier at the delivery point, but the buyer is responsible for the transport, insurance and import duties after the delivery point.

- CIP (Carriage and Insurance Paid To): The delivery point is a named place where the seller delivers the goods to the carrier, where risk of loss passes to the buyer. However, the seller is responsible for the cost of carriage and for covering the minimum insurance until the goods reach the final destination. The buyer is responsible for import procedures and customs duties. This is best for buyers who want the seller to handle transport and insurance but are comfortable handling the import customs formalities.

- DAP (Delivered at Place): The delivery point is typically the buyer's premises. Risk transfers upon arrival at the destination, but prior to unloading. The seller is responsible for all transport, and insurance costs, and export clearance; however, the buyer is responsible for import formalities, including duties and tariffs, and unloading. This is appropriate for arrangement where the buyer does not want to deal with the logistics of transport but is comfortable with the import customs procedures.

- DDP (Delivered Duty Paid): The delivery point is typically at the buyer's premises. Seller is responsible for arranging and paying all transport and delivery costs, insurance and all import/export formalities, including all taxes, duties and tariffs. The buyer receives goods at their door, fully cleared. This is best for buyers who desire to have seller handle all transport obligations and costs, and do not want to take on the risk of fluctuating tariffs.

Tariff Implications: Who Pays?

Here's where delivery terms can have a direct financial impact in a volatile tariff environment. DDP is the only Incoterm where the seller has the explicit obligation to pay the tariffs. However, the purchase price of the goods will likely be higher to offset the seller's costs. Under all other Incoterm Rules, the buyer is responsible for the tariff costs, unless the parties negotiate otherwise in an integrated agreement. Given the uncertainty surrounding tariffs in our current climate, buyers and sellers should be keenly aware of how each shipping term shifts the tariff responsibilities.

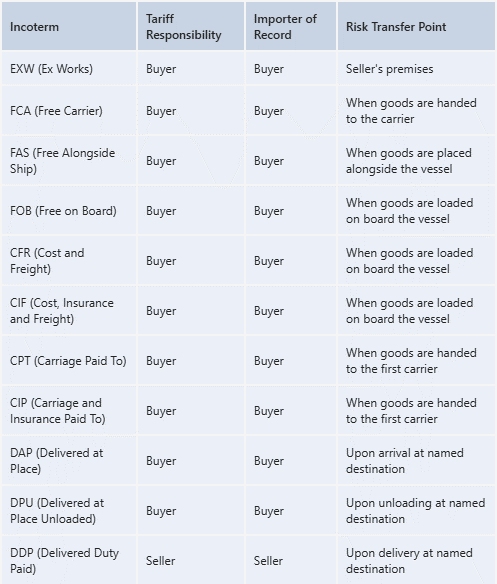

Below is a chart detailing the traditional tariff and import responsibilities under each Incoterm.

Final Thoughts

By understanding the difference between the UCC and the Incoterm Rules, and choosing the right delivery term, your business can:

- Avoid disputes over risk and responsibility

- Better manage logistics and customs processes

- Control tariff exposure and total landed cost

If your contracts involve the sale or purchase of goods—especially across borders—understanding and negotiating delivery terms is crucial in today's market. And if you're unsure which term is right for your deal, it may be time to consult legal counsel who can help you structure the agreement to your advantage.

Footnotes

1. The UCC is a framework, not a binding law itself. The UCC is produced jointly by the Uniform Law Commission and the American Law Institution, proffering model laws for adoption by jurisdictions to enable consistency and certainty in commercial transactions across state lines. The UCC only has legal effect as, and when, adopted as law by a jurisdiction. All fifty states and the District of Colombia have adopted the UCC, or parts thereof, in some form. See Uniform Commercial Code. Uniform Law Commission | uniformlaws.org. https://www.uniformlaws.org/acts/acc; see also Uniform Commercial Code (UCC). Duke Law | law.duke.edu/lib/. https://law.duke.edu/lib/research-guides/ucc.

2. Meaning without the designation that it is an Incoterm, signified by including "(Incoterms 2020)" with its usage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]