- within Compliance topic(s)

On April 2, President Trump issued an Executive Order (EO) imposing global reciprocal tariffs (White House Fact Sheet). The EO drew enough parallels to the Smoot-Hawley Tariff Act that Trump mentioned it in his Rose Garden announcement. The EO imposes a 10% baseline tariff on all imports to the United States beginning April 3, 2025.

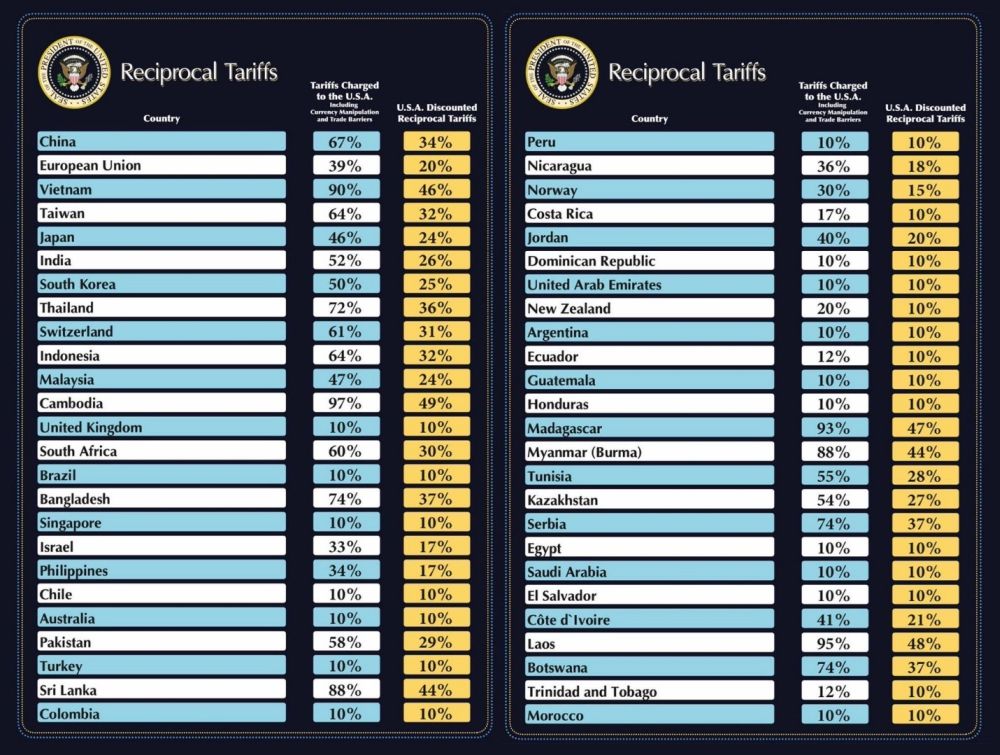

On top of that baseline, the EO also imposes country-by-country tariffs reciprocal tariffs represented in the chart below. Those amounts are based on what the United States Trade Representative (USTR) determined in its 2025 Foreign Trade Barriers report to be the current tariff rate imposed on U.S. goods for imports to that country. That rate includes official tariffs, as well currency manipulation and other "trade barriers." The "kind" reciprocal tariffs for each country are roughly half of that amount.

Certain goods will not be subject to the reciprocal tariff. Those include the following:

- Communications of no value, humanitarian donations, information materials and media, and personal luggage, subject to 50 USC 1702(b);

- Steel/aluminum articles and autos/auto parts already subject to Section 232 tariffs;

- Copper, pharmaceuticals, semiconductors, and lumber articles;

- All articles that are or become subject to future Section 232 tariffs (e.g., steel, aluminum, autos and auto parts);

- Bullion; and

- Energy and other certain minerals that are not available in the United States.

For Mexico and Canada the existing tariffs imposed in March remain in effect. USMCA compliant goods will continue to see a 0% tariff, non-USMCA compliant goods will be subject to a 25% tariff, and non-USMCA compliant energy and potash will be subject to a 10% tariff. However, if the EO specific to Mexico and Canada were to be terminated, USMCA compliant goods would receive preferential treatment, and non-USMCA compliant goods would be subject to the 12% reciprocal tariff.

In addition to the universal tariff imposition, beginning on May 2, 2025, the 54% tariff rate on imports from China will also be applied to packages worth less than $800 coming to the United States from China or Hong Kong.

Because the new tariffs are imposed under the International Emergency Economic Powers Act (IEEPA), there does not appear to be a formal process for requesting a waiver to the tariffs or providing comments on their implementation. However, it is likely that actions will be filed in U.S. courts as well as before the World Trade Organization contesting the tariffs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.