- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

PREAMBLE

This Manufacturing Overview report is a quarterly series designed to offer readers a concise evaluation of the current financial performance of manufacturers across industries and the underlying macro indicators and challenges influencing these firms. With this report, we aim to equip readers with strategies to proactively address and navigate the constantly evolving challenges faced by manufacturers.

QUARTERLY SUMMARY – Q4 2024

Manufacturers are facing continued cost pressures due to revenue slowdowns and increasing tariff volatility. To remain competitive, businesses must simplify operations, learn to be lean, leverage automation opportunities, and gain supply security. Manufacturers were able to show some resilience in gross margin through cost-cutting measures but need to navigate uncertain investment landscapes and evolving regulations. Businesses need to clearly define "how to win".

NEGATIVE REVENUE GROWTH TREND

Manufacturers experienced a slowdown in revenue in Q4. The slowdown was driven by economic uncertainty and changing consumer preferences.

REDUCED INVENTORY LEVELS

Manufacturers turned inventory at a faster rate in the last quarter, finishing the calendar year well in a better position than previous quarters.

HIRING FREEZE

High interest rates raised the cost of goods sold for manufacturers. Most companies are freezing hiring with lowered demand volume.

WORKFORCE CHALLENGES

Attracting and retaining highly skilled labor remains the top challenge for manufacturers. This issue is exacerbated by rising healthcare costs and an increasingly competitive labor market.

TARIFF MITIGATION

Manufacturers are rethinking their network strategies to adapt to new consumer behaviors and geopolitical risks. Building a footprint to gain supply security is a key focus.

PRODUCTIVITY

Increasing competitiveness should be the key focus for German and US manufactures in 2025. Firstly, companies should reduce SG&A cost. Secondly, they need to optimize their manufacturing footprint as utilization of factories is at an unhealthy low level. Lastly, they need to invest in digitization and automation whilst keeping their profitability and cash flow healthy.

KEY TRENDS AND CHALLENGES IN MANUFACTURING

01 COST PRESSURES

- Supply chain disruptions leading to production delays and increased costs have impacted industries

- Vertically integration, strengthening partnerships and automation are levers to gain supply security and remain cost competitive

02 WORKFORCE DYNAMICS

- Skilled labor shortage continues to plague manufacturers (e.g., in chip manufacturing and its recent demand boom) and increasing healthcare costs

- Healthcare cost management via optimizing offerings and management through wellness programs are potential ways to address cost pressures

03 THE "AI" BOOM

- Companies are focusing on smart manufacturing and predictive maintenance, using AI to improve efficiency and reduce operational costs

- AI is being leveraged to simplify design, innovate and increase productivity

KEY TRENDS AND CHALLENGES

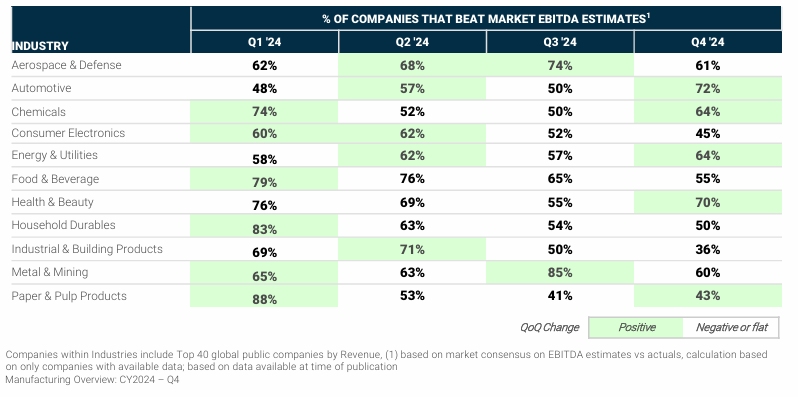

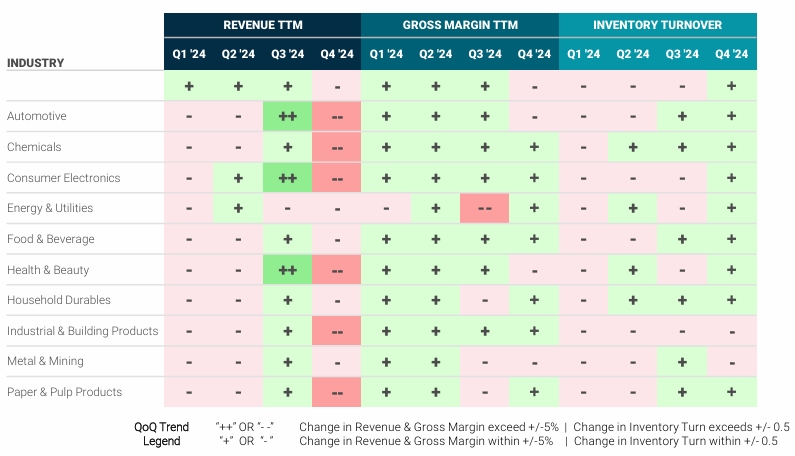

COMPANIES FACED HEADWINDS IN REVENUE GROWTH IN Q4 BUT MAINTAIN STABLE GROSS MARGINS

COMMENTS

- Most industries saw significant downward revenue trends in Q4.

- Gross margin across most industries are generally trending upward, likely driven by the recovery of commodity prices, and the passing on of costs to customers.

Note: Companies within Industries include Top 40 global public companies by Revenue; metric trend based on median in industry group; based on data available at time of publication

To read this article in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]