- within Food, Drugs, Healthcare and Life Sciences topic(s)

- within Food, Drugs, Healthcare and Life Sciences topic(s)

- within Compliance and Insurance topic(s)

A Trillion-Dollar Realignment

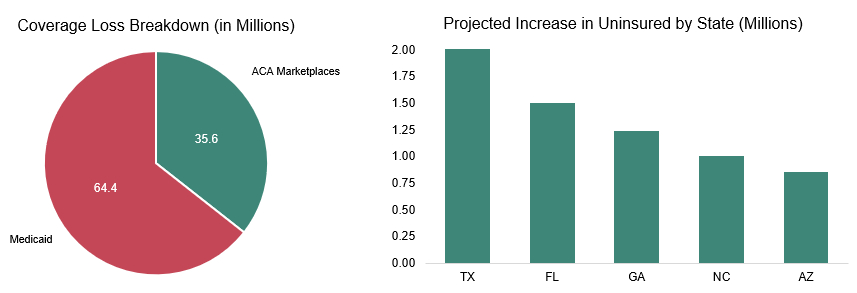

On July 4, 2025, President Donald Trump signed into law his signature tax bill commonly referred to as the "One Big Beautiful Bill Act" (OBBBA).1 At the heart of the legislation lies a dramatic reconfiguration of federal healthcare funding. The bill slashes over $1 trillion from federal healthcare funding over the next decade, primarily through tighter Medicaid eligibility rules, modifications to state Medicaid funding requirements, and the non-extension of the enhanced premium tax credit for the Affordable Care Act (ACA) marketplace coverage set to expire in 2025.2 These cuts are expected to result in 16 million more uninsured Americans by 2034, according to the Congressional Budget Office (CBO).3

The Medicaid provisions alone will reduce enrollment by 10.3 million, driven by new work requirements, eligibility redeterminations, and reduced federal matching rates.3 For ACA marketplaces, the expiration of enhanced premium tax credits will raise out-of-pocket premiums by over 75% on average, pricing many out of coverage.4

The OBBBA also includes significant changes to tax policy, which will impact healthcare operators over the next several years. These provisions, including the extension of bonus depreciation, enhanced Section 179 expensing, and increasing the limit for interest deduction, are generally considered to be favorable to corporations. For more tax insights, explore Ankura's article diving into the implications of the OBBBA on the broader mergers and acquisitions (M&A) market.

Winners and Losers in the Healthcare Ecosystem

Hospitals and health systems are among the most exposed. With uncompensated care costs poised to rise, especially in rural and underserved areas, many facilities may be forced to consolidate or close.2] The OBBBA includes $50 billion in investments over five years for rural hospital stabilization. However, the long-term viability of many rural health facilities is expected to remain at risk. Additionally, the OBBBA did not include an extension of the Disproportionate Share Hospital (DSH) payments that are set to expire Sept. 30, 2025, which will further increase the financial strain on safety-net providers.

Health insurers face a mixed outlook. While the rollback of ACA subsidies may shrink individual market enrollment, the repeal of certain taxes and regulatory relief could benefit large, diversified payers. However, the elimination of auto-renewals and new documentation requirements will increase plan membership churn and administrative complexity.4]

Pharmaceutical and medical device companies emerge as relative winners. However, the likely increase in uninsured individuals may impact federal and payer drug spending levels in the short term. The industry did receive a sought-after win with the exemption from the Medicare Drug Price Negotiation Program for certain drugs approved for one or more rare diseases or conditions.

Long-Term Care Providers, heavily reliant on Medicaid, are bracing for funding shortfalls. The bill's changes to provider taxes and eligibility redeterminations will strain operations, particularly in states with aging populations.2

Strategic Imperatives for Healthcare Leaders

- Scenario Planning: Healthcare leaders should model multiple coverage-loss scenarios to understand their potential impact on patient volumes, payer mix, and revenue cycles. This could involve the use of data analytics to forecast the effects of reduced Medicaid and ACA funding on the healthcare system. Embracing cost containment and digital transformation will be essential to maintaining financial viability in the face of funding reductions. Leaders should focus on streamlining operations, reducing waste, and investing in technology that enhances efficiency and patient care. This may involve adopting electronic health records, telemedicine, and automated administrative processes to cut costs and improve service delivery. In light of declining reimbursement rates, healthcare leaders should also explore the strategic application of artificial intelligence (AI) in denials management and other key business functions.

- M&A Readiness: With increased pressure for

consolidation, healthcare organizations must prepare for M&A.

This involves assessing potential partnerships and acquisitions

that can provide scale, access to capital, and diversification of

revenue streams. Leaders should be ready to seize opportunities for

growth through strategic alliances or vertical integration, which

can help absorb financial shocks and enhance market position.

M&A Implications of the 2025 Trump Tax Bill on Healthcare

- Increased Consolidation Pressure on Providers: The reduction in Medicaid and ACA funding is significantly impacting revenue streams for hospitals, particularly safety-net and rural providers. These financial pressures will further accelerate consolidation in the market, as providers look to gain economies of scale, better negotiating leverage with payers, and operational efficiencies.

- PE Repositioning: Private equity (PE) firms are adjusting their investment strategies to focus more on sectors less dependent on public reimbursement, such as outpatient care and tech-enabled services. The OBBBA's deregulatory stance and relief of capital gains taxes are encouraging these firms to pursue buy-and-build strategies, which involve acquiring multiple smaller companies and integrating them into a larger platform to drive growth and efficiency.

- Payer-Provider Convergence: Insurers are increasingly acquiring or partnering with healthcare providers to better manage risk under value-based care models. With the rollback of ACA subsidies, insurers are shifting their focus to Medicare Advantage plans and employer-sponsored insurance, which are seen as more stable and lucrative markets. This convergence allows insurers to better control costs, improve care coordination, and enhance patient outcomes.

- Life Sciences and MedTech Expansion: The repeal of the medical device excise tax in 2020 and the preservation of research and development (R&D) tax credits are fueling M&A in biotech and medtech. Large pharma is pursuing pipeline acquisitions to offset pricing pressure and patent cliffs, with numerous products currently generating billions in revenue, losing exclusivity as a result of patent expirations over the next five years.

A Defining Moment

The OBBBA represents more than just a tax package — it is a redefinition of the federal government's role in healthcare. For industry leaders, the challenge is not merely to adapt, but to lead. Those who can anticipate the ripple effects, engage constructively with policymakers, and innovate around these new constraints will shape the next chapter of American healthcare.

Footnotes

1 H.R.1 – One Big Beautiful Bill Act, (Congress, July 4, 2025). https://www.congress.gov/bill/119th-congress/house-bill/1

2 Center on Budget and Policy Priorities (2025). Medicaid and ACA Cuts Impact. https://www.cbpp.org/

3 Congressional Budget Office (2025). Analysis of the One Big Beautiful Bill. https://www.cbo.gov/

4 Kaiser Family Foundation (2025). Health Coverage and Premium Trends. https://www.kff.org/

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.