- with Finance and Tax Executives

- in South America

- in South America

- with readers working within the Accounting & Consultancy industries

Key Takeaways:

- Tariff-driven business model changes may affect P.L. 86-272 protections and trigger throwback exposure.

- Throwback and throw-out rules can tax income in original states when destination states don't impose income tax.

- Reshoring strategies tied to tariffs should be reviewed through a tax lens to manage nexus and apportionment exposure.

—

Tariff uncertainty continues to challenge manufacturers and distributors. In response, many businesses are making fast, sometimes reactive decisions: shifting fulfillment strategies, diversifying suppliers, and reworking customer contracts. While these steps are often necessary to protect margin, they can have unexpected ripple effects — particularly when it comes to state income tax exposure.

As operations evolve, companies may unknowingly trigger state-level tax rules — including throwback and throw-out provisions — that can increase tax burdens in their home states. These rules are rarely top of mind during operational planning, but, in today's climate, they should be.

What You Think You Know: Public Law 86-272 Protections

Public Law 86-272 (P.L. 86-272) has long been a helpful shield. It protects companies from state income taxes when their only activity in each state is asking for orders for tangible personal property, and when orders are approved and fulfilled from outside that state.

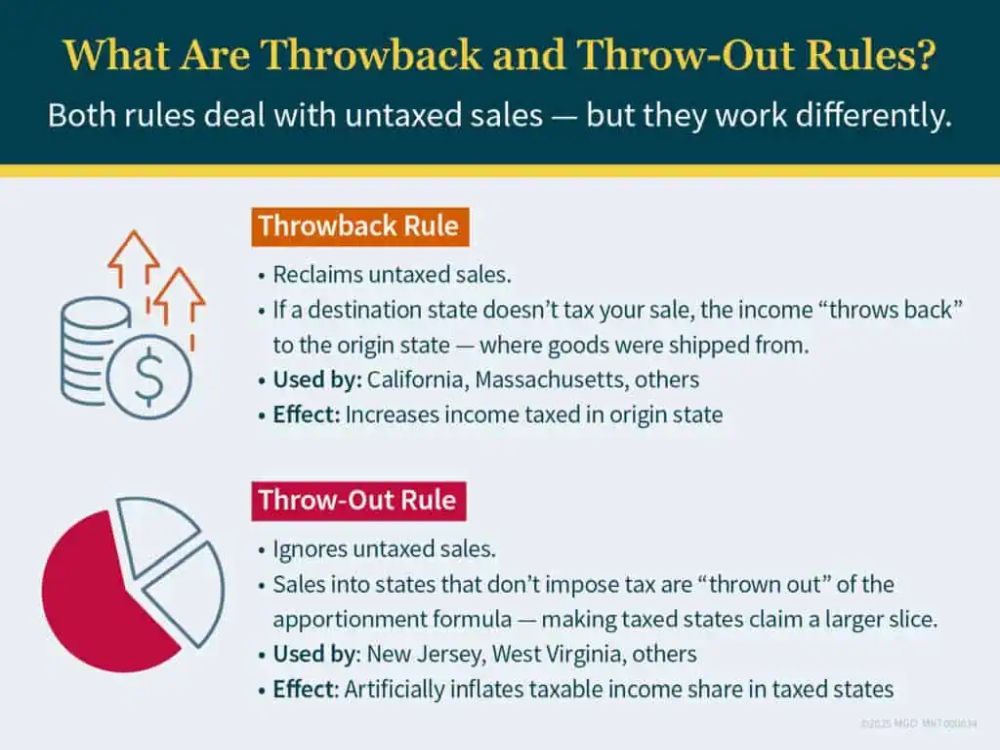

But P.L. 86-272 isn't a blanket exemption — and it doesn't prevent other states from taxing that same income through alternative mechanisms. That's where throwback and throw-out rules come in.

In response to evolving e-commerce practices and the Multistate Tax Commission (MTC's) revised Statement of Information on P.L. 86-272, several states have taken steps to limit the scope of this federal protection:

- California: Issued Technical Advice Memorandum 2022-01, aligning closely with the MTC's guidance. The memorandum specifies that certain internet-based activities, such as post-sale help via electronic chat or email, may exceed the protections of P.L. 86-272.

- New York: Released draft regulations incorporating the MTC's examples, showing that interactive internet activities could lose P.L. 86-272 immunity. The regulations are currently in draft form and subject to change.

- New Jersey: Announced a policy change to evaluate P.L. 86-272 protection on an entity-by-entity basis within combined groups, potentially altering the tax obligations of group members.

- Minnesota: Circulated a draft revenue notice in April 2023 proposing adoption of the MTC's revised guidance, signaling a move towards stricter interpretations.

Businesses using these states should closely examine their internet-based activities to assess potential tax implications under the updated interpretations of P.L. 86-272.

Throwback and Throw-Out Rules: Why They Matter

In states that enforce these rules, untaxed sales into other states can be "thrown back" to the state of origin. Here's how:

- Throwback rules require that if you're not taxed on a sale in the destination state (for example, due to P.L. 86-272), the income from that sale must be reported in the state where the goods were shipped from.

- Throw-out rules remove untaxed sales from the apportionment formula, which can artificially inflate your tax burden in the states where you do pay.

These rules can significantly shift your tax liability — especially if you're shipping into multiple states where you have no nexus but generate substantial sales volume.

In a recent engagement for a new client, we found that the location of the client's warehouse was the largest factor in planning when potential throwback was considered. If the client relocated operations from a throwback state to a non-throwback state, the impact on the sales factor in the apportionment formula was neutralized. Setting up operations in a state with throwback led to an inflated sales factor in the apportionment formula and an unexpected state tax liability.

Having conversations before transactions is extremely valuable as proper planning can lead to potential tax savings.

Why Tariff Responses Are Quietly Changing Your Tax Profile

Tariffs aren't just a global trade issue, they're reshaping day-to-day decisions inside U.S. companies. For many manufacturers and distributors, the last year has been a series of rapid adjustments: rethinking where goods come from, how they're delivered, and how quickly orders get to customers.

You may have shifted fulfillment closer to major markets to cut lead times. Maybe you've swapped offshore suppliers to sidestep new tariffs. Some companies have moved toward direct-to-consumer models, while others have quietly changed how customer orders are approved or supported.

Individually, these decisions may feel operational. But taken together, they have a real impact on how income is sourced and taxed across states. They can shift your exposure under throwback or throw-out rules — especially if your sales are increasing in states where you don't currently have income tax obligations.

In short, what begins as a supply chain fix can evolve into a state tax issue — often without anyone realizing it until filing time.

Reshoring and Tax Considerations Go Hand in Hand

For many companies, reshoring has become a practical response to ongoing tariff uncertainty. Bringing operations back to the U.S. can reduce exposure to trade risk and improve supply chain control — but it also reshapes how and where your business is taxed at the state level.

Operational changes like relocation or restructuring can result in:

- Nexus creation in new states

- A shift in which sales are protected by P.L. 86-272

- Adjustments to your apportionment formula

- New reporting obligations, credits, or incentive opportunities

While every business has unique goals, involving tax professionals early in reshoring or fulfillment planning can help find potential exposure or compliance gaps — without delaying execution.

For example, when companies shift operations to avoid tariffs by opening new distribution hubs or adjusting shipping routes, the tax impact extends beyond coordination. These changes may influence how income is apportioned and whether certain sales fall under throwback or throw-out rules.

Tax professionals can support this process by:

- Modeling apportionment changes: Projecting how operational shifts affect sales factor weighting

- Evaluating throwback exposure: Estimating tax impacts from untaxed destination-state sales

- Finding new nexus points: Highlighting where physical or economic presence may trigger new filings

These insights help companies anticipate tax consequences tied to operational agility (without crossing into trade policy or legal advice). It's about making sure strategic decisions don't lead to unintended risk at the state level.

What You Can Do

Protecting your company from unexpected throwback exposure doesn't require slowing down — it just takes coordination. Here are three practical steps to take now:

- Evaluate protected sales: Identify where you're relying on P.L. 86-272 and whether the destination states impose income tax.

- Map shipping and fulfillment models: Understand where goods originate and whether origin states apply throwback rules.

- Review apportionment exposure: Determine how throw-out rules or untaxed sales may affect your overall income distribution.

Tax May Not Be the Driver — But It's in the Passenger Seat

You're adapting to economic pressure with speed and creativity. But every supply chain move or sourcing shift may have tax implications your business didn't see coming.

P.L. 86-272 may protect your business in some states, but it doesn't stop others from taxing that income using throwback or throw-out rules. And when tariff-driven decisions lead to reshoring, the tax impact becomes even more layered.

Understanding how these state rules apply can keep your strategy intact and your risk exposure in check.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.