Stock Market Commentary

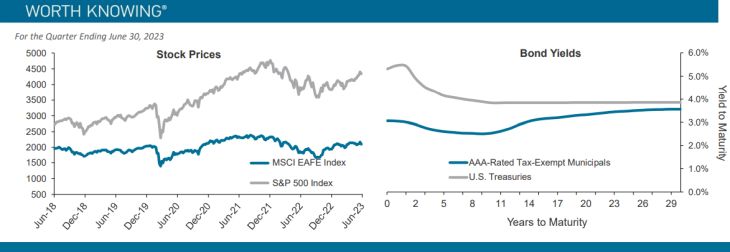

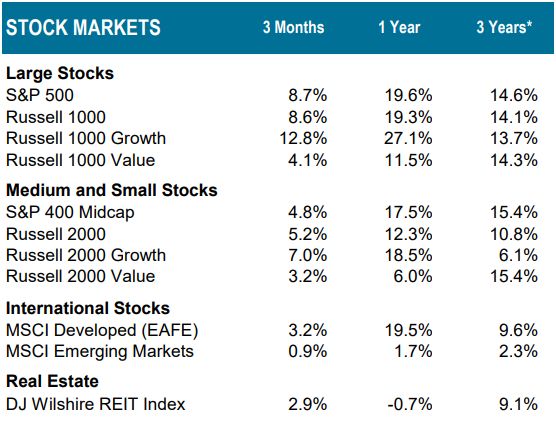

U.S. stocks kept up their rally in the second quarter of 2023, with the S&P 500 returning 8.7% as earnings continued to surprise to the upside despite higher interest rates and ongoing inflation. Though not up as much as markets in the U.S., international markets and emerging markets also showed gains, posting 3.2% and 0.9% returns, respectively.

Technology stocks were the top-performing sector in the S&P 500 in the quarter, returning 17.2% as excitement over artificial intelligence drove chip stocks to triple-digit returns for the year. Through May, just seven large tech and consumer discretionary stocks accounted for most of the market returns in the S&P 500, with the other 493 constituents averaging a negative return year-to-date. In June, the rally broadened out, but just 20% of stocks were beating the S&P 500 returns. Energy stocks were the worst performers in the quarter, falling 0.9% as the price of oil steadily declined.

European stocks were up during the quarter despite Germany slipping into a recession. Japan posted a strong performance, up 18.5%, as the central bank indicated it would keep rates low despite higher inflation. Chinese markets declined in the quarter as the economy's recovery failed to spark investor interest and the country faced ongoing structural challenges.

Bond Market Commentary

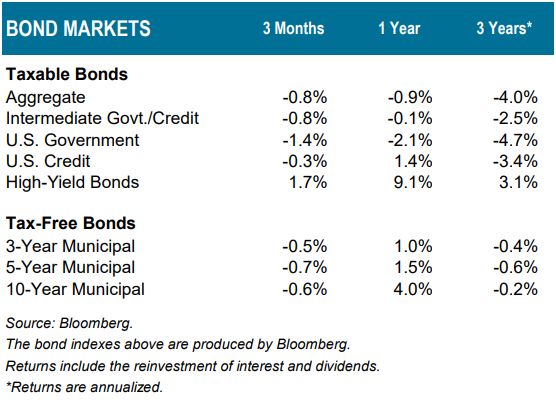

Bonds had a muted quarter as the debt ceiling debate caused investor unease and mixed economic data blurred the Fed's path forward. A broad benchmark of U.S. corporate and government bonds returned -0.8% for the quarter. Municipal bonds, which provide the benefit of tax-free income, held up slightly better, returning -0.5%.

It was a busy quarter for central banks across the globe. Following a 0.25% rate hike in May -- its 10th hike in 15 months -- the Federal Reserve opted to hold rates steady in June. However, Chairman Powell maintained a hawkish tone in his comments and indicated that rates could rise further this year. The Bank of England increased rates an aggressive 0.5% in response to persistently high inflation. The U.K. inflation rate was 8.7% in May, more than double the 4% rate in the United States. In Turkey, where inflation climbed over 39%, the central bank raised its benchmark rate to 15%. Facing the opposite problem of tepid growth and falling prices, the People's Bank of China cut rates to spur the country's economy.

Inflation remains the primary concern for many central banks, and they seem resolute in keeping rates elevated if inflation stays above target. Higher rates can be a positive for bond investors as bond performance is closely linked to the starting point of yields, which are at more attractive levels than in recent years.

Economic Commentary

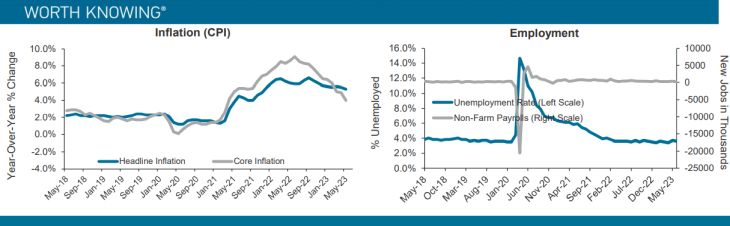

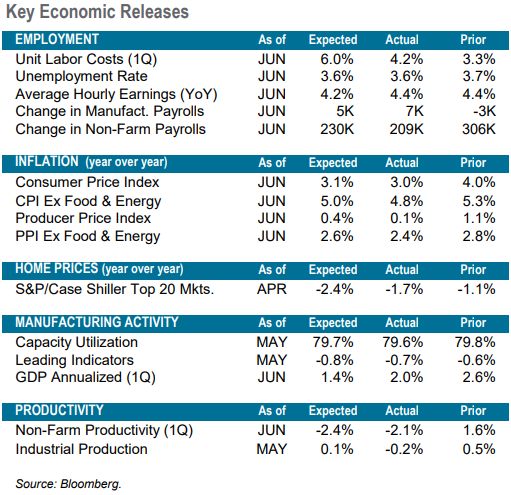

U.S. GDP expanded through the first half of 2023 even as economic indicators flashed warning signs over the past year.

Manufacturing data has been weak for numerous quarters in the U.S. as well as in the U.K., Europe, Japan, and Australia. Services, such as travel and leisure, have been more resilient, but recent data points to some cracks in the global service sector as well. The U.S. yield curve, considered a key leading indicator, remains deeply inverted. This is consistent with investors anticipating future Fed rate cuts, which may happen if the economy slows significantly.

On the other hand, the labor market remains incredibly robust. Demand for workers is immense, with 10.1 million job openings in May for only 6.1 million unemployed. Wages have increased over 5% compared to the prior year, and while jobless claims are up 45% from their lows, they are still minor by historical standards. The U.S. economy depends heavily on the consumer, and low unemployment with rising wages tends to bode well for future spending.

In May, U.S. housing starts unexpectedly surged and permits for future construction also rose. The South, Midwest, and West saw double-digit increases in the number of building projects, though projects declined in the Northeast. Over the last 12 months, however, sales of existing homes have been at their lowest level since August 2012. Low supply remains the primary culprit, hindered by potential sellers reluctant to move given current mortgage rates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.