As the cost of capital increases and deal flow slows, private equity (PE) funds are looking to improve efficiency and strategize growth to improve EBITDA at their healthcare portfolio companies.1,2 While the Fed has signaled its intent to slow the measure of rate increases seen in the third and fourth quarters of 2022, the rates themselves are expected to increase until the third quarter of 2023.3 As it stands, multispecialty physician practice management, skilled care and behavioral health deals declined approximately 28% year-over-year from 2021 to 2022.4 This decline will likely be exaggerated in 2023, as closed 2022 deals were started prior to rate hikes and other economic signals.5

During a typical healthcare transaction, there is a period of intensive acquisition and integration activity that brings forth rapid change. This can create momentum for continued change but often leads to an "integration hangover" as support from consultants and other third parties diminish. Substantial effort is placed on planning for the 100-day integration, but after Day 100, the activity typically slows. Often, the combined company has well-intentioned, ambitious plans for the target state, but as time passes, integration initiatives get placed on hold or shelved completely. This leaves PE firms with partially integrated assets that rely on an internal team of project managers to achieve continued integration and performance improvement.

"Business as usual" operations for a healthcare newco can be achieved if integration and performance improvement are viewed as part of an evolution toward target state and not as stand-alone events. To maintain the momentum created by the transaction after the first 100 days, three principles can mitigate the risk of portfolio company stagnation: post-Day 100 goal setting, governance structure and communications.

While achieving integration Day 100 is a significant milestone, governance, principles and initiatives should be maintained to achieve target-state goals, performance improvement and newco business operations.

Principle #1: Define clear goals for continuing integration and performance improvement after the first 100 days.

Key foundations - the who, what, when and how - should be firmly established to achieve target state.

Early in the integration and performance improvement process, a "Target Operating Model" (TOM) is defined, setting the course for 100 days and beyond. The TOM should be clear, concise, and specific while including details beyond integration. An example of a general integration goal vs. a specific performance improvement goal: Consolidate HR systems and policies vs. Migrate X to Y Human Resources Information Systems (HRIS) and upgrade to v4.2 by August 1.

The Who: Key stakeholders will be seeking to achieve business continuity, but roles require definition. While more than one role can be played by a stakeholder, four roles should be well established:

- Planners: Workplan activity creation, planning and reporting need to be maintained by functional stakeholders. Progress will need to be tracked by a group of planners who monitor defined Key Performance Indicators (KPIs) and manage functional needs.

- Leaders: With numerous functional stakeholders coming together, one or two leaders should be designated to present progress reports, drive activities with planners and make key decisions that influence maintaining or shifting integration priorities.

- Dependents: Functional leaders should have regular touchpoints with dependents or leaders of other related functions who are critical for cross-functional integration development. Alignment on timelines and risk mitigation planning will be crucial. For instance, HR should be well aligned with Legal on matters of employee services and retention.

- Executors: With planners and leaders serving as the driving force of activity goal-seeking, executors need to perform the work. Activity dependencies on legal (e.g., general counsel) and IT (equipment set-up) may require dedication to functional activity execution.

The What: As a continuation of integration activities from Day 1 to Day 100, functions should ensure that they are committed to their workplans and have the appropriate activities defined. While activities, goals or charters can be modified, functional teams should be able to pinpoint which activities need to be completed by when and with which functional or cross-functional stakeholders.

Once the goals and activities are in place and validated by functional teams and leadership, the next step is to ensure that the specific areas where performance can be improved have been identified. The Integration Management Office (IMO) should also drive steps to involve (1) performing a thorough analysis of the current system, looking for bottlenecks or inefficiencies that can be addressed and (2) implementing strategies and solutions to address these issues. Implementing improvement initiatives may involve new technologies, processes or procedures to improve performance. It may also involve training and education for employees to help them understand the importance of performance improvement and how they can contribute to the effort. Such activities should be relayed and aligned with functional leaders to be included as part of post-100-day performance improvement planning.

The When: The timing of the pivot from integration to performance improvement is also a key consideration. A pivot to a post-integration phase should take place only after core functions have been integrated satisfactorily. For instance, Finance and HR should have sufficient integration to provide the critical reporting on performance improvement initiatives. Once Day 100 readiness is established, activity timelines may need to be re-addressed by functional teams to ensure appropriate and timely activities. Any changes should be properly aligned through IMO reporting and Steering Committee decisions.

The How: The approach to any activity accomplishment is a process. With market activities creating potential unintended consequences to newco based on internal or external factors, changes to integration activity may require a different approach. Teams should remain nimble throughout the process, especially since integration activities may not always be core responsibilities for employees and stakeholders. While progress can be tracked through a dedicated cadence of meetings (which should not be overbearing), activity planning should consider what can and should be accomplished with current resources in reasonable timeframes.

Principle #2: Maintain the integration governance structure

Proper structures and responsibilities provide assurance for achievable timelines, sound decision-making and risk mitigation, and proactive activity tracking.

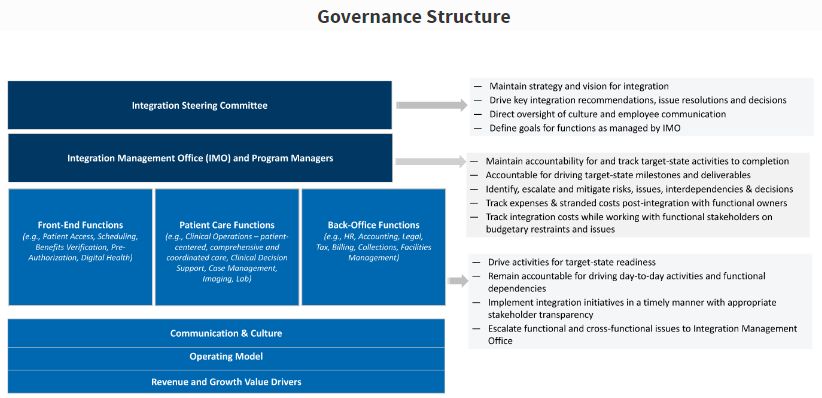

A healthcare merger integration 100-day plan creates collaboration across legacy organizations that would not happen, and may not continue, without a strong governance structure. The discipline and accountability related to steering committees, status reports and workstreams help the newco push forward in a coordinated and focused manner. After integration targets are achieved, the governance structure may need to be rebranded or reset to include performance improvement.

Key components of a robust integration governance feature a steering committee, Integration Management Office, and functional areas with defined activities. While these components come from the Day 1 to Day 100 integration phase, responsibilities will change as required to ensure continued momentum. The foundations of the governance ensure defined value drivers, a clear operating model, and transparency through uniform communication and culture.

Principle #3: Continue robust communications

Communication for post-Day 100 integration planning should enable alignment and transparency on key activities

A decline in morale leading to increased turnover often occurs post-transaction due to the anxiety created by uncertainty.6 Frequent communications from leadership on the state of the integration, performance improvement initiatives and, most importantly, celebrating successes can mitigate risks. One key aspect of the transition from integration to performance improvement is alignment of ongoing cross-functional and leadership activities. Alignment will ensure proper evaluation and monitoring of functional activities and the effectiveness of strategies while planning for timely adjustments. Regular communication and collaboration with all stakeholders, including employees, management and customers, is crucial to ensure that everyone is working towards the same goals with agreed-upon approaches.

Conclusion

The path to "business as usual" in any merger integration can be a long one. The macro environment leaves PE firms with assets in their portfolios that were acquired and partially integrated and looking to improve their financial position or increase market share. Because of the economy, PE firms now have a longer horizon until the next liquidity event. The time is right to evaluate the level of asset integration and reinvigorate post-integration performance improvement efforts. If continued focus beyond a 100-day plan has clear definition, structure and open communication, the performance improvement timeline can be shortened, thereby creating additional value until economic conditions improve.

Footnotes:

1: Richard Hans. "Build a Strategy for Rising Cost of Capital." EPSNews (April 21, 2022). https://epsnews.com/2022/04/21/build-a-strategy-for-rising-cost-of-capital/.

2: Rebecca Springer. "Q3 2022 Healthcare Services Report." PitchBook Data, Inc. (November 14, 2022). https://files.pitchbook.com/website/files/pdf/Q3_2022_Healthcare_Services_Report.pdf.

3: "Goldman raises forecast for 2023 Fed rate peak by 25 basis points." Reuters (November 16, 2022). https://www.reuters.com/markets/rates-bonds/goldman-raises-forecast-2023-fed-rate-peak-by-25-basis-points-2022-11-16/.

4: Rebecca Springer. "Q3 2022 Healthcare Services Report." PitchBook Data, Inc., Page 7 (November 14, 2022). https://files.pitchbook.com/website/files/pdf/Q3_2022_Healthcare_Services_Report.pdf.

5: Katie Adams. "Healthcare Deal Value Expected to Keep Decreasing in 2023, PwC says." MedCity News (December 8, 2022). https://medcitynews.com/2022/12/healthcare-deal-value-expected-to-keep-decreasing-in-2023-pwc-says/.

6: John E. Gutknecht and J. Bernard Keys. "Mergers, acquisitions and takeovers: maintaining morale of survivors and protecting employees." Academy of Management Executive, Vol. 7 No. 3 (1993). https://gmdconsulting.eu/nykerk/wp-content/uploads/2019/06/M-and-A_-Maintaining-and-Protecting-Morale-of-Survivors.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.